Both traditional and crypto markets experienced negative movements again in June, with all covered digital assets declining sharply following the liquidation of Three Arrows Capital, the hardest hit being ETH and BTC, which fell -44.9% and -37.4% respectively.

Volatility also continued to rise across both markets, ranging from a high of 144% (SOL) to a low of 15.7% (gold), equity indices also saw a rise in volatility with the S&P500 and Nasdaq jumping to 35.4% and 44.8% respectively.

Access the full asset report here for all the latest insights.

Key takeaways:

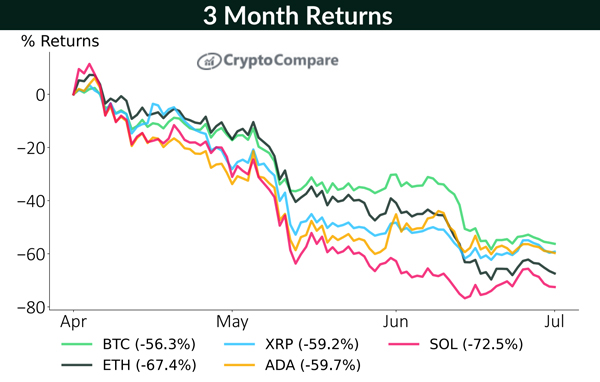

- Over the last three months, all covered digital assets have lost over half their value, with BTC fairing the best (down 56.3%, ending the month at $19,908), and SOL suffering the most, (falling 72.5% to $33.74). ETH was also hit hard, falling 67.4%, as were both XRP and ADA, which also fell 59.2% and 59.7% respectively.

- Total Value Locked (TVL) in the Solana blockchain fell 37.3% in June to $2.50bn, the lowest monthly close for the blockchain since July 2021. This is largely due to the declining price of SOL, which has fallen 80.1% since the start of the year.

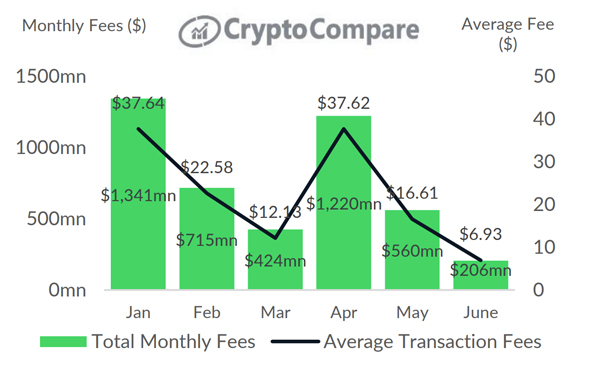

- The Ethereum Network’s average transaction fee has fallen to $6.93, its lowest level since July 2021, according to our data. Transaction fees surged in the summer of 2021 as the popularity of NFTs and DeFi increased over time. The decrease in transaction fees coincides with the current bear market, as interest in NFTs and DeFi falls.

- Despite the launch of the CBDC Innovate challenge by Ripple and other continuous efforts, activity on the XRP blockchain has diminished since the start of the year. In January, the XRP network averaged just under 176k daily active users, an all-time high for the cryptocurrency. Since then, active addresses have declined sharply, falling to an average of 64.8k in June – a 63.1% drop from its peak.

Covered Digital Assets Decline Over 50% In Last 3 Months

Over the last three months, all covered digital assets have lost over half their value. with BTC fairing the best (down 56.3%, ending the month at $19,908), and SOL suffering the most, (falling 72.5% to $33.74). ETH was also hit hard, falling 67.4%, as were both XRP and ADA, which also fell 59.2% and 59.7% respectively

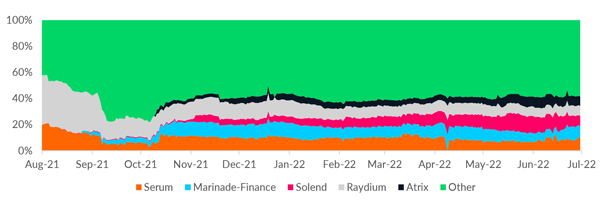

Solana TVL Reaches Lowest Level Since July 2021

Total Value Locked (TVL) in the Solana blockchain fell 37.3% in June to $2.50bn, the lowest monthly close since July 2021. This is largely due to the declining price of SOL, which has fallen 80.1% since the start of the year.

Solana’s protocol dominance remains evenly divided between a number of top protocols, suggesting a healthy ecosystem split between a range of different applications. This makes the network less vulnerable to idiosyncratic protocol risks. The largest five protocols in Solana together account for 45.9% of TVL.

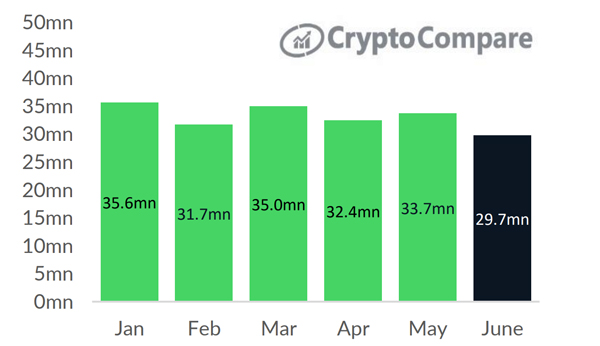

Monthly Ethereum Transactions Fall To Lowest Level In 2022

Monthly transactions on the Ethereum network are the lowest they have been in 2022 – falling to 29.7mn for the month of June.

The Ethereum network’s average transaction fee has also fallen to $6.93, the lowest level since July 2021 according to our data. Active addresses on the network have also been on a downward trend as of late.

This news is republished from another source. You can check the original article here

Be the first to comment