Darius Dale is the Founder and CEO of 42 Macro, an investment research firm that aims to disrupt the financial services industry by democratizing institutional-grade macro risk management processes.

Key Takeaways

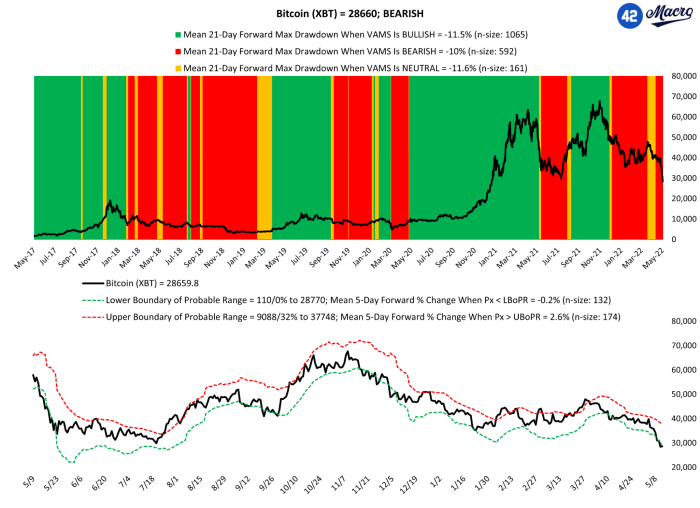

Short-Term (less than one month): Our market signaling process is pointing to a continuation of the challenging environment for risk assets. While a downside surprise in the U.S. April CPI data provided some reprieve, we, at 42 Macro, don’t think a grossly anticipated negative rate of change inflection will do much in isolation to catalyze a durable bottom in either stocks or bonds given our analysis of second-round inflation momentum and the latest forward guidance out of the Federal Reserve and European Central Bank.

Medium-Term (three to six months): We continue to see downside risk to around $3,200–$3,400 for a durable bottom in the S&P 500 — which would likely catalyze another 30–50% decline in bitcoin once cross-asset correlation risk kicks in. While that range may prove to be 200–300 points too low once the Fed put option is factored in, we do believe it is important for every investor to comprehend the risk we continue to see on an ex ante basis.

(Source)

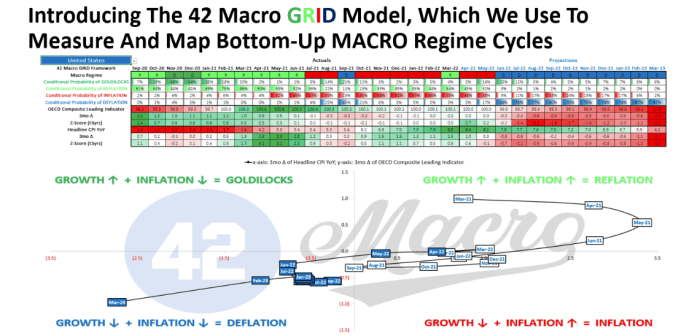

Our base case scenario sees the U.S. economy returning to inflation in April 2022 and May after a brief stint in reflation before settling into a persistent deflation by June. Inflation and deflation are the two components of 42 Macro’s “GRID Regimes” that feature elevated volatility and covariance across asset classes. Given this condition of elevated portfolio risk, it is likely we are only in the middle innings of the bear market(s) in high-beta risk assets we have been anticipating since the fall.

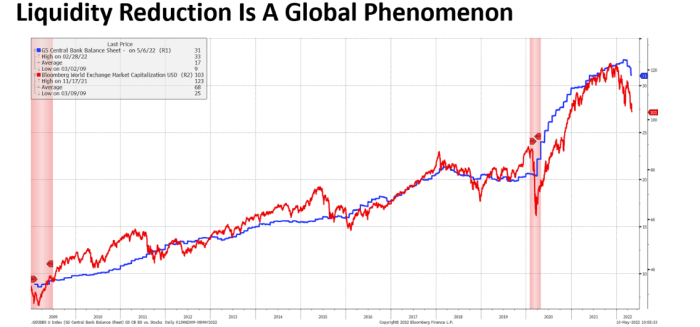

With the Fed unlikely to receive any signals from either the labor market or inflation statistics to stop tightening monetary policy for at least another quarter (perhaps two or three), it is likely financial conditions must tighten considerably to force a dovish pivot. While U.S. and global growth dynamics do not yet support such an adverse outcome, we believe simultaneous deteriorations in the liquidity cycle, growth cycle and profits cycle will continue to perpetuate a protracted and pervasive breakdown in risk appetite.

(Graph by 42 Macro)

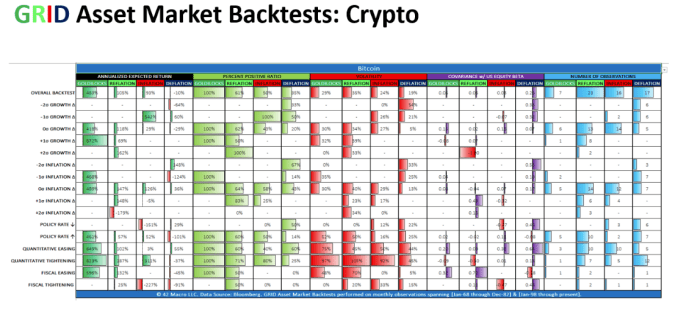

The balance of risks surrounding our model outcome are balanced. With respect to what we believe is a low-probability bull case, risk inflation peaks and slows much faster over the next two to three months than we, economist consensus and the Fed, currently anticipate, leading to a sharp repricing lower of the projected path for the Fed Funds Rate in money markets. Any such sharp deceleration in inflation would also inflate real incomes and delay a more meaningful slowdown in growth by perpetuating a growth plus inflation (“Goldilocks”) soft landing in the U.S. and across large parts of the global economy. Goldilocks is an extremely bullish regime for bitcoin, with an annualized expected return north of 400%.

With respect to what we believe is a low-probability bear case, a deterioration on the geopolitical front amid incremental supply chain disruptions stemming from China’s “Zero COVID” policy may sustain the ongoing inflation impulse for another two or three months. This causes Fed officials to take incremental actions (relative to market pricing) to tighten financial conditions into the teeth of the sharper deceleration in growth our models have persisted throughout 2H22E. The resulting deflation would likely be deeper and more protracted, perpetuating jump conditions in recession probability models. A deep deflation — as evidenced by a (two-sigma) growth delta is quite bad for bitcoin. That regime features a negative 64% annualized expected return for the digital asset.

This is a guest post by Darius Dale. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc. or Bitcoin Magazine.

This news is republished from another source. You can check the original article here

Be the first to comment