A US bill that was allegedly leaked yesterday seeks to increase regulation of many key Ethereum-based offerings.

- The total market capitalization of the digital asset industry has risen by 2.1% since June 7.

- Despite its relatively weak price action, Ethereum’s share of the crypto market has risen to 17.5%, its highest levels in over a week.

- Cryptocurrency exchange Crypto.com recently unveiled a new startup accelerator worth US $100 million focusing exclusively on the DeFi and Web3 markets.

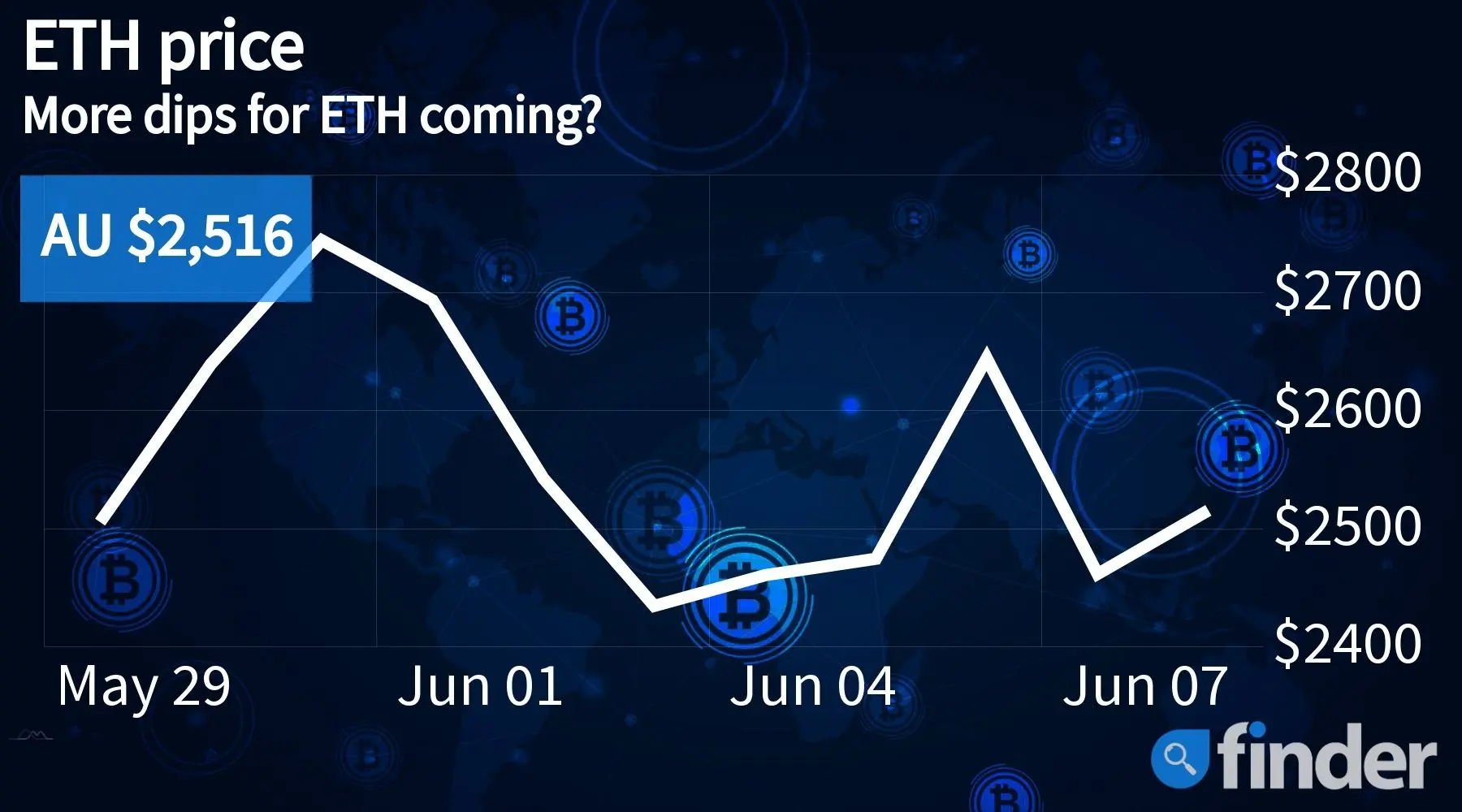

The past week has seen Ethereum fall from a relative high of AU $2,700 to approx. AU $2,400, bringing the altcoin’s losses to -7.8%. ETH’s 12-month profit/loss ratio now stands at -30% with the currency trading at AU $2,487.

This poor performance comes amidst the leak of a United States draft bill concerning crypto assets, particularly Ethereum niches such as decentralized finance (DeFi), stablecoins and decentralized autonomous organizations. As per the bill, regulators will increase their focus on user protection, with crypto products — like DAO’s, DeFi protocols — now being required to register with relevant authorities before their launch.

Anonymous projects will find it hard to exist in the United States, with the leaked bill stating that platforms without the necessary legal affiliations may be liable to pay heavy tax penalties. On the subject, Dogecoin co-founder Billy Markus commented: “All they really gotta do is go hard after exchanges and the party is officially over.”

Adam Cochran, partner at VC firm Cinneamhain Ventures, noted that the leaked document appears to only be draft bill and may not be representative of the “complete/final/real thing”, adding: “I would say if it is real, and if it is passed in this form it will be good in the long term for big entities but super painful in the near term for 99% of all cryptos.”

How to buy Ethereum

Crypto.com released $100M accelerator for DeFi and Web3 startups

Cronos, a blockchain network developed by trading platform Crypto.com, recently unveiled the launch of its accelerator program that seeks to help spur the development of products within the decentralized finance (DeFi), Web3 and Metaverse arena. The initiative will dole out $100 million worth of funding to crypto projects in their seed and pre-seed stages.

The accelerator fund has been launched in conjunction with mainstream crypto entities including Mechanism Capital, Spartan Labs, IOSG Ventures, OK Blockchain Capital, AP Capital. Successful applicants will receive $100,000–$300,000 as seed investment (with additional funding also available, if required).

Binance Coin faces massive bearish pressure

Over the course of the last 24-hours, the price of Binance Coin (BNB) price has dropped by nearly 7.3%, scaling as low as $275, its lowest level in three weeks. The currency faces further potential negative price action as its issuing firm Binance continues to face serious allegations of money laundering and securities rule breaches.

Disclosure: The author owns a range of cryptocurrencies at the time of writing

Trying to get a handle on the markets? Cut through the noise with our overview of the best cryptos to buy right now, explore some strategies for how to trade crypto or see if there’s a better platform for you with our guide to the best crypto exchanges.

Disclaimer:

This information should not be interpreted as an endorsement of cryptocurrency or any specific provider,

service or offering. It is not a recommendation to trade. Cryptocurrencies are speculative, complex and

involve significant risks – they are highly volatile and sensitive to secondary activity. Performance

is unpredictable and past performance is no guarantee of future performance. Consider your own

circumstances, and obtain your own advice, before relying on this information. You should also verify

the nature of any product or service (including its legal status and relevant regulatory requirements)

and consult the relevant Regulators’ websites before making any decision. Finder, or the author, may

have holdings in the cryptocurrencies discussed.

This news is republished from another source. You can check the original article here

Be the first to comment