By Omkar Godbole (All times ET unless indicated otherwise)

Bitcoin held above $100,000, with VET, ENA, LINK and LDO posting notable gains a day after President Donald Trump bypassed mentioning crypto or a strategic bitcoin reserve in his inauguration speech.

Signals from the bitcoin options market indicate heightened expectations for short-term price turbulence alongside signs of growing risk aversion among traders since Trump’s swearing in, according to Griffin Ardern, head of options trading and research at crypto financial platform BloFin.

That could be due to several reasons, including MicroStrategy’s impending shareholder vote today on expanding its authorized shares to support its bitcoin buying strategy. In addition, the Bank of Japan (BOJ) is expected to increase rates on Friday, which may strengthen the yen. The late July BOJ rate hike torched the currency’s rally, destabilizing risk assets, including cryptocurrencies.

There’s also uncertainty stemming from Trump’s plans to impose tariffs of up to 25% on Canada and Mexico and the looming debt ceiling although, historically, the latter has not had a significant bearish impact on risk assets.

“Markets received a stark reminder of life under President Trump, with more volatility-inducing rhetoric,” QCP Capital said,.

Still, observers remain optimistic.

“Despite a generally disappointing first day for cryptocurrencies under the new administration, Bitcoin managed to remain firmly above $101K, sidestepping the feared ‘sell-the-news’ effect,” Valentin Fournier, an analyst at BRN, noted. Fournier added that while regulatory progress and adjustments to national reserves may take time, conditions are expected to improve in the coming weeks.

The debut of the TRUMP memecoin over the weekend marked “a fundamental shift in the American digital asset landscape, ultimately attracting new buyers, particularly into BTC and SOL,” according to Laurent Benayoun, CEO of Acheron Trading.

“This phenomenon can be seen as a dual narrative: a significant value creation in TRUMP, initially driven by intra-market rotation, which later sparked fresh capital inflows as fundamental investors recognized the broader positive catalysts for digital assets,” Benayoun said. Stay alert!

What to Watch

- Crypto

- Jan. 21: MicroStrategy (MSTR) shareholders vote on increasing the authorized share capital to help fund bitcoin purchases.

- Jan. 23: First deadline for SEC decision on NYSE Arca’s proposal to list and trade shares of Grayscale Solana Trust (GSOL), a closed-end trust, as an ETF.

- Jan. 25: First deadline for SEC decisions on proposals for four spot solana ETFs: Bitwise Solana ETF, Canary Solana ETF, 21Shares Core Solana ETF and VanEck Solana Trust, which are all sponsored by Cboe BZX Exchange.

- Jan. 29: Ice Open Network (ION) mainnet launch.

- Feb. 4: MicroStrategy Inc. (MSTR) reports Q4 2024 earnings.

- Feb. 4: Pepecoin (PEPE) halving. At block 400,000, the reward will drop to 31,250 pepecoin.

- Feb. 5, 3:00 p.m.: Boba Network’s Holocene hard fork network upgrade for its Ethereum-based L2 mainnet.

- Feb. 12: Hut 8 Corp. (HUT) reports Q4 2024 earnings.

- Feb. 15: Qtum (QTUM) hard fork network upgrade is scheduled to take place at block 4,590,000.

- Feb. 20: Coinbase Global (COIN) reports Q4 2024 earnings.

- Macro

- Jan. 21, 8:00 a.m.: The U.S. Treasury will start taking “extraordinary measures” to stop the government from breaching the $36.1 trillion debt limit.

- Jan. 21, 8:30 a.m.: Statistics Canada releases December’s Consumer Price Index.

- Core Inflation Rate MoM Prev. -0.1%.

- Core Inflation Report YoY Prev. 1.6%.

- Inflation Rate MoM Est. -0.7% vs. Prev. 0%.

- Inflation Rate YoY Est. 1.7% vs. Prev. 1.9%.

- Jan. 22, 8:30 a.m.: Statistics Canada releases December’s Industrial Product Price Index.

- PPI MoM Est. 0.8% vs. Prev. 0.6%.

- PPI YoY Prev. 2.2%.

- Jan. 22, 10:00 a.m.: The Conference Board releases December’s Leading Economic Index (LEI) report for the U.S.

- MoM Est. -0.1% vs. Prev. 0.3%.

Token Events

- Governance votes & calls

- ApeChain is voting on a revamped governance process for 75% of the on-chain treasury to be directed to the DAO treasury contract and the remaining 25% to the Ape Foundation for administrative and support purposes. Voting began Jan. 17 and will last for 13 days.

- CoW DAO is discussing the potential allocation of 80 million COW to empower the core treasury team for further liquidity provisioning, economic opportunities, and the development of the DAO’s product roadmap from 2025 to 2028.

- Jan. 22: Mantle (MNT) will host a livestream with updates on its 2025 roadmap. at 8 a.m.

- Unlocks

- Jan. 21: Fasttoken (FTN) to unlock 4.6% of circulating supply worth $76 million.

- Jan. 31: Jupiter (JUP) to unlock 41.5% of circulating supply worth $626 million.

- Token Launches

- Jan. 21: Bybit is listing Solayer (LAYER).

- Jan. 22: Jambo (J) is listing on OKX, Bitfinex and Bybit.

Conferences:

Token Talk

By Shaurya Malwa

Donald and Melania Trump’s official memecoins have inspired wannabe token creators to issue tokens based on other family members. One such token themed after son Barron Trump just rug pulled for millions of dollars.

A spoof X account impersonating Barron promoted a BARRON token, which quickly gained traction reaching a peak market cap of $87 million.

Initially, a significant amount of liquidity was added to make the token appear legitimate and encourage trading. However, it seems the token was designed to deceive from the start. Once the token reached a high buy volume, all liquidity was removed from the token pools causing the price to crash.

On-chain watchers estimated at least $1 million worth of Solana’s SOL tokens were extracted in the rug pull, based on initial buying and final selling transactions.

A fake $BARRON token was launched, quickly reaching a valuation of $72 million, with one top insider wallet earning over $1M.

This wallet purchased 136.35M $BARRON for 4.43 $SOL ($1,048) and sold it for 4,456 $SOL worth $1.05M.

Numerous insider wallets were involved, and most… pic.twitter.com/DUR4Ha7vdO

— Onchain Lens (@OnchainLens) January 21, 2025

Even some industry observers were take in.

Derivatives Positioning

- Open interest in TRUMP perpetual futures has increased 8%, suggesting the price drop is at least partly led by fresh shorts. Opposite is the case for AAVE as prices have risen alongside an uptick in open interest.

- Other than AAVE, most major coins, including BTC and ETH, have seen negative open interest-adjusted CVD, a sign of net selling pressure.

- BTC and ETH calls remain pricier than puts, but the call bias is weaker than a day ago.

- Top block trades for the day include BTC bull call spreads and some outright longs in ETH calls, according to data source Amberdata, Deribit and Paradigm.

Market Movements

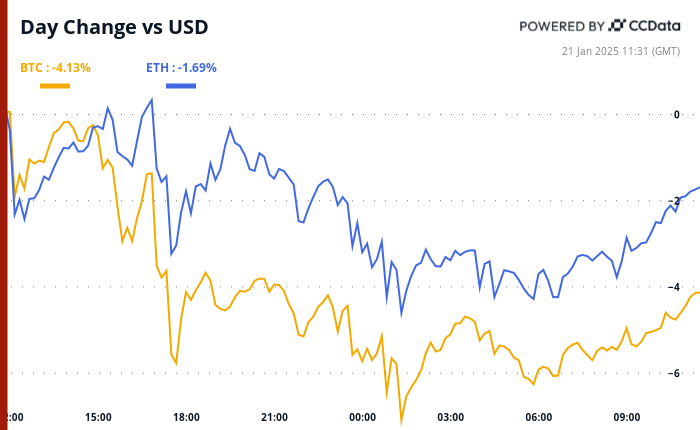

- BTC is down 0.3% from 4 p.m. ET Monday at $103,280.72 (24hrs: -4.66%)

- ETH is down 0.43% at $3,307.05 (24hrs: -1.97%)

- CoinDesk 20 is down 1.27% at 3,960.57 (24hrs: -5.14%)

- Ether staking yield is up 27 bps at 3.58%

- BTC funding rate is at -0.0026% (-2.9% annualized) on OKX

- DXY is down 0.56% at 108.74

- Gold is up 0.36% at $2,718.39/oz

- Silver is unchanged at $30.48/oz

- Nikkei 225 closed +0.32% to 39,027.98

- Hang Seng closed +0.91% to 20,106.55

- FTSE is unchanged at 8,521.58

- Euro Stoxx 50 is unchanged at 5,160.68

- DJIA closed on Friday +0.78% to 43,487.83

- S&P 500 closed +1% to 5,996.66

- Nasdaq closed +1.51% to 19,630.20

- S&P/TSX Composite Index closed on Monday +0.41% to 25,171.58

- S&P 40 Latin America closed +1.23% to 2,258.33

- U.S. 10-year Treasury is down 4 bps at 4.59%

- E-mini S&P 500 futures are up 0.44% at 6,060.00

- E-mini Nasdaq-100 futures are up 0.48% at 21,698.75

- E-mini Dow Jones Industrial Average Index futures are up 0.33% at 43,841.00

Bitcoin Stats:

- BTC Dominance: 58.70

- Ethereum to bitcoin ratio: 0.03193

- Hashrate (seven-day moving average): 786 EH/s

- Hashprice (spot): $60.7

- Total Fees: 12.37 BTC/ $1.3M

- CME Futures Open Interest: 188,825 BTC

- BTC priced in gold: 37.8 oz

- BTC vs gold market cap: 10.74%

Technical Analysis

- BTC remains in bullish territory above the Ichimoku cloud despite Trump failing to mention crypto or strategic BTC reserve Monday.

- The resilience may entice more buyers to the market, potentially leading to record highs.

Crypto Equities

- Galaxy Digital Holdings (GLXY): closed on Monday at C$31.15 (+4.04%).

- MicroStrategy (MSTR): closed on Friday at $396.50 (+8.04%), down 2.22% at $387.70 in pre-market.

- Coinbase Global (COIN): closed at $295.48 (+4.92%), down 0.65% at $293.55 in pre-market.

- MARA Holdings (MARA): closed at $19.91 (+8.8%), down 0.5% at $19.81 in pre-market.

- Riot Platforms (RIOT): closed at $13.38 (0.67%), down 0.3% at $13.35 in pre-market.

- Core Scientific (CORZ): closed at $15 (+2.53%), up 0.47% at $15.07 in pre-market.

- CleanSpark (CLSK): closed at $11.87 (+6.17%), up 0.51% at $11.93 in pre-market.

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $25.37 (+3.13%).

- Semler Scientific (SMLR): closed at $64.68 (+11.06%), down 1.52% at $63.70 in pre-market.

- Exodus Movement (EXOD): closed at $38.51 (+1.69%), up 8.47% at $41.77 in pre-market.

ETF Flows

U.S. exchanges were closed on Jan. 20 in observance of Dr. Martin Luther King, Jr. Day.

The ETF data below is from Jan. 17 and remains unchanged.

Spot BTC ETFs:

- Daily net flow: $1072.8 million

- Cumulative net flows: $38.18 billion

- Total BTC holdings ~ 1.11 million.

Spot ETH ETFs

- Daily net flow: $23.9 million

- Cumulative net flows: $2.66 billion

- Total ETH holdings ~ 3.67 million.

Source: Farside Investors

Overnight Flows

Chart of the Day

- The supply of stablecoins on the Solana blockchain has nearly doubled since October.

- Most of that is in USDC, the world’s second-largest dollar-pegged stablecoin.

While You Were Sleeping

- U.S. to Hit Debt Ceiling on Tuesday. Will Bitcoin Soar or Suffer? (CoinDesk): The U.S. Treasury begins extraordinary measures to avoid breaching the $36.1 trillion debt limit. Historically, drawdowns in the Treasury General Account (TGA), the government’s cash reserve, have coincided with bitcoin price increases.

- TRUMP, MELANIA Tokens Plunge 50% as Trump Inauguration Fails to Buoy Bitcoin (CoinDesk): Memecoins TRUMP and MELANIA fell sharply post-inauguration despite trading volumes exceeding many major tokens. QCP Capital speculates that TRUMP’s launch on Solana highlights the chain, potentially aiding U.S. SOL ETF prospects.

- World Liberty Financial Buys $112.8 Million in Crypto on Trump’s First Day in Office (The Block): On Monday, World Liberty Financial, a Trump-linked crypto project, commemorated his inauguration by spending a total of $112.8M on ETH, wBTC, AAVE, LINK, TRX and ENA.

- Trump’s Plans for Canada, Mexico Tariffs Send Dollar Higher (The Wall Street Journal): The U.S. dollar rose against the Canadian dollar and Mexican peso after Trump’s proposed tariffs. Asian markets showed mixed movements, while oil prices fell as Trump pledged expanded U.S. production.

- ECB’s Kazimir Sees Three to Four More Cuts Starting Next Week (Bloomberg): Peter Kazimir, an ECB Governing Council member, expects a rate cut next week and possibly three more. He warns of risks from U.S. trade policies and inflationary pressures from import prices.

- China Stocks, Yuan Cautiously Firm After Trump Delays Tariffs (Reuters): Chinese stocks and the yuan rose cautiously after Trump avoided imposing immediate tariffs, offering short-term relief. China is focusing on technological innovation and stimulating consumer spending to boost growth.

In the Ether

This news is republished from another source. You can check the original article here

Be the first to comment