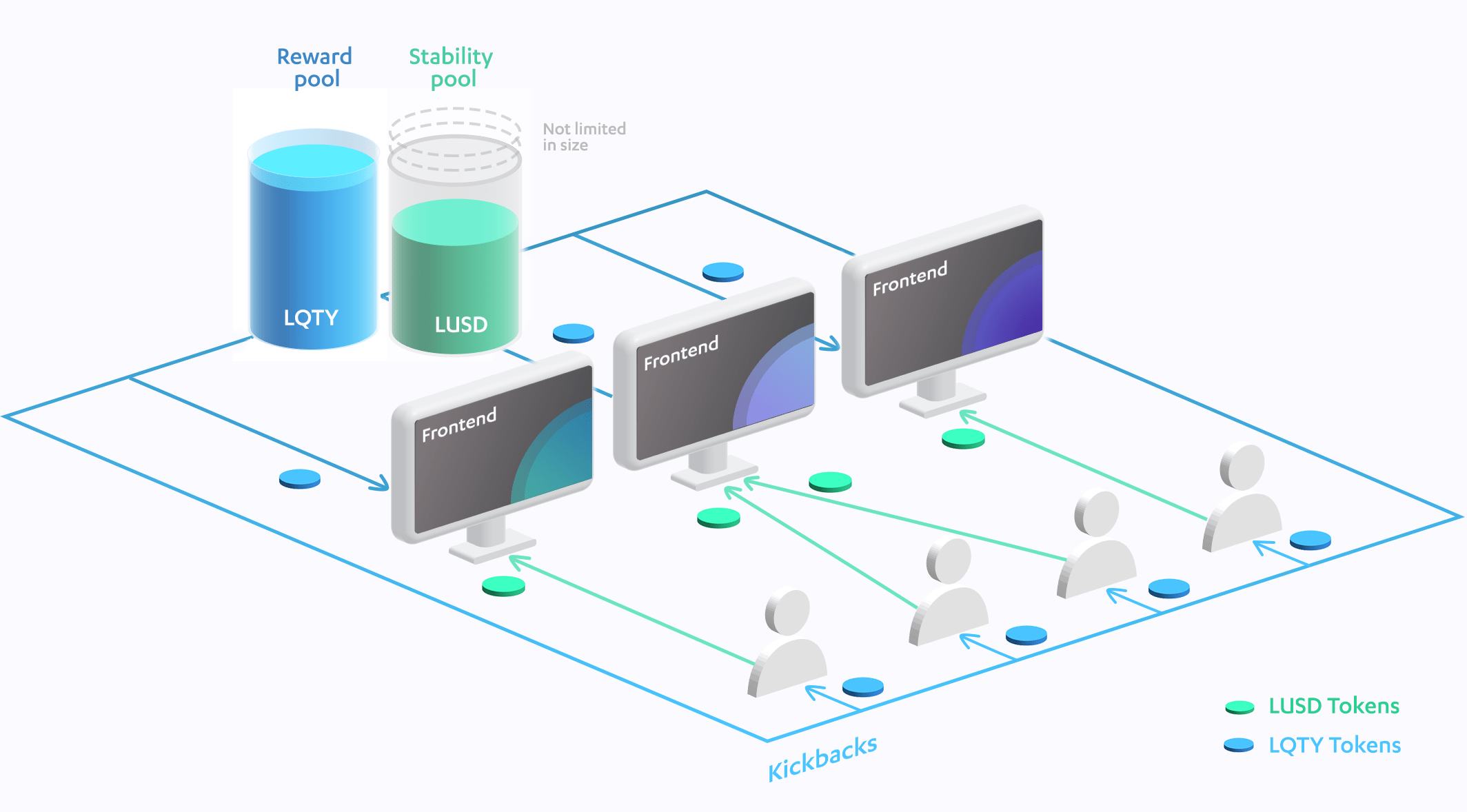

LQTY is a coin that earns fees from the Liquity Protocol by staking. Liquity is a decentralised borrowing technology that allows you to make interest-free loans using Ether as collateral. Loans are made in LUSD with a collateral ratio of at least 110 percent. In addition to the collateral, the loans are secured by a Stability Pool comprised of LUSD and other borrowers acting collectively as guarantors of last resort. Liquity is a protocol that is non-custodial, immutable, and governance-free.

www.liquity.org

Last Month’s equity price is $2.06 USD, a -22.25 percent decrease from the previous day. The hourly loss has been -1.20 percent. Liquity’s market capitalization is currently $143,109,132.83 USD, giving it a market capitalization rank of #313. The entire transaction value was $6,297,997.06 USD. With a market capitalization of $143,109,132.83 and a volume of $6,297,997.06 in 24 hours, Liquity is number 313 in terms of market value. There are 100 million stocks in circulation, with a total supply of 100 million stocks and a maximum supply of 100 million stocks.

LQTY is an Ethereum token that drives the Liquity protocol, a decentralised lending platform that accepts ETH as collateral for 0% interest loans. Loans are paid out in the LUSD stablecoin, and LQTY holders can stake their token to earn a percentage of the fees created by opening and closing loans.

Liquity is on the rise this week.

In the last seven days, the price of Liquity has increased by 4.94 percent. In the last 24 hours, the price has risen by 37.10%. The price has risen by 24.09 percent in the last hour. The current price per LQTY is 130.885187. Liquity is down 97.32 percent from its all-time high of 4,876.82852.

70,753,587.388 LQTY is the current circulating supply.

Is it a good time to invest in stocks?

The Liquity technical analysis gauge displays ratings in real time for the timeframes you pick. This is not a solicitation to buy, sell, or trade. It is a technical study of the stock market based on the most often used technical indicators:

Oscillators, Moving Averages, and Pivot Points

This chart is not meant to provide advice or a guarantee of success. Rather, it assesses the real-time recommendations of three commonly used technical indicators based on Liquity’s performance: moving averages, oscillators, and pivots. LQTY’s performance is not the responsibility of Finder.

The equities price index is compared to the most important cryptocurrencies.

Compare the price index of Liquity over the previous 90 days to those of Bitcoin, Ethereum, Ripple, and Tether. This chart does not show actual prices, but rather how LQTY’s price changes compare to BTC, ETH, XRP, and USDT. Price index graphs can be used to assess various assets by benchmarking their prices on a specific date and displaying the change since then. We’re comparing current prices to those from 90 days ago in this case. The pretty straight line represents Tether, a stable coin linked to the US dollar.

Most recent actions

liquity protocol

The current price of LQTY is $2.06.

In the last hour, LQTY has down 0.81 percent.

The price of LQTY has plummeted 25.62 percent in the last day.

The price of LQTY has dropped 3.53 percent in the last week.

LQTY has a market capitalization of $143 million.

LQTY had a $7.1M trading volume.

Liquity (LQTY) is now ranked #314 in the cryptocurrency market, with a price of $2.06, a circulating supply of $69.33 Million (69,331,286.50 LQTY), and a total supply of $100 Million (100,000,000 LQTY). It presently has a maximum supply of $100,000,000 (100,000,000 LQTY), a market capitalization of $142.54 Million ($142,536,072.09), and a fully diluted market value of $205.59 Million ($205,586,942.48).

LQTY has dropped -22.68 percent in the previous 24 hours. Its most recent 24-hour volume is $6.26 Million ($6,261,169.74), which is massive and astounding.

Liquity’s price has dropped by -2.92 percent in the last seven days.

In the last month, the price of Liquity has declined by -15.99 percent.

As a result, all of the specified values may differ from one trade to the next. Do your investigation and discover what experts expect from each coin if you want to invest in cryptocurrencies and get a high return on your investment.

Liquity (LQTY) Price Prediction for 2022

The anticipated data analysis predicts that the price of LQTY will cross the $2.61 mark. By the end of the year, equity is expected to reach a minimum price of $2.55. In addition, the LQTY price has the potential to hit a high of $2.73. Cryptocurrency investors and holders should be informed of the Liquity Price Prediction 2022.

Examine the LQTY pricing month by month.

Liquity (LQTY) Price Prediction for 2023

The anticipated data analysis predicts that the price of LQTY will cross the $2.81 mark. By the end of the year, Liquity is expected to have reached a minimum charge of $2.74.

In addition, the LQTY price has the potential to hit a high of $2.88. The Liquity Price Prediction 2023 should be noted by investors and holders of cryptocurrency assets.

Examine the LQTY pricing month by month.

Equity in social media.

Liquity was mentioned in 434 out of 2,119,353 social media postings on Twitter and Reddit on April 15, 2022. Liquity has been discussed by 198 people and is ranked #287 in terms of the most mentions and activity from collected posts.

Blockchain-based loan services are an important part of the developing decentralised economy. As a financial basic, lending allows users to earn more income on diverse assets, whilst borrowing frees up liquidity for users who want to retain exposure to the underlying collateral asset. Borrowers and lenders are linked in a non-custodial and peer-to-peer manner via smart contracts in decentralised lending, providing new tools and updated capabilities to both parties.

Liquity, a major player in the decentralised lending ecosystem, allows users to unlock liquidity against their ETH without jeopardising their ETH exposure. Users must only provide ETH as collateral and borrow a stablecoin (LUSD).

Liquity’s key competitive advantages over competing decentralised borrowing protocols originate from 0% interest-rate loans and a low collateralization requirement of 110 percent. Users must only pay a 0.5 percent one-time fee during the loan acquisition period, and the loan has no terms or set duration. While all small contracts are immutable to some extent, the governance systems that support these blockchain protocols typically allow for continuous improvement.

To maintain these critical competitive advantages, the Liquity team realised they needed a tamper-proof source of ETH/USD price data that would allow them to open, close, and settle loan positions quickly and reliably, even in volatile market conditions.

To maintain its competitive advantage, Liquity required a ready-made pricing oracle with 100 percent uptime and timely price changes in tumultuous market conditions.

To assure solvency and secure the protocol while maintaining a competitive advantage, Liquity need access to a tamper-proof, real-time ETH/USD price oracle. Price oracles are critical to all of Liquity’s core functions, from initiating liquidations and opening troves to closing loan positions through LUSD redemptions.

If Liquity did not have access to a fast, decentralised, and secure Oracle network to power core borrowing operations, it would have been vulnerable to common price feed exploits such as flash loan attacks, price manipulation of a single data source or exchange, and borrower insolvency due to unreliable price updates during volatile market conditions.

After reviewing a variety of current price oracle solutions, the Liquity team determined that most existing price oracle solutions had single points of failure and so could not reliably support Liquity’s minimal collateralization requirements or governance-free approach. A suitable price oracle should be decentralised from start to finish and reliable in all market conditions.

Because the Liquity protocol is completely immutable and governance-free, any external Oracle solution requires a constant oracle address and interface with strong guarantees of 100 percent uptime. Because of the nature of their protocol design, any oracle outage or difficulty with pricing data delivery would be completely irreversible on Liquity’s end.

Despite the fact that they could develop their own Oracle solution, the Liquity team picked a simple plug-and-play solution from the start. A proprietary Oracle solution would need 100+ hours of development time, using crucial engineering resources both during development and ongoing maintenance. They needed ready-made infrastructure to tap into so they could focus on developing their protocol. They desired one that would withstand the test of time, allowing them to continue providing users with a competitive decentralised borrowing experience supported by safe, decentralised, and reliable price data year after year.

Chainlink Price Feeds are incorporated into Liquity’s Tamper-Proof Borrowing Operations.

Liquity picked Chainlink because it is the industry’s most time-tested decentralised oracle solution, with high-quality data, safe node operators, and a solid reputation structure for confirming the security and functionality of its systems. Chainlink Pricing Feeds, accessed through an immutable proxy interface, enabled Liquity to keep its governance-free approach while providing highly accurate and secure price data directly to Liquity’s smart contracts.

Because of Chainlink’s ready-made price oracle architecture, the Liquity team had a clear strategy to getting powerful pricing feeds that did not require centralised oracle services or domestically built price oracles.

Chainlink Price Feeds met all of Liquity’s rigorous requirements for a decentralised, constant-price oracle solution. Chainlink Price Feeds’ three layers of data aggregation provide excellent resistance to price manipulation or exploitation. Furthermore, with a price deviation threshold of 0.5 percent for the ETH/USD Market Feed, even with a collateralization ratio of 110 percent, minor price fluctuations can be reflected in real-time to securely liquidate undercollateralized positions and protect borrower funds.

Total Liquidity Value Exceeds $2.7 Billion Locked

Liquity’s protocol architecture combined with Chainlink’s tamper-proof price data drove Liquity to near-instant success. Liquity began in April 2021, and it only took two days to integrate Chainlink Price Feeds, which has maintained 100 percent uptime and saved the Liquity team 100+ hours in development time compared to building a bespoke Oracle solution. Liquity has rapidly expanded to serve thousands of users since then, acquiring $2.7 billion in TVL in 8 months with a peak of $4.6 billion.

This news is republished from another source. You can check the original article here

Be the first to comment