A quick look at what is DeFi and its benefits

With great power comes great responsibility

I am pretty sure we all heard that from uncle Ben but have you ever taken a minute to think about its true meaning? Because it’s a powerful quote if interpreted wisely. But wait what the heck does this has to do with Decentralised Finance /DeFi anyway? The answer is everything and you will see.

Background

As someone who always learns his lessons the hard way, let me tell you that DeFi is far less complicated than you think. If you can understand how traditional/current finance works, half of the battle is already won. That is why it is necessary to cover the basics before moving to DeFi. I should also say that this is just the basics but don’t worry I’ll leave more resources should you be interested.

Traditional finance/TradeFi basics

We refer to the current financial services as traditional finance. At its core, it composes financial institutions that are all coming together to form what we call the financial system. Here are they;

- Banks( Barclays, Bank of America, HSBC)

- Insurance companies (Berkshire Hathaway, AIA Group, Aviva etc…)

- Payment companies ( Visa, Mastercard etc..)

- Exchanges ( Nasdaq, London Stock Exchange etc…)

- brokers ( Charles Schwab, Fidelity Investments etc…)

Although these institutions provide different services, they almost operate the same way. They have shareholders to pay dividends and people to run the company. To participate in any financial activity, one must have an account that is verified with the respective institution. For instance, to lend money, you will open a bank account. In traditional finance, trust needs to be built between participants otherwise it would not work. I mean, would you put your money in the bank if you don’t trust them? The problem is the more we go the more institutions we need to trust. And if there is one thing I know for sure, is that when it comes to money trust no one but yourself. The fact of trusting a third party to custody, and managing all your assets is damn scary to me for many reasons.

- fraud, theft, mismanagement

- The loss of freedom over your own money.

And another layer of risk is added on top when you hand in your data to a third party. Can you answer for sure they won’t sell it? you never know. The other bad thing about Traditional Finance is since they have shareholders and bills to pay, they need money to stay in business. Guess where they get the money from. Yup, you’re right! Fees fees fees.

Decentralised Finance

DeFi in simple terms can be described as a financial system that utilises blockchain technology combined with smart contract codes to achieve a more transparent, trustless and permissionless with no middleman in between parties. Blockchain protocols like Ethereum, run smart contracts which is a fancy term for saying an agreement or a contract that is intended to be automatically executed when the terms are met. As an example, when a bank standing order is set, the transaction will only be executed when the date comes and the payer has money in his account. If those two terms are not met, then the transaction won’t go through. Smart contracts work in a similar way that doesn’t involve any human execution and can be pretty much any contract or agreement. Read more about smart contracts

Smart contracts allow developers to build protocols on top of blockchains platforms like Ethereum. Given that all financial institutions simply constitute a set of contracts, those same contracts can be coded in the blockchain to serve the same services these institutions do in a much better way. These financial services are:

- Deposits

- Lending

- Investment

- Currency exchanges

- Insurence

DeFi allows us to perform all these operations in a completely decentralised manner as stated above using protocols build on top of blockchain platforms that can be accessed by anyone with a simple smartphone and an internet connection anywhere in the world. In contrast to traditional finance where a user has to trust a third party whether it is a bank or a brokerage firm for the custody of their assets, in DeFi, users are one hundred per cent responsible for their funds that can simply be managed using a wallet which is a gateway that enables us to access these protocols in a secure, permissionless way. Read more about wallets

Since DeFi protocols once built don’t need human management to operate, make them way cheaper and more reliable than traditional finance.

The benefits of DeFi

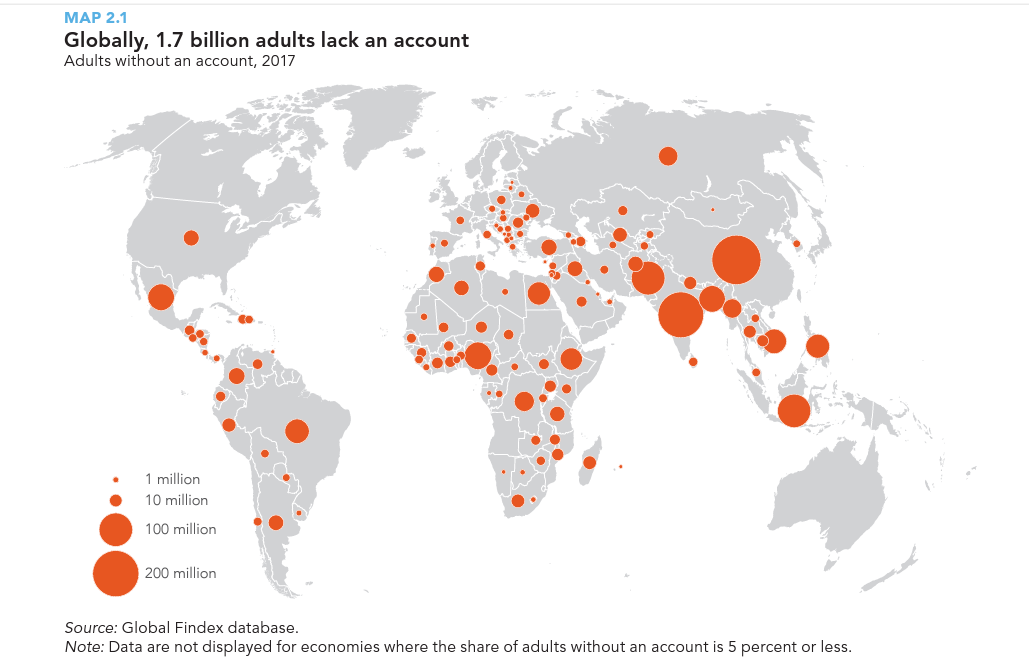

It should be noted that the main goal of DeFi is to make the financial world as accessible as the internet and that can only be achieved by making it permissionless, decentralised, transparent and humanless. The reason the latter is so crucial is that financial institutions are just businesses that are here for profits and that means they only operate in profitable environments. That disfavours those living in less developed countries from having access to basic financial needs such as banking and investing. Another critical issue DeFi solves is the need for necessary documentation and trust to participate in any financial activities. Over 1.7 billion adults remain unbanked and having an alternative that gives them access to these activities is life-changing if you ask me.

My concerns about DeFi

As much as I like using DeFi, I have to say it is not perfect. Although DeFi protocols are permissionless and trustless, it is not yet the best user-friendly for the average person. For most people setting up a wallet and signing transactions can be overwhelming compared to traditional finance where pretty much all those steps are taken care of for you. The trade-off of course is the fees and commission that are charged for this service. This, however, is not to say that DeFi won’t get better as time goes on. After all, DeFi is only 3 years old. Compared to centuries of traditional finance, I think we are doing great!

This news is republished from another source. You can check the original article here

Be the first to comment