In the current bear market, many investors prefer to hold safer, more reliable stablecoins to minimize risks and make decent profits by staking a single currency. It is better to stock up in a bear market, so safety and stability have to be our top priority. Thus, we are here to analyze possible investment choices: AAVE, Compound, and TrueFi.

AAVE

A well-established lending protocol on Ethereum, AAVE is a decentralized system that allows users to borrow, lend, and earn interests on crypto assets without an intermediary. This flagship project in the Ethereum ecosystem tops the list among all DeFi projects in Total Value Locked (TVL), the number of users, and the value of tokens.

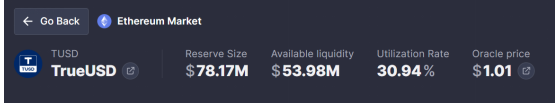

At present, TUSD on AAVE has reached $78.17 million, with a utilization rate of 30.94% and a supply APY of 0.49%.

TUSD can be used as collaterals on AAVE, which reflects the latter’s affirmation of TUSD’s safety and stability. There are 33 lending markets on the Ethereum version of AAVE, including 10 stablecoin projects. However, only 4 stablecoin projects, including TUSD and USDC, can be used as collateral assets, accounting for only 40%.

It should be emphasized that TUSD’s MAX LTV on AAVE is 80%, a high-ranking rate even among projects able to be used as collateral assets. This means users providing TUSD lending on AAVE can not only earn interests from their deposits but also use TUSD as collateral to borrow other assets, which further indicates TUSD’s safety and stability. (MAX LTV refers to the maximum borrowing capacity of a specific collateral. For example, the MAX LTV of TUSD is 80%, which means for every 1 TUSD deposited as collateral, users can borrow up to 0.8 TUSD worth of other encrypted assets.)

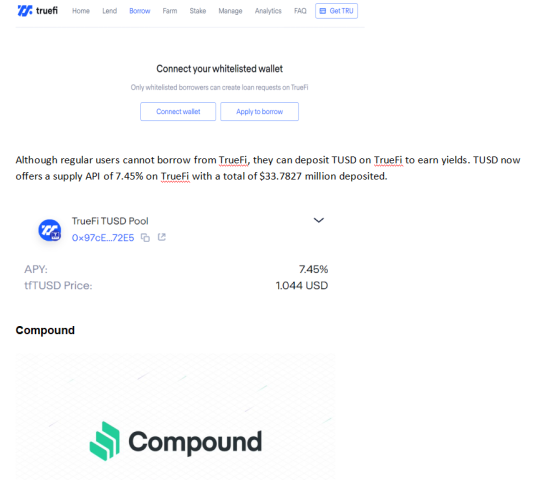

Developed by TrustToken, TrueFi is a fine example of non-collateral lending projects. The TureFi platform was launched in November 2020. The founder of FTX Sam Bankman-Fried (SBF) was the first TUSD borrower on the platform.

Most DeFi lending platforms now operate with over-collateralization to minimize the risk of bad debts. In other words, if a user wants to borrow assets worth 1 ETH, assets worth over such amount have to be collateralized. Apparently, over-collateralization means low fund utilization rate. Additionally, users have to buy collateral before they can borrow money, which increases the cost of borrowing. In contrast, non-collateral lending is more appealing but requires more trust from users.

To ensure repayment and reduce bad debts, borrowers on TrueFi need to complete KYC verification first. Only after being whitelisted by the TrustToken team can they apply for loans. As KYC verification and credit check are mostly required in CeFi, TrueFi is slightly different from other DeFi projects on this front. Borrowing money on the platform is now only open to institutional investors. After borrowers make applications, lenders will vote to decide whether to approve them, and lenders will have to bear the default risk.

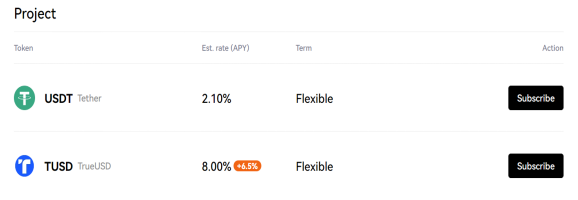

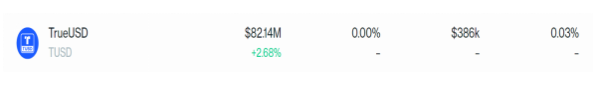

Compound is an established market-leading lending protocol whose security stands the test of time. Currently, the total supply of TUSD on Compound is $82.14M. The TUSD DeFi staking event is now live on OKX, where users can earn an APY of 8% by staking TUSD, with the TUSD team subsidizing 6.5%. This is too great an opportunity to be missed.

Don’t worry if you don’t have sufficient TUSD to join the event. Users can stake assets including USDC, DAI, and ETH on Compound and borrow TUSD with an APY of only 0.03%, with which they may join this DeFi staking event and earn an APY of up to 8%. TUSD offers top security as a fiat-backed stablecoin while OKX is a well-established crypto exchange, so the security of this event is highly guaranteed.

Conclusion

Above is how TUSD works on three major platforms. In conclusion, in the crypto winter, no one would know whether the market has hit bottom. Thus, it is a sound choice to earn stable yields with TUSD on major lending protocols.

Media Contact

Company Name: Globalnewsonline

Contact Person: Luayy Alkilani

Email: Send Email

Country: United States

Website: http://www.globalnewsonline.info/

This news is republished from another source. You can check the original article here

Be the first to comment