Many investors new to the cryptocurrency scene are unaware that you can earn interest on your digital token holdings – just like you would in a bank account. However, unlike a traditional bank account – you’ll have access to significantly more attractive yields.

In this beginner’s guide, we’ll discuss the very best crypto interest accounts in terms of reputation, supported tokens, APYs, lock-up terms, and more.

The Best Crypto Interest Accounts for 2022 List

The five platforms listed below came out as the overall best crypto interest account providers for 2022.

- Aqru – Overall Best Crypto Interest Account for 2022

- Crypto.com – Earn Upto 14.5% Interest on Stablecoins

- BlockFi – Safe Crypto Interest Account to Earn 4.5% APY on Bitcoin

- Binance – Top Interest Savings Account for High Yields

- Coinbase – User-Friendly Way to Earn Passive Income on Your Crypto Savings

Scroll down to read our reviews of the above crypto compound interest accounts.

Top Crypto Interest Platforms Reviewed

When searching for the very best crypto interest accounts in the market, there are a number of core factors to cross-check. Not only does this include the safety of your funds, but what coins and yields are on offer.

The overall best ways to earn interest on crypto today are with the five providers reviewed below.

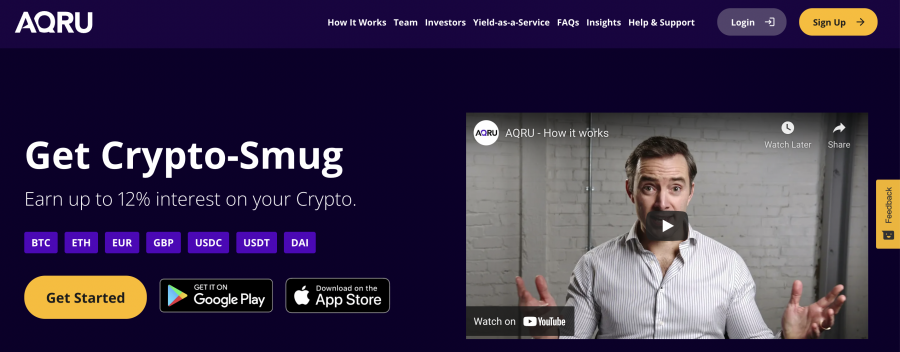

1. Aqru – Overall Best Crypto Interest Account for 2022

Aqru offers a one-stop shop for all of your crypto interest-earning needs. Regardless of your experience in this space, the Aqru website is user-friendly and free of jargon, so you get yourself set up in less than 10 minutes from start to finish. Upon researching the platform from top to bottom, we found that Aqru offers support for both stablecoins and conventional cryptocurrencies.

Regarding the former, this covers USDT, USDC, and DAI. In terms of supported crypto-assets, you can earn interest on the two largest digital currencies in terms of market cap – Bitcoin and Ethereum. Looking at the yields on offer, stablecoins provide the highest APY at 12%. If depositing Bitcoin or Ethereum into your Aqru account, a smaller yet still competitive APY of 7% is offered. Crucially, regardless of what digital asset you decide to generate interest on, your rewards will be paid out daily.

This allows you to grow your digital asset portfolio faster, as you can elect to keep reinvesting your interest back into the Aqru crypto interest account. Moreover, we like the fact that all savings accounts at Aqru are flexible, so you can cash out your tokens at any given time. Perhaps the main drawback with this provider is that in comparison to other crypto interest accounts in the market, the number of supported tokens is somewhat limited.

We also like Aqru for its simple and fair pricing model. That is to say, the APYs that you are offered do not incur any commissions, so you’ll get the full amount that you are owed. On the other hand, the platform’s $20 fee on crypto withdrawals is a drawback to consider. Finally, if you’re the type of investor that seeks top-quality customer support, Aqru offers a live chat facility that allows you to speak with a member of the team in real-time.

Cryptoassets are a highly volatile unregulated investment product.

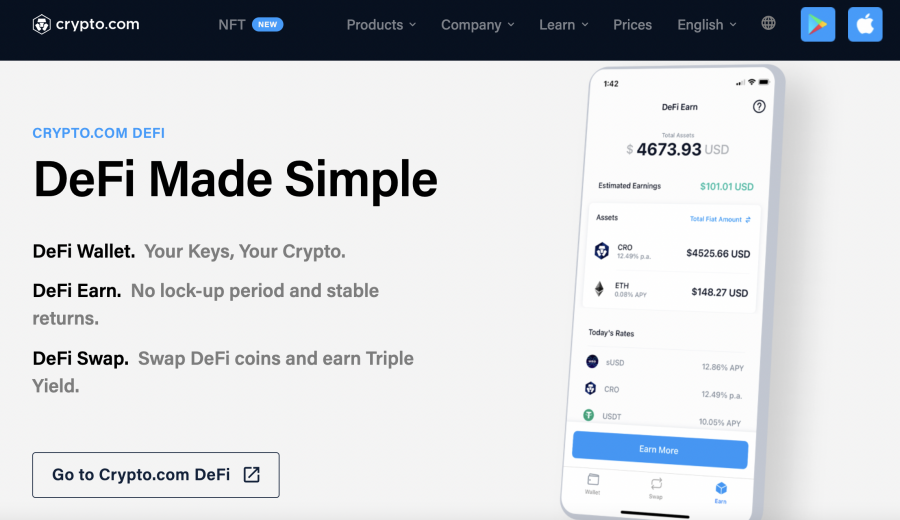

2. Crypto.com – Earn Upto 14.5% Interest on Stablecoins

Next up on our list of the best crypto interest accounts for 2022 is Crypto.com. This online platform offers a range of services, from low-cost cryptocurrency exchanges where you can buy cryptocurrency, an NFT marketplace, education, digital asset-backed debit cards, and more. In terms of its crypto savings accounts, the platform supports dozens of digital tokens. Not only does this include stablecoins but plenty of large and medium-cap cryptocurrencies.

In terms of yields, Crypto.com allows you to earn up to 14.5% per year on stablecoin deposits. This attractive APY is, however, depending on the term of your deposit and whether or not you stake CRO tokens, which is native to the Crypto.com website. For instance, let’s suppose that you want to stake a stablecoin like Tether. To get the maximum benefit, you need to stake at least 40,000 CRO tokens and lock the funds up for three months.

If, however, you switch over to a flexible lock-up period and decide not to stake any CRO tokens, the yield is reduced to 6%. This is still very competitive when you consider that banks in the US rarely offer an APY on flexible cash balances of more than 0.10% annually. Outside of its strong stablecoin offering, Crypto.com also provides savings accounts for the likes of Bitcoin Ethereum, Litecoin, Bitcoin Cash, Stellar, EOS, Cardano, Chainlink, and more.

Take note, although just like Aqru, your interest will be paid out daily, the rewards will not compound at Crypto.com. As such, you will need to manually reinvest the tokens to benefit from a long-term compounding strategy. Nevertheless, another reason that we like Crypto.com is that you can access your digital currency investments at any given time via the pre-paid debit card. This means that you could, for example, withdraw cash from an ATM and the funds will be deducted from your crypto interest account.

Cryptoassets are a highly volatile unregulated investment product.

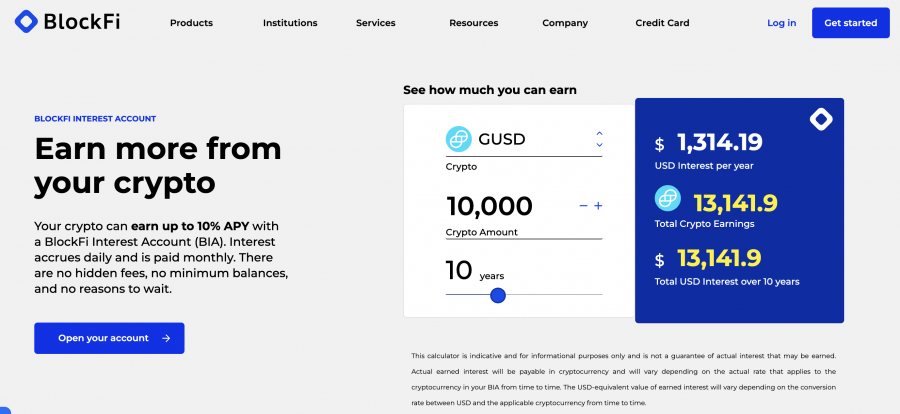

3. BlockFi – Safe Crypto Interest Account to Earn 4.5% APY on Bitcoin

BlockFi is a specialist crypto savings and lending platform that allows users to engage in financial services without needing to go through a traditional bank. Crucially, we found that BlockFi offers one of the safest avenues to earn interest in your crypto investments for several key reasons. First and foremost, BlockFi has agreed to bring its platform in line with the SEC’s regulations on the Investment Company Act of 1940.

In Layman’s Terms, this will offer BlockFi users much greater safeguards in terms of the risks involved. Second, BlockFi has an insurance policy in place with BitGo, which covers investors up to a certain amount should the platform experience a hack. Moreover, BlockFi keeps its digital asset funds with Gemini, which itself is regulated by the New York State Department of Financial Services as a trust company.

In addition to offering a safe and secure (but not risk-free) platform, BlockFi is home to dozens of supported crypto assets – all of which you can generate interest on. At the forefront of this is the 4.5% APY that you can earn on Bitcoin deposits. Ethereum is slightly more competitive a BlockFi with an APY of 5%. If you’re seeking an even higher yield, Cosmos and Polkadot pay 7% and 9.5% respectively.

Just like Crypto.com, BlockFi offers a range of other products and services on its platform. For instance, should you wish to increase your exposure to a specific cryptocurrency investment, the platform offers real-time loans. The amount of offer will depend on how much collateral you are able to put down. BlockFi also offers one of the best crypto wallets for beginners – which comes in the shape of a mobile app.

Cryptoassets are a highly volatile unregulated investment product.

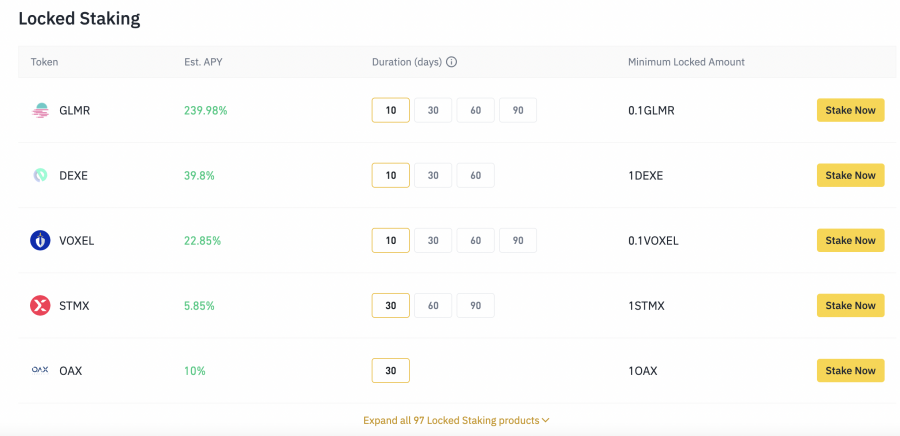

4. Binance – Top Crypto Interest Account for High Yields

Binance is home to the largest cryptocurrency ecosystem globally. Not only does its primary exchange attract the most daily trading volume in the market, but the platform also offers debit cards, leveraged products, educational courses, loans, and its very own native digital currency – BNB. Moreover, Binance also offers one of the best crypto interest platforms in terms of supported coins and yields.

In fact, if you’re looking to earn interest on cryptocurrencies outside of the top-10 for market capitalization, you’ll be offered some phenomenal APYs. For instance, this stands at 104% on Axie Infinity as of writing, and 21% on Near. The likes of Polkadot and Luna offer APYs of 12% and 18% respectively. Do note, that much like any other crypto interest account in the market, specific APYs are also dependent on your lock-up terms.

For instance, while the aforementioned Axie Infinity offers 104% on a 90-day lock-up period, this is reduced to 25% on a 7-day plan. If you’re more interested in large-cap projects, you can earn up to 5% APY when depositing Bitcoin. And, best of all, this is a flexible savings account – so you can withdraw your BTC tokens at any given time. Another way to grow your crypto portfolio at Binance in a passive way is via staking crypto.

The platform supports dozens of staking coins at various APYs and lock-up terms – so this is well worth checking out. Moreover, we should also note that Binance offers super-low trading fees of just 0.10% per slide. This is relevant because you can use the Binance exchange to easily purchase the digital currency that you wish to earn interest. Finally, Binance allows you to view the performance of your crypto interest account in real-time – both online and via the provider’s app.

Cryptoassets are a highly volatile unregulated investment product.

5. Coinbase – User-Friendly Way to Earn Passive Income on Your Crypto Savings

Although Coinbase put its crypto interest accounts on hold last year, the popular exchange still allows you to earn passive income via its staking platform. If you’re unfamiliar with staking, the underlying process is much the same as a crypto interest account. This is because with staking on the Coinbase website, you will be required to lock up your crypto tokens for a certain period of time.

During which, Coinbase will pay you rewards in the form of interest. We should note that as of writing, just six tokens are supported at Coinbase for the purpose of staking. The highest APY is offered on Cosmos at 5%, with Ethereum yielding 4%. Tezos and Algorand pay 4.64% and 4% respectively, while with Dai and USDC, this stands at just 2% and 0.15%. To be eligible for staking at Coinbase, you must have a verified account with a confirmed tax identification number (TIN).

If you like the sound of Coinbase and wish to use the exchange to earn passive income, you have two options to get started today. First, if you already have an eligible cryptocurrency to hand, you can transfer the tokens over to Coinbase. Or, if you do not currently have any crypto, you can make a purchase directly on the Coinbase website. This will cost you 3.99% when using a debit or credit card and 1.49% via ACH.

Cryptoassets are a highly volatile unregulated investment product.

Best Crypto Interest Accounts Compared

For a snapshot overview of the best crypto interest accounts reviewed in the previous sections, check out the comparison table below.

| Interest on BTC | Interest on Stablecoins | Lock-Up Terms | |

| Aqru | 7% | Up to 12% | Flexible |

| Crypto.com | 8.50% | Up to 14% | Flexible – 3 Months |

| Blockfi | 4.50% | Up to 9.25% | Varies |

| Binance | 5% | 7% on USDT | Flexible – 3 Months |

| Coinbase | N/A | 2% | Flexible |

The crypto interest rates comparison table above is accurate at the time of writing.

How Does Crypto Interest Work?

Ordinarily, when you invest in cryptocurrencies, you will only make money if the value of the token increases and you decide to sell. However, a whole new investment landscape has since entered the blockchain market in the name of crypto savings accounts.

As the name suggests, this operates much like a traditional bank account, insofar that by depositing funds, you will be paid a rate of interest. And, just like you get with traditional financial institutions, some crypto interest accounts come with lock-up terms, while offers offer a flexible withdrawal policy.

Moreover, the specific cryptocurrency that you deposit will determine how much interest you will be paid – as will your choice of provider. This is why it’s important to do lots of research in your search for the best crypto interest account.

With that said, before you begin searching for the highest yields on offer for your preferred crypto token, it is important that you understand how platforms are able to pay you interest on a digital asset class that only generates capital gains.

How do Crypto Interest Accounts Pay Interest?

In the vast bulk of cases, your chosen crypto interest account provider is able to pay you interest on your idle digital tokens through a centralized loan model. In more simple terms, when you deposit cryptocurrencies into the platform, the provider will use the funds to facilitate loans for those looking to borrow capital.

Let’s look at a basic example of how this might work:

- You deposit $1,000 worth of Bitcoin into a crypto interest account

- Your chosen provider offers 5% on a 3-month lock-up. As such, you won’t be able to withdraw the tokens until the 3-month period has concluded.

- The $1,000 that you deposited is then used to fund crypto loans. For simplicity, we’ll say that the user pays a 7% interest per year.

- After three months have passed, you get your $1,000 in Bitcoin back.

- Plus, you also generated 5% APY in interest, which amounts to $12.50 over a 3-month lock-up

There are some important points to note about the above example. First and foremost, the example was based on a 3-month lock-up period. However, this isn’t the industry standard, as the best crypto interest account providers that we came across offer a variety of terms. Many of which offer flexible accounts that allow you to withdraw your tokens at any given time.

Moreover, you will quickly notice that because the interest is paid by a user that is borrowing funds, this in itself presents a risk. After all, if too many users on a specific platform default on their crypto loan repayments, this could result in you getting back less than you originally invested.

Which Platforms Have the Best Crypto Interest Rates?

If you’re searching for the best platforms in terms of crypto interest rates, then this really does vary. For example, while one platform might offer a more competitive APY on Bitcoin, its interest rate on Ethereum might not be as attractive.

And as such, it’s really important to shop around to find the best deal for your circumstances.

- Nevertheless, to give you an idea of what’s on offer, Aqru offers up to 12% on stablecoin deposits, and 7% on Bitcoin and Ethereum.

- In comparison, the best stablecoin APY at Coinbase stands at just 2%, which is paid on DAI tokens.

- And, over at BlockFi, you’ll get a maximum of 4.5% and 5% on Bitcoin and Ethereum respectively.

Another thing to bear in mind when searching for the best crypto interest rates is that higher yields might be a result of less favorable terms.

For example, to maximize the Crypto.com interest rate, not only do you need to lock your tokens away for 90 days, but you’ll also need to stake the platform’s native digital token – CRO. These are all points to take into account before you proceed.

What Cryptos Can You Earn Interest On?

Put simply, you can earn interest on virtually any cryptocurrency – as it’s up to the platform in question which digital assets it offers support for. With that said, most crypto interest accounts will focus on large-cap projects like Bitcoin, Ethereum, and Cardano.

If you are looking to stake less liquid cryptocurrencies that carry a smaller market capitalization, then Binance is probably the best platform for this purpose.

- If you’re looking for the highest yields with the least amount of volatility, nothing quite compared to stablecoins.

- This is because the likes of Aqru offer an APY of up to 12% on stablecoins like USDT and USDC, both of which are pegged to the US dollars.

- And as such, you don’t need to worry about ever-fluctuating token prices when earning interest on crypto stablecoins.

On the other hand, when opting for a traditional cryptocurrency like Bitcoin or Ethereum, you always stand the risk of the token going down in value. If this does happen, your losses may exceed the amount of interest that your chosen crypto interest account provider is offering.

Crypto Compound Interest?

In the traditional investment markets – whether that’s in the shape of stocks, bonds, or real estate – assets that generate income allow you to grow your portfolio much faster.

This is because of the impact of compound interest. In its most basic form, by reinvesting your dividends, coupon payments, or monthly rental income back into other assets, your newly purchased instruments will also start generating a regular yield.

And as such, you will ‘earn interest on the interest’. The good news from your perspective is that compound interest can also be achieved through a crypto interest account.

This means that every time you receive a payment – which is often daily, you will reinvest the funds back into the respective interest-bearing account.

In doing so, you can accelerate the pace at which your crypto funds grow.

For example:

- Let’s say that you invest $1,000 into a crypto savings account that pays 10% per year.

- At the end of the first year, you will have made $100 in interest.

- If you choose to withdraw this $100, then your balance will revert to $1,000 and at the end of the following year, you will once again make $100 in interest – assuming the APY remains at 10%.

- However, if you reinvested the $100 back into the crypto interest account, the following year would yield an interest payment of $110.

- This is because a total balance of $1,100 at 10% APY yields $110.

- Then, if you again reinvested the interest, your new balance would stand at $1,210. Meaning – at 10%, next year’s interest payment would stand at $121.

As you can see from the example above, on each occasion that you reinvest your crypto interest back into the savings account, your payments exponentially increase.

How to Earn Interest on Crypto?

We will now show you the ropes of how to earn interest on crypto at a top-rated platform like Aqru.

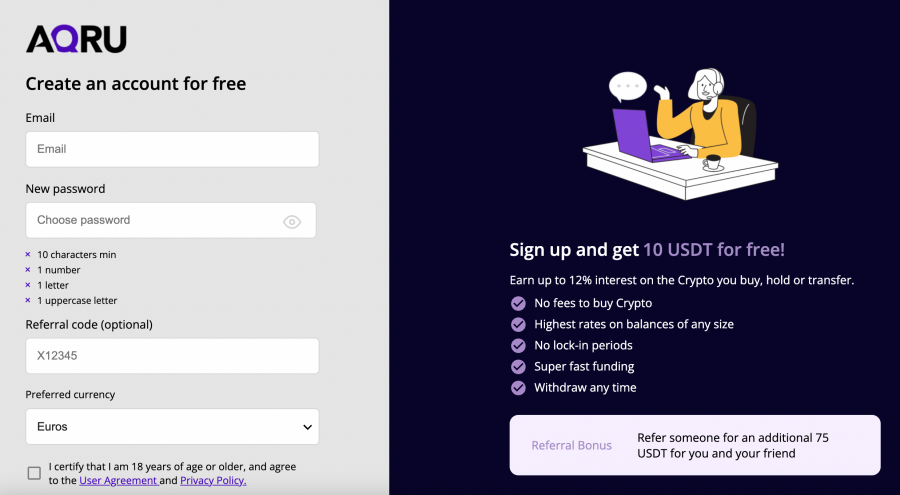

Step 1: Register an Account

The first part of the process is to register an account with Aqru. This will initially require your email address, preferred currency, and a chosen password.

You will also need to read and accept the terms and conditions, before clicking on ‘Create Account’.

Step 2: Verify Identity

Aqru complies with all relevant laws surrounding anti-money laundering. And as such, all newly registered users must go through a KYC process.

First, this will require you to enter some personal information about who you are – such as your full legal name, nationality, residential address, and date of birth.

Next, you will need to upload a copy of your government-issued ID.

Step 3: Deposit Funds

Once your Aqru account has been verified, you can then proceed to make a deposit. Interestingly, Aqru supports deposits via both fiat currency and digital assets.

The former supports euros and pounds. The latter supports a variety of stablecoins, Bitcoin, and Ethereum. The minimum amount that can be deposited in fiat currency is £/€ 100.

Step 4: Start Earning Crypto Interest

Once you have made a deposit with your chosen asset, you will then start earning interest. You can check the respective APYs for each supported fiat currency and digital asset via your Aqru account dashboard.

And, don’t forget, your interest will be paid to you on a daily basis and you can elect to withdraw your funds at any given time.

Is Crypto Interest Taxed?

You might already know that many jurisdictions tax cryptocurrency trading profits in the same way as other assets that generate capital gains.

But, what about crypto interest?

Well, this really does depend on the jurisdiction that you are a resident of for tax purposes – as there is no universally accepted system.

With that said, you might find that if your respective jurisdiction does tax the earnings you make via a crypto interest account, this might be initiated in the same way as dividend income.

But, once again, it is imperative that you seek professional guidance from a qualified tax specialist.

Are Crypto Interest Accounts Safe?

This section of our guide is potentially the most important – as we discuss the implications of using a crypto interest account in terms of safety.

Across most savings accounts, there are a number of core risks that need to be considered – including:

- The risk of the platform offering the crypto interest account

- The risk of a great number of borrowers defaulting on their loans

- The risk of the broader crypto market crashing

We explore the above risks in more detail in the sections below.

Platform Risk

When you deposit funds into a crypto interest account, you are using a centralized provider. In a nutshell, this means that you are trusting the platform in question to meet its obligations.

This includes keeping your cryptocurrency investment safe and away from the hands of remote hackers. This also means distributing your interest payments on time and at the agreed amount.

There are no guarantees that any of the above agreements will be acted on by the platform – so it’s crucial that you research the respective provider extensively before opening a crypto interest account.

Default Risk

We explained in great detail earlier that crypto interest account providers are able to pay you interest because your deposited tokens are used to fund loans. And of course, as is the case with all loan agreements, there is always the risk of default.

- On the one hand, if a small number of borrowers default on their loan, this likely wouldn’t be a major issue.

- However, if a large number of defaults are experienced on a single platform, then this could be problematic.

- After all, we have seen many peer-to-peer lending platforms collapse in recent years – which resulted in investors losing some or even all of their money.

With that said, the best crypto interest accounts that we came across have a crucial safeguard in place – collateral. This means that for somebody to borrow funds on the platform, they must put down a security deposit in the form of crypto.

This means that in the event the individual defaults on their loan agreement, the platform will sell the collateral to ensure that investors are repaid.

Market Crash Risk

Leading on from the above section, it is notable that the best crypto interest platforms require a minimum amount of collateral to facilitate loan requests. However, this collateral likely won’t be sufficient in the event that there is a major crypto market crash.

After all, if the platform is required to sell large amounts of collateral when market prices are down considerably, this means that it will get far less back when compared to the original principal amount at the time of the loan.

Conclusion

In summary, crypto interest accounts give you the best of both worlds. Not only can you invest in your favorite digital currencies in the hope that the value of the token will increase over time, but you can earn regular interest on your holdings.

And, when compared to traditional bank accounts, crypto interest accounts offer much more attractive yields. In many cases, this will exceed an APY of 10%. You do, however, need to consider the risks – as returns are never guaranteed.

To get started with the best crypto interest account for 2022 – consider Aqru. The trusted platform offers an APY of 7% on both Bitcoin and Ethereum, and 12% on stablecoins like USDC and USDT.

Cryptoassets are a highly volatile unregulated investment product.

Frequently Asked Questions on Crypto Interest Accounts

Can you earn interest on crypto?

What are crypto interest rates?

Who has the highest crypto interest rates?

What are the best ways to earn interest on crypto?

Which crypto pays the most interest?

What is the best crypto interest account?

This news is republished from another source. You can check the original article here

Be the first to comment