We are delighted to announce the release of CryptoCompare’s latest research report – 2022 Q3 Outlook: Winter is Here.

The second quarter of 2022 was catastrophic for the digital asset space. Bitcoin and Ethereum fell 56.3% and 67.4% respectively, recording one of the worst quarterly performances in their history.

The collapse of UST and the Terra ecosystem and the subsequent contagion that led to the bankruptcy of Three Arrows Capital and the insolvency of multiple centralized yield providers like Celsius, has likely sent the industry into a bear market.

This report aims to capture, explain, and analyze these events and put into context what they might mean for cryptocurrencies over the next quarter and beyond. We cover macroeconomics, stablecoins, DeFi, NFTs, and more.

This report aims to capture, explain, and analyze these events and put into context what they might mean for cryptocurrencies over the next quarter and beyond. We cover macroeconomics, stablecoins, DeFi, NFTs, and more.

You can access the report here.

Key takeaways:

- The digital asset space has been hard hit over the last quarter. Q2 was Bitcoin’s second-worst quarterly performance in its history, returning -56.3%, while Ethereum declined by -67.4% over the same period. This negative performance can be attributed to a trifecta of intensifying market conditions, a liquidity & credit crunch within the sector, and a revaluation of risk assets across financial markets.

- Stablecoins have been a focal point of the digital asset industry following the collapse of UST and Terra. In the report, we conduct a USDT Redemptions Analysis, which suggests that Tether’s collateral structure is sustainable and will be able to handle severe stress tests, as it would be able to effectively convert its T-Bills balance into cash and fulfill significant redemptions.

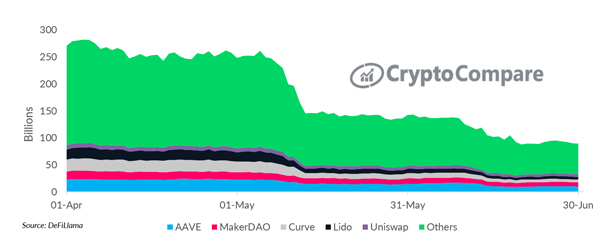

- Q2 was marred by high-profile contagion events within the digital assets ecosystem. Consequently, the fall in the price of crypto assets has translated into a decline in Total Value Locked (TVL) in DeFi protocols – falling 65.7% to $93.2bn in Q2 2022. AAVE, which launched its v3 application near the end of Q1, is the largest protocol with a TVL of $10.4bn and has been at the forefront of recent market developments, being used by 3AC and centralised lenders to pursue yields in DeFi.

- ‘Blue-chip’ NFTs appear to have performed as an important store of value for crypto-native individuals. CryptoPunks and Fidenzas have marginally outperformed Ether so far this year, while Bored Ape Yacht Club has strongly overperformed the layer 1 blockchain, mainly due to the success of Yuga Labs and the rest of the BAYC ecosystem.

Growth Asset Returns & Bitcoin

The digital asset space has been hard hit over the last quarter. Q2 was Bitcoin’s second-worst quarterly performance in its history, returning -56.3%, while Ethereum declined by -67.4% over the same period.

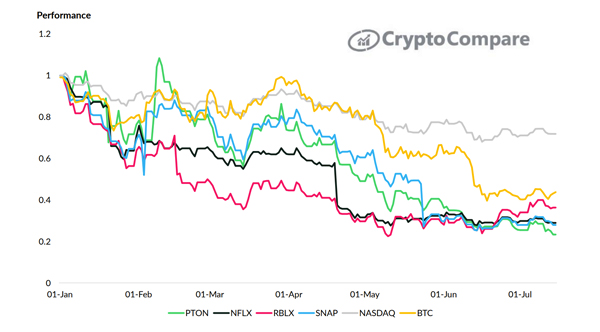

Having said this, it is important to put Bitcoin into context with other risk-assets. While the volatility of Bitcoin and cryptocurrencies has long been understood, traditional assets have also performed extremely poorly this quarter and it is unsurprising that a high-risk asset class such as crypto has seen severely negative returns amid negative market conditions. What is striking is the performance of various growth stocks which have underperformed Bitcoin, even with much lower volatility.

Examining Stablecoins: USDT Redemptions Scenario Analysis

The below analysis assumes Tether would initially use all cash positions to pay redemptions, and that only US-T Bills would be used for redemptions subsequently. Of course, this would be in extreme market conditions, where 10 – 30% of total USDT market capitalization is redeemed in the space of 7 – 30 days.

The scenario below suggests that Tether’s collateral structure is sustainable and will be able to handle severe stress tests, as it would be able to effectively convert its T-Bills balance into cash and fulfill significant redemptions. Given the possibility of such a large-scale bank run is improbable, this gives confidence in the stability of these collateralized stablecoins, albeit these have other problems for the industry, particularly their centralization.

Total Value Locked (TVL) in DeFi Protocols

AAVE, which launched its v3 application near the end of Q1, is the largest protocol with a TVL of $10.4bn and has been at the forefront of recent market developments, being used by 3AC and centralised lenders to pursue yields in DeFi.

MakerDAO, the protocol behind the DAI stablecoin, also gained some interest after its overcollateralized algorithmic model was deemed safer compared to the now demised algorithmic stablecoin TerraUSD. It followed as the second largest protocol with $7.89bn in TVL.

The same can be said about Curve Finance, the DEX liquidity pool on Ethereum for efficient stablecoin exchange, and Lido Finance, a liquid staking pool that allows users to earn staking rewards. Both these platforms were instrumental cogs in the events of the last few months – with Curve being a key marketplace in the depegging of UST, while Lido’s stETH product has been a major matter of questioning following its fall in parity with ETH.

The information provided by this report does not constitute any form of advice or recommendation by CryptoCompare. Any redistribution of charts appearing in this Review must cite CryptoCompare as the sole provider and creator.

CryptoCompare is an FCA authorised and regulated global leader in digital asset data, providing institutional and retail investors with high-quality real-time and historical data. Leveraging its track record of success in data expertise, CryptoCompare’s thought-leadership reports and analytics offer objective insights into the digital asset industry.

This news is republished from another source. You can check the original article here

Be the first to comment