I don’t know where Bitcoin is headed and no one else does either, but margin calls and leverage could easily lead to a rout

Bitcoin Breaks Support

Bitcoin broke technical support at the $35,000 level, but that support was very weak with only one bounce off that level.

Words of Warnings

Technically speaking, the $32,000 level looks far more promising for a bounce.

But this is a bear market now, not just in Bitcoin but in all risk assets. Thus, there is no reason, fundamental or technical, for a bounce at the $32,000 level to hold.

And if it doesn’t, the next support is at the $19,000 level.

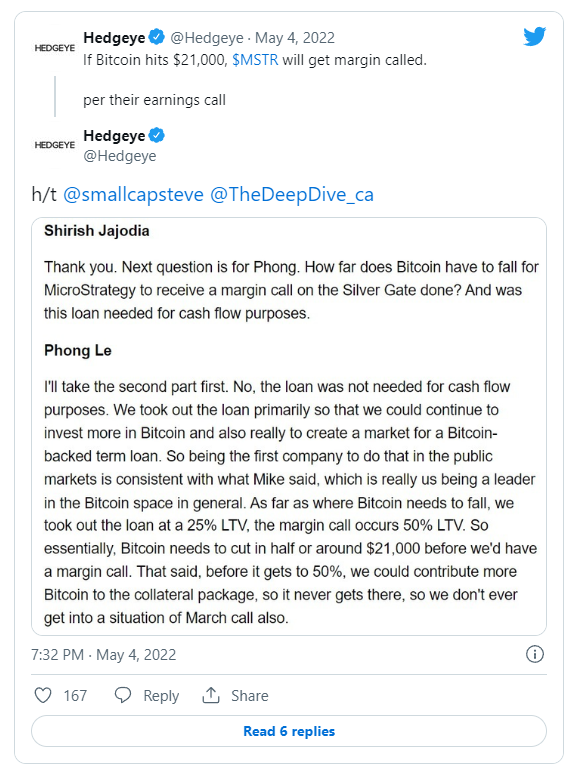

Margin Calls

The $19,000 level is an interesting level because margin calls are in play.

MSTR Takes Out Loan to Buy Bitcoin

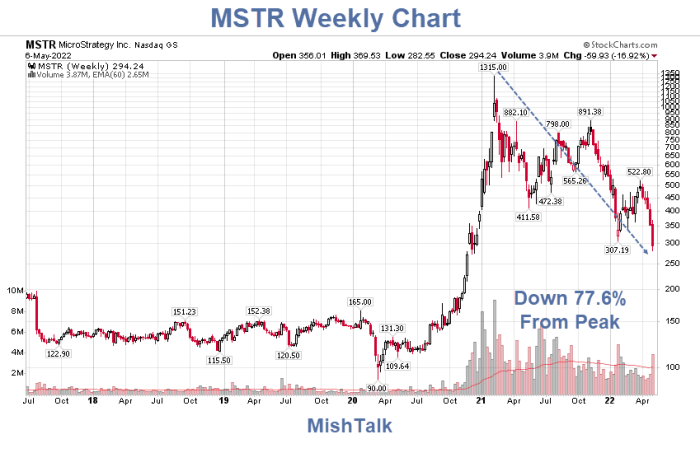

MSTR MicroStrategy Weekly Chart

MSTR chart courtesy of StockCharts.Com annotations by Mish

Casino Is Open

The casino is clearly open folks, and MicroStrategy has morphed into a leveraged speculative play on Bitcoin.

A margin call awaits at $21,000 with support at $19,000.

Place Your Bets!

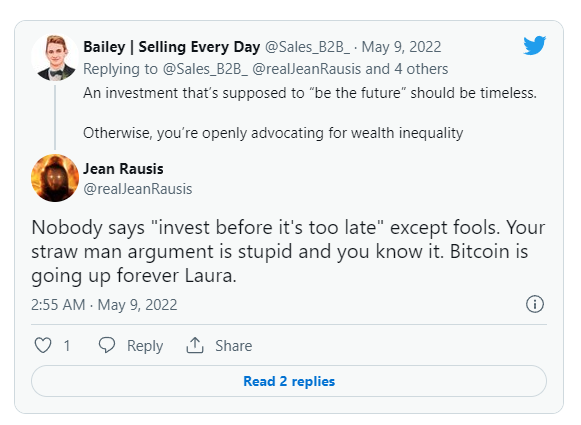

Bitcoin Is Going Up Forever

Will the $10,000 Level Hold?

That’s the man who leveraged MSTR to the hilt.

Contradictory Ideas

- Bitcoin is going up forever

- Bitcoin will hit $10,000 this year or CryptoWhale will give $1,000 to anyone who reTweets his Tweet.

Got Popcorn?

Amusingly, they both can easily be wrong in a major way.

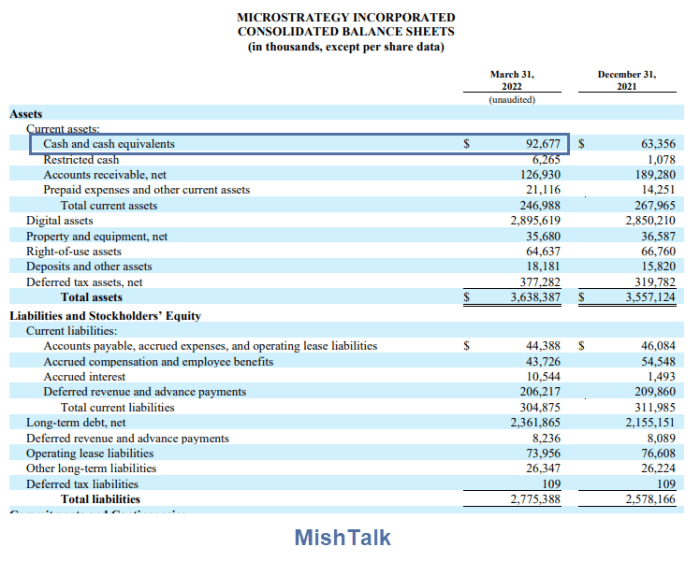

That aside, let me chime in on the margin call idea, starting with a look at MSTR’s balance Sheet.

MicroStrategy Balance Sheet March 31, 2022

MicroStrategy 10Q Balance Sheet

Potential Cascade

The bulls suggest MSTR can pledge more Bitcoin to meet margin calls as only a portion is leveraged.

Sorry bulls, this idea does not work well, and in fact will lead to a massive cascade if Saylor tries.

Any pledge of Bitcoin to meet margin calls will be immediately sold by the creditors into a plunging market.

Saylor needs cash, not a Bitcoin or other asset pledge, to meet a margin call. To that end, Saylor has as of March 31, $92,677,000 cash on hand. That’s nowhere near sufficient.

If Bitcoin approaches the margin level, traders will step back and/or hedge funds will short futures.

The possibility of a very steep plunge is real, arguably self-fulfilling. But hey, don’t worry, because we all know “Bitcoin is going up forever.”

What a hoot!

An Official Denial Suggests Stagflation is Now the Base Case for Europe

Meanwhile An Official Denial Suggests Stagflation is Now the Base Case for Europe

What About the US?

Stagflation is the base case for the US too.

For discussion, Check Out Delusional Fed President Neel Kashkari, Even Worse Than Powell

So, it’s not just Europe. Rather Europe is likely to be first.

There is no reason to believe a speculative risk asset like Bitcoin will do well in the global recession that’s on the horizon, if not here already.

This news is republished from another source. You can check the original article here

Be the first to comment