Major cryptoassets gave back some of their previous gains in early European trading on Friday after a strong overnight session that briefly sent bitcoin (BTC) above the USD 22,000 mark, helped by improving risk sentiment on Wall Street on Thursday. Despite the losses in early trading, the coin remained in positive territory for the past 24 hours.

At 13:30 UTC, bitcoin stood at USD 21,366, up 5% for the past 24 hours and up 9% for the past 7 days. Meanwhile, ethereum (ETH) traded at USD 1,210, up 2% for the day and up a 15% for the week.

Friday’s modest gains for the two largest coins came after a strong day in the US stock market on Thursday, when the broad S&P 500 index gained some 1.5%, marking its fourth consecutive day of gains. At press time on Friday, however, the risk-on sentiment appeared to have weakened, with S&P 500 futures indicating an opening 0.6% below yesterday’s closing price.

Analysts at the crypto exchange Bitfinex said in an emailed market commentary on Friday that,

“An inherent resilience that cryptocurrency has displayed in recent weeks in the face of a wave of liquidations and solvency issues has come to the fore today as the market enters the green zone.”

They added that “hedge funds betting on wider contagion and market capitulation” are now “licking their wounds” after gains for both BTC and ETH, and said it will be interesting to see if the crypto market can continue rising this month.

“Bitcoin has been bolstered by an increased appetite for risk, as evidenced by a four-day winning streak in the US’s S&P 500 where battered technology stocks have also rebounded,” the analysts said.

‘Massive deleveraging’ mostly over

According to the well-known crypto proponent and CEO of Galaxy Digital, Mike Novogratz, the worst is likely already over for the crypto market, although he said it could well be “chopping sideways for a while.”

“We’ve had this massive deleveraging, and I think most of that deleveraging is now out of the system,” Novogratz said during an interview on CNBC. He added that the market “of course” could go lower, but reiterated that “it feels like we’re 90% through that deleveraging.”

A similar sentiment was also shared by Marcus Sotiriou, an analyst at the digital asset broker GlobalBlock, who said in an emailed commentary on Friday that the market has finally seen “some renewed optimism.”

The optimism followed reassurances from crypto billionaire Sam Bankman-Fried and his company Alameda Research that they have “a few billion” available to bolster flagging crypto firms, with Sotiriou saying this could mean that the worst of the liquidity crisis is behind us.

Still, it is something else that remains the most important factor for the price of bitcoin, according to Sotiriou.

“The only Bitcoin bottom signal for me is persistent data showing us that inflation is convincingly inflecting down. This should result in the US Federal Reserve becoming less aggressive with their monetary policy, and therefore provide confidence that the liquidity crisis in the crypto market is over,” he said.

Positive outlook on-chain

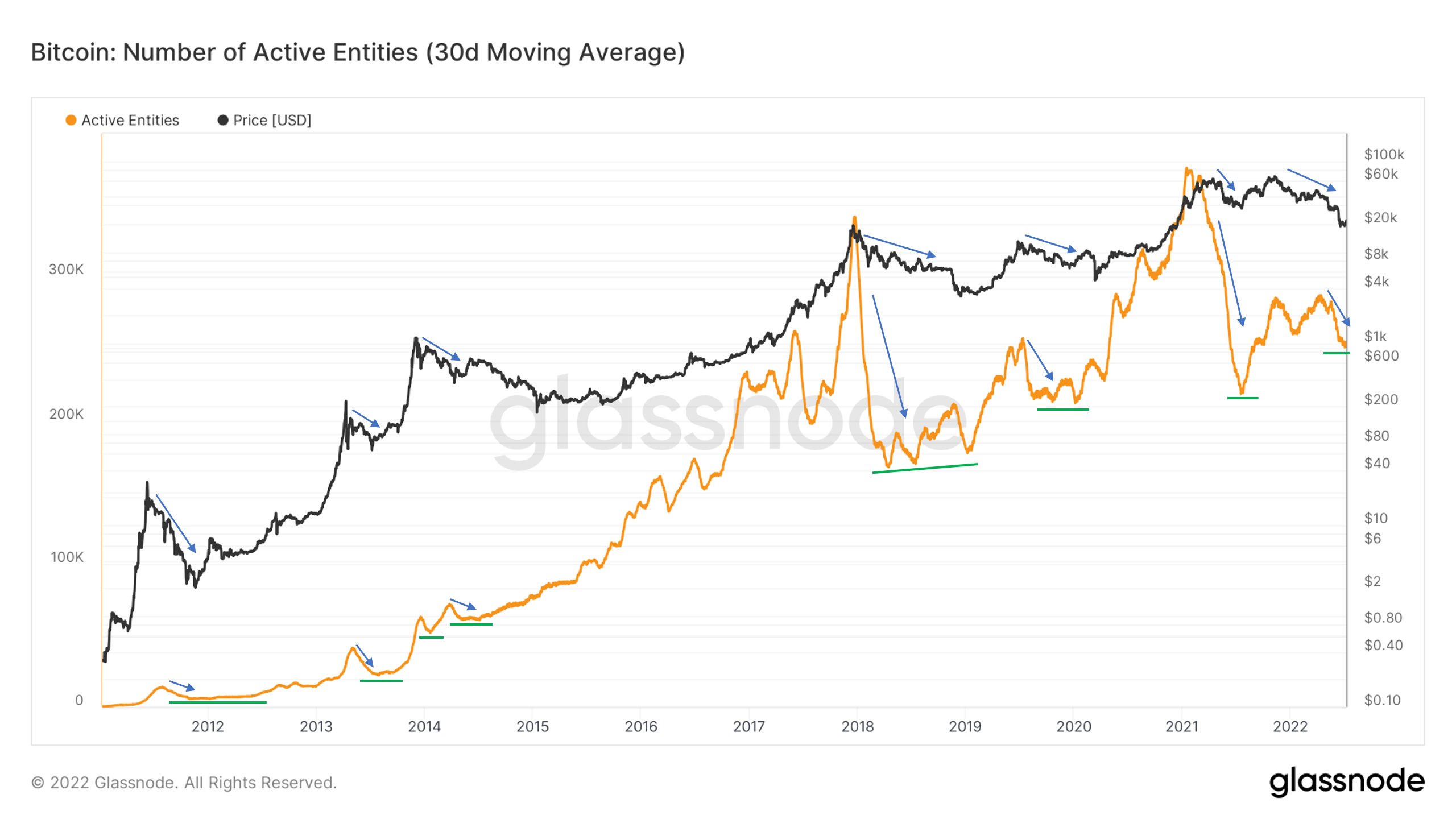

Analyzing the bitcoin market from an on-chain perspective, Will Clemente, Lead Insights Analyst at Bitcoin mining company Blockware Solutions, pointed to an increasing number of active entities on the Bitcoin network as “the real signal” of adoption.

Sharing a chart of the number of active entities, Clemente argued that,

“Every price drawdown some new market participants leave (that were only here for price going up), but there’s a higher base of people who gain conviction in Bitcoin and stay.”

Coinbase premium

Taking a different approach, Ki Young Ju, the CEO of crypto analysis website CryptoQuant.com, pointed to the so-called Coinbase premium as one sign that the market is starting to see a “recovery from contagion fear.”

The Coinbase premium shows the gap between the spot price of bitcoin on Coinbase versus on the rival crypto exchange Binance. It is believed that since more institutions in the US use Coinbase to make their purchases, a rising premium is a sign that American financial institutions are accumulating bitcoin.

Increased correlation with gold

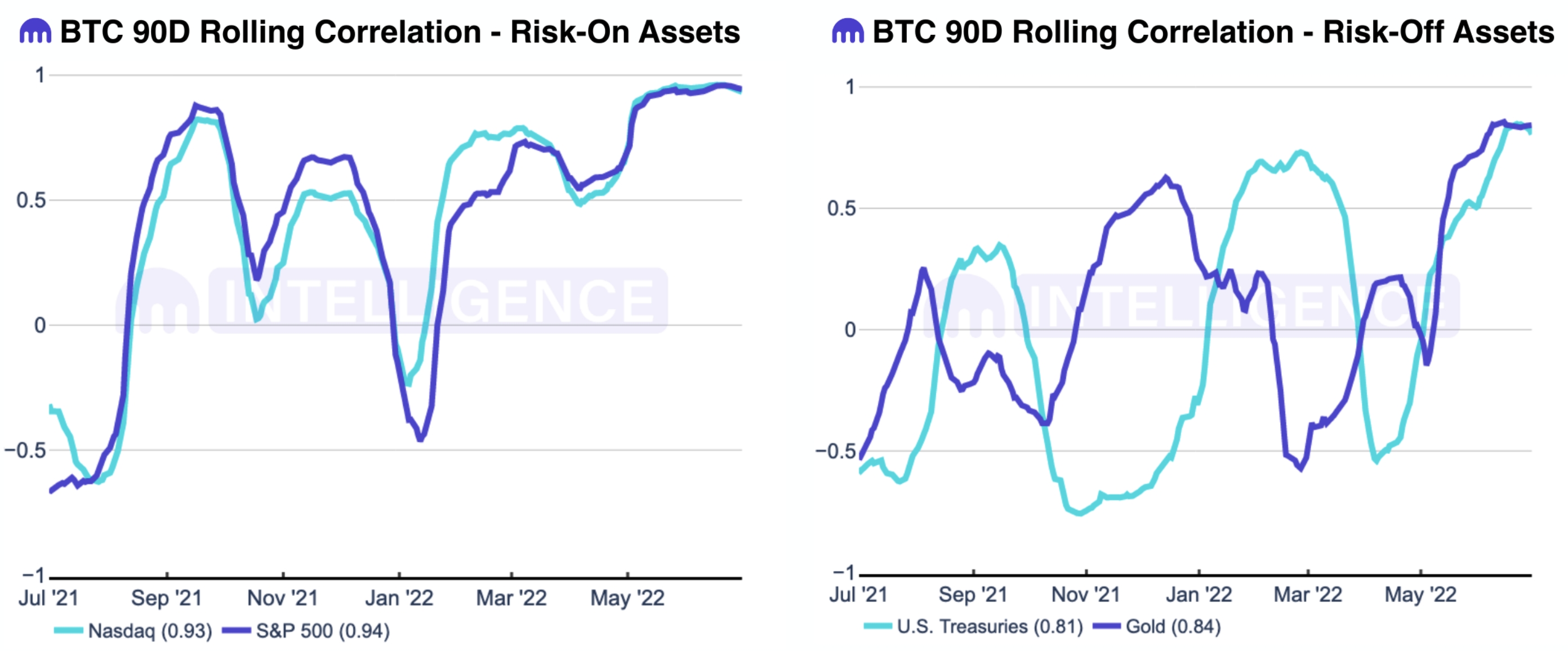

Meanwhile, crypto exchange Kraken in its monthly market update noted that bitcoin and the US stock market remained positively correlated for the month of June, with no significant change in correlation over the course of the month.

And while the correlation with stocks remained unchanged, bitcoin’s correlation with the traditional safe haven and inflation hedge gold rose during the month.

The increased correlation “signals a broader trend of correlations between all asset classes rising amidst significant macroeconomic uncertainty,” Kraken commented.

____

Learn more:

– Mt. Gox Trustee Moves Closer to Pay-Out, Asks Creditors for Payment Details

– Cautious Bullishness in Bitcoin & Crypto Amid Warnings of Further Downsides

– More Crypto Meltdowns Could Be Seen This Summer, but the Worst Is Behind Us – Pantera’s Morehead

– Bitcoin Better at Tackling Rate Hikes than Ethereum, Stocks – Report

– Bull or Build, There is No Bear

– Coin Race: Top Winners/Losers of June, Q2, and H1; Bitcoin Sees Worst Month Ever

This news is republished from another source. You can check the original article here

Be the first to comment