Despite a horror end to the year, crypto enthusiasts are bullish heading into 2022. This is where they think you should sink your money.

With 2021 coming to a close, cryptocurrency enthusiasts are already starting to speculate about which blockchains they should invest in for next year.

Following trends from this year as well as big projects soon coming to fruition, some experts have predicted what to expect for 2022 in the crypto realm.

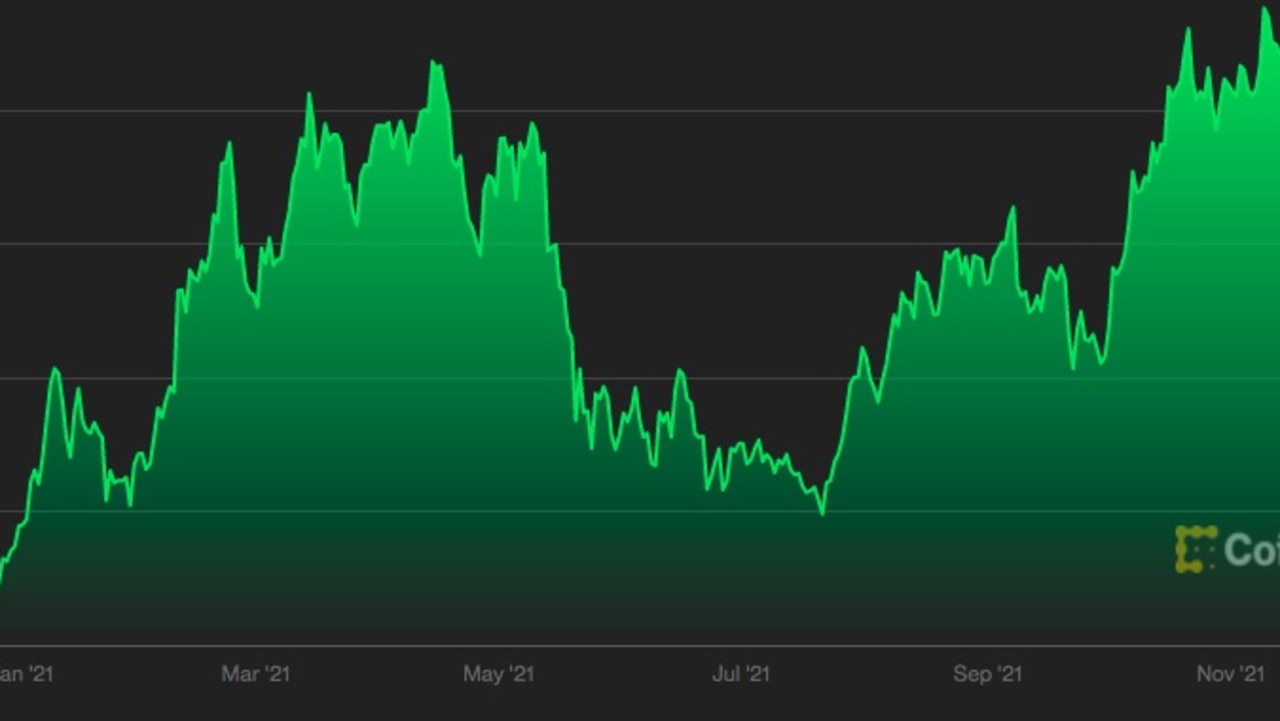

Although cryptocurrency has been experiencing a rough couple of weeks heading into the end of the year, it’s worth noting that these digital coins have experienced an unprecedented amount of growth over the last 12 months.

Against the backdrop of the Covid-19 pandemic, these blockchains have risen to prominence, with highlights including Tesla billionaire Elon Musk spruiking the coins, El Salvador adopting bitcoin as legal tender, Facebook creating an entire metaverse with crypto as the only currency and digital assets entering global stock markets in the form of exchange traded funds (ETFs).

But at the same time, China banned all cryptocurrency, the coins have suffered from huge drops in price, sometimes over the course of just an hour, and government regulations are looming across the world to control the rapidly growing market, including in Australia with Treasurer Josh Frydenberg flagging changes.

News.com.au has put together a list of the coins that experts think could do well into the new year, and the ones that will drag down your finances.

What can we expect for cryptocurrency in 2022?

Greg Rubin, head of trading at Aussie firm Global Prime, said that early next year would be volatile for crypto investors with some of the coins more than doubling in value. Then there would be a big drop and prices would remain relatively stable but low, he predicted.

“Looking at the scale of probabilities, it seems the most likely end to the bull run that kicked off in 2020 will be next year,” he told news.com.au.

He thinks it could be as soon as the first quarter of 2022.

“What we usually see is a blow off top and then the markets tend to drop quite quickly, and then the markets tend to go sideways for a number of months or years,” Mr Rubin warned.

Like the 2017 crypto crash, he predicts that most of the coins won’t survive and will never reach the same levels again once the price drops drastically.

“A lot of the altcoins are going to go crazy before the end is nigh,” he added.

What will set up a cryptocurrency token for success heading into 2022?

Tommy Honan, head of corporate partnerships at Aussie crypto exchange platform Swyftx, had some tips about what to look out for before piling your cash into the next big thing.

He explained that cryptocurrency in 2021 was characterised by meme coins soaring after major hype, a huge growth of play-to-earn gaming which rewards participants with cryptocurrency and/or non-fungible tokens (NFTs), and Facebook’s metaverse.

“If the meme coins and gaming and NFTs were the trend of 2021, I think [for] the start of 2022, the top performers are going to be ones that incorporate all of that,” he told news.com.au.

On top of that, he expects the decentralised finance aspects of coins to regain popularity with the world heading into high inflationary environments, which cryptocurrency is largely immune to.

He also pointed to some of the most successful coins this year, such as gala which is up by more than 41,000 per cent, ceek is up by 27,000 per cent, axiom with a 16,000 percentage increase and solana is at around 15,000 per cent more than it started out in 2021.

“There are some of your big performers and trends for 2021 [and] some of the trends we’ll see continuing into 2022,” he added.

“The message doesn’t change, the long term view overall [is] definitely bullish.”

What about regulations being introduced for cryptocurrency in 2022?

Every time there is mention of greater regulations and restrictions for cryptocurrencies, the market responds, usually by dropping in price.

But Mr Honan said it’s nothing to be afraid of.

“We know that there is a lot of money waiting in the sidelines for the correct regulations,” he said.

“The overall sentiment is that they’re positive. A lot of it comes from a consumer protection background, gives more people the confidence to get involved.”

Earlier this month, Federal Treasurer Josh Frydenberg said he wanted to protect investors who traded cryptocurrency on exchanges, in case the exchanges collapsed, as has happened twice before.

Bitcoin

Both Mr Rubin and Mr Honan think bitcoin is slated for greatness, with expectations it will hit six figures per coin next year.

However, what level of six figures varied wildly between both experts.

Mr Honan thinks bitcoin could easily be within US$500,000 (A$699,000) territory at its peak next year.

Mr Rubin had a more conservative estimate, suggesting the blockchain would hit anywhere from US$114,000 (A$158,000) to US$130,000 (A$181,000) before plummeting back to the US$10,000-US$20,000 (A$13,000-A$27,000) mark, a drop of around 70 per cent, where it would remain.

“When the volatility dies down, it will meander on low volume for years,” he explained.

At the moment, the top-ranked cryptocurrency is worth US$48,000 (A$66,000), after hitting an all-time high in November of nearly US$69,000 (A$96,000).

Bitcoin started out trading at about $0.08 back in 2010. The coin’s return on investment is 36,134.65 per cent — which is how much you would have made back if you’d put money into it at the very beginning.

At the start of this year, BTC was going for US$19,000 (A$26,000), so it has risen by 157 per cent over the last 12 months after continually topping its previous all-time highs.

Ethereum

Eethereum, which is ranked second on the crypto scale, is expected to surpass its current prices and all-time high in the new year.

“In terms of ethereum, it’s pretty much the same trend, I can see ETH hitting and holding a five figure price,” Mr Honan said.

Meanwhile, Mr Rubin expected gains from anywhere between US$10,000 (A$13,000) to US$20,000 (A$27,000).

However, he then expected the coin to shed as much as 85 per cent of its value.

At time of writing, ETH was trading for just over US$4000 (A$5500), down from its November high of nearly US$4900 ($6800).

It started the year off at just US$560 (A$780) per coin, indicative of its whopping 607 per cent rise.

Solana

Mr Honan said that both the attributes of solana as well as its bullish year of 2021 could indicate a positive future for the altcoin.

Ranked number five on the crypto leaderboard, solana emerged almost out of non-existence to overtake bigger players in the crypto space.

SOL started at US$1.50 (A$2) a year ago, before hitting a high of US$260 (A$360) last month.

Its current price is around US$180 (A$250) with a market capitalisation of $US54 billion (A$75 billion).

“Solana is seen as an ethereum competitor. It’s one that a lot of people are backing, it scales really well, it’s faster and cheaper than ethereum, they also made a play into the NFT space,” Mr Honan said.

Fanadise

You might not have heard of it, and I wouldn’t blame you. Fanadise, or FAN, is 4598th on the cryptocurrency ladder.

However, Mr Rubin thinks it’s headed for big things because it has been involved in Facebook’s metaverse — which is where crypto is the main form of currency that can be traded while in the meta world.

Fanadise is one of the coins that has got an early foothold in the metaverse.

“The metaverse coins have been doing really well, there’s been a big drive, one of those is FAN,” Mr Rubin explain.

“Metaverse is the hot topic.”

Fanadise is worth US$0.02849 right now. Its July 2021 all-time high was $0.4751.

Gala, ceek, axiom

These three cryptocurrencies are rising in popularity after being doled out as prize money in play-to-earn games.

Gala has increased in value by more than 41,000 per cent, ceek is up by 27,000 percentage wise, and axiom has jumped 16,000 per cent.

Of those, gala is selling for US$0.51 and is ranked number 29 while ceek is valued at US$0.5645 and coming in 153rd place on the crypto charts.

Axiom is further behind, ranked in 7549th position and can be bought at US$0.004401.

“The other really big trends that have emerged are play to earn gamin with axiom, gala, ceek, absolutely having some phenomenal progress there,” Mr Honan said.

“Definitely one of the standouts of 2021. People are playing games and earning a living, all they need is an internet connection and a computer.”

If this year’s trends are anything to go by, he said things are looking promising for these coins.

What not to invest in

There are a few big mistakes you should avoid when it comes to the crypto world, according to experts.

Shiba inu

Although shiba inu was the “standout” coin of this year, soaring by more than 50,000 per cent of its original price when it began 2021, experts don’t expect its success to be repeated.

Ranked number 13 on the cryptocurrency market, shiba inu is currently trading for US$0.00003286, down significantly from its all-time high of US$0.000086. However, it’s still up significantly compared to how it started the year.

Mr Rubin said crypto enthusiasts are on the hunt for the next big coin like SHIB but they’re missing one important point.

“People are looking for the next shiba but it’s actually something you should stay away from,” he explained.

“They only hear about it [its gains] afterwards, unfortunately by then the move has already happened, unlikely to be replicated.”

On top of that, he says coins that experience “overexcitement” are not a good long-term investment.

“Meme coins are hype coins, have little to zero value behind them,” the investor said.

“As they start to go higher or higher, it’s just not even feasible on a scale, it becomes very dangerous, every time it goes higher, you keep expecting more, ultimately you do end up holding the bag.”

XRP Ripple

Acknowledging it was a controversial opinion, Mr Rubin said Ripple (XRP) was not all it was cracked up to be.

Ripple XRP is currently ranked eighth on the cryptocurrency scale, after starting out in 2012.

It has a market cap of US$38 billion and each coin sells for US$0.8046 at the moment.

“It’s one of the few coins that has not made an all-time high [in 2o21],” Mr Rubin explained.

“It has the biggest cult following. For some reason, people who are invested in it think it’s the best coin, yet it’s a coin that is not performing in the bull run.”

He’s right; XRP’s all-time high of US$3.84 occurred in January 2018.

The coin is now worth just a fraction of that price, down by a whopping 78 per cent of its highest price.

“Why would you trade something that might go higher when there’s stuff around it that is going higher?” Mr Rubin asked.

“A missed opportunity for traders, it’s been a waste of time having your money in there.”

What’s more, the coin is embroiled in a court case with the US financial watchdog, the only cryptocurrency to be involved in such a controversy.

The US Securities and Exchange Commission (SEC) has claimed that every Ripple sale for the past seven years was an illegal securities trade because it was an unregistered entity.

The matter has gone to court and although it’s expected that Ripple will win, Mr Rubin expects the crypto crash to have already happened by then.

“By the time the court case comes out, the [crypto] market will be going out,” he warned.

Scam coins

It should go without saying, but do your research first before investing into a coin in case it turns out to be a scam — as millions learned the hard way earlier this year.

The squid coin, or SQUID, rose to prominence off the back of the Netflix TV series Squid Game in October.

The coin surged 90,0000 per cent within hours of listing, starting out at US$0.01235 and by midafternoon was worth $11.16 per token.

However, not all was as it seemed.

There was no option to sell the coins, only to buy them. It turned out the whole thing was a major scam, with the people behind SQUID making off with A$4.38 million.

This news is republished from another source. You can check the original article here

Be the first to comment