Written by Kane Pepi. Updated 3rd Mar 2022.

Decentralized finance (DeFi) is tipped to be the next big thing in the cryptocurrency and blockchain technology arenas.

Put simply, the phenomenon refers to projects that aim to provide traditional financial services – such as loans, savings accounts, and asset exchanges, but without requiring a third-party intermediary.

In this guide, we analyze the best DeFi coins to buy in 2022 so that you can enter the decentralized finance space while it is still in its infancy.

Best DeFi Coins to Buy in 2022

Although the decentralized finance marketplace is now home to hundreds of projects – we found that the overall 10 best Defi coins are those listed below:

- Lucky Block – Overall Best DeFi Coin to Buy in 2022

- Uniswap – Top Decentralized Exchange With Leading Defi Coin

- Terra – Leading Defi Coin That Continues to Outperform the Market

- Decentraland – Invest in the MetaVerse via the MANA Token

- Yearn.finance – Defi Services via Decentralized Lending Agreements

- The Graph – Blockchain Index Services via the GRT Token

- SushiSwap – All-in-One Defi Platform With Popular Token

- Cosmos – Top-Rated Defi Coin Protocol Offering Blockchain Interoperability

- Kyber Network – Decentralized Protocol Providing Defi Coins With Liquidity

- AAVE – Open Source Defi Protocol

To find out why we believe that the Defi crypto list above represents the best projects in this space – read on. We’ll also show you how to buy cryptocurrency with low fees using the best crypto broker in 2022.

A Closer Look at the Best DeFi Tokens to Invest in

In order to pick the very best Defi coins for your investment portfolio – you’ll need to consider metrics surrounding:

- Current market capitalization

- Growth potential

- Past performance

- Objectives and road map targets

- Token cost price

- Exchanges that list the token

Taking these core factors into the account, below you will find our analysis of the top Defi coins for 2022.

1: Lucky Block – Overall Best Defi Coin to Buy in 2022

Lucky Block came out as a clear winner as the overall best Defi coin to buy right now. The project – which was first founded in late 2021, is in the final process of launching an innovative lottery gaming platform. In a nutshell, the Lucky Block lottery ecosystem stands out from conventional operators – insofar that all gaming outcomes are decentralized.

And as such, lotteries are not run by state-franchised bodies that are connected to the respective government – as is often the case. In order to offer a decentralized lottery platform, Lucky Block games are executed by a smart contract. If you’re familiar with how smart contracts work, then you will know that the underlying code is both immutable and free from manipulation.

Therefore, Lucky Block players can be sure that all gaming outcomes are random and legitimate. Moreover, as Lucky Block operates on top of the Binance Smart Chain, this means that players from all over the world can access its lottery games. This is in stark contrast to how traditional operators run – which limits lottery games to citizens of the respective country.

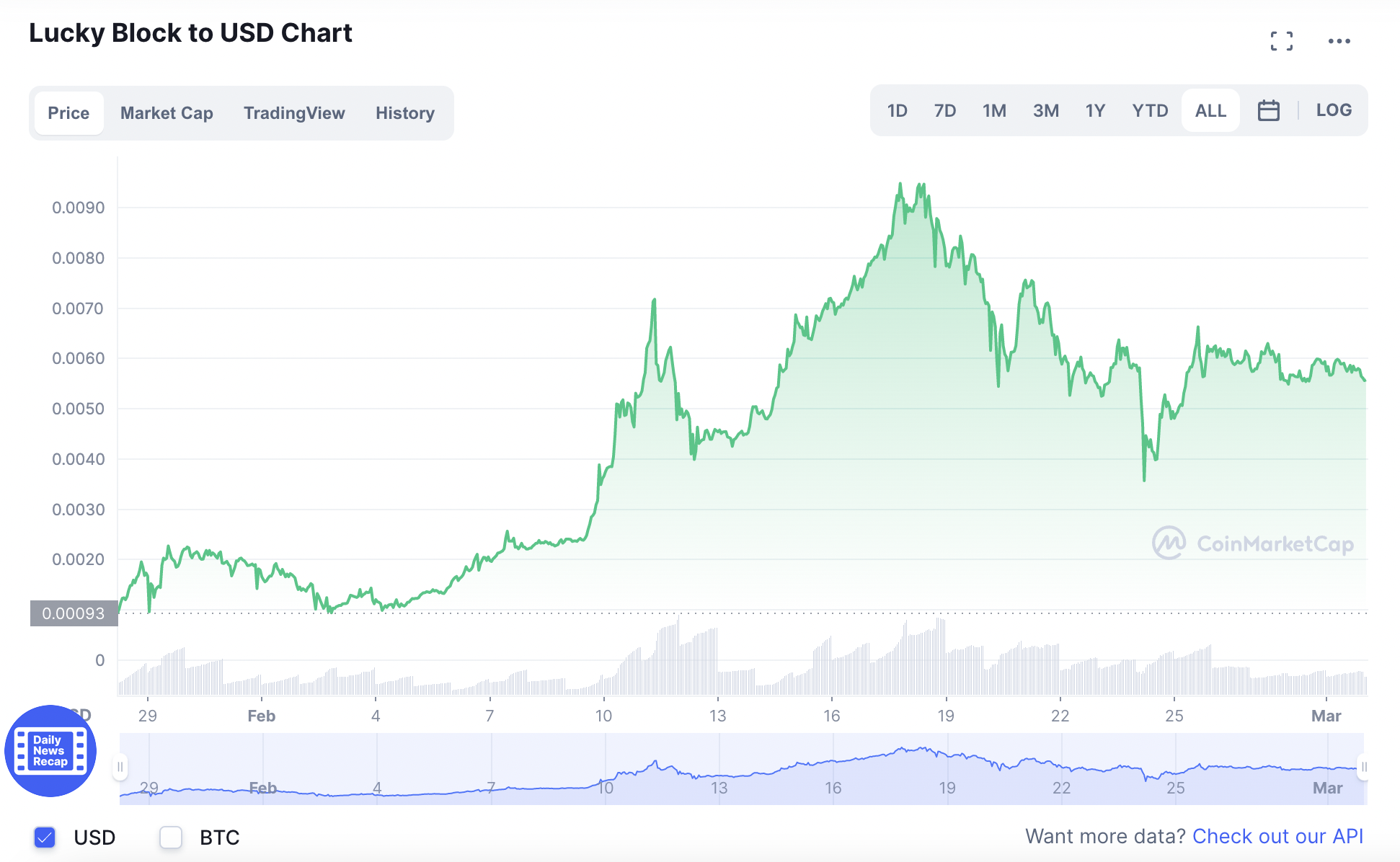

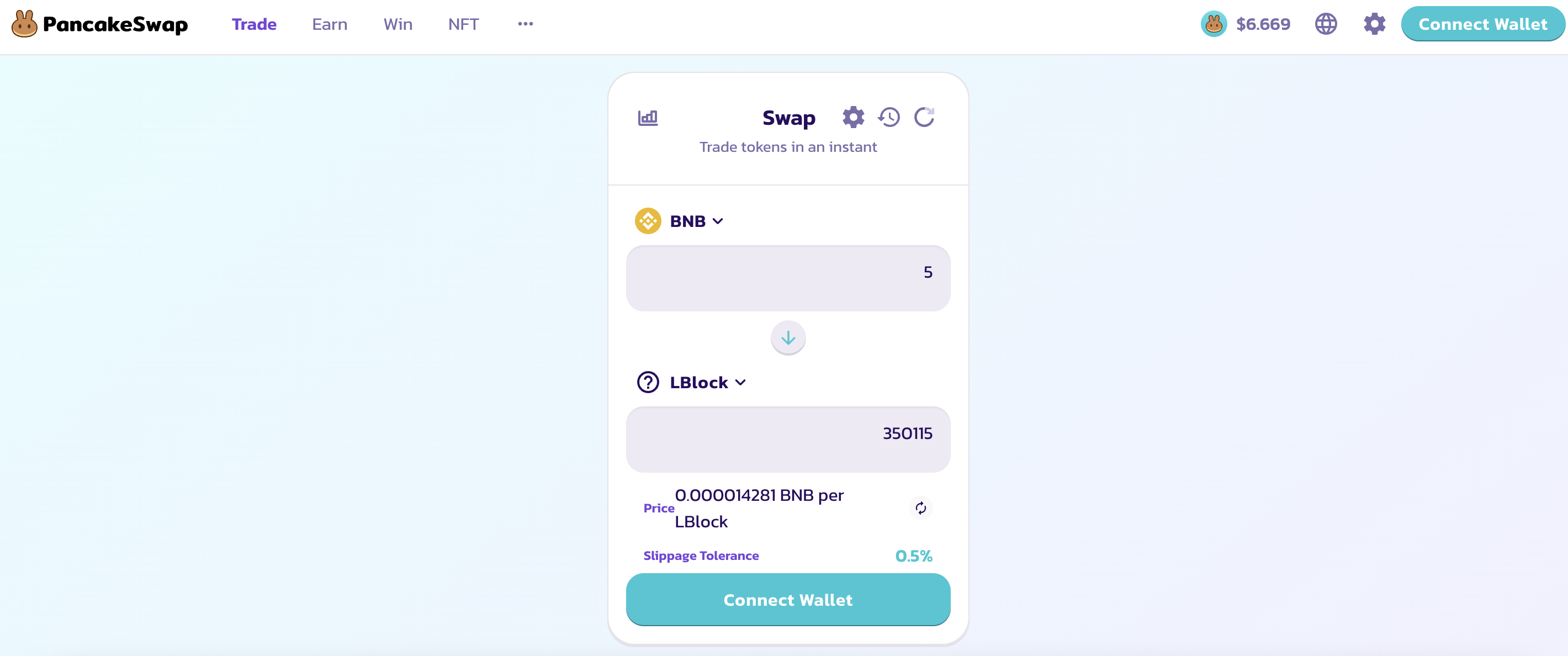

In terms of how to invest in this top-rated Defi coin, the Lucky Block token initially held its pre-sale launch in January 2022 – whereby it raised the crypto-equivalent of $5 million. At the end of the same month, the Lucky Block token launched to the public via Pancakeswap – where it has since become one of the best-performing digital assets of the year.

To illustrate this point, Lucky Block was priced at just $0.00015 during its initial pre-sale campaign. Since then, CoinMarketCap notes that the project has hit highs of $0.00961 per token. As such, this represents gains of over 6,000% in just over a month of trading. Ultimately, in buying Lucky Block today – you can still get in on this project super-early.

Cryptoassets are a highly volatile unregulated investment product.

2: Uniswap – Top Decentralized Exchange With Leading Defi Coin

Next up on our list of the best Defi coins to watch in 2022 is Uniswap. This project represents the true definition of decentralized finance, insofar that it is home to an innovative exchange platform that allows traders to swap tokens on a peer-to-peer basis. In other words, in buying and selling crypto assets via Uniswap, no centralized party is required.

This is in stark contrast to the industry norm, which is dominated by large centralized crypto exchanges such as Binance, FTX, and Coinbase. All of which sit between buyers and sellers – making huge commissions along the way. In the case of Uniswap, the exchange doesn’t utilize traditional order books to match market participants.

Instead, the platform is home to an automated market maker – or AMM, model. In its most simple form, Uniswap’s AMM will set token prices based on a wide variety of variables – such as volume, demand, and market capitalization. This allows for a smooth and burden-free way of trading cryptocurrencies in a decentralized manner.

In its of its native Defi coin – UNI, the project is a top-25 digital asset for market capitalization. When the token was first launched on public exchanges in 2020, you would have paid in the region of $7. Year-to-date 2022, UNI has hit highs of over $17. This represents a growth of over 140%. With that said, investors will be looking for a return to the $40+ region that UNI hit in 2021.

Cryptoassets are a highly volatile unregulated investment product.

3: Terra – Leading Defi Coin That Continues to Outperform the Market

There is no denying that the broader cryptocurrency markets – especially that of Defi coins, have largely been bearish moving into 2022. With that being said, there appears to be no stopping the value of Terra – which continues to perform extremely well. For those unaware, Terra is a decentralized finance project that specializes in algorithmic stablecoins.

Unlike most stablecoins in the market, Terra doesn’t just focus on major fiat currencies such as the US dollar or euro. On the contrary, the Terra protocol covers a full range of other national currencies – including but not limited to the South Korean won, Japanese yen, and Chinese yuan.

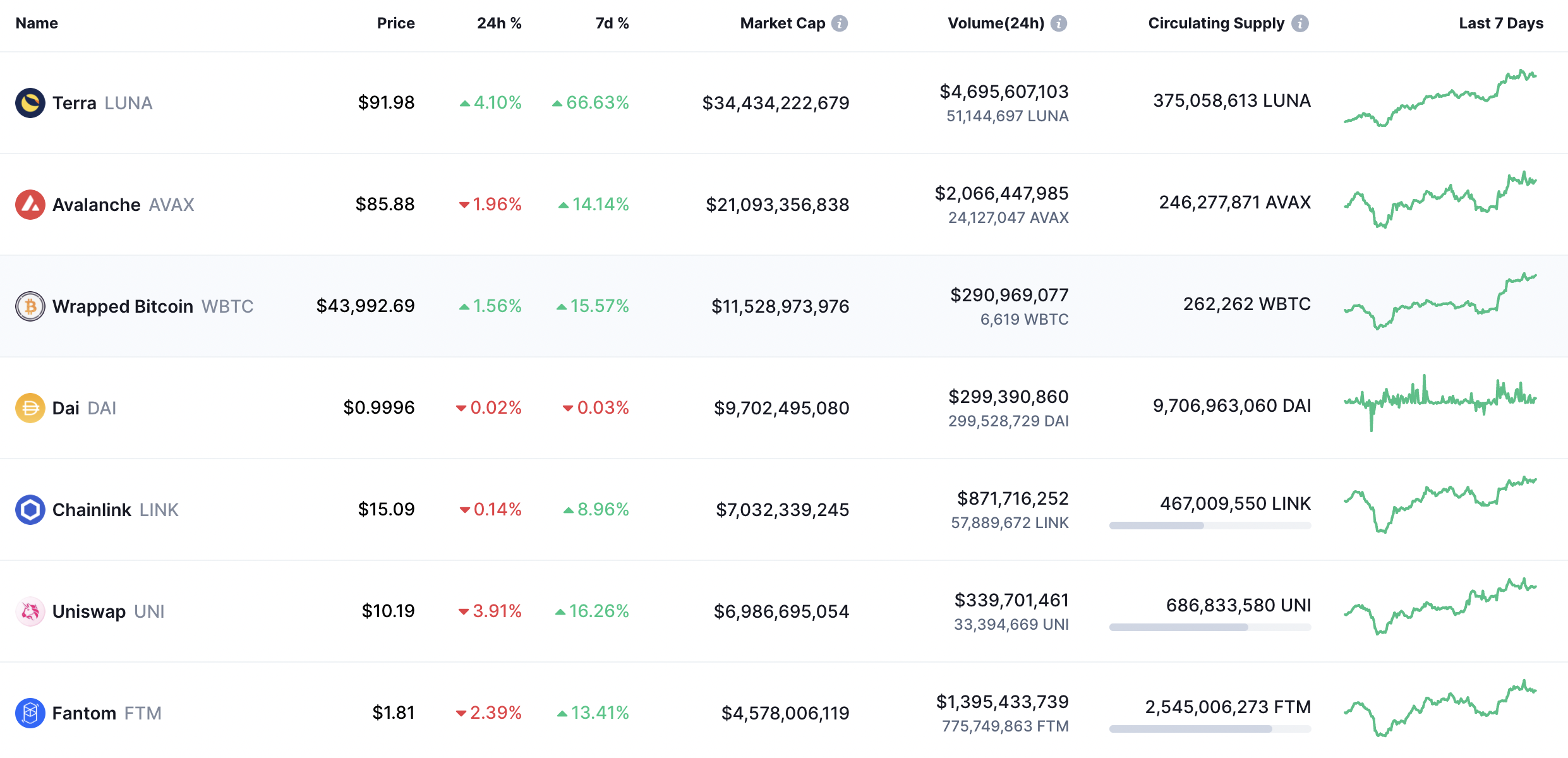

In fact, Terra even supports the SDR (Special Drawing Rights) – which is the currency backed by the International Monetary Fund. In terms of its performance, – Terra was priced at just $1.30 per token when it was launched on public exchanges in 2019 – as per CoinMarketCap. Fast forward to early 2022 and the same Defi coin is priced at over $90.

This means that in less than three years of trading, Terra has increased in value by over 6,800%. In more recent times, Terra was trading at just $44 in the four weeks prior to writing this guide – meaning that the value of the project has more than doubled in just one month alone. And as such, Terra has since become a top-10 cryptocurrency for market capitalization.

Cryptoassets are a highly volatile unregulated investment product.

4: Decentraland – Invest in the MetaVerse via the MANA Token

The MetaVerse is expected to become extremely popular in the coming years, with the likes of Facebook even rebranding its NASDAQ-listed company name to Meta Platforms. And as such, if you’re looking to invest in this growing concept early, you can do so by purchasing some MANA tokens – which is the native digital asset of Decentraland.

In its most basic form, Decentraland is a project built on top of the Ethereum blockchain that offers a virtual gaming world that can be accessed by all. One of the most innovative things about Decentraland is that users can buy virtual land and subsequently build digital real estate.

This real estate – alongside a full suite of other in-game items, can then be sold on the open marketplace. This business model has already achieved a proof-of-concept for several reasons. First and foremost, some real estate plots sold via the Decentralized platform have raised in excess of a million dollars.

Second, the MANA token – which is the native currency used for all purchases and sales made via the Decentraland platform, is now a multi-billion dollar project. In terms of performance, MANA was worth a mere $0.025 back in 2018. In mid-2021, the crypto asset hit highs of almost $6. And as such, this represents significant growth of nearly 24,000%.

Cryptoassets are a highly volatile unregulated investment product.

5: Yearn.finance – Defi Services via Decentralized Lending Agreements

The next project to consider from our list of the best Defi coins for 2022 is Yearn.finance. This project specializes in decentralized financial services – which as of writing, focuses on peer-to-peer style loans. By this, we mean that Yearn.finance forms a bridge between borrowers and lenders without requiring a centralized middleman.

This is made possible through smart contract technology – whereby everyday consumers can use Yearn.finance to borrow capital without needing to go through a credit check process. These loans are funded by investors that wish to earn a yield of their idle cryptocurrency holdings.

And in doing so, investors will earn an attractive rate of return. Yearn.finance also allows investors to provide liquidity for trading pairs, which, again, provides an APY that far outweighs anything offered by traditional banks and financial institutions. In terms of investing in the Yearn.finance project – you can do so by purchasing its Defi coin – YFI.

CoinMarketCap notes that YFI was first launched on public exchanges back in July 2020 at an initial price of $907. Since then, the YFI token has hit highs of over $93,000. This translates into gains of over 10,000%. Another major benefit of this Defi coin is that at just over 36,000 tokens – the total supply of this digital asset is extremely limited.

Cryptoassets are a highly volatile unregulated investment product.

6: The Graph – Blockchain Index Services via the GRT Token

The Graph is behind an innovative piece of technology that allows blockchain networks to ‘index’ data. This simply means that blockchains can efficiently store and extract data – such as transactions and mining logs, without overloading the network. As of writing, it is claimed that more than 25 blockchains are currently using The Graph’s technology for this purpose.

And, in order for these blockchains to index their data, they must use the GRT token to pay for transactions. Looking at its price action since launching in late 2022 – where the GRT token was priced at $0.21, the digital asset has since hit highs of over $2.20. This represents growth of over 700%. GRT is, however, available at a discount in early 2022 at less than $0.40 per token.

Cryptoassets are a highly volatile unregulated investment product.

7: SushiSwap – All-in-One Defi Platform With Popular Token

In a similar nature to Uniswap, SushiSwap is a decentralized exchange that allows users to buy and sell digital currencies without the need for a third-party middleman. SushiSwap does, however, offer a variety of other services that are aligned with the goals of decentralized finance.

This includes the ability to earn a yield of cryptocurrency holdings by investing tokens in liquidity pools, staking, and even lending agreements. As of writing, SushiSwap has attracted more than $2 billion in liquidity across $172 billion worth of trading volume. You can invest in SushiSwap by purchasing its native digital token – SUSHI.

Cryptoassets are a highly volatile unregulated investment product.

8: Cosmos – Top-Rated Defi Coin Protocol Offering Blockchain Interoperability

Cosmos is another top-rated Defi coin that you might consider adding to your investment portfolio. This project offers an innovative solution to the age-old problem of blockchain interoperability. By this, we mean that the underlying Cosmos protocol allows competing blockchains to talk with one another.

And as such, this would allow Bitcoin, for example, to share and extract data from the Ethereum blockchain – and vice versa. This promising concept has resulted in Cosmos becoming one of the sought-after Defi coins of 2022.

In terms of performance, ATOM – which is the native digital token of Cosmos, was trading at just over $21 in the 12 months prior to writing. Fast forward to early 2022 and the toke is now trading at over $30 – representing modest gains of over 35%.

Cryptoassets are a highly volatile unregulated investment product.

9: Kyber Network – Decentralized Protocol Providing Defi Coins With Liquidity

Kyber Network is a decentralized protocol that provides Defi coins with much-needed liquidity. The reason that this is a problem which needs solving is the Defi coin trading scene is somewhat fragmented – meaning that tokens are spread across multiple exchanges – such as Uniswap, Pancakeswap, SushiSwap, Curve, SpookySwap, and more.

With that said, Kyber Network is able to extract deep liquidity from all of the aforementioned platforms – which ensures that Defi coins provide sufficient market conditions for buyers and sellers. As of writing, Kyber Network is trading at a market capitalization of under $500 million, so there is plenty of upside potential left on the table.

Cryptoassets are a highly volatile unregulated investment product.

10: AAVE – Open Source Defi Protocol

AAVE describes itself as an open source liquidity protocol that forms the gap between peer-to-peer investors and borrowers. Through the AAVE platform, investors can inject crypto tokens into lending pools in return for interest. The specific APY offered will depend on the respective token.

Nevertheless, the funds are then distributed to borrowers – who are required to put up a security deposit in order to access instant funding. The AAVE token is now a leading Defi coin in terms of market capitalization and value. When the token was launched in 2020, you would have paid just $53.At the turn of 2022, AAVE was trading at over $262 – representing gains of nearly 400%.

Cryptoassets are a highly volatile unregulated investment product.

What are Defi Coins?

In its most basic form, Defi coins are digital currencies that serve a specific function for a project that offers decentralized financial services. For example, we mentioned earlier in our analysis of the best Defi coins for 2022 that the likes of Yearn.finance and AAVE each offer a decentralized lending facility that does not require a third-party middleman.

In order for these platforms to function without a centralized intermediary, transaction fees are paid for in the respective Defi coin – the YFI and Aave token. Similarly, Uniswap and SushiSwap both offer decentralized trading services, whereby buyers and sellers can exchange tokens on a peer-to-peer basis. Once again, the respective Defi coin of these projects fuels the platform.

As of early 2022, CoinMarketCap notes that there are now over 500 Defi coins active in this marketplace. On the one hand, this can make it a challenge to know which Defi coin to buy. With that said, if you’re looking to gain exposure to the broader decentralized finance industry – you could consider diversifying across dozens of different projects.

Are Defi Coins a Good Investment?

Defi coins could be a good investment for your portfolio if you’re looking to inject some capital into a niche marketplace that is growing at an exponential pace.

However, Defi coins – like all crypto assets, are extremely volatile and oftentimes – highly speculative. And as such, we would suggest doing some research prior to investing in the best Defi projects for your portfolio.

To start, you might consider some of the key points outlined below:

Growth of the Defi Coin Investment Scene

Before we get to core fundamental research data, we should start by exploring just how quickly the broader Defi coin investment scene has grown.

- Many of the Defi coins that we have discussed today were launched as recently as 2020 – which shows just how new this marketplace is.

- However, according to CoinMarketCap as of writing, the total valuation of all the 500+ Defi coins active in this space now exceeds $137 billion.

- At first glance, this might sound like a significant amount of capital.

- However, when you consider that as of writing the entire cryptocurrency arena carries a market capitalization of nearly $2 trillion, Defi coins still represent a relatively small segment of the broader sector.

Taking this into account, it could be argued that the Defi coin scene is still massively undervalued.

And, should you wish to diversify across multiple Defi coin projects, you can do so with ease at SEC-regulated broker eToro – not least because you only need to meet a $10 minimum on each trade that you place.

Some of the Best-Performing Crypto Assets are Defi Coins

If you’re looking to invest in the best Defi coins in the market because you are looking to target above-average gains – you will be pleased to know that this niche segment of the cryptocurrency scene has generated some phenomenal returns in recent years.

For example:

- Let’s suppose that you had invested $5,000 into Yearn.finance when the digital asset was first launched in July 2020.

- In doing so, you would have paid approximately $907 per token.

- Had you held onto your Yearn.finance investment until mid-2021 – you would have been able to cash out at over $93,000 per token.

- And, in doing so, your original investment of $5,000 would have been worth over $500,000.

In another example:

- Let’s say that you were aware of the MetaVerse phenomenon back in 2018 and so you decided to invest $5,000 into Decentraland

- In doing so, you would have paid just $0.025 per token.

- And, if you held on until mid-2021 when Decentraland hit nearly $6 per token – that’s an increase of almost 24,000%

- Therefore, your original investment of $5,000 would have been worth over $1.2 million

Of course, not all Defi coins have witnessed such significant price increases. As such, there is no guarantee that your chosen Defi coins will perform in the way as the likes of Yearn.finance or Decentraland.

This is why it’s so important to conduct your own research prior to investing and diversifying across several Defi projects.

The Fundamentals of Defi

Now that we have covered the technical performance of the Defi coin industry, we can now take a look at the fundamentals. After all, if you are looking to invest in the broader Defi industry, it’s a good idea to understand why this marketplace appears to be so attractive for early adopters.

So, in a nutshell, the main concept of Defi is to take traditional financial services away from centralized operators – such as banks. That is to say, in the near future, we could see everyday consumers obtaining loans from Defi platforms – which are subsequently funded by investors.

This peer-to-peer model can be extended to a whole range of financial services – such as brokerage transactions, insurance, and more. And, if decentralized finance does reach its full potential, then the best Defi coins discussed on this page only stand to benefit in the long run.

Plenty of Low-Cap Entry Points

Another great benefit of investing in decentralized finance is that many of the best Defi coins in the market carry a small valuation.

This means that the upside potential on offer is going to be a lot more attractive when compared to projects that already have a large market capitalization.

For example, according to CoinMarketCap, of the 500+ Defi coins listed on the platform – less than 20. have a market capitalization of over $1 billion.

Defi Crypto Price

The market price of Defi crypto coins functions the very same way as any other digital asset. That is to say, market prices are determined by demand and supply.

For instance, when Decentraland went from a price of $0.025 to nearly $6 in the space of just four years, this is because buying pressure significantly outweighed sell orders.

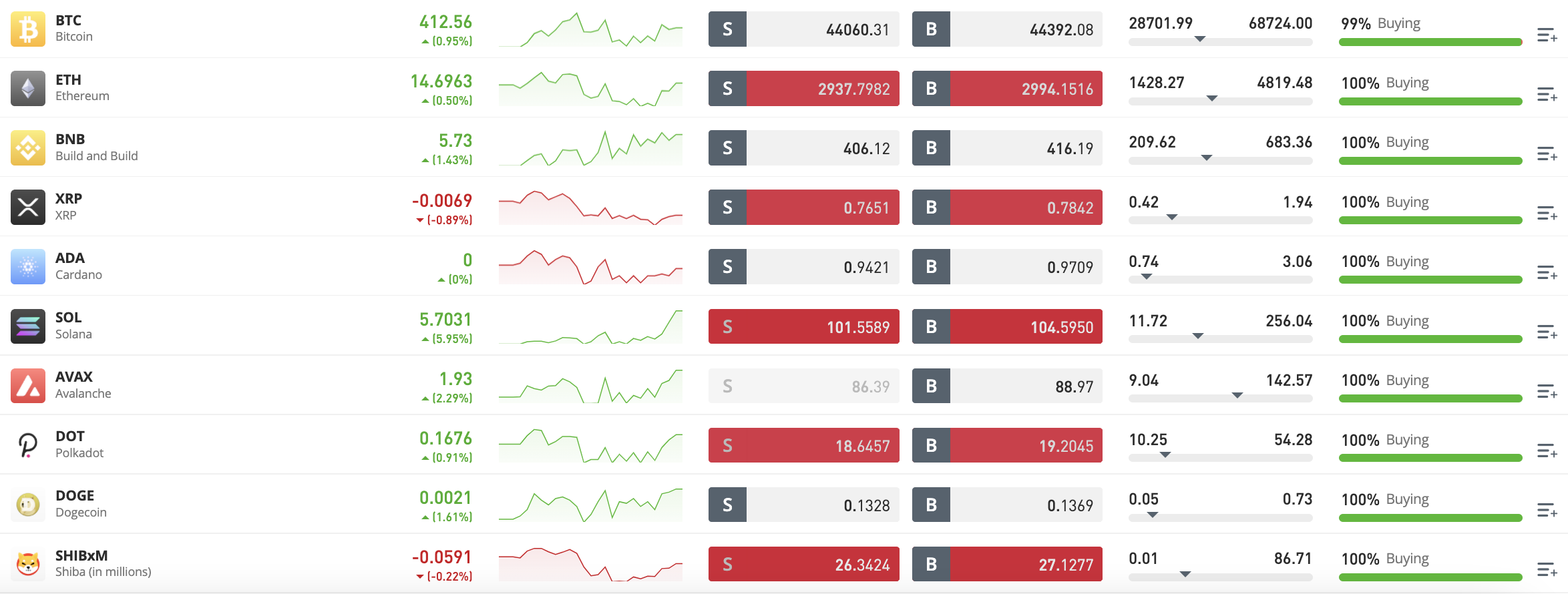

If you’re wondering how to keep tabs on Defi crypto prices, then you might consider using the data aggregation platform CoinMarketCap.

Alternatively, if you end up buying Defi coins through a user-friendly platform like eToro, you can simply head over to your portfolio to assess how your investments are performing in real-time.

Where to Buy Defi Coins

In terms of where to buy Defi crypto coins, this will ultimately depend on your chosen token.

For example, if you are looking to invest in upcoming Defi coins that carry a small market capitalization, then you might be required to invest via a decentralized exchange.

However, if you’re interested in leading Defi coins with a large valuation – such as Uniswap, AAVE, or SushiSwap – then you should have plenty of options at centralized platforms – which are more suited for newbies.

As per our market research, we found that eToro is the overall best place to buy Defi coins – and here’s why:

eToro – Overall Best Place to Defi Coins in 2022

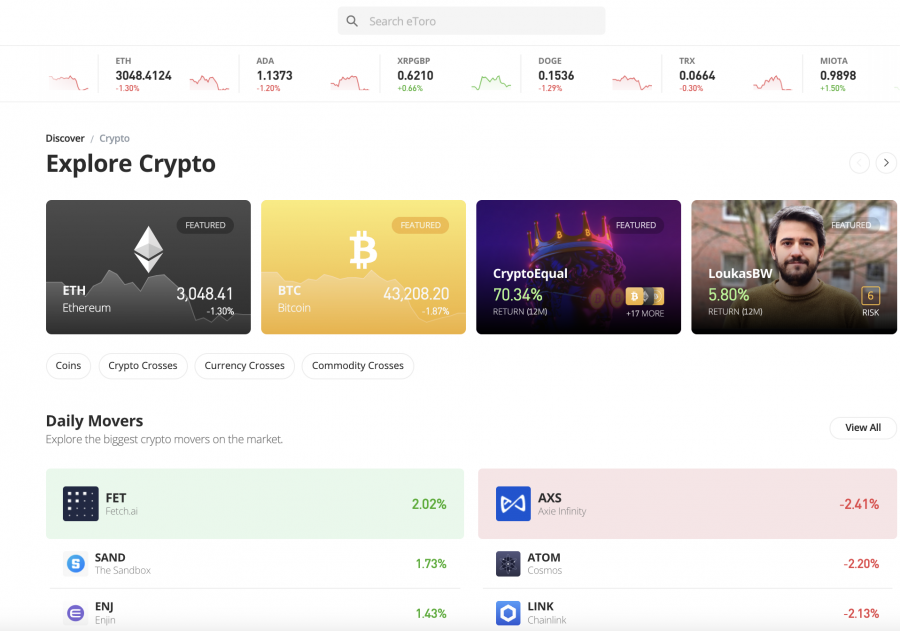

eToro was founded in 2007 and is now used by 20 million traders of all skill sets. The platform is regulated by the SEC and registered with FINRA. Additional regulation comes from bodies in the UK, Australia, and Cyprus. As such, you can invest in the best Defi coins of your choosing in a secure manner. In terms of supported Defi coins, most of the projects discussed today are available to buy at eToro.

eToro was founded in 2007 and is now used by 20 million traders of all skill sets. The platform is regulated by the SEC and registered with FINRA. Additional regulation comes from bodies in the UK, Australia, and Cyprus. As such, you can invest in the best Defi coins of your choosing in a secure manner. In terms of supported Defi coins, most of the projects discussed today are available to buy at eToro.

This includes everything from Decentraland, Yearn.finance, and AAVE to Uniswap, SushiSwap, and The Graph. Regardless of which Defi coins you decide to buy, eToro only charges the spread – which is the gap between bid/ask prices. Moreover, you can deposit US dollars into your eToro via a debit or credit card, e-wallet, or bank wire without paying any fees. The minimum deposit and Defi coin investment stands at just $10.

Another option you have at eToro should you be unable to pick the best Defi coins for your portfolio is to invest in a CryptoPortfolio. In a nutshell, this offers a pre-made, diversified basket of digital currencies that are weighted based on market performance, valuation, and other core variables. Most importantly, CryptoPortfolios are managed by the eToro team, so you can invest in the broader Defi space in a passive way.

Another passive investment tool available at eToro is the Copy Trading feature. Instead of investing money into a pre-made portfolio, this tool will see you inject capital into a successful trader that uses the eToro platform. We also like eToro for its access to other asset classes – which includes thousands of stocks and ETFs that can be traded commission-free. eToro can be accessed online or via the iOS/Android crypto app – and verified accounts take just minutes to open.

Cryptoassets are a highly volatile unregulated investment product.

How to Buy Defi Coins

If you’re wondering how to buy Defi coins today – the specific process will depend on which exchange the platform is listed on.

To ensure that all of the 10 top Defi tokens discussed on this page are covered – we’ll show you the required steps with two leading platforms – Pancakeswap and eToro.

How to Buy Lucky Block

Lucky Block – which came out as the number one Defi coin to buy in 2022 – is the only digital token discussed today that cannot be purchased at eToro.

The reason for this is that Lucky Block was only launched in early 2022 – so the vast bulk of its trading activity is conducted on Pancakeswap.

For those unaware, Pancakeswap is a decentralized exchange that supports tokens operating on the Binance Smart Chain – so the investment process is ever-slightly more challenging.

Nevertheless, here’s how to buy Lucky Block on Pancakeswap right now:

Step 1: Download Trust Wallet

In order to buy Lucky Block via the Pancakeswap exchange, you need to pay for your purchase with BNB. And as such, you also need a wallet that not only allows you to access Pancakeswap – but buy and store BNB tokens.

Without a doubt, the best option in this respect is Trust Wallet – which is backed by the leading exchange Binance. So, to get the ball rolling, head over to Google Play or the App Store and download the Trust Wallet app to your phone.

Step 2: Buy/Transfer BNB

As noted above, you need BNB in your Trust Wallet so that you can buy Lucky Block via Pancakeswap. If you already own BNB, you can transfer the tokens over to Trust Wallet.

Alternatively, Trust Wallet comes with a debit/credit card feature that allows you to buy BNB instantly. You do, however, need to upload a copy of your government-issued ID to do this – as per KYC regulations.

Step 3: Connect to Pancakeswap via Trust Wallet

If you’ve now got BNB tokens in your Trust Wallet, you can connect to Pancakeswap. You can do this with ease by clicking on the ‘DApps’ button, before selecting the Pancakeswap logo.

Next, you will be asked to connect your Trust Wallet to Pancakeswap. You can do this by authorizing access when the notification pops up.

Step 4: Search for Lucky Block

Now that your Trust Wallet is connected to Pancakeswap, you can search for Lucky Block. The only way to do this is to paste in the Lucky Block contract address.

You can get this via the Lucky Block website or Telegram group.

Step 5: Buy Lucky Block

And finally, you will now need to fill out a buy order form so that you can complete the investment process.

For this, you will need to enter the number of BNB tokens that you wish to swap for Lucky Block. Then, you will need to confirm the purchase by clicking on the ‘Swap’ button.

How to Buy Defi Coins on eToro

If you’re also interested in buying a selection of other popular Defi coins – SEC-regulated broker eToro allows you to complete the process in less than five minutes. In using this broker, you’ll need just $10 to invest in the best Defi coins.

Step 1: Open eToro Crypto Account

First, visit the eToro website and open an account. You will need to enter some personal information – such as your:

- Name

- Date of Birth

- Residential Address

- Cell Phone Number

Next, upload a copy of your passport or driver’s license to instantly verify your eToro account.

Step 2: Deposit Funds From $10

To buy the best Defi coins at eToro, deposit a minimum of $10.

Some of the payment methods supported by eToro include:

- Debit Cards

- Credit Cards

- Paypal

- Neteller

- ACH

- Domestic Bank Wire

- Trustly

Best of all, eToro charges no transaction fees of USD deposits – or withdrawals.

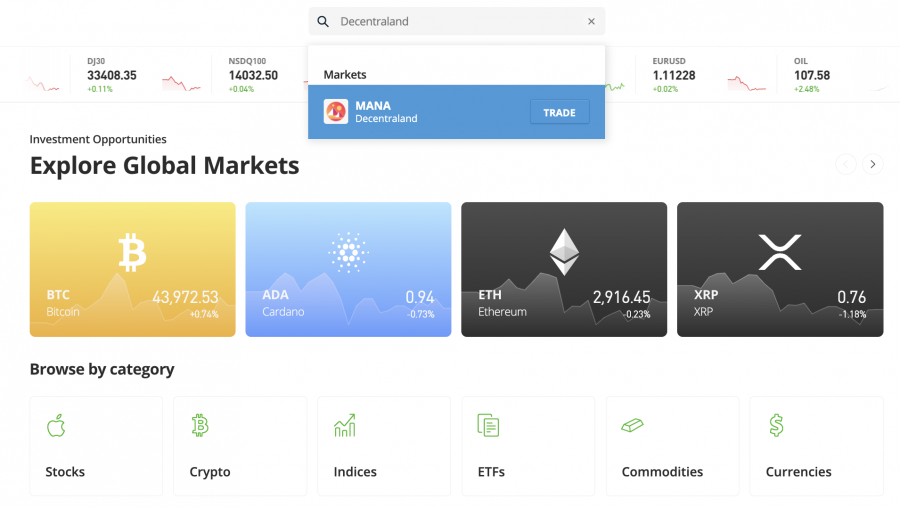

Step 3: Search for Defi Coin

Next, you can use the search box at the top of the page to find your chosen Defi coin.

In our example above, we are looking to buy Decentraland.

Step 4: Buy Defi Coin

To finalize your Defi coin investment, you need to enter your total stake in the ‘Amount’ box. To recap, this can be any amount of $10.

Once you click on the ‘Open Trade’ button, eToro will execute your order.

Best Defi Crypto Wallet

You will need to obtain a top-rated Defi coin wallet after you complete your investment – which will ensure that your tokens remain safe at all times.

If, however, you decided to buy Lucky Block and you followed our tutorial, then you will already have a safe storage facility in the form of Trust Wallet.

Moreover, if you bought Defi coins from SEC-regulated broker eToro – the provider offers a secure crypto wallet called the eToro Money Crypto Wallet. This means that there is no requirement to download a third-party wallet to keep your Defi coins safe.

Conclusion

In summary, a number of Defi coins have performed extremely well in recent years – with the likes of Decentraland, Yearn.finance, and Terra all generating gains in the thousands of percentage points since launching.

However, for us, Lucky Block stands out as the overall best Defi coin to buy in 2022. Although the project was only launched in early 2022, it has already generated returns of over 6,000% for early investors.

Best of all, when you consider just how young this innovative lottery-centric project is – you can still invest at a super-early stage.

Cryptoassets are a highly volatile unregulated investment product.

Frequently Asked Questions on Defi Coins

What is Defi crypto?

What are the best Defi coins to buy now?

What are the top 10 Defi coins?

How do I buy Defi coins?

Should I buy Defi coins?

This news is republished from another source. You can check the original article here

Be the first to comment