- Cardano benefits from its reputation as a “green cryptocurrency,” and the launch of its smart contract functionality.

- DeFi applications line up for $180 million Avalanche Rush, and the network shifts focus to the metaverse.

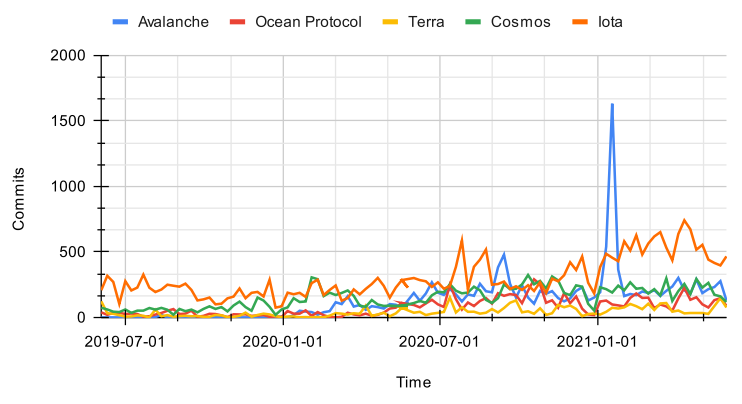

- Total Github commits by Avalanche increased by more than 700% over the past year, the network dominates layer-one solutions.

Avalanche has shifted focus from DeFi to building the metaverse, and Cardano is now ready to host smart contract applications. Cardano is set to capture a large share of the DeFi ecosystem.

Partnerships and upgrades in Avalanche and Cardano trigger price rally

The Avalanche Foundation made a strategic investment in NFT ecosystem Kalao to leverage its marketplace and power the metaverse experience. Kalao combines NFT with virtual reality technologies and implements it in real-world use cases.

NFTs are a relatively new trend in the cryptocurrency ecosystem, and Avalanche is jumping in on the trend with Kalao.

The blockchain network’s native token AVAX has posted nearly 40% gains over the past week. AVAX has offered the highest risk-adjusted returns in the past 40 days, followed by Tezos (XTZ) and Cardano (ADA).

Risk-adjusted return over the past 30 days.

Currently, Avalanche network is the only consensus that can possibly scale active validators in the network and offer throughput at the same level as payment giant Visa. Fast and low-cost transactions coupled with $180 million incentives through the Avalanche Rush program are attracting more decentralized applications to the network.

Alongside rising popularity in the crypto community, Avalanche developers made 12,575 commits so far in 2020-21, a growth of 709% over last year’s Github commits. Github commits have emerged as a key indicator of a network’s relevance and level of interest in the development community.

Git commits: Top 5 projects.

Cardano, a leading altcoin and Ethereum-rival network, made 702 commits, making it 555% more active than the average protocol. With the arrival of smart contract functionality on its mainnet, Cardano is set to resume its upward climb.

Cardano is different from Ethereum in that it prides itself on one of the most democratic distributions. This ensures that Venture capitalists and influencers don’t control a large share of the altcoin’s distribution.

A pseudonymous Cardano proponent, @TheADAApe, shared statistics and insights on the altcoin’s decentralization and democratic distribution against other projects in the ecosystem.

It’s becoming quite clear that the main reason most big influencers & VCs from other projects hate #cardano yet praise demonstrably less secure projects is because, as @IOHK_Charles said, the distribution of $ADA is too democratic and they can’t get the lions share of profits. pic.twitter.com/DDVxLNwTzH

— ADAape.com || (APE) (@TheADAApe) September 14, 2021

Cardano’s reputation as the “Green Cryptocurrency” is another factor leading to the overall rise in on-chain activity. The altcoin has posted over 10% losses over the past week, and FXStreet analysts consider a drop below $2.20 would be catastrophic to ADA rally.

The uncertainty around the deployment of smart contracts on the blockchain network led to the drop in the altcoin’s price since the Alonzo hard fork. With enhanced capability and upgrades, ADA price is expected to increase in the long term.

@Pentosh1, a cryptocurrency analyst and trader, argues that Cardano’s price is too high and that a bearish retest is likely.

This news is republished from another source. You can check the original article here

Be the first to comment