The Graph (GRT) hit its highest price point more than seven months ago, reaching the coin’s all-time-high level of $2.99 on 12 February before falling along with several other cryptocurrencies.

Meanwhile, some analysts say that GRT’s indexing protocol has established itself as a crucial component of the global decentralized finance (DeFi) infrastructure, owing to which, the token may return to its all-time-high and beyond by the end of this year.

GRT: everything you need to know

GRT is a token that powers The Graph, a decentralized indexing protocol used by blockchains such as Ethereum.

In a similar way to how search engines such as Google index the Internet, Graph protocol indexes blockchain data, grouping it into subgraphs on open application programming interfaces (API) that anyone can query via GraphQL, Graph’s programming language.

Subgraphs can be then composed into a global graph of all the public information. This data can be transformed, organized and shared across applications, enabling users to make a search using GRT tokens.

The Graph platform makes it easy to search for blockchain data through simple queries.

“Before The Graph, teams had to develop and operate proprietary indexing servers,” Graph says on its website. “This required significant engineering and hardware resources and broke the important security properties required for decentralization.”

Currently, The Graph supports nine networks, including Ethereum, Polygon, CELO and BSC.

The Graph (GRT) analysis: Key growth drivers

As The Graph provides specific functionality to the blockchain ecosystem, any positive developments or improvements in the technology or software behind The Graph could push the GRT price higher.

In February 2020, for example, when The Graph introduced Edge & Node, a software development company that aims to help blockchain protocol development, the GRT token skyrocketed an eye-popping 144% in the four days after the announcement. Any further positive Graph crypto news from Edge & Node could give an extra boost to the price.

Most recently, The Graph announced it was offering a $2.5m reward to developers and ethical hackers to identify vulnerabilities and shortcomings in its protocol and help fix them. Any improvements of The Graph software coming out of this initiative has the potential to drive GRT price higher.

– Partnerships and expansion

Asked about the key drivers behind The Graph’s expansion that are likely to determine its price range in the coming months, Tim Frost, the chief executive and founder of DeFi-focused fintech Yield App, told capital.com that the token plays a valuable role in the DeFi ecosystem.

“The Graph itself is very important to the DeFi Industry if you look at the adoption of a number of blockchain protocols such as Polkadot,” Frost told capital.com.

Frost also mentioned that the rising inflow of capital into DeFi benefits The Graph’s popularity. “Many new users have joined these ecosystems in the past months, there is a noticeable float of capital to them, and their adoption has taken off,” Frost added.

On 18 February 2021, the company announced that it now supports additional blockchains Polkadot, NEAR, Solana and Celo – the price rose 5.15% that same day. If The Graph software continues to expand, potentially supporting the Bitcoin blockchain, GRT token could benefit.

The Graph token (GRT): key risks

The Graph is a relatively new initiative, founded in 2018. While some of the biggest blockchain networks such as Ethereum already use The Graph protocol, there may be barriers to adoption by other big networks.

The GRT price can be influenced by the broader trends in cryptocurrency markets. For example, wider crypto market sentiment or regulatory crackdown could spark or dampen investor enthusiasm.

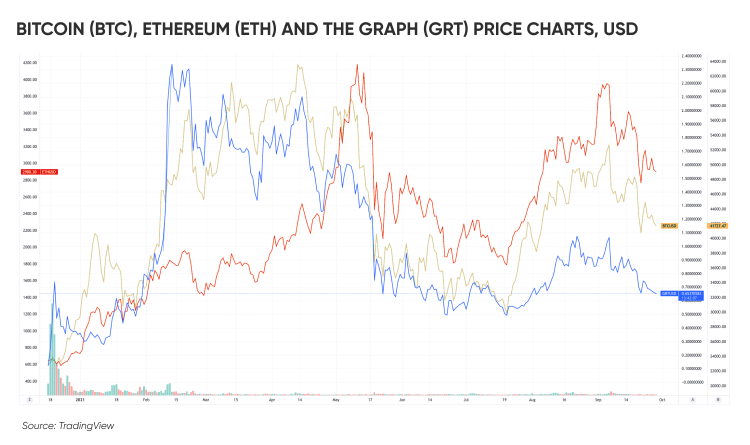

We can observe a limited correlation between BTC, ETH and GRT prices on the chart below. All coins saw prices go up and down over approximately the same periods. Between May and August 2021, for example, all cryptocurrencies were dipping, followed by a short-lived bull run. Since September, the sentiment has shifted yet again and all coins are suffering a slight reversal.

GRT: year-to-date price history

GRT started this year with a solid boost – the $0.35 price on 1 January soared to $2.24 on 13 February, a 586% rise. GRT achieved a record intraday high of $2.99 a day prior on the back of the Edge & Node launch.

Yet the peaks were short-lived. After sideways to lower action that lasted till May, the token entered a bearish phase. Since then, GRT has been trading in the $0.427 to $1.15 range.

GRT: what do the analysts say?

Yield App’s Tim Frost said that despite the token’s price dip in the past few months, The Graph has strengthened its position as a crucial element of the DeFi infrastructure which plays a big role for the future of GRT token.

“In May, there was a significant market correction, but now there is a noticeable rejuvenation in the crypto markets,” Frost told capital.com.

“It is clear that many coins have not returned to their all-time-highs yet, and The Graph is one of such coin,” Frost added.

“However, it is still gaining a lot of price support at its current levels, and I think there is a possibility that The Graph could hit its all-time-high price again later this year,” Frost concluded, referring to the $2.45 level

The Graph price prediction (2021-2025).

Algorithm-based forecasting service LongForecast predicts GRT to rise to between $1.07 and $1.33 by October 2025, yet with some bumps on the road. The company sees the price fluctuating between $0.58 and $0.74 in October 2024.

Digital Coin Price supports a bullish The Graph crypto price prediction, expecting the token to grow to $1.91 in October 2024, falling to $1.78 in October 2025.

Wallet Investor, on the other hand, gives a bearish GRT coin forecast. The company sees GRT gradually losing its value and falling as low as $0.007023 by October 2023.

The Graph’s pros

GRT’s market capitalisation reached $3.041bn on 28 September, according to the data from CoinMarketCap, making it 46th largest cryptocurrency.

The Graph’s indexing protocol powers nine blockchain networks, including Ethereum, and has established itself as a crucial component for decentralized finance.

The Graph’s cons

Its current price is roughly one-third of the all-time-high, and GRT could have a long way to go before recovery. There is much to consider before deciding to invest in The Graph crypto.

GRT is a relatively new token which creates additional barriers to its adoption. It’s now used by Ethereum, but it is unclear whether Bitcoin or other big networks will adopt the protocol in the future.

Edited by Jekaterina Drozdovica

FAQs

Read more: Bitcoin analysis for the rest of 2021: the near-term trend is favourable

Capital Com is an execution-only service provider. The material provided on this website is for information purposes only and should not be understood as an investment advice. Any opinion that may be provided on this page does not constitute a recommendation by Capital Com or its agents. We do not make any representations or warranty on the accuracy or completeness of the information that is provided on this page. If you rely on the information on this page then you do so entirely on your own risk.

This news is republished from another source. You can check the original article here

Be the first to comment