This is an opinion editorial by Andrea Bianconi, a research assistant at the Idaho Freedom Foundation, which is a public policy think tank.

An analysis of the fundamentals, recent geopolitical and macroeconomic events and their impact on Bitcoin’s future.

Introduction

In the last few months, financial markets have lost over 30% from their highs as the Federal Reserve Board took away the punchbowl from the intoxicated market players by hiking interest rates, and now recession (stagflation) seemingly looms.

The yen and the euro are inflating like developing countries’ currencies.

Inflation and commodities explode higher.

The spark for WWIII has been lit in Ukraine — unbeknownst to the ignorant and brainwashed masses who think that this is just a local conflict and that “peace” can be reached in spite of Western nations selling unlimited quantities of weapons into the war and pouring billions of “freshly printed” U.S. dollars and euro debt into the conflict, adding fuel to the fire.

Then we have the suicidal sanctions, which are destroying the economies of the Western sanctioning countries rather than the sanctioned Russia.

After all, it is clear to anyone with a functioning brain that 10 years of sanctions have made Russia totally decoupled and immune from Western economical warfare.

And finally, the icing on the cake, bitcoin has died for the 459th time in its short 12-year history.

Financialization Is The Problem

As I have expected and warned about in this February 2021 article, the growing financialization of the industry could become an existential threat for Bitcoin. Wall Street has brought its usual playbook — excessive debt and leverage — to their darling DeFi cryptocurrency sector drawing a crowd of suckers and shitcoiners who were allowed to leverage their bitcoin equity 100x or more to speculate on altcoins like LUNA. The leveraging and deleveraging process is well described in this ZeroHedge article here. All this is good until, sooner or later, reality hits. Shitcoins are invariably revealed for what they ultimately are, usually scams, and the only real asset posted as collateral (bitcoin) is then sold to cover the losses. Then the deleveraging causes a cascading liquidation of collateralized bitcoins. The suckers are wiped out and the smart money buys back the bitcoin on the cheap.

While one of the biggest purposes of Bitcoin is to “be your own bank,” DeFi rather aims at recreating the fiat fractional banking system with all its risks and hazards. This Bitcoin Magazine article correctly points out: “Crypto lending shops such as Celsius are fractional reserve banks in principle; however this time there is no ‘lender of last resort’ in the form of a central bank to bail out the founders and their clients when things turn sour.”

“Let’s make one thing clear: a yield always has to come from somewhere. To generate a positive yield on a scarce asset such as bitcoin, the institution offering said yield has to leverage the clients’ deposits in various ways. And whereas banks face strong regulatory requirements as to what they can do with the customer deposits (such as buy treasuries, facilitate mortgage loans etc.), cryptocurrency lending companies face no such regulatory requirements, so they basically go and put their customers’ deposits into casinos of various kinds — DeFi yield farming, staking, speculating on obscure altcoins.”

While this wash-and-rinse cycle is nothing new for seasoned Bitcoiners — and one can reasonably argue that it is needed to clean up the market from excesses — I feel that there is one new, worrying and more obscure side to it this time.

Bitcoin In Davos Crosshairs And What Everyone’s Missing

The Terra/LUNA collapse is an example. We do not know for sure whose fiat fake money was behind the attack. Both Blackrock and Citadel — among the most influential Davos players in advancing the globalist agenda – were rumored to have played a key role in the attack, however they officially denied involvement. The thought remains, though, in order to borrow 100,000 bitcoin worth approximately $3 billion to pull off the attack you must be a big player — or at least have someone with big pockets to back you up. It will be almost impossible to learn where the money came from.

Until the current fiat-based system — which grants to the few close enough to the spigots of “fake” money the “great privilege” to fight wars, colonize and enslave others at no cost — collapses, then the massive amount of fiat-based debt created ex nihilo will be always used by the privileged few to expropriate real assets like gold or bitcoin. This is the main reason why one should keep direct custody of his/her bitcoin and not play the corrupted fiat game with DeFi and shitcoins.

Bitcoiners Should Stay Away From Altcoins And DeFi

Alternative cryptocurrencies and DeFi in the end are nothing but the latest casino playground for Wall Street. The problems are well-known: excessive leverage, derivatives, derivatives of derivatives in an endless chain of liabilities, contagion and spiraling insolvencies when things turn sour. There’s one big difference though: in cryptocurrency and DeFi there is no Fed to bail risk-takers out. Unfortunately bitcoin is the only solid cryptocurrency asset with no counterparty risk which can be used as collateral in the sector. Therefore bitcoin will always be subject to extreme volatility in case of insolvencies in the sector. This is not the first time nor the last it will happen.

Ultimately, DeFi’s artificial yield game will play against one’s bitcoin stash. Every bitcoin which is left in third-party custody or rather pledged as collateral, will be used against its ultimate owner. It will be lent out or collateralized in a spiraling game of leverage with shitcoins and un-stablecoins. When prices go down this triggers margin calls and the liquidation of the only real asset pledged as collateral in a cascading effect of ever-increasing margin calls and liquidations to cover the losses. In the end one will lose both the speculative altcoin position and the collateralized bitcoins. By using the structural weaknesses of fragile protocols like Terra/LUNA, smart players can trigger margin calls and liquidations thereby gaining both from shorting the shitcoin, betting safely against bitcoin on the futures market (they are causing the price drop so it is a safe bet) and then closing the positions by buying the suckers’ bitcoin on the cheap. They can further double the bet by going long on the futures market as well. An easy and safe bet given enough “firepower.” And traditional finance has plenty of firepower thanks to the leveraged debt-based fiat system. Unless of course, Bitcoiners finally wake up and stop playing in DeFi’s casino and stop collateralizing their bitcoin.

Reality Check: Bitcoin Is Stronger Than Ever

Truth is, like most of bitcoin’s pullbacks before, this one too has very little to do with Bitcoin itself.

The protocol is stronger than ever. The following charts will give you an idea of the exponential growth of the network.

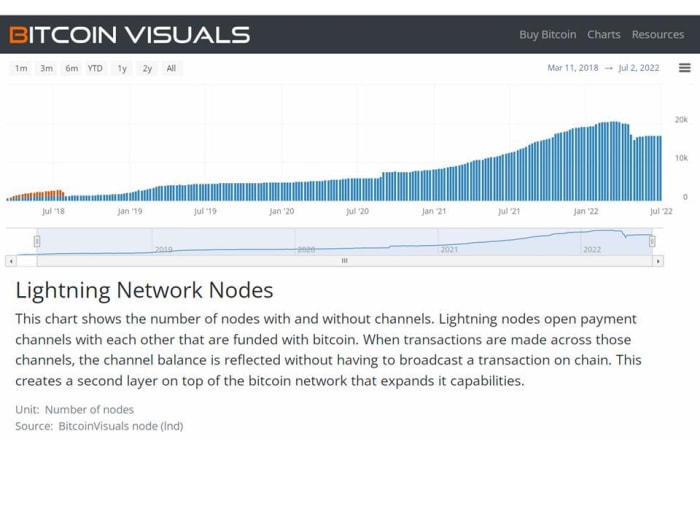

The growth of the Lightning Network — which is a real proxy for Bitcoin’s adoption mainly in the East and global South — has been impressive. Here is the chart:

Figure 2 — Lightning

Lightning can handle 1 million transactions per second, while Visa handles 24,000 per second. The network has been increasing its capacity and is currently handling approximately 4,000 BTC on public channels.

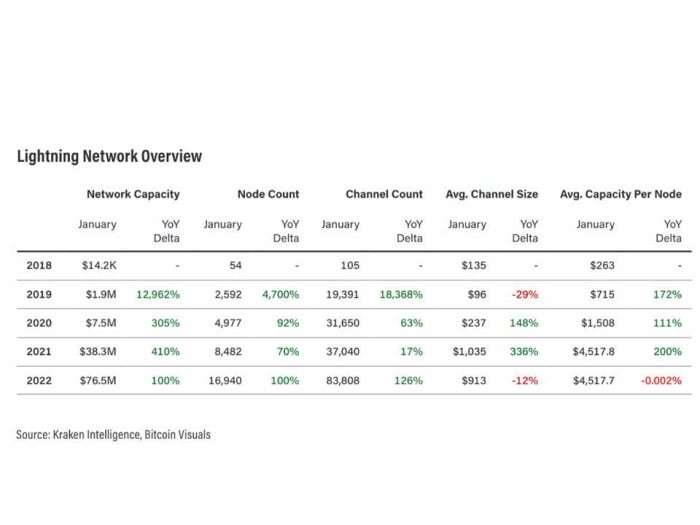

Kraken, a major cryptocurrency exchange, has now added Lightning to its standard payment options and it has released an intelligence report showing very interesting data on Lightning growth and adoption.

According to the Kraken Report “Lightning usage has been on a steep upwards trajectory since late 2020, growing parabolically in September 2021 corresponding with the introduction of BTC as legal tender in El Salvador. Still, public metrics do not describe the full extent of Lightning adoption because of the number of users in the Lightning ecosystem utilizing private channels.”

Regarding the Lightning nodes´growth (Figure 2), Kraken states “Furthermore, the growth in the sheer number of Lightning nodes indicates that the network is beginning to see many new participants. Nodes saw continuous growth from 2018 to late August 2020, rising from 54 to 6,134. However, node growth has since gone parabolic, rising over 176% to 16,940 nodes at the time of writing. Lightning node growth has proliferated so fast that there are now roughly 1,000 more Lightning nodes than Bitcoin nodes. Should adoption continue to grow at this rate, the Lightning network could realize BTC’s potential as a medium of exchange asset — an essential feature for global money that was previously a bottleneck for BTC going mainstream.”

Among developing countries El Salvador has been leading the path towards Bitcoin adoption. While I have been and remain critical of the risky strategy adopted by the country, I grant that President Bukele has taken a “revolutionary” step, and a historical one for a nation-state. Therefore, El Salvador’s success remains fundamental for Bitcoin’s future adoption among developing countries. So far El Salvador´s results are encouraging.

No doubt many developing countries are looking at El Salvador’s experience and are preparing to follow in its steps.

Bitcoin Is The Best Form Of Money Ever Invented So Far

Sound money has ruled human monetary history while an unconstrained fiat money standard has been the peculiar case of only the last 50 years. While the topic of sound money and fiat money in monetary history is not the purpose of this article, I still need to make an important point.

Money has been primarily a technological issue. Technology has always dictated the transition from a less technological form of money to a superior one. Think about the transition from primitive forms of money to gold and silver thanks to the invention of coinage and the standardization of weight in ancient Greece (for a good history of money read Dr. Saifedean Ammous’ “The Bitcoin Standard”). The fundamental reason why gold was abandoned as money was because it could not be moved through space and time at the same speed of information and commerce as new technologies appeared. Historically, the banking sector was born to arbitrage the opportunity created by technological developments by initially substituting gold´s cumbersome circulation with convenient to use paper “IOUs” fully backed by gold reserves held at the bank. The next step was to move to a fractional reserve system partially backed by gold and, once enough trust was built into the fractional fiat system, the fractional reserve asset was completely abandoned to conveniently install an unbacked fiat currency system based solely on paper claims, which gifted the “elites” with the riches and privileges granted by the Cantillon effect: a five=decade sleight of hand which is coming, one way or another, to an end.

So it was technological progress and the laws of physics which rendered gold obsolete and impractical as a bearer asset for financial/business transactions in modern times. Gold could only serve as a reserve asset. This was the true reason for its demise as a bearer settlement asset first and for its full demonetization later.

Bitcoin´s revolutionary technology completely changes that paradigm.

Nowadays there is no opportunity to arbitrage time and space in financial transactions by offering soft/unsound money solely because it moves faster than hard money. Bitcoin fills that gap.

Not only can nowadays bitcoin travel faster than fiat money, but it also has the additional advantages — as a bearer settlement asset — to have cash-like immediate finality, more security, total immutability and absolute scarcity

Bingo.

Therefore, as far as technology is concerned, Bitcoin is a superior form of money compared to anything humanity has ever experienced so far. 12 years after its creation still nothing compares to Bitcoin, full stop.

While it remains impossible to forecast what the course of its adoption and its monetization process will be in the future — because that will depend on too many variables — Bitcoin is there for everyone to use, to experiment with and there’s no way to put the genie back in the bottle.

The Energy Transition And A Highly Inflationary Macroeconomic Background Will Favor Bitcoin

In addition, a number of competent authors have done a great job in analyzing the real aspects of Bitcoin’s energy use and its complexities. Among them Nic Carter is certainly one of the most prolific and competent. Here you can find all his interesting articles on the topic. The critics, even if largely instrumental in the demonization of Bitcoin, had the positive effect of fostering a change in mining operations towards the use of residual energy sources — which would be lost in any case or would negatively impact the environment like gas flaring/venting in oil fields or using landfill methane — and the stabilization of energy grids in critical instances. Very important developments which the MSM has totally disregarded, obviously.

Therefore, going forward — despite the debunking and the rapid progress of Bitcoin’s “alternative” mining — one should only expect that the pressure applied using the energy consumption FUD narrative will continue to increase in the future.

The reason is that climate change has been erected by the World Economic Forum’s Davos 2022 conference as their foundational narrative to justify all sorts of restrictions on human activity. From praising the virtues of the destructive — for both the economies and the health of human beings — COVID-19 lockdowns to the U.N. praising the virtues of famine, to the banning of Bitcoin mining or “unhosted” wallets. Therefore the fight against this new type of FUD will be much more difficult. Simply debunking their arguments with real data, statistics and counter arguments will have little impact against the massive firepower at their disposal in terms of money and the support this money buys from the corrupted mainstream media.

But in the medium-long term the green energy transition narrative forced by Davos 2022 will ultimately play in favor of Bitcoin.

Energy markets expert Dr. Anas F. Alhajji points out in this interesting “MacroVoices” interview that “a major global energy crisis is inevitable. That crisis is essentially created by our political leaders’ policy, which is forcing away key investments in the oil and gas sector before the alternative replacement had realistically been phased in.”

Simply put, only an insane person will stop investing in a fundamental resource which keeps the whole economy and societal life running until a reliable replacement has been found. Unless of course the consequent massive energy crisis and the double-digit inflation which will be arising from that “insane” policy is exactly what they want and what they need. Indeed, in addition to benefiting from directing hundreds of billions of freshly printed fiat currencies into the pockets of their own ESG (environmental, social and corporate governance) players, “what they want and what they need” is to fulfill a complex agenda whose ultimate and true objective is NOT the “green transition” but the transition to a new monetary system to save their old privileges: a monetary reset.

That is a key point to be noted.

What is going on does not happen by chance. Nor it is simply the result of the politicians’ incompetence. My belief is that it is a deliberate policy choice, and the agenda includes (i) inflating the excessive debt away, (ii) the unavoidable (high) inflation of the national currencies will be used as the excuse to transition into a new monetary system based on CBDCs. Western populations – while impoverished and annihilated by monetary inflation – will be easily made dependent on governmental subsidies, and they will easily accept free digital currencies in their wallets to survive at the expense of their freedoms; and (iii) this will consequently achieve the final objective of installing a global government, a global money and the global enslavement of populations.

As I write, the euro is down to parity against the dollar and is breaking below parity against the Swiss franc — levels not seen since exactly 20 years ago in 2002.

So if it is inflation that they want on one side of the ocean, Luke Gromen adds that it is not different on the other side of it: “The balance sheet of the United States is our leading indicator, and it tells you that we are going to get inflation for a long time to come. And just by way of context, the 8% CPI inflation we saw in 2021. It took our deficit from 129% of GDP to 122% of GDP. You have to have inflation run higher than your interest coupon for an extended period of time. So we need double-digit inflation for probably five years.”

Summing up, an artificially created global energy crisis is in the making and double-digit inflation is very likely to persist for a very long time because — in the end — this is what Western governments need to destroy their excessive debt.

To further make the point there is also a concurrent artificially created global food crisis in the making which — despite the West blaming of Russia — clearly has nothing to do with the war. This food crisis has been set up by a few global players who have cornered the food commodities market. Again, those few players are also part of the Davos elite and owned by the usual suspects who profit from their oligopolistic market position. A handful of global funds which basically own all the global companies: Blackrock, State Street, Vanguard, Bill Gates Foundations, George Soros, etc.

Regardless of the causes though, the highly inflationary macroeconomic background which is shaping up will be net positive for Bitcoin for two reasons:

(i) while Davos-sponsored ESG and green energy transition projects will fail miserably — simply because there is currently not yet a viable timely alternative to fossil fuels and this will soon force governments to either go back to more polluting alternatives like coal (already happening in the “green” EU) or simply collapse — Bitcoin miners are extremely flexible to respond to market signs and incentives. If oil and gas prices go through the roof then they will switch to untapped renewable sources, since you can mine bitcoin in the middle of the desert with solar panels well away from energy grids.

(ii) The response by governments to the energy crisis will be to print more money to hand out subsidies to the impoverished citizens. This creates a highly inflationary environment which is bullish for Bitcoin, the ultimate scarce asset.

The Geopolitical Background Has Never Been More Bullish For Bitcoin

The Western indiscriminate sanctions on Russia — with the unlawful and arbitrary expropriation of Russian assets, both private and state-owned — together with the weaponization of the dollar and its payment rails (SWIFT), have shown to the global South and the East of the world that the Western “democracies” are a joke and their monetary system is terminally ill. They may be looking for alternatives to transact business without using the dollar and its payment rails. The entire world has learned from Russia’s hard lesson what each Bitcoiner learns first — the equivalent of “not your keys not your bitcoin.” U.S. Treasurys are not a safe asset to own if you do not conform to the issuer’s diktats. Nor is it safe to hold “reserves” in the dollar or euro currencies or entrust gold reserves with a Western central bank. All can be seized and expropriated on a whim. This is the lesson that all the independent (or willing to be) countries in the world have learned from recent events. And the lessons won’t be forgotten anytime soon.

So, while the West has committed economic and monetary suicide, the rational bet can only be bullish bitcoin, regardless of its short-term volatility caused by the deleveraging in the cryptocurrency space.

Why the West collectively commits economic suicide though is a much more complex question to answer. While this is commonly blamed on the Western politicians’ incompetence (which is also a factor), the truthful explanation lies with the role that the Davos globalist elite plays in directing those politicians who have been co-opted within their powerful network. The Davos elite are the puppeteers and the Western politicians are their puppets.

For anyone familiar with how the lobbying system and the “revolving doors” work in advancing one’s interest and agendas at political level, it should not take a lot of imagination to figure out what Davos-supported politicians would do to advance the agenda of their sponsors.

Among their ranks it is not only the Davos WEF which plays a key influential role in nurturing and shaping the young global leaders of the future, but also parallel, complex and interlocking networks like the Bilderberg Meetings, the Trilateral Commission, the Atlantic Council, the Fabian Society or the Soros Open Society.

Make no mistake, those sponsored politicians are not idiots (well some are …). They are very well paid actors and they are fulfilling their role splendidly. They are executors and they have to implement an agenda. The puppeteers and their puppets know what they are doing.

By expropriating Russia’s assets and by weaponizing the dollar they have killed the dollar, the U.S. Treasurys and the euro as reserve currencies and safe assets. This suicidal move of the U.S. administration cannot be explained if not with the prevalence within the U.S. government of non-American interest. Indeed, rather than American interest, the latest moves are beneficial to a global government and global money at the expense of the reserve status of the U.S. dollar.

Basically, both the U.S. administration and the EU, do not represent their citizens anymore — rather, they represent the gang of Davos. Independent geopolitical analyst Tom Luongo shares the same view: “… that the American president, ‘as a proxy for the oligarchs in Davos, is acting on their behalf to ultimately weaken the U.S.’”

Global enslavement could ensue for the ignorant masses globally.

Everything changes and nothing changes.

With some luck though, their plan now has two fierce adversaries. The first one they have themselves created and it is the unexpected and unwelcome result of their geopolitical crazy games. The other one has been there since 2009 but only more recently came into their crosshairs.

Russia and China, together with the rest of the global South and the East, have been forced in an inextricable alliance for survival and independence from the West. They have had enough and have stopped playing a game made by someone else with someone else´s rules. The short-lived American unipolar global order — born in 1989 after the fall of communism — ends now, and a new multipolar order is born. Again, this new multipolar order and the consequent deglobalization, should be a thriving environment for Bitcoin, the embodiment of decentralization. Since gold and bitcoin are the only existing assets with no counterparty risk they might even play a role in the coming monetary reset. They might be part of the basket of currencies and/or commodities chosen to back up the SDR or whatever else is chosen. In this article I have postulated the reasons why a monetary reset might mean $18,000 gold and $650,000 bitcoin.

“More likely though governments will not use bitcoin but only gold in a monetary reset. After all this is the real asset that the biggest central banks own. Bitcoin then will become the preferred reserve asset for all non-sovereign institutions and also small developing nations which have little gold reserves. In this scenario, the Bitcoin standard will be likely adopted by the legacy financial sector, commercial banks (which can use bitcoin as a reserve asset to offer a new wave of commercial free banking services), corporations and individuals. Basically, the world might be using two monetary systems mutually integrated: an upper tier – for governments and central banks – running with SDR as the global world currency fractionally backed up by gold reserves; and a lower tier for small sovereigns, banks and individuals running on national fiat currencies and bitcoin as a reserve asset, frictionless moving between fiat currencies for expenditures and bitcoin for savings. This would be the ideal solution.”

At least this is what I hope. Anything short of that will mean a dark future for humanity.

Conclusions

Despite the recent price pullback, Bitcoin’s fundamentals and its investment case are stronger than ever. Never before has the protocol been more secure. It continues to grow and adoption is on the rise especially in developing countries, where Bitcoin represents a lifesaver for millions of people. As we have seen, even the most recent geopolitical events paint a bullish case for Bitcoin. That background though is fluid, complex and with so many variables, it is impossible to forecast what the outcomes will be.

The war in the heart of Europe, the high risk of an escalation outside of Ukraine’s borders, the high inflation and a global crisis building up in the energy, commodities and food sectors and the Western currencies inflating after years of monetary madness to fund consumerism and asset bubbles rather than productive investment: All this should in my opinion compellingly direct investors towards the ONLY asset which acts as protection against such complex and worrisome background thanks to its unique features. Bitcoin achieves absolute scarcity, true decentralization, censorship resistance, immutability, the highest protocol security, unlimited portability, relative anonymity and unique cash-like finality to settle peer-to-peer transactions in a parallel financial system. But this is the first time in history that we are at such a complex juncture with Bitcoin so we will have to see what happens next.

Then we have the Davos variable.

It is a fight between two powerful forces. The one pushes towards an authoritarian globalist regime based on the central banks’ control of new digital money, the abuse of surveillance tech and the control of big data. The other is a fully decentralized asymmetrical technology which empowers the majority of the people over elitist central entities thanks to the unique combination of cryptography, encryption, difficulty adjustment and POW (proof-of-work – this is why POW is needed and the whole debate about POW and proof-of-stake for Bitcoin is preposterous).

It is a battle between a top-down authoritarian power and a bottom-up tech market-based revolution which can bring about the very much needed separation of State and money.

One is the dark Middle Ages, the other is the early American dream and the Western frontier free spirit.

Someone said that being decentralized does not mean being disorganized. I agree. It is probably high time for Bitcoiners to come together in an organization similar to the Bitcoin Mining Council, at least to study the scenarios and the background that I have mentioned in this article and somehow elaborate some countertactics. At least debating over such topics will also bring ideas.

Count me in.

As for the rest, Bitcoin remains “the wrench thrown in the evil globalist engine.” It will no doubt continue to do its work against evil and for the free world provided we let it do what it has been programmed to do.

Being a Bitcoiner means always holding your keys, having a low time preference and

investing for the future to be a free man.

This is a guest post by Andrea Bianconi. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc. or Bitcoin Magazine.

This news is republished from another source. You can check the original article here

Be the first to comment