If you’re based in the United Kingdom and decide to invest in cryptocurrencies like Bitcoin or Dogecoin, you might be liable for tax when you eventually cash out your tokens and the trade results in a profit.

Also if you decide to utilize a crypto savings account to earn interest – this could attract income tax.

In this guide, we cover everything there is to know about crypto tax in the UK.

Key Points on UK Crypto Tax

Below you will find a quick overview of the key points to take into account about crypto tax in the UK.

- If you sell crypto and the trade results in a profit – the proceeds could be liable for capital gains

- If you earn interest from a crypto savings account – the proceeds could be liable for income tax

- However, whether or not you will need to pay tax will depend on your personal circumstances

- All UK residents get an annual capital gains allowance of £12,300 for the 2022/23 tax year

- As such, as long as you don’t make more than this amount in the current tax year – no capital gains tax will be liable

Also consult with a qualified specialist when assessing your cryptocurrency tax liabilities.

How Crypto is Taxed in the UK – Overview

On the one hand, crypto assets are unregulated financial products in the UK. However, it is important to note that when it comes to taxation, HMRC views cryptocurrencies like Bitcoin in the same way as traditional investments like stocks and shares.

That is to say, if you buy cryptocurrency and sell it at a later date for more money – the profit that you will make will be liable for capital gains tax. As we cover in more detail later, unless you are making more than £12,300 in capital gains for the 2022/23 financial year, then no tax will be owed to HMRC.

Another thing to note is that crypto tax might also come into play if you are generating a yield on your digital currencies. For instance, if you decide to use a crypto savings account to earn interest – your payments could be liable for income tax. This could also be the case for other passive income streams like crypto staking and yield farming.

It is also important to take into account the potential tax liabilities associated with crypto debit cards in the UK. This is because transactions result in your crypto being sold for GBP at the time of the transaction, meaning that capital gains are realized and thus – tax could be liable.

We cover each of the aforementioned points in more detail in the subsequent sections of this guide on UK crypto tax.

Crypto Capital Gains Tax

If you are looking to invest in cryptocurrency in the UK – the most pressing tax that you need to keep into account is with respect to capital gains.

For those unaware, capital gains refer to the profit that you make from a trade. In the traditional financial scene, this could be the profit you make from buying and selling stocks, ETFs, or even property.

In the case of crypto, capital gains are made when you buy digital currency and then cash out at a later date at a profit.

For example:

- Let’s say that you open an account with a crypto exchange and decide to buy Bitcoin at a total stake of £2,000

- You put your Bitcoin into a crypto wallet and leave the investment to sit for a few months

- You eventually decide to cash out your Bitcoin back to GBP

- When you do, Bitcoin is worth 50% more than what you originally paid

- As such, you receive £3,000 back – so your capital gains – or profit, is £1,000

As per the above example, your capital gains tax merely refers to the profit element of the digital currencies that you sell.

In theory, tax would be liable on the capital gains of £1,000 that you made in the above example.

However, as we cover in the later sections of this guide – you also need to take into account the annual allowances that all UK residents get surrounding income, capital gains, and more.

This means that unless you are making huge profits throughout the year, you might not be liable for capital gains tax on crypto investments.

Swapping Cryptocurrencies

In addition to conventional digital asset investments, people in the UK often forget that crypto taxes can come into force when you swap digital tokens.

- For example, let’s suppose that you use a decentralized exchange to swap Ethereum for Uniswap.

- Although you are not selling your Ethereum tokens back to GBP, HMRC will likely still view this as a trade.

- And as such, there might be tax to pay if there is a profit element involved. This is where things can get complex.

This is because the tax element will come into play if at the time you swapped your Ethereum for Uniswap, the digital currency was worth more than you originally paid.

After all, if the value of Ethereum was higher than when you invested, you are essentially getting more Uniswap tokens for your money.

- For instance, let’s say that you bought Ethereum in April 2022 when it was trading at $3,000 per token.

- Then, in June 2022 – which is when you swap Ethereum for Uniswap on a decentralized exchange, Ethereum is worth $4,500 per token.

- This means that Ethereum has increased by 50%.

- As such, if your original investment amounted to £1,000 – there would be a £500 capital gain to take into account – even though you do not actually receive the funds back in pounds and pence.

As such, it’s important to keep records of each and every trade that you make when investing in cryptocurrency in the UK to ensure that you have a firm grasp of your tax liabilities.

Crypto Debit Cards

A relatively new concept in the UK digital asset scene is that of crypto-backed debit cards that are issued by the likes of Visa and MasterCard.

There is often a major knowledge gap in this respect when it comes to taxation. This is because when you use a crypto debit card to buy goods and services online or in-store – or withdraw cash via an ATM, the transaction will trigger a trade behind the scenes.

The Crypto.com VISA card

After all, when you use a crypto debit card – the merchant receives the money in pounds and pence. In order for this to be achieved, the card provider will see your cryptocurrency holdings for GBP to cover the size of the transaction.

And as such, if the respective amount of cryptocurrency that is sold has increased in value since you made the investment, this will generate capital gains. Therefore, this will count towards your annual capital gains liability.

Capital Losses on Crypto

Another interesting element of crypto tax in the UK is with respect to capital losses and whether or not these can be written off. In a nutshell, a capital loss occurs when you sell a cryptocurrency investment for less than you originally paid.

For example:

- Let’s say that you invest £5,000 into Dogecoin

- Dogecoin has lost 50% of its value since you made the investment

- You want to cut your losses and decide to cash out back to GBP

- This means that you receive £2,500 back

- In this example, your capital losses amount to £2,500

Now, the theory is that because HMRC taxes capital gains, you should be able to offset your liabilities with any investment losses that you made in the same financial year.

For example:

- Let’s say in the 2022/23 tax year, you place two cryptocurrency trades

- First, you buy £2,000 worth of Ethereum and cash out at £4,500 – which results in capital gains of £2,500

- Second, you buy £3,000 worth of XRP, but cash out at £2,000 – resulting in losses of £1,000

- This means that across the two investments – your total capital gains for the year amount to £1,500 (£2,500 profit less £1,000 loss)

- As such, when it comes to calculating your liability to HMRC, your capital gains tax should be based on £1,500 only.

Naturally, if you are an active cryptocurrency investor that places many trades throughout the year, understanding your tax liabilities can be challenging.

There are, however, a number of online providers that allow you to track your gains, losses, and tax liabilities throughout the year in an automated manner.

Capital Gains Tax Rates for Crypto

If your total capital gains tax for the financial year exceeds your annual allowance – which we cover shortly, then tax will be owed to HMRC.

The amount that you pay will depend on your personal tax band, albeit, this mirrors the same rates applicable when you invest in traditional assets like stocks or ETFs.

In the table below, you will find an overview of capital gains tax rates for crypto investments in the UK.

| Income Tax Band | Capital Gains Tax |

| Basic Rate | 10% |

| Higher Rate | 20% |

| Additional Rate | 20% |

Take note, the above table refers to both the 2021/22 and 2022/23 UK tax years.

Crypto Income Tax

Now that we have covered capital gains, we can now move on to income tax liabilities that are relevant to your cryptocurrency portfolio.

This segment of our UK tax on crypto guide will cover a wide range of investment and trading ventures – which we cover in the sections below.

Getting Paid in Crypto

If you perform work and you receive payment in crypto, then the tax liabilities on this are no different from receiving a conventional salary in pounds and pence.

- This is because HMRC views this as ‘money’s worth’, which means that the asset you receive – in this case, cryptocurrency, can readily be converted into cash.

- And therefore, not only will the crypto payment count towards your income tax liability, but also national insurance contributions.

Moreover, the money’s worth element will be based on the value of the cryptocurrency you are paid in at the time of the transaction.

Again, when you consider that cryptocurrency prices change on a second-by-second basis, this makes the tax returns process even more of a challenge.

Crypto Mining

If you make money by mining cryptocurrencies – the taxation element of this will depend on whether you are doing this casually or as part of a fully-fledged business operation.

If it’s the former, then any income that you make from your crypto mining operations will likely be viewed as miscellaneous income by HMRC. On the other hand, if you’re running a crypto mining business, then corporation tax will come into play.

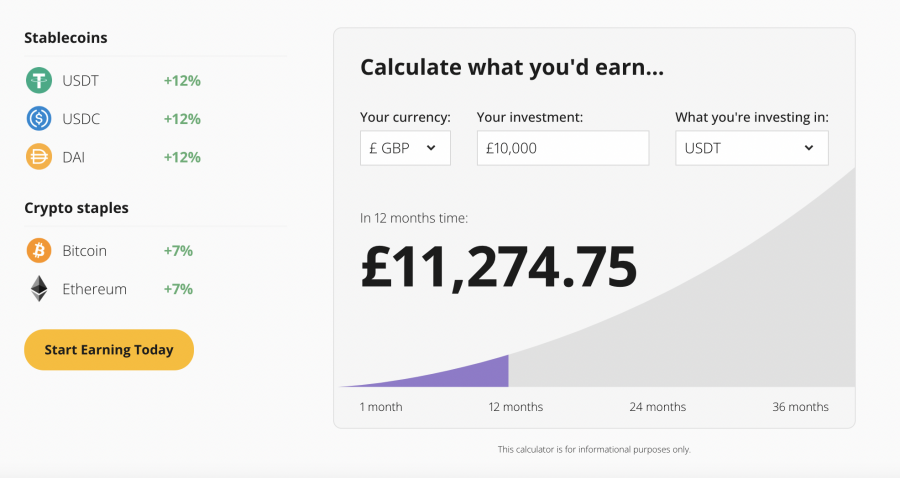

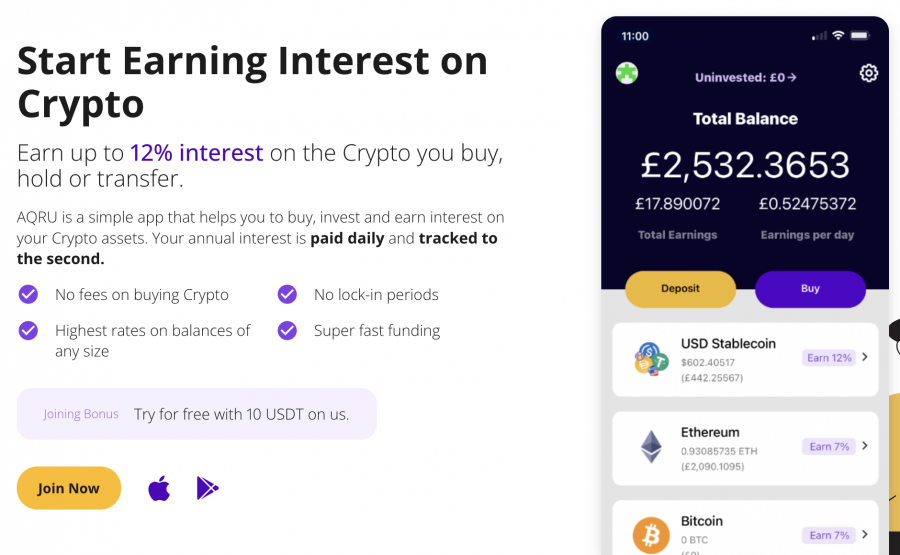

Crypto Savings Accounts

Crypto savings accounts are becoming more and more popular in this industry. As a prime example, the likes of Aqru allow you to earn 7% in interest per year simply for depositing your Bitcoin or Ethereum tokens into its platform.

Now, when it comes to crypto tax rules in the UK for the interest earned, this is where things become even more complex. First and foremost, when you receive an interest payment, this will need to be stated in your annual tax return.

The Aqru crypto savings account platform

Just like crypto mining, this will likely fall under miscellaneous income. Moreover, the amount that needs to be stated should be based on the value of the cryptocurrency received at the time of the interest payment.

- For example, let’s suppose that you deposit Bitcoin into a crypto interest account.

- You receive a weekly interest payment of 0.00049 BTC.

- As of writing, this amounts to a realizable value of £15.

- As such, £15 is the amount that you would need to report.

If this wasn’t difficult enough, leading crypto savings account providers like Aqru distribute interest payments on a daily basis.

And as such, once again, this is why you should consider signing up for an automated crypto tax platform if you are active in this investment scene.

Staking and Yield Farming

Staking is the process of depositing crypto tokens into a proof-of-stake blockchain and in return – you will be paid a rate of interest.

In terms of yield farming, this will see you deposit crypto tokens into a liquidity pool, which also results in interest being paid.

As for your tax liabilities on staking and yield farming, HMRC will likely view this in the very same way as crypto savings accounts.

This means that any tokens you receive as part of an interest-earning agreement will be liable for tax – based on the value of the cryptocurrency when it is paid.

Airdrops

In the cryptocurrency arena, airdrops are associated with newly launched projects that wish to distribute their tokens on a fee-free basis.

- This means that the project is not raising capital for its airdropped tokens.

- And as such, HMRC will likely not view this as a taxable event at the time you receive the tokens.

- However, if at some point in the future you sell the tokens for cash or cash equivalents – which will likely include other cryptocurrencies, then this is all but certain to trigger a capital gains tax liability.

To reiterate, HMRC is often unclear with its interpretation of cryptocurrency assets – especially with regard to emerging services like airdrops and staking.

Therefore, it’s best to speak with a qualified tax advisor to ensure that your understanding of your liabilities is valid.

Crypto Gambling Profits

This is yet another area that HMRC is yet to clarify with any certainty. On the one hand, gambling winnings in the UK are not subject to tax and this has been the case since 2005.

This means that in theory, if you are using a crypto gambling platform, your winnings should not be liable for tax. However, if you were to then sell your crypto gambling winnings for pounds and pence, this will potentially trigger capital gains.

The uncertain part here is how HMRC views the cost price of the trade. After all, the winnings element alone has no cost price and this was achieved through a successful gambling transaction.

Income Tax Rates for Crypto

In a similar nature to capital gains, the rate that you pay on crypto income in the UK will depend on your personal tax band.

The table below highlights the various income tax rates for each band:

| Taxable Income | Personal Tax Band | |

| Up to £12,570 | Personal allowance | 0% |

| £12,571 – £50,270 | Basic rate | 20% |

| £50,271 – £150,000 | Higher rate | 40% |

| £150,000 + | Additional rate | 45% |

It is important to remember that the UK operates a progressive tax system. This means that as your income for the year increases, you might pay more than one tax rate.

For example, if your crypto income amounts to £14,570, the first £12,570 would attract a 0% tax rate. The balance of £2,000 would fall under the ‘Basic’ rate at 20%.

Moreover, as we cover shortly, all UK residents get an annual tax allowance – not only for income but capital gains and dividends too.

Do You Pay Tax for Buying and Selling Cryptocurrency in the UK?

Yes – when you buy and sell crypto in the UK – this does attract tax liabilities. This is no different from buying and selling stocks and shares.

As noted throughout this guide, each and every buy and sell transaction that you conduct will need to be taken into account when you fill out your tax return for the year.

Moreover, this also includes crypto swaps even if GBP or any other fiat currency is not involved. On standard investments, capital gains tax will be relevant.

On other crypto ventures – such as staking, interest accounts, airdrops, and yield farming, then this will likely fall within the bracket of income tax.

Crypto Tax Breaks UK

This section of our guide on tax on cryptocurrency in the UK is potentially the most important. The reason for this is that as a UK resident – you get a certain amount of allowances each year on the amount of tax that you are required to pay.

In the sections below, we cover crypto tax breaks in the UK for both capital gains and income.

Capital Gains Tax Allowance on Crypto

In both the 2021/22 and 2022/23 tax years, UK residents are given an annual capital gains tax allowance of £12,300. In simple terms, this means that unless you make more than £12,300 in capital gains for the respective year, no tax will be owed.

Not only does this cover traditional asset classes like stocks, ETFs, and property – but cryptocurrency too.

And therefore, unless you are investing huge amounts into cryptocurrency or you happen to sell a token that grows by significant levels, then there is every chance that you will get to keep all of your profit.

For example:

- Let’s say that you in £5,000 into BNB at the start of the tax year

- You cash out your BNB investment for £15,000

- This means that your capital gains from the trade amount to £10,000

- If this was the only investment you made throughout the financial year, then no capital gains tax would be liable on this £10,000 profit

On the other hand, if your profit exceeds the annual allowance of £12,300 – then tax would need to be paid to HMRC.

For example:

- Let’s say that you invest £2,000 into Shiba Inu

- In just six months, the value of your Shiba Inu has grown by 5,000%

- As such, when you cash out, you receive £100,000

- We’llfirst subtract your original £2,000 investment, which leaves you with capital gains of £98,000

- Assuming that this is only the investment you make for the tax year, we can then subtract your annual capital gains allowance of £12,300

- This means that the taxable element of this investment should be based on £85,700

- The specific tax that you pay would depend on whether you are a basic (10%) or higher/additional (20%) rate payer.

Crucially, don’t forget that your capital gains allowance is inclusive of all tradable assets throughout the year and not just crypto.

As such, all of your gains need to be added together. You can also include capital losses in your calculation – as we covered earlier.

Income Tax Allowance on Crypto

If you are involved in cryptocurrency investments that fall within the remit of income tax – such as staking, interest accounts, and yield farming – then you will be pleased to know that UK residents also get a separate annual allowance.

- In the 2021/22 tax year, this amounts to £12,570.

- Ordinarily, this will increase each year to at least cover inflation.

- Unfortunately, the UK government has announced that the annual income tax allowance will be frozen for four years.

- As such, this will remain at £12,570 until at least 2025/26.

Nonetheless, the good news is that any crypto income that you make in the respective year will be included within your allowance. As such, if your income for the year falls below £12,570 – then you will not be liable for tax.

The eToro crypto platform which is open to UK traders

With that said, if you work full time then it is all but certain that you will earn more than the annual allowance permits.

Let’s look at a quick example of how crypto income tax works in the UK:

- Let’s say that in the 2021/22 year, you receive a taxable salary of £20,000

- In addition to this, you make £1,000 from crypto staking and £500 from yield farming

- In total, this means that your total taxable income amounts to £21,500

- But, we first need to subtract your annual income tax allowance of £12,570

- This leaves you with a taxable income of £8,930

- As such, you would fall into the basic tax band, which means you will pay 20%

- On £8,930, your tax liability for HMRC would amount to £1,786

There are many other factors that come into play when calculating your crypto income tax liabilities, so the above example is for illustrative purposes only. Always consult with a qualified tax specialist.

What Crypto Transactions are Exempt from Tax in the UK?

If you’re wondering which crypto transactions are exempt from tax in the UK – we discuss this in the sections below.

No Tax Until Crypto Gains Are Realized

Just like the traditional stocks and shares space, capital gains in the UK crypto investment industry are not taxed until profits are realized. In investment jargon, this simply means that you have cashed out your crypto tokens back to GBP.

The good news is that until you do this, you won’t be liable to pay any crypto tax in the UK. As such, to avoid paying tax on your crypto investment, you simply need to hold onto your tokens.

Crucially, this can actually work out to your advantage in specific tax years when you have generated higher capital gains from your investments.

- For example, let’s say that in the 2021/22 tax year, across stocks and ETFs, you have made £10,000 in realizable capital gains.

- At the same time, you have a Bitcoin investment that when sold, will generate a further £5,000 in profit.

- The shrewd thing to do here is to only cash out £2,3o0 and leave the balance until the following tax year.

- In doing so, you will not exceed your annual capital gains allowance of £12,300.

- Then, when the 2022/23 tax year kicks in, you can then cash out the remaining £2,700 from your Bitcoin capital gains.

Another thing to note is that married couples in the UK received £24,600 in annual capital gains allowance. As such, this can work in your favor if you are looking to maximize your tax-free allowances each year.

Investing in Cryptocurrency

The rules surrounding cryptocurrency investments in the UK are much the same as stocks and shares. This means that when you buy cryptocurrencies from an online exchange or broker with pounds and pence, you won’t be required to pay any tax.

With that said, unlike shares listed on the UK stock exchange, cryptocurrencies do not attract stamp duty tax. In turn, this will save you a further 0.5%.

Wallet Transactions

When you transfer cryptocurrency that you own from one wallet to another, this will not trigger a tax liability with HMRC. On the contrary, you are free to transfer tokens on a wallet-to-wallet basis without restrictions.

Charity Donations

Another transaction that is exempt from Uk tax on crypto is a charity donation. The charity must be registered in the UK for the transaction to remain tax-free.

How Does HMRC Know About Your Crypto Assets?

There is often a misconception that transactions carried out on blockchain networks like Bitcoin and Litecoin are anonymous. However, this is not correct – as transactions are actually pseudonymous.

- In simple terms, while cryptocurrency transactions are tied to the identity of the sender or receiver, all transfers appear on the blockchain ledger – which is public.

- And as such, there are now data analytical companies that have the capability to trace transactions to those involved in the transfer.

- Moreover, brokers and exchanges that have the legal remit to offer cryptocurrency trading services in the UK must submit documentation to government agencies like HMRC and the FCA when requested.

All in all, don’t make the mistake of thinking that your cryptocurrency investments are anonymous.

UK Cost Basis Method

Another thing to note when learning about cryptocurrency tax in the UK is the cost basis method that HMRC deploys.

For those unaware, this refers to the way that HMRC determines the cost price that you paid for your cryptocurrency and thus – the size of the capital gains tax that you should report.

In the UK, there are actually three different methods that can come into play. Moreover, you need to work through each method in numerical order to determine which calculation is right for your circumstances.

1. Same-Day Rule

This cost basis rule is linked to day trading positions. For instance, let’s say that you buy Bitcoin at $40,000 at 9 am and sell your position at 2 pm when it hits $41,500. In this example, your cost price is simply $40,000.

2. Bed and Breakfast Rule

If you hold onto your cryptocurrency positions for more than a day but less than one month, then the Bed and Breakfasting rule kicks in. This means that your profit and loss must be reported for that specific month.

3. Section 104 Rule

If you hold onto your cryptocurrency investment for more than a month, then you will need to add all of your cost prices together and divide this by the total investment amount. This will then give you an average cost price that you can base your capital gains on.

Reporting Crypto Gains & Losses on Tax Returns

When it comes to reporting your profits and losses from your cryptocurrency investments, it might be best to go through a qualified tax professional.

In doing so, you can be sure that you are repotting the correct figures. This is especially the case if you are an active trader that has placed many buy and sell positions throughout the tax year.

How to Avoid Paying Crypto Tax in the UK

By consulting with a professional that specializes in crypto assets, you might be able to deploy a strategy that enables you to reduce your tax liabilities legally.

Some of the most common ways of doing this are as follows:

- Avoid selling your cryptocurrency investments so that capital gains are not realized

- Reduce the amount of cryptocurrency that you sell in a particular tax year so that you do not exceed your annual capital gains allowance

- Consider donating some of your cryptocurrency to charity so that you can offset the gains

- Sign up with a crypto tax platform to assess whether you might have missed a previous trading loss that you can offset

The above strategies are just four examples from many. Ultimately, whether or not you have the capacity to reduce your crypto tax exposure will depend on your personal circumstances.

Is Crypto Interest Taxed?

As we discussed earlier, the interest generated from cryptocurrency investments is taxable in the UK. This will fall within the remit of your income tax liabilities for the respective financial year.

It will be difficult for you to strategize in this respect – especially if you are using a crypto savings account provider that automatically distributes interest payments on a daily or weekly basis.

As such, you will need to report your crypto interest payments in the same way as any other taxable liability.

Aqru – the Best Crypto Interest Account?

We mentioned earlier that the overall best way to avoid paying tax on crypto investments in the UK is to simply hold onto your tokens for as long as possible.

In doing so, this means that your capital gains are not realized and thus – you won’t need to pay any tax until your actually cash out.

Crucially, if you are going to hold onto your cryptocurrencies long-term to avoid paying capital gains tax – then it goes without saying that you should deposit the digital assets into a savings account. This will enable you to earn interest on your investments.

One of the best new crypto interest account providers available the United Kingdom (some such as Celsius are not open to the UK) is Aqru.

Earn up to 12% Annually in Crypto Interest at Aqru

![]() Aqru offers crypto interest accounts to UK residents that wish to generate income on their digital currency investments. You can deposit Bitcoin and Ethereum into your Aqru account to earn up to 7% per year in interest. Alternatively, you can earn 12% per year on stablecoins like Tether.

Aqru offers crypto interest accounts to UK residents that wish to generate income on their digital currency investments. You can deposit Bitcoin and Ethereum into your Aqru account to earn up to 7% per year in interest. Alternatively, you can earn 12% per year on stablecoins like Tether.

Either way, for as long as you keep your cryptocurrency tokens in your Aqru savings account, your capital gains won’t be realized. This means that you can avoid paying capital gains tax until you eventually sell the tokens. In the meantime, Aqru will deposit your interest payments into your account on a daily basis.

The Aqru.io homepage

As noted earlier, each interest payment must be reported and the cost price is based on the value of the token on the day you receive the funds. What we also like about Aqru is that the platform allows you to deposit funds in pounds and pence with a debit/credit card or bank transfer.

This can come in handy if you wish to maximize your potential interest earnings. Another huge benefit of depositing cryptocurrency into an Aqru account is that there are no lock-up terms. This means that if there comes a time when you want to realize your capital gains by cashing out, you can do so instantly without being penalized.

Cryptoassets are a highly volatile unregulated investment product. No UK or EU investor protection.

Conclusion

In summary, it is important to remember that crypto is taxed in the UK. Your liability will come into force when you cash out your cryptocurrency investment and the tax is based on the capital gains that are realized.

You will also need to pay income tax when you earn interest on your cryptocurrency via a savings account or staking. Crucially, the good news is that by depositing your tokens into a crypto savings account, you won’t pay any capital gains tax until you cash out.

As such, interest account providers like Aqru are worth considering – as you will earn an APY of 7% on Bitcoin and Ethereum and 12% on stablecoins as passive income. United Kingdom based investors are also accepted, which isn’t the case at some crypto interest providers such as Celsius.

Cryptoassets are a highly volatile unregulated investment product. No UK or EU investor protection.

FAQs on Crypto Tax in the UK

Is crypto taxed in the UK?

How much crypto is tax free in the UK?

Can you avoid paying crypto tax in the UK?

How do crypto winners avoid a tax shock?

How much tax do I pay on crypto capital gains in the UK?

This news is republished from another source. You can check the original article here

Be the first to comment