DeFi protocol Orca has experienced a surge of new users, placing it well ahead of its Solana DEX competitors and closer to its goal of becoming DeFi’s “Apex Predator”.

The Decentralized Exchange (DEX) and Automated Market-Maker (AMM) recently launched Whirlpools, giving users of the protocol access to concentrated liquidity pools. Soon after, popular web3 lifestyle app STEPN integrated Orca’s pools to power its swaps. As a result, usage of the protocol is at an all-time high.

Daily active users of Orca (defined as unique wallets with fewer than 20 transactions per day, with arbitrage wallets filtered out) surpassed 130,000 at the beginning of May 2022, placing it head and shoulders above other exchanges on Solana.

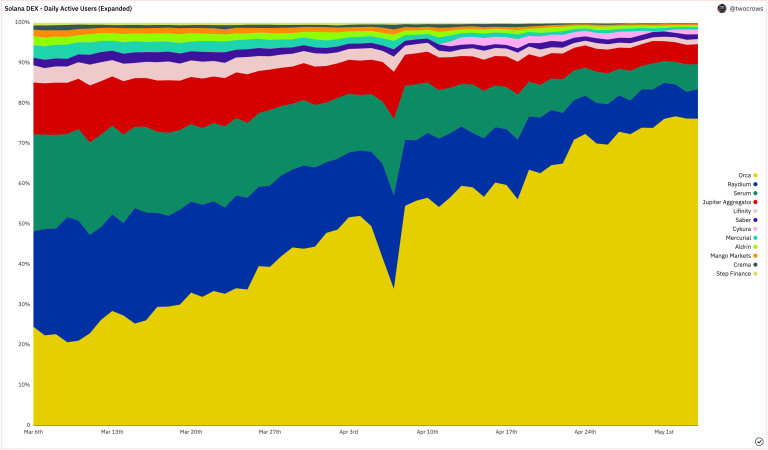

Number of unique wallets interacting with Solana DEXs Source: @TwoCrows on Dune

With daily DEX usership on Solana running at around 160,000 unique addresses

at the beginning of the month, Orca occupies the whale’s share at over 75%. This is in stark contrast to Orca’s nearest competitors, Raydium (7.4%) and Serum (6.2%).

Source: @TwoCrows on Dune

This surge in activity has led to a corresponding spike in swap volume. In 2022, Orca has seen over $9 billion in volume, with roughly half of that occurring in the last month.

For longtime users, Orca’s dominance comes as no surprise. Its rare combination of intuitive user experience and cutting-edge technology has lent it broad appeal amongst DeFi newcomers and veterans alike. Not to mention Orca’s commitment to real-world impact; approximately 0.01% of all swap fees go to fighting climate change and sustainability through the Orca Impact Fund.

Another element to Orca’s success is its composability. Just as Orca’s interface is designed for usability, Orca’s open-source Software Development Kit (SDK) is designed for easy integration into other applications. This has led protocols like STEPN to integrate Orca “under the hood” to facilitate swaps for their users.

But these are mere stepping stones for Solana’s “Apex AMM”. The newly released Whirlpools technology allows LPs to earn higher fees with less liquidity, improves prices for swaps, and makes markets within Solana more efficient as a whole.

In the coming months, Orca aims to transition all of its existing pools to Whirlpools and launch Community Listings, allowing anyone in the ecosystem to “permissionlessly” list a concentrated liquidity pool. This will allow Orca to become the fundamental liquidity layer for all fungible tokens in Solana. (More details can be found here.)

The Whirlpools smart-contract has been double-audited by Kudelski and Neodyme and will be open-sourced in May 2022. Meanwhile, the Whirlpools SDK allows easy integration by developers seeking to leverage the power of concentrated liquidity, and is already in use by popular aggregator Jupiter.

In the near future, Orca will encourage developers to integrate Whirlpools in its upcoming Builders Program. Potential integrations include leveraged farming on protocols like Tulip, the efficient trading of fractionalized NFTs, and automated concentrated liquidity strategies known as “vaults”.

To see Solana’s Apex Predator for yourself, visit orca.so.

This post is commissioned by Orca and does not serve as a testimonial or endorsement by The Block. This post is for informational purposes only and should not be relied upon as a basis for investment, tax, legal or other advice. You should conduct your own research and consult independent counsel and advisors on the matters discussed within this post. Past performance of any asset is not indicative of future results.

This news is republished from another source. You can check the original article here

Be the first to comment