We’ve written many side by side comparisons of crypto exchanges and this one stands out as an example where the vast majority of investors should want to open accounts at both, for different reasons.

Both tick certain boxes the other platform doesn’t – for example eToro is a far more regulated platform and has copytrading, plus stocks and other asset classes whereas Binance has futures trading and more crypto assets currently listed. For a more in-depth comparison read on as we’ll get into the finer details in this guide.

Both are very popular cryptocurrency platforms where you can buy and trade crypto either on desktop or mobile, that offer a wallet and staking, but beyond that the differences are quite detailed.

eToro vs Binance – Summary

If you want to simply buy and hold with peace of mind, the internationally regulated eToro is ideal. Especially if you want to trade forex too, or diversify your portfolio into commodities, stocks, ETFs and more. Whether on a demo account or for real money.

If you’re a low timeframe scalp trader, day trader, use leverage or want to buy lesser-known low cap altcoins, Binance is better for those.

Of course many people will do both, splitting their funds up into both a 5-10 year hold and a small portion to use for active trading.

- eToro is FCA, ASIC and CySEC regulated and open to the US. When you buy or sell cryptocurrencies on eToro, you’ll pay a 1% spread. Users can also deposit on this platform using a debit card, Paypal, bank transfer, e-wallet and more options. It’s the most accessible fiat on-ramp to buy crypto and beginner friendly.

- Binance is not yet regulated and operates a downgraded version with few cryptos in the US. In the rest of the world, over 600 cryptos are listed and it uses a maker / taker fee of 0.1%. It’s therefore ideal for day traders. It caters to them with more technical analysis (TA) tools and indicators. Depositing is best done via crypto you already own, e.g. from your eToro account.

eToro is preferable for long-term investment because it is safer to store crypto for years on a much more regulated platform, and the 1% spread fee is worth it if just purchasing once and holding.

eToro also provides copy-trading and smart portfolios, which allow you to trade efficiently and profitably and adapt your portfolio, unlike Binance. In terms of deposit choices, copy-trading, and regulation, eToro wins, whereas Binance wins in terms of active trader trading fees, and more staking coins.

Binance has perpetual futures trading pairs, but eToro does not. For American traders, eToro, by providing the option for 60+ cryptos, easily beats Binance US. Both feature a trade academy and classes to help people learn how to trade.

Cryptoassets are a highly volatile unregulated investment product.

| Fees and Features | eToro | Binance |

| Licensing | FCA, CySEC, ASIC | Central Bank of Bahrain (CBB), Dubai |

| Number of Cryptocurrencies | 60+ | 600+ |

| Pricing Structure | Fixed transaction fees | Varying transaction fees |

| Fee for Buying Bitcoin | 1% spread | 0.1% maker / taker fee |

| Trading Tools and Features | Price charts, social networks, copy trading, staking, eToro Academy | Technical charts, Tradingview indicators are integrated, Staking, Binance Academy |

| Mobile App Rating | 5/5 | 4/5 |

| Payment Methods | Debit card, credit card, PayPal, Neteller, Skrill, bank transfer | Debit card, credit card, Bank transfer, P2P |

| Minimum Deposit | $10 | $10 |

| Demo Account | Yes ($100,000) | No |

What are eToro and Binance?

Back in 2007, eToro, a multi-asset broker and cryptocurrency exchange, was launched in Israel. On the site, you can buy stocks and Exchange-Traded Fund (‘ETFs’), cryptocurrencies, and Contracts for Difference (‘CFDs’) for commodities and forex. eToro stands out from other multi-asset platforms in several ways.

It’s a social trading platform where all investors can network with each other via their own profiles and walls that they can post to. So you’re never alone on the website.

Several regulatory bodies license and regulate eToro namely the Cyprus Securities and Exchange Commission (CySEC), the Australian Securities and Investments Commission (ASIC), and the Financial Conduct Authority (FCA) of the United Kingdom.

Binance was founded in 2017 by Changpeng Zhao and has quickly risen to become one of the most popular cryptocurrency exchanges in the world. It is, in reality, the world’s largest crypto-only exchange by volume. When compared to other options, Binance has a larger range of cryptocurrencies. Currently, the exchange is home to over 600 cryptocurrencies, with more on the way.

of the most popular cryptocurrency exchanges in the world. It is, in reality, the world’s largest crypto-only exchange by volume. When compared to other options, Binance has a larger range of cryptocurrencies. Currently, the exchange is home to over 600 cryptocurrencies, with more on the way.

Binance provides services to consumers in over 180 countries. However, Binance.com, the main domain, is unavailable in the United States owing to US government regulations. Binance US (Binance.us domain) is a separate platform that complies with federal rules, however the cryptocurrency alternatives available there are limited. On their website, they list just 50 cryptocurrencies that are available for Americans to buy.

Tradable Cryptocurrencies on eToro & Binance

The number of cryptocurrencies users can trade on each of these platforms is one of the most significant differences between eToro and Binance. Presently, Binance offers its users to easily and safely buy Bitcoin, Binance Coin, Dogecoin, Ripple, Tether, Cardano, and 600+ cryptocurrencies with their credit/debit card.

US traders are limited to about 50. Apart from this, Binance also has its own NFT marketplace. On the other hand, eToro offers customers to exchange thousands of financial products, of which there are over 60 cryptocurrencies. It is a multi-asset exchange. All the major cryptocurrencies such as Bitcoin, Ethereum, Ripple, Cardano, Binance Coin, XRP etc. are listed however.

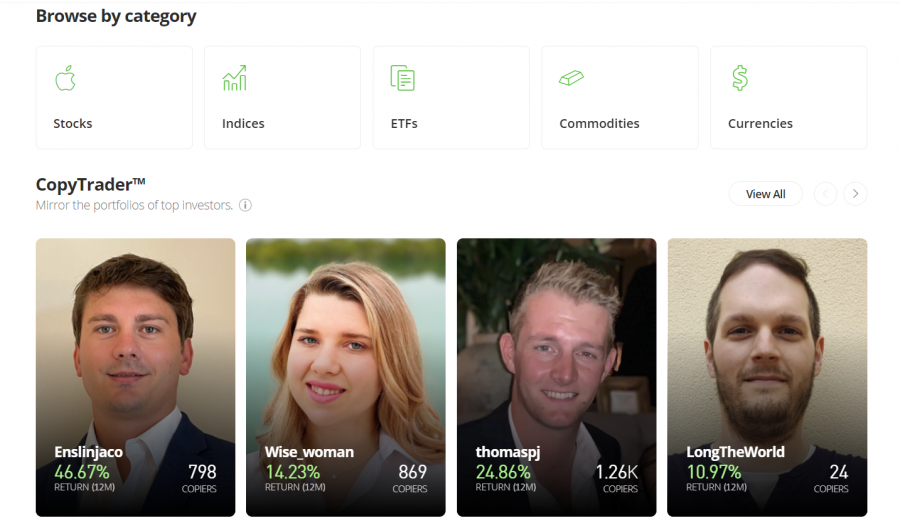

Unlike Binance, eToro allows users to copy-trade professional investors or imitate a smart portfolio, a calculated distribution of the best cryptos to buy and hold over time. Last year eToro users had a 30.4 percent return on investment (ROI) when copy-trading.

Cryptoassets are a highly volatile unregulated investment product.

Account Types

eToro offers both a demo account to paper trade and a real money account. There are no account creation fees and only a $10 minimum deposit is required in the US and UK (slightly more elsewhere).

Binance has no demo account but like eToro offers a free trading account that can be set up online. A minimum deposit of $10 is required to buy cryptocurrency. Residents of the United States are required to open a separate account in order to use Binance US.

eToro Fees vs Binance Fees

eToro has competitive, low fees especially for a cryptocurrency exchange open to the United States. When you buy crypto, you incur 1% of the transaction value as spread, but no additional maker / taker fee on top of that. So the bid/ask price you see is what you get.

When you withdraw money from your eToro account, you will be charged a $5 fee.

On the other hand, the maker-taker type structure is followed by Binance while computing the fees. The makers are the people who bring liquidity to the market, whilst the takers are the individuals who take away liquidity. As a result, the type of deal, as well as the volume, determines the fees.

For transactions under $50,000, Binance levies a 0.10% transaction fee via the maker/taker method. This cost reduces inversely proportional to the order value. Sending fiat from a bank account is free; however, when using a debit card, the platform levies a fee equivalent to 1.8% of the trade value on the main exchange and 4.5% on Binance US.

Here’s how eToro fees vs. Binance fees break down when trading:

| Fees | eToro | Binance |

| Instant Buy Fee | 1% | 0.1% |

| Trading Fee | 1% | 0.1% |

| Cost to Buy $100 of Bitcoin with a Bank Transfer | $1 | $0.1 |

Cryptoassets are a highly volatile unregulated investment product.

| Non-Trading Fee | eToro | Binance |

| Account Fee | None | None |

| Withdrawal Fee | $5 | Dynamic |

eToro vs Binance User Experience

Both Binance and eToro have great user interfaces. These platforms being so popular among crypto investors and traders could be attributable to their ease of use.

While using eToro, you will have a customised dashboard where they can learn everything about the crypto market. The dashboard not only displays the day’s top gainers and losers but also displays the most popular cryptocurrencies among eToro users.

For the benefit of the users, color-coded charts depicting performance over the previous seven days are displayed alongside the day’s price fluctuations. In addition to that, the platform uses a set of eight technical indicators to assign, buy, sell, and hold ratings to most cryptocurrencies, making it simple to spot possible trades.

On the other hand, Binance welcomes users to its all-encompassing dashboard right away. This dashboard provides all the relevant information to the traders and investors which will be needed to make an informed purchasing decision. At the outset, the website presents day trends at the top, such as “Highlight Coins,” new listings, coins exchanged by volume and day’s top gainers.

In addition to this, a dashboard will also be available with pertinent information about each crypto coin. This will include the most recent price, the % change in price over the last 24 hours, the 24 hour traded volume, and the market capitalization of a coin.

It also provides a number of sorting features and filters which will, in turn, allow a user to customise it to their needs and preferences.

Some find the trading platform on Binance to be complicated. It does have a classic mode setting you can turn on, but if you still find it daunting you will likely prefer eToro.

eToro and Binance Mobile Apps

You can find both Binance and eToro mobile applications on the AppStore and Playstore. eToro’s mobile app and their eToro Money Wallet supports more than 120 different cryptocurrencies.

eToro’s mobile app has a high rating for both Android and iOS. What you can access on the eToro app is the same as on the web-based platform. On the other side, the Binance application is as fast as Binance’s website and has a very solid aesthetic appeal which enforces users’ faith in the platform.

Even within the application, you’ll find a range of tools which are required to complete a transaction. Furthermore, non-fungible tokens (NFTs) can also be traded and deposited using the mobile application of Binance. Overall, both crypto exchanges, whether it’s eToro or Binance, both have good apps.

Trading Tools & Features on eToro & Binance

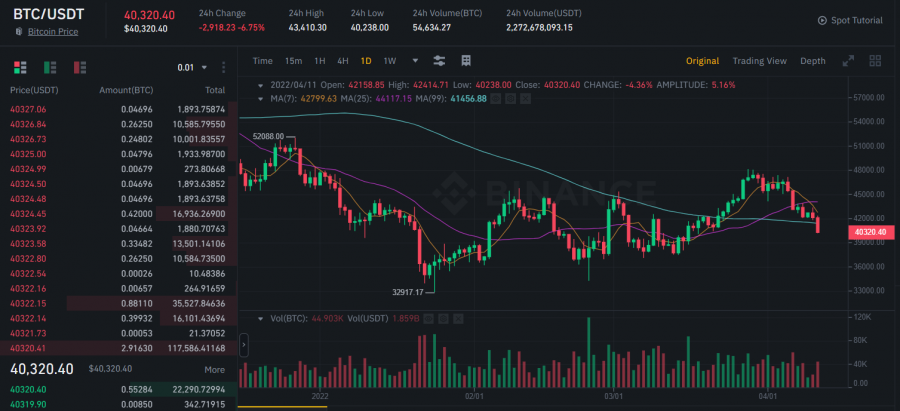

Technical Charts

Technical charts are available on both eToro and Binance. The charts at eToro, on the other hand, are defined to be user-friendly and have a narrow scope. Candlestick, bar and line charts are available at eToro.

The use of Heikin-Ashi candlesticks is encouraged. Moving averages, Bollinger Bands, RSI, MACD, and other charts are among the sketching techniques and indicators available. Each indicator’s timeline can be changed, and two cryptocurrencies can be compared on the same graph.

Clearly, the technical charts at eToro aren’t deficient in any way. However, it isn’t a specialized charting platform, and the user interface isn’t as creative as we’d hope from a purpose-driven exchange.

Binance’s technical charts have a number of elements that might assist you with your trading analysis. Candlestick charts, depth charts, time interval selections, and sketching tools are among the most popular. All of these capabilities make it possible to create a customized interface for technical analysis.

Furthermore, the platform includes more than 100 technical indicators such as average price, volume, moving averages, and the daily open/close, or whatever timescale any user trade on. The view also includes drawing tools such as trend lines, pitchforks, brushes, and text.

| Features | eToro | Binance |

| Candlestick Charts | Yes | Yes |

| Customizable Indicators | 75+ | 125+ |

| Trading from Charts | Yes | Yes |

| Price Alerts | Yes | Yes |

| Depth of Market | No | Yes |

Crypto Analysis

eToro provides proprietary crypto market analysis to assist you in making investment choices. This study covers everything you need to learn about a cryptocurrency, including its background, market cap, and the amount of buying and selling activity currently taking place.

eToro also evaluates a variety of similar technical indicators and displays the results in easy-to-understand buy, sell, or keep ratings.

Staking

Crypto staking on eToro is simple, safe, and convenient. Users receive staking incentives every month paid in extra coins of crypto asset they stake, with no necessary input on their side. Just hold and yield is calculated automatically based on your total balance.

Currently eToro supports three coins for staking – Ethereum (ETH), Cardano (ADA) and Tron (TRX).

The staked crypto-assets continue to be the assets of eToro users, who trust eToro to safely and properly carry out the full staking operation on their behalf.

Binance supports 100+ coins with locked staking, including Solana, Cardano, and Polygon. Staking is also free on Binance, and the APY (annual percentage yield) is higher, making it a good alternative for cryptocurrency staking.

Cryptoassets are a highly volatile unregulated investment product.

Social and Copy Trading

The social and copy trading capabilities of eToro set it apart from Binance and other cryptocurrency exchanges. eToro has an integrated social exchange that allows traders to follow one other and initiate conversations. You can remark on headlines or exchange opinions about individual cryptocurrencies on the platform, making it simple to discover what other traders believe about a crypto’s potential.

Furthermore, eToro compiles all of the platform’s commercial transactions activities into a simple mood indicator. You can see how many eToro users are purchasing a cryptocurrency and how many are selling it at a glance for every cryptocurrency.

eToro also has copy portfolios or Smart Portfolios, which allow users to duplicate the positions of professional crypto traders and investors. On eToro, you may copy dozens of traders, and the site shows you their assets and position in comparison to assist you in choosing who to copy. Many traders specialize in cryptocurrencies, while long-term traders who develop portfolios of the most promising new cryptocurrencies can also be found.

You get to choose how much money you wish to put into the mirrored portfolio when you replicate a trader on eToro. The smallest amount that you can copy is $200. On eToro, there are no fees for replicating a portfolio, and you can suspend or change traders at any moment.

Binance Academy

It’s difficult for many crypto newbies to gather all of the required instructional materials in one spot. Binance Academy is a savior in this situation.

The platform begins with instructional resources on blockchain, economics, history, decentralized finance (the Binance exchange lists numerous DeFi coins), NFTs, and other topics. To keep the learning experience suited to each individual, criteria such as difficulty level and reading duration can be adjusted.

The platform contains a number of in-depth articles that cover a wide range of crypto-related topics. Binance also offers a free trading education in which students who perform well are recognized weekly. To top it off, all of these resources are accessible via the smartphone app.

Cryptoassets are a highly volatile unregulated investment product.

Demo Accounts

A demo account instructs a novice on all aspects of trading. The feature is very useful since it allows you to make mistakes without having to lose money. Beginners can pick up skills like risk management and positioning from actively trading cryptocurrencies. In this regard, it has to be noted that eToro provides a $100,000 virtual currency to trade within a demo trading account.

You can also request a demo account reset at any time. A massive advantage is that all of eToro’s features, including copy trading, are available with a demo account.

Conversely, Binance does not offer a demo account. However, that is not a major drawback since it offers a low minimum deposit, allowing users to trade cryptocurrency without putting too much money at risk.

To summarize, eToro offers three types of accounts i.e. Professional, Retail and Demo. Whereas, Binance offers VIP and Individual account only.

eToro vs. Binance Payments & Minimum Deposit

Both eToro and Binance accepts a range of payment options. Talking about eToro first, one can finance their eToro account with a debit or credit card from Visa or Mastercard, Neteller, Skrill, or a bank transfer.In fact, one of the greatest sites to buy Bitcoin with a credit card is eToro.

For most payment options at eToro, the minimum deposit is set at $10. A $500 minimum deposit is required to use a Smart Portfolio. Bank transfers take 3-5 days to process, whereas credit, debit, and e-wallet deposits are available instantly. Furthermore, while eToro does not charge a deposit fee, it does charge a $5 withdrawal fee.

On the other hand, Binance also accepts a wide range of payment methods including Debit Card, Credit Card, Paypal, Google Pay, and Bank Transfer. Further, Binance has a $10 minimum deposit requirement. When it comes to Binance, the processing time is reduced since the deposits are processed almost immediately. An unconfirmed user can normally withdraw up to 2 BTC per day. Whereas, a verified user can withdraw up to 100 BTC per day.

| Brokers | eToro | Binance |

| Payment Methods | Debit card, credit card, PayPal, Neteller, Skrill, and bank transfer | Debit card, credit card, PayPal, Google Pay, and Bank transfer |

| Minimum Deposits | $10 ($500 for bank transfers) | $10 |

| Processing Time | Instant (3-5 days for bank transfers) | Instant |

Cryptoassets are a highly volatile unregulated investment product.

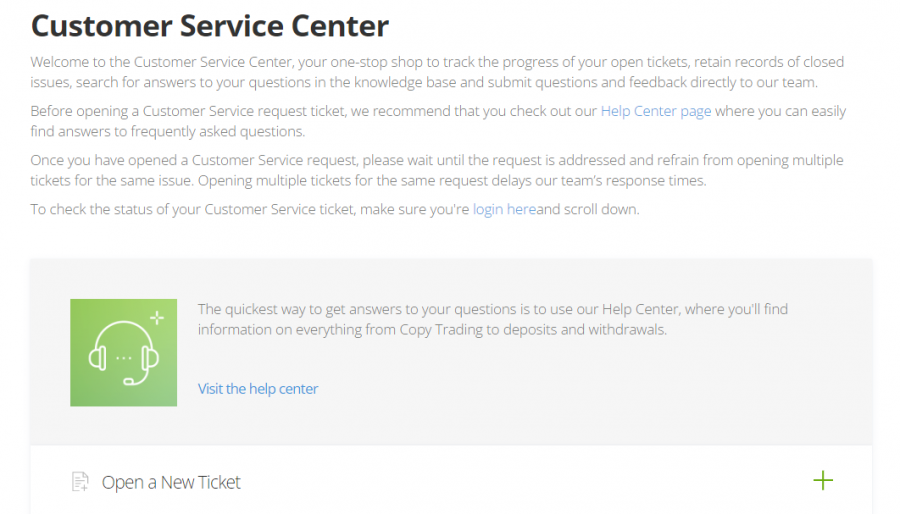

Customer Service

Both eToro and Binance have responsive customer service. You can reach out to eToro’s customer assistance through its ticketing system. Following that, the customer service team will answer through email.

eToro customer service

The eToro website also offers a comprehensive online knowledge base with tutorials on how to register an account, payment and cost structures, trading features, and much more. In addition, eToro Academy has a collection of short lectures that cover the fundamentals of the crypto market as well as famous cryptocurrencies.

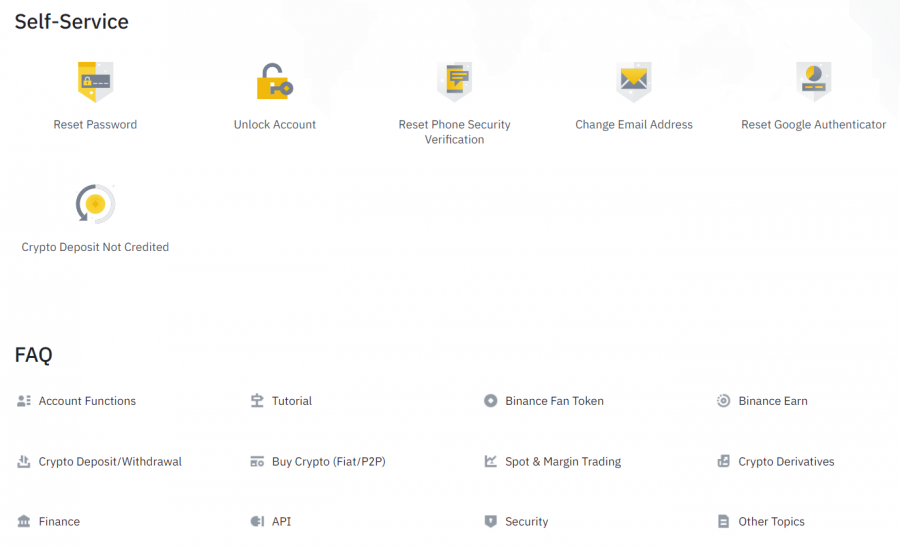

A user must enter their query through a chatbot available on the Binance website to get their concern answered. After a request, the chatbot shows the most pertinent FAQs and explains a topic. If the problem is not resolved within 5 minutes, the user has to click the thumbs down icon, and a customer service representative will join the chat.

Binance customer service

There is additional information available in the form of FAQs, extensive how-to manuals, and pieces that thoroughly explain pertinent crypto issues.

eToro vs Binance Regulation & Security

Because Binance is an unregulated site, US residents are not permitted to use it. The new platform BinanceUS, on the other hand, adheres to US legislation and is based in San Francisco.

Despite the fact that both platforms are deemed to be fairly secure, Binance has a tarnished reputation and is the subject of a regulatory inquiry in the United States. Binance has numerous security protocols in place to protect its digital assets on the safety front.

Binance collaborates with Trust Wallet, an open-source online wallet with more than 5 million active users around the world. A PIN, biometric access, encrypted keys, and the 12-word recovery phrase are all required to enter this wallet.

Binance also has advantages such as address whitelisting, enhanced verification, and the ability to inspect the devices that have access to your account. All of these features offer strong security and give users peace of mind when it comes to their digital possessions.

The Financial Conduct Authority (FCA) of the United Kingdom, the Cyprus Securities and Exchange Commission (CySEC), and the Australian Securities and Investments Commission (ASIC) all regulate eToro. All customer funds are held in tier 1 institutions, and cash deposits are protected by the Federal Deposit Insurance Corporation (FDIC) for up to $250,000. To secure your account, all your data is encrypted, and eToro offers two-factor authentication.

Therefore, both eToro and Binance have regulated crypto platforms with a great track record of keeping customers’ assets safe. eToro has been operating for ten more years than Binance though, never being hacked in all that time.

eToro vs Binance- The Verdict

Our main recommendation overall, especially for beginners, is eToro.

A definite answer to this question of which is the better exchange might depend if you require margin trading on crypto. While eToro does have CFDs for other asset classes, it no longer offers leverage for crypto. In that case you may prefer Binance, or even Crypto.com which we also rate highly.

While the research conducted by eToro and copytrading features are excellent, the trading platform, low maker / taker fees and staking on Binance are also great.

The heavy regulation of eToro makes the 1% spread fee worthwhile and negligible in the long-term when confidently holding crypto on the platform for years. Binance will be a good option to go with when it comes to ‘day trading’ since it charges just 0.1%.

eToro offers more deposit options, such as Paypal and eWallets, making it more accessible to deposit onto.

You might want to open accounts on both crypto platforms, some investors even have three or four accounts on different exchanges. All platforms can be used for different purposes.

For example you could use part of your funds for copytrading or holding, and send the rest to your own Binance account to margin trade with. It’s less risky to not trade short-term movements with 100% of your funds.

If you’re in the US you may also be interested in our eToro vs Coinbase comparison to see how the two US facing sites compare.

Cryptoassets are a highly volatile unregulated investment product.

FAQs

Is eToro better than Binance?

Which is cheaper, Binance or eToro?

Is there a better platform than Binance?

Is eToro good for cryptocurrency?

What fees does eToro charge for crypto?

This news is republished from another source. You can check the original article here

Be the first to comment