Get inside Wall Street with StreetInsider Premium. Claim your 1-week free trial here.

Table of Contents

As filed with the Securities and Exchange

Commission on May 16, 2022

Registration No. 333-262629

UNITED STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 2 to

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Athena Bitcoin

Global

(Exact name of registrant as specified in its

charter)

| Nevada | 6099 | 87-0493596 |

| (State or other jurisdiction of | (Primary Standard Industrial | (I.R.S. Employer |

| incorporation or organization) | Classification Code Number) | Identification Number) |

1332 N Halsted St Suite 403

Chicago, IL 60642

(312) 690-4466

(Address, including zip code, and telephone

number, including area code, of registrant’s principal executive offices)

Eric Gravengaard

Chief Executive Officer

1332 N Halsted St Suite 403

Chicago, IL 60642

(312) 690-4466

(Name, address, including zip code, and telephone

number, including area code, of agent for service)

Copies

of all communications to:

| Iwona Alami, Esq. |

Matthew |

|

| Law Office of Iwona J. Alami | K&L Gates, LLP |

|

| 620 Newport Center Dr. |

599 |

|

| Suite 1100 |

New |

|

| Newport Beach, CA 92660 |

(212) |

|

| (949) 200-4626 |

|

Approximate

date of commencement of the proposed sale to the public: As soon as practicable after this registration statement becomes effective.

If

any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the

Securities Act, check the following box: ☒

If

this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the

following box and list the Securities Act registration statement number of the earlier effective registration statement for the same

offering. ☐

If

this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If

this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting

company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,”

“smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☐ | Accelerated filer ☐ |

| Non-accelerated filer ☒ | Smaller reporting company ☒ |

| Emerging growth company ☒ |

If

an emerging growth company, indicate by checkmark if the registrant has not elected to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

The Registrant hereby amends this Registration

Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which

specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities

Act of 1933, as amended, or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission,

acting pursuant to said Section 8(a), may determine.

The

information in this prospectus is not complete and may be changed. These securities may not be sold until the registration statement

filed with the Securities and Exchange Commission is declared effective. This prospectus is not an offer to sell nor does it seek an

offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

Subject

to completion, dated May 16, 2022

459,783,937 Shares of Common

Stock

This prospectus relates to the resale or other

disposition of up to 459,783,937 shares of Athena Bitcoin Global common stock, par value $0.001 per share (the “common stock”

or “shares”), which may be offered for sale from time to time by the selling shareholders named in this prospectus (each

a “Selling Shareholder” and, collectively, the “Selling Shareholders”). The shares of our common stock covered

by this prospectus include: (i) 409,933,937 shares of common stock that were issued by us to the Selling Shareholders in the share

exchange transaction or were purchased by the Selling Shareholders in private transactions, and (ii) up to 49,850,000 shares of

common stock issued or issuable upon exercise of our outstanding 6% Convertible Debentures Due 2023 (the “Convertible Debentures”)

which were issued in connection with a private placement financing in 2021. We are registering the resale of the shares of common stock

underlying the Convertible Debentures as required by the Securities Purchase Agreement that we entered into with the Selling Shareholders

as of June 22, 2021, which provided said Selling Shareholders with certain registration rights with respect to the common stock issuable

upon conversion of the Convertible Debentures (the “Purchase Agreement”). We are not selling any shares of common stock under

this prospectus and will not receive any proceeds from the sale of any shares of common stock by the Selling Shareholders. The Selling

Shareholders will bear all commissions and discounts, if any, attributable to the sale or other disposition of the shares of common stock.

We will bear all costs, expenses and fees in connection with the registration of the shares of common stock.

Our common stock is quoted on the OTC Pink Market

(“OTC Pink”) operated by the OTC Markets Group, Inc. under the symbol “ABIT”. On May 12, 2022, the last reported

sale of our common stock was $0.2875. There is a limited public trading market for our common stock. You are urged to obtain current

market quotations for the common stock.

Our registration of the shares of common stock

covered by this prospectus does not mean that the Selling Shareholders will offer or sell any of the shares. The Selling Shareholders

may offer and sell or otherwise dispose of the shares of common stock described in this prospectus from time to time through public or

private transactions at prevailing market prices, at prices related to prevailing market prices or at privately negotiated prices at

varying prices. See “Plan of Distribution” which begins on page 88 of this prospectus for more information.

This offering will terminate on the earlier

of (i) the date when all of the shares have been sold pursuant to this prospectus or Rule 144 under the Securities Act of 1933, as amended

(the “Securities Act”), (ii) or the date that all of the securities may be sold pursuant to Rule 144 without volume or manner-of-sale

restrictions, (iii) or we decide at any time to terminate the registration of the shares at our sole discretion.

We have made no written communications as

defined under Rule 405 of the Securities Act to prospective investors or investors.

You should rely only on the information contained

in this prospectus. We have not authorized anyone to provide you with information different from that contained in this prospectus. The

information contained in this prospectus is accurate only as of the date of this prospectus.

Investing in our shares involves a high

degree of risk. You should carefully consider the Risk Factors beginning on page 11 of this prospectus before you make an

investment in our securities.

We are an “emerging growth company”

as that term is used in the Jumpstart Our Business Startups Act (the “Jobs Act”) and defined under the federal securities

laws and, as such, may elect to comply with certain reduced public company reporting requirements in future reports after the completion

of this offering. See “Prospectus Summary—Implications of Being an Emerging Growth Company.”

We may amend or supplement this prospectus

from time to time by filing amendments or supplements as required. You should carefully consider the risks and uncertainties

described under the heading “Risk Factors” beginning on page 11 of this prospectus before you make

an investment decision.

Neither the Securities and Exchange Commission

nor any state securities commission has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus.

Any representation to the contrary is a criminal offense.

This Prospectus is dated

[●], 2022.

You should rely only on information contained

in this prospectus. We have not authorized anyone to provide you with information other than that contained in this prospectus or in any

free writing prospectus we may authorize to be delivered or made available to you. We take no responsibility for and cannot provide any

assurance as to the reliability of any other information others may give you. The Selling Shareholders are not offering to sell or seeking

offers to buy shares of common stock in jurisdictions where offers and sales are not permitted. The information in this prospectus or

any free writing prospectus is accurate only as of its date, regardless of its time of delivery or of any sale of shares of our common

stock. Our business, financial condition, results of operations, and prospects may have changed since that date. We are responsible

for updating this prospectus to ensure that all material information is included and will update this prospectus to the extent required

by law.

For investors outside of the United States: Neither

we nor any of the Selling Shareholders have done anything that would permit this offering or possession or distribution of this prospectus

in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside the United States who

come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the offering of common

stock by the Selling Shareholders and the distribution of this prospectus outside of the United States.

This prospectus is a part

of a registration statement on Form S-1 that we filed with the Securities and Exchange Commission (the “SEC”) using a “shelf”

registration or continuous offering process. Under this shelf process, the Selling Shareholders may, from time to time, sell the shares

of common stock covered by this prospectus in the manner described in the section titled “Plan of Distribution.” Additionally,

we may provide a prospectus supplement to add information to, or update or change information contained in, this prospectus (except for

the section titled “Plan of Distribution,” which additions, updates, or changes that are material shall only be made pursuant

to a post-effective amendment). You may obtain this information without charge by following the instructions under the section titled

“Additional Information” appearing elsewhere in this prospectus. You should read this prospectus and any prospectus supplement

before deciding to invest in our shares.

Market data and certain

industry data and forecasts used throughout this prospectus were obtained from internal Company surveys, market research, consultant

surveys, publicly available information, reports of governmental agencies and industry publications and surveys. Industry surveys, publications,

consultant surveys and forecasts generally state that the information contained therein has been obtained from sources believed to be

reliable, but the accuracy and completeness of such information is not guaranteed. We have not independently verified any of the data

from third party sources, nor have we ascertained the underlying economic assumptions relied upon therein. Similarly, internal surveys,

industry forecasts and market research, which we believe to be reliable based on our management’s knowledge of the industry, have

not been independently verified. Forecasts are particularly likely to be inaccurate, especially over long periods of time. Statements

as to our market position are based on the most currently available data. While we are not aware of any misstatements regarding the industry

data presented in this prospectus, our estimates involve risks and uncertainties and are subject to change based on various factors,

including those discussed under the heading “Risk Factors” in this prospectus.

Glossary

of Bitcoin and Crypto Terms

| · | Address: An alphanumeric reference to where crypto assets can be sent or stored. |

| · | Ankr: An Ethereum token that powers a decentralized public blockchain infrastructure that aims to make it easy and affordable for anyone to participate in blockchain ecosystems. |

| · | Bitcoin: The first system of global, decentralized, scarce, digital money as initially introduced in a white paper titled Bitcoin: A Peer-to-Peer Electronic Cash System by Satoshi Nakamoto. Bitcoin, while having several of the primary attributes of money, is not considered a currency or money in the jurisdictions that the Company operates, with the exception of El Salvador where it is legal tender. |

| · | Bitcoin ATM: A kiosk that can be used by a Customer to buy or sell Bitcoin or other crypto assets in exchange for Cash. |

| · | Bitcoin Cash (BCH): A fork of Bitcoin that seeks to add more transaction capacity to the network in order to be useful for everyday transactions. BCH is based on the original Bitcoin blockchain with some distinct differences. A major one is an increased maximum block size of 32MB, compared to just 1MB on Bitcoin. Increased block size allows BCH to process transactions faster than Bitcoin, with lower fees and an increased per-second transaction capacity. |

|

| · | Bitcoin SV: A fork of Bitcoin Cash (BCH), also known as Bitcoin Satoshi’s Vision, that attempts to restore the original Bitcoin protocol to align with Bitcoin inventor Satoshi Nakamoto’s original vision for the blockchain network. |

| · | Block: A grouping of Transactions validated by Miners and disseminated by the Network to servers that maintain the records in a Blockchain. Blocks are added to an existing Blockchain as transactions occur on the network. Miners are rewarded for “mining” a new block. |

| · | Blockchain: A cryptographically secure digital ledger that maintains a record of all transactions that occur on the network and follows a consensus protocol for confirming new blocks to be added to the blockchain. |

| · |

Cash: The physical specie or |

|

| · |

Chivo: |

|

| · | Cold storage: The storage of private keys in any fashion that is disconnected from the internet. Common cold storage examples include offline computers, USB drives, or paper records. |

| · |

Confirmation: A Bitcoin or |

|

| · | Crypto: A broad term for any cryptography-based market, system, application, or decentralized network. |

|

| · | Cryptocurrency: Bitcoin and alternative coins, or ‘altcoins’. This category of crypto asset is designed to work as a medium of exchange, store of value, or to power applications and excludes security tokens. |

| · | Customer: A retail user of our Bitcoin ATMs or client of one of our other services. |

| · | Customer Buying: When a Customer acquires Bitcoin or crypto asset in exchange for Cash or a Wire Transfer. In these transactions, the Company is selling Bitcoin or crypto asset and acquiring Fiat Currency. |

| · | Customer Selling: When a Customer acquires Fiat Currency, either Cash or Wire Transfer, in exchange for Bitcoin or crypto asset. In these transactions, the Company is acquiring Bitcoin or crypto asset in exchange for Fiat Currency. |

| · |

Crypto Asset or Digital Asset: |

|

| · | Ethereum: A decentralized global computing platform that supports smart contract transactions and peer-to-peer applications, or “Ether,” the native crypto assets on the Ethereum network. |

| · | Fiat Currency: The currency issued by a sovereign government or bloc including the US Dollar, Argentine Peso, or Euro. |

| · | Fork: A fundamental change to the software underlying a blockchain which results in two different blockchains, the original, and the new version. In some instances, the fork results in the creation of a new token. |

| · | Hot Wallet: A wallet that is connected to the internet, enabling it to broadcast transactions. |

| · | Miner: Individuals or entities who operate a computer or group of computers that add new transactions to blocks, and verify blocks created by other miners. Miners collect transaction fees and are rewarded with new tokens for their services. |

| · | Mining: The process by which new blocks are created, and thus new transactions are added to the blockchain. |

| · | Monero: A cryptocurrency focused on privacy, which allows users to send and receive transactions without making this data available to anyone examining its blockchain. |

| · | Network: The collection of all Miners and Nodes that use computing power to maintain the ledger and add new blocks to the blockchain. Most networks are decentralized, reducing the risk of a single point of failure. |

| · | Node: A server that maintains a record of the Blockchain and can communicate with other Nodes on the Network to propagate new Transactions. Nodes can also maintain Wallets and safeguard Private Keys. |

| · | Protocol: A type of algorithm or software that governs how a blockchain operates. |

| · |

Public key or private |

| · | Ripple (XRP): Ripple is the cryptocurrency used by the Ripple payment network. Built for enterprise use, XRP aims to be a fast, cost-efficient cryptocurrency for cross-border payments. |

| · | Siacoin: Native cryptocurrency for the Sia blockchain platform, which serves as a way for customers to pay hosts for renting storage space. The Sia project is meant to create a distributed, decentralized network for cloud data storage, similar to Dropbox or Google Drive. |

| · | Stable Coin: A Token issued for the purpose of maintaining a constant value relative to a fiat currency. Examples include USDC, Tether, or GUSD. Many of these operate as un-regulated money market fund equivalents. These have become a popular method to transfer funds between exchanges without taking price risk. |

| · | Tether: A blockchain-based cryptocurrency whose tokens in circulation are backed by an equivalent amount of U.S. dollars, making it a stablecoin with a price pegged to USD $1.00. |

| · | Token: A unit of a crypto asset or other instrument secured by and recorded on a Blockchain. Tokens could include the primary units of a Blockchain as in Ethereum or Bitcoin, or be a separate construct whose ownership is recorded using such a Blockchain as in an ERC-20 Token, whose ownership might convey any number of properties. |

| · | Transaction: The transfer of Bitcoin or a crypto asset from one Address to one or more Addresses. The Transaction is validated by Nodes and Miners according to the Protocol and specifically must be signed using the private key of the sending Address to be included in a Block, whereby it becomes Confirmed. |

|

| · |

Tron: |

| · | Wallet: A place to store public and private keys for crypto assets. Wallets are typically software, hardware, or paper-based. |

| · | Wire Transfer: A permanent inter-bank transfer on a national or international settlement system including the Fedwire system in the United States or the SWIFT international system but excluding non-permanent systems like ACH. |

This summary

highlights selected information contained elsewhere in this prospectus. This summary does not contain all the information that you

should consider before investing in our common stock. You should carefully read the entire Prospectus, including “Risk

Factors”, “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the Financial Statements, before making an investment

decision. Unless the context suggests otherwise, all references to “Athena”, “we”, “us”,

“our”, or “the Company” refer to Athena Bitcoin Global, a Nevada corporation and all of its subsidiaries,

and all references to “Athena Bitcoin” refer solely to Athena Bitcoin, Inc., a Delaware corporation and a wholly-owned

subsidiary of the Company. As used below, Bitcoin with an uppercase “B” is used to describe the system as a whole that

is involved in maintaining the ledger of bitcoin ownership and facilitating the transfer of bitcoin among parties. When referring to

the digital asset within the Bitcoin network, bitcoin is written with a lower case “b” (except, of course, at the

beginning of sentences or paragraph sections, as below). The name “Athena Bitcoin” and the Athena Bitcoin logo service

mark appearing in this prospectus are the property of Athena Bitcoin, Inc., a wholly-owned subsidiary of the Company. Solely for

convenience, the trademarks, servicemarks and trade names in this prospectus are referred to without the ® and ™

symbols, but such references should not be construed as any indicator that the owner of such trademarks, servicemarks and trade

names will not assert, to the fullest extent under applicable law, their rights thereto. We do not intend the use or display of

other companies’ trademarks and trade names to imply a relationship with, or endorsement or sponsorship of us by, any other

companies.

Introduction

We are an early entrant in the crypto asset

market and one of the first U.S. publicly traded companies using crypto assets and blockchain technologies in our business operations

which include a global network of Athena Bitcoin ATMs.

Our management has determined that it is in our

best interests to become a reporting company under the Securities and Exchange Act of 1934 as amended (“Exchange Act”), and

endeavor to establish a public trading market for our common stock on the OTCQB or other trading systems. Currently our trading volume

is limited and we are subject to the Alternative Reporting Standard of OTC Pink Market. Our management believes that establishing a public

market on OTCQB or another exchange: (i) will increase our profile as a leading company in the international operation of Bitcoin ATMs,

giving us greater identity and recognition, and (ii) will make it easier for us to attract additional equity capital, which we need to

expand our business. There is no assurance that we will accomplish any of the foregoing goals and prospective investors are cautioned

to carefully read the risk factors set forth herein prior to making an investment decision.

Athena

Bitcoin connects the world’s

cash to the world of cryptocurrency.

Overview

Athena Bitcoin Global owns and operates a global

network of Athena Bitcoin ATMs, which we refer to as our ATMs, that allow our customers to buy or sell Bitcoin and other major crypto

assets in exchange for their local fiat currency, such as dollars or pesos. We are focused on making Bitcoin and other major crypto assets

more easily accessible, functional and usable for ordinary people and small businesses. Bitcoin, blockchains, smart contracts and crypto

assets are poised to transform the international financial order, however for billions of people, this new financial system is out of

reach. They still rely on cash, either because they do not have a bank account or choose not to use one. For them, a connection between

digital finance and paper currency is necessary.

Bitcoin is a system for decentralized digital

value exchange that is designed to enable units of bitcoin to be transferred across borders without the need for currency conversion.

Bitcoin is not legal tender, except recently in the country of El Salvador. The supply of bitcoin is not determined by a central government,

but rather by an open-source software program that limits both the total amount of bitcoin that will be produced and the rate at which

it is released into the network. The responsibility for maintaining the official ledger of who owns what bitcoin and for validating new

bitcoin transactions is not entrusted to any single central entity. Instead, it is distributed among the network’s participants.

As such, crypto assets are transferred entirely online, with no physical coins or bills. Instead of being held at a bank, crypto assets

are held in one’s digital wallet, which is an online vault for holding public and private keys for crypto assets. Instead

of being transferred through banks, clearing houses and payment processors, crypto assets are transferred directly to the recipient online

and transactions are recorded on a blockchain or public ledger. The value of each crypto asset is determined by trading among buyers and

sellers all over the world. At the end of 2020, the overall market capitalization of crypto assets reached $782 billion, representing

a compounded average growth rate (CAGR) of over 150% since 2012. The supply of Bitcoin is greater than the M1 money supplies of the Swiss

Franc and the Russian Ruble. One challenge for Bitcoin and other crypto assets is that they typically cannot be used to pay for things

like groceries, utility bills, or a house. When someone wants to spend their bitcoin, they will generally need to first convert it to

their local currency. Crypto asset owners can use crypto exchanges like Coinbase and acquire U.S. dollars by selling their crypto asset(s).

On Coinbase or other crypto asset exchanges, users can oftentimes sell their bitcoin or other crypto assets for up to 50,000 U.S. dollars

a day which can be wired or otherwise sent directly to a bank account and typically usable after one or two business days. Crypto exchanges

are well suited for larger, planned transactions but can be inconvenient or entirely unsuitable for smaller or more immediate transactional

needs. They also do not offer the level of convenience that bank customers are accustomed to. Most people in the U.S. use bank ATMs rather

than bank tellers to get spending cash due to the added convenience.

ATM Market

According to a University of Florida study, there

were over 470,135 traditional ATMs operating in the United States in 2018. For Bitcoin owners, our ATMs play a similar role by providing

cash conveniently and quickly. Someone that owns Bitcoin, Ethereum, Litecoin or BCH can visit our ATMs and get up to $2,000 in cash in

a single transaction. While our ATMs dispense cash for Bitcoin owners like a typical ATM cash machine does for a bank customer, our ATMs

function is more akin to currency exchange booths at international airports. Our ATMs are performing real-time exchange between major

crypto assets and local fiat currency including dollars and pesos. Instead of exchanging across countries, we exchange between the legacy

financial system and a new emerging digital financial system. The majority of our customers use our services to purchase Bitcoin with

dollars. Although some of our ATMs in the United States support dispensing dollars in exchange for Bitcoin, only a small percentage of

customers use this service. However, in Central and South America, there is a more even distribution between purchases and sales. Athena

Bitcoin ATMs enable anyone to quickly buy or sell Bitcoin, Ethereum, Litecoin or BCH in exchange for local paper money. While our ATMs

differ substantially in function from bank ATMs, they provide a similar level of convenience. In addition, our ATMs benefit from the public’s

vast experience using bank ATMs, which greatly contributes to making our ATMs a very user-friendly method for anyone to buy or sell Bitcoin.

Company Summary

The Company is focused on developing, owning

and operating a global network of Athena Bitcoin ATMs, which are free standing kiosks that permit customers to buy or sell crypto assets

(including Bitcoin, Ethereum, Litecoin and BCH) in exchange for cash (banknotes) issued by sovereign governments and often

referred to as fiat currencies. The Company places its machines in convenience stores, shopping centers, and other easily accessible

locations. Our network presently includes Athena Bitcoin ATMs in 10 states and 3 countries in Central and South America. We seek to expand

our network in the U.S. and globally, and to further develop Athena Bitcoin as a trusted and preferred brand for parties seeking

to exchange currency for Bitcoin and other major crypto assets.

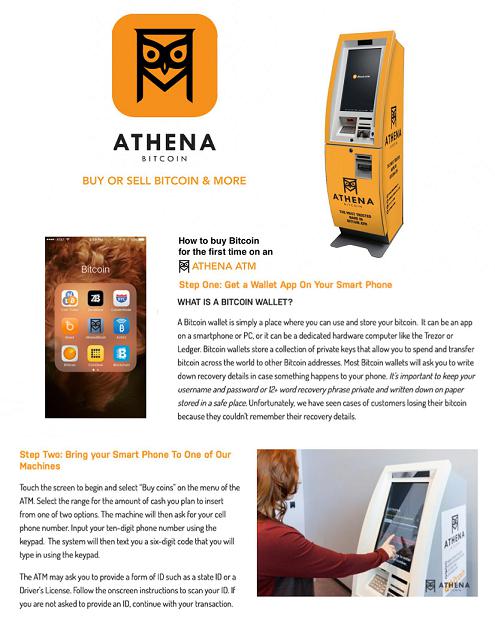

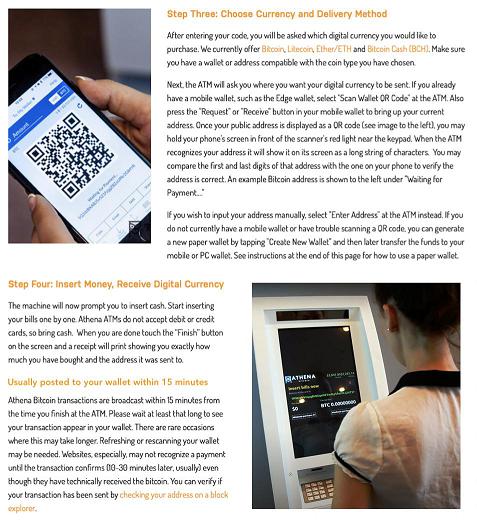

Customers can purchase as little as $1 of Bitcoin,

but normally choose between $100 and $1,000 using Athena Bitcoin ATMs. The typical ATM that the Company operates is about 5-feet tall

and features a large touchscreen for customer interaction. The customer typically needs to have a wallet app on his smart phone to buy

or sell crypto assets on our ATM. In the process of the transaction, the customer will follow the steps prompted on the screen. When a

customer is buying crypto assets, the machine will prompt the customer to insert cash since our ATMs do not accept debit or credit cards.

When the customer is done, a receipt will print showing exactly how much crypto assets have been bought and the address they were sent

to.

The Company’s ATMs do not contain any crypto

assets or keys to crypto assets. The Company sells Bitcoin, Ethereum, Litecoin, LTC and BCH from cloud-based wallets in each country,

enabling real-time supply of crypto assets to its customers. For the fiscal years ending December 31, 2021 and December 31, 2020, the

Company’s breakdown of volume of ATM transactions per crypto asset is as follows:

| Crypto Asset |

For the Twelve Months Ended December 31, 2021 |

For the Twelve Months Ended December 31, 2020 |

| Bitcoin |

87,816 | 100,113 |

| Ethereum |

1,936 | 913 |

| Litecoin | 5,513 | 7,511 |

| Bitcoin Cash (BCH) |

865 | 1,044 |

| Total |

96,130 | 109,581 |

The Company buys most of its crypto assets through

automated purchases on crypto exchanges, based on algorithms the Company has developed for balancing its holdings with anticipated demand.

In addition to this automated buying program, the Company is active in the over-the-counter dealer market and has bilateral relationships

with several large crypto asset trading desks. We replenish our supply of Bitcoin, Ethereum, Litecoin and BCH daily as needed, and hold

them in our wallet to sell to users of our ATMs. On average, we sell our holdings of Bitcoin within 3 to 5 days of buying it, and within

7 to 10 days of buying our Ethereum, Litecoin, and BCH holdings. We strive to keep this period short to reduce the effect of changes in

crypto assets/U.S. dollar exchange rates on our business and to maximize our working capital. We do not invest or have long term holdings

of Bitcoin, Ethereum, Litecoin or BCH.

We charge a fee per crypto asset available through

Athena Bitcoin ATM, equal to the prevailing price at U.S.- based exchanges plus a mark up that typically ranges between 5% and 20%. The

prices shown to customers on our Bitcoin ATM are inclusive of this price spread and are calculated by multiplying the prevailing price

level of crypto asset by one plus the mark up. The mark up varies from one crypto asset to another and by location. It is determined

by a proprietary method that is maintained as a trade secret. Our revenues associated with our ATM transactions are recognized at the

time when the crypto asset is delivered to the customer. By increasing our geographic service area, including our recent expansion of

operations in El Salvador, we aim to make Athena into a global financial services company that can connect the world’s cash to

the world of crypto assets.

Corporate History and Other Information

The Company was incorporated in the state of

Nevada in 1991 under the name “GamePlan, Inc.” for the sole purpose of merging with Sunbeam Solar, Inc., a Utah corporation,

which merger occurred as of December 31, 1991 with GamePlan, Inc. as a sole surviving entity. The Company was involved in various businesses,

including, gaming and other consulting services, prior to becoming a company seeking acquisitions (a “shell company” as defined

in Rule 405 of the Securities Act). The Company was a reporting issuer under the Securities and Exchange Act of 1934 (the “Exchange

Act”) from 1999 until 2015 when it filed Form 15 pursuant to Rule 12g-4(a)(1) with the Commission and ceased to be a reporting

company.

On January 14, 2020 the Company entered into a

Share Exchange Agreement (the “Agreement”), by and among the Company, Athena Bitcoin, Inc., a Delaware corporation (“Athena

Bitcoin”) incorporated in 2015, and certain shareholders of Athena Bitcoin. The Agreement provides for the reorganization of Athena

Bitcoin, with and into the Company, resulting in Athena Bitcoin becoming a wholly-owned subsidiary of the Company. The agreement is for

the exchange of 100% shares of the outstanding common stock of Athena, for 3,593,644,680 shares of GamePlan, Inc. common stock (an exchange

rate of 1,244.69 shares of common stock of GamePlan, Inc. for each share of Athena Bitcoin common stock). The closing of the transaction

occurred as of January 30, 2020. Subsequently, in May, 2020, the Company filed its amended and restated articles of incorporation authorizing

a total of 4,409,605,000 shares of common stock.

The Company approved the name change from “GamePlan,

Inc.” to “Athena Bitcoin Global” on March 10, 2021 by the unanimous consent of its Board of Directors and a majority

consent of its shareholders. The Company filed an amendment to its Articles of Incorporation with the Secretary of State of the state

of Nevada on April 6, 2021, with the effective date of April 15, 2021. The Company’s name change and trading symbol change to “ABIT”

was declared effective by FINRA on OTC Pink Market as of June 9, 2021.

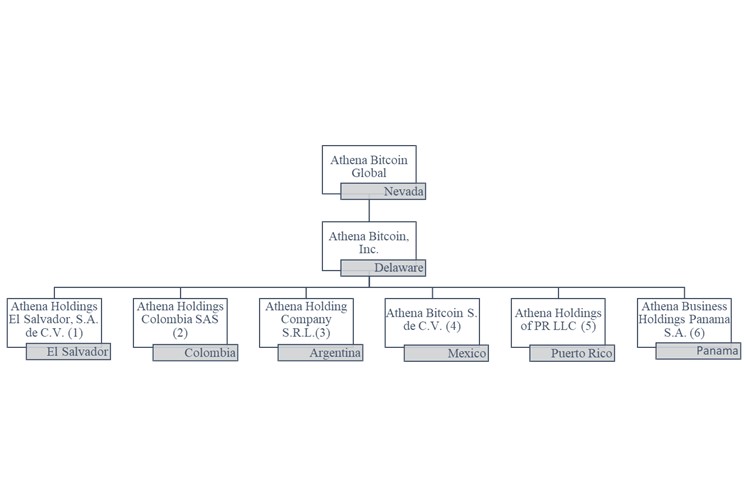

The Company, Athena Bitcoin Global, is a Nevada

corporation which owns 100% of our operating subsidiary, Athena Bitcoin, Inc., a Delaware corporation. Our domestic business operations

are conducted by Athena Bitcoin, Inc. We have operating subsidiaries in the specific countries where we operate, as more fully described

in the following:

(1) Athena Bitcoin Inc. owns 99% of

Athena Holdings El Salvador SA de CV and Eric Gravengaard holds 1% on behalf of the Company.

(2) Athena Bitcoin Inc. beneficially

owns and controls Athena Holdings SAS which is nominally owned by Eric Gravengaard 95% and Matias Goldenhörn 5%.

(3) Athena Bitcoin Inc. beneficially

owns and controls Athena Holding Company SRL which is nominally owned by Eric Gravengaard 45%, Gilbert Valentine 45%, and Matias Goldenhörn

10%.

(4) Athena Bitcoin Inc. owns 2,999

Shares of Athena Bitcoin SRL de CV and Eric Gravengaard owns 1 Share on behalf of the Company.

(5) Athena Bitcoin Inc. is the only

member of Athena Holdings of PR, LLC.

(6) Athena Bitcoin Inc. owns

100% Athena Business Holdings Panama S.A.

Our corporate office is located at 1332 N Halsted

St., Suite 403, Chicago, IL 60642, and our telephone number is 312-690-4466. Our website is www.athenabitcoin.com. The information

on, or that can be accessed through, our website is not part of this prospectus and is not incorporated by reference herein.

Industry Summary

The Company is an active participant in the operation

of Bitcoin ATMs in the U.S. and Latin America. More broadly we operate in the market of retail sales of bitcoin facilitating small purchases

of Bitcoin, Ethereum, Litecoin, and BCH. There are many ways that retail consumers, individuals purchasing small amounts from one dollar

to a few thousand dollars’ worth, can purchase or dispose of crypto assets.

The Birth of Bitcoin ATMs

In the earliest days of Bitcoin, most transactions

were done in person – often facilitated by websites. These sites matched prospective buyers with sellers and facilitated communications

and wallet coordination, allowing them to meet in public places like coffee shops and street corners, and exchange bitcoin for envelopes

of cash. The first Bitcoin ATMs began appearing in 2014. These ATMs were an instant hit with retail customers who were accustomed to

in-person transactions because they offered instantaneous access to bitcoin in a familiar and safe method.

According to Reuters in a March, 2021 article

titled “Bitcoin ATMs are coming to a gas station near you”, the industry has grown from a handful of machines operated by hobbyists

to more than 15,000 kiosks worldwide primarily operated by increasingly larger organizations. There are many operators of Bitcoin ATM

networks, from crypto businesses to major corporate and conventional kiosk companies including Coinstar.

Some Bitcoin ATMs offer one-way exchange,

allowing customers to only buy crypto assets. Others offer two-way exchange, so customers can buy crypto assets for cash, or sell some

of their crypto assets and receive cash. Athena Bitcoin ATMs, serve clients with the following types of crypto assets: Bitcoin, Ethereum,

Litecoin, and BCH in either one-way or two-way exchanges, depending on the functionality of each ATM machine.

Bitcoin Exchanges

Parties that want to use their bank accounts to

buy Bitcoin can do so without an ATM. These transactions are the domain of exchanges and specialty apps including services from Coinbase,

Gemini, Kraken, and Square. These services generally accept U.S. dollar transfers from bank accounts and do not accept physical currency.

These services may or may not, depending on several factors including method of deposit, allow the purchaser of a crypto asset on their

platforms to immediately transfer the crypto asset into their own wallet. These services cater to larger purchasers and investors in crypto

assets. Users of exchanges may use ATMs as a convenient method to get spending cash, similar to how bank account and credit card holders

use bank ATMs.

The growth of businesses and services that accept

Bitcoin and make it more functional is contributing to increasing Bitcoin usage. In October of 2020, PayPal and Venmo announced they will

accept Bitcoin, thus enabling PayPal and Venmo customers to use their Bitcoin to make online purchases and online payments. In 2020 and

2021, with little promotion and advertising, we have experienced a significant increase in transaction volumes and average transaction

sizes (see “Management’s Discussion and Analysis of Financial Condition and Results of Operations”).

We believe this trend is due in part to an increase in companies and online service providers that are helping to make Bitcoin more widely

and easily usable. We believe that the use of Bitcoin ATMs will continue to rise as the Bitcoin and crypto industry and its many interconnected

service providers expand.

Business Strategies

We seek to grow and distinguish Athena Bitcoin

services based on our method of location selection, our global expansion, operational efficiencies, and our authenticity as a crypto

industry forerunner with respect to Bitcoin ATMs.

We are an efficient operator.

We are focused on placing our ATMs in optimal

locations that maximize both current income and future potential. Our ATMs are in urban, suburban, and rural locations. Our site selection

criteria and metrics are a closely guarded proprietary aspect of our business. In placing our ATMs, we employ a data driven strategy based

on factors we have learned over the years. In addition to data metrics, our placement strategy includes analysis of immediate trends,

as we are in a dynamic business where usage is widening dramatically and often in unpredicted ways. Each location is chosen to complement

the rest of the fleet and offer customers of diverse backgrounds access to convenient crypto assets transactions.

We are constantly improving our operational efficiency.

Our ATMs serve as remote tellers that connect to our centralized cloud-based crypto trading operation. We have proprietary systems and

methods of managing our currency exchange operation. Our founders have a deep understanding of high-frequency trading and were some of

the first to electronically trade Bitcoin on multiple exchanges simultaneously. The objective of our purchasing algorithms is to frequently

re-balance our crypto holdings to meet the dynamic demand of our many customers. Over-buying of any crypto asset can result in inefficiency

and currency risk, while under-buying may temporarily prevent us from selling crypto assets at our ATMs. We strive to improve the efficiency

of our currency exchange operations to maximize our profits, manage risk and facilitate growth.

We are a global business.

We placed our first ATM outside the U.S. in Mexico

in 2017. According to the CIA World Factbook, the median age in the United States is 38. In South America it is 31, and Africa has a median

age of only 18. As the digital generation accumulate their wealth, they are far more likely to embrace crypto assets than their predecessors.

Bitcoin is poised to quickly become a part of the lives of a huge percentage of the developing world’s population. This “global

south” offers a large green field expansion opportunity for us because it combines high usage of physical currency with low median

age and reduced access to quality banking.

On June 8, 2021, El Salvador became the first

and remains the only country to officially adopt the cryptocurrency as legal tender when its congress passed the Bitcoin Law proposed

by President Nayib Bukele. On September 7, 2021, the Bitcoin Law was implemented and Bitcoin became legal tender in El Salvador, alongside

the U.S. dollar, the country’s other official currency. Under the new law, Salvadorans can pay taxes in Bitcoin and businesses are

obliged to accept Bitcoin as payment for goods and services, in addition to the U.S. dollar. Given that more than 70% of the adult population

of El Salvador does not have access to the traditional banking system, the government of El Salvador believes that Bitcoin will greatly

help the unbanked get access to electronic payments.

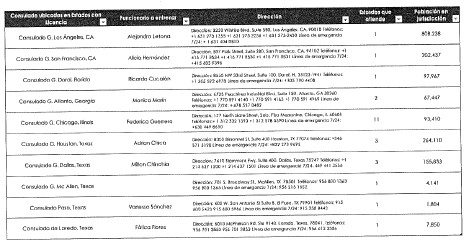

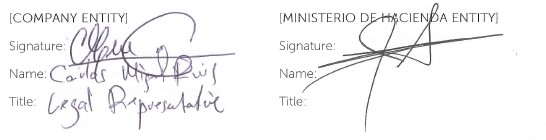

The Company began working with the government

of El Salvador in late June 2021 to support the implementation of its Bitcoin Law. In August 2021, we entered into certain agreements

for services to be rendered by the Company to the Department of Treasury (Ministerio De Hacienda) of El Salvador, pursuant to which we

have installed and are operating 200 Chivo Bitcoin ATMs in El Salvador, 10 Chivo Bitcoin ATMs at El Salvador consulates in the U.S.,

45 Chivo Bitcoin ATMs in other U.S. locations, and importing and delivering 950 Chivo point-of-sale (“POS”) terminals for

local businesses in El Salvador to transact with Bitcoin. As of December 31, 2021, all Chivo Bitcoin ATMs are installed and operational

and all 950 point-of-sale terminals have been delivered and subsequently distributed to end-users as per above. The Company is responsible

for maintaining the existing software infrastructure supporting the operation of the ATMs, the hardware maintenance of the ATM, cash

logistics and customer support. Currently, there are no on-going obligations with respect to the POS terminals. For the fiscal year

ended December 31, 2021 the Company presented to the government of El Salvador/Ministerio de Hacienda invoices amounting to $300,000

for the installation of white label machines, $1,000,000 for the monthly maintenance of the 200 white label machines in El Salvador,

$360,000 for the sale of POS terminals, $584,000 for the monthly software maintenance, $385,000 for the monthly maintenance of the 55

white label machines in the USA and $37,800 for the service fee for the 55 white label machine transactions. The total amount of $2,666,800

exclusive of VAT was recorded as part of Revenues in the Consolidated Statement of Operations and Comprehensive Income. As of December

31, 2021, $1,418,800 of these amounts remained outstanding and was recorded as part of Accounts receivable on the Consolidated Balance

Sheets. The Company does not anticipate any further sales of POS terminals to the government of El Salvador.

In addition to the ATM and POS portions of

the agreements for services, we were also contracted to develop and maintain a Bitcoin platform (Chivo Ecosystem) to support the Chivo

digital wallet. The Company was obligated to provide the software for the Chivo digital wallet, comprising both the software that

runs on mobile smartphones, which we refer to as the App, and the software that runs on servers, which together comprise the Chivo Digital

Wallet. The Chivo Digital Wallet has the following functions: (i) storing and displaying USD and Bitcoin balances; (ii) sending and receiving

USD and Bitcoin between users of the Chivo digital wallet and (iii) sending and receiving Bitcoin using on-chain and Lightning Network

transaction.

The delivery of the software was initially completed

on September 7, 2021 . In response to news reports of user problems and government requests for changes the Company hired additional

technology resources and delivered subsequent improvements continuously throughout the quarter ending December 31, 2021. The usage of

the software we provided and the operation of the Chivo digital wallet was conducted by Chivo S.A. de C.V., a government-controlled entity.

Through the year ended December 31, 2021, the Company booked $3,500,000 as advances for revenue contract and $757,000 as capitalized

software development within other non-current assets for the costs related to the Chivo Ecosystem in the consolidated balance sheets.

In addition, $700,000 in taxes were recorded as part of income tax expense in the consolidated statement of operations and comprehensive

income.

The government of El Salvador discontinued

use of the Company’s software on or about December 15, 2021, but has not terminated its contract with the Company as the Company

assists the government’s secondary provider. At the time the contract for the software was negotiated, the Company was aware that

the government of El Salvador was considering multiple providers and our contract included the option for the government to change providers.

Our non-disclosure agreement with the government of El Salvador prohibits us from discussing the operation of the Chivo digital wallet.

The government of El Salvador did not provide us with the reasons behind their decision. Parts of the contract related to data retention

security, analysis and reporting remain in effect as of the time of this prospectus as do the services related to the operation of the

Chivo branded ATMs and the POS terminals, but the government of El Salvador is not using the Company’s software to enable the Chivo

digital wallet. The expected revenues and associated costs of satisfying those data obligations will be determined based on ongoing negotiations

and requests of the government.

There are no expected future costs for

the POS sections of the agreements as the Company does not expect to sell additional POS terminals to the government of El Salvador

as of the date of this prospectus.

On April 20, 2022, David Gerard, an author

of several books and an eponymous website, reported that there was a theft of several million dollars from the Chivo digital wallet on

or around April 1, 2022. This event, if true, was after the migration of user data from the Company’s software to the new software

provider for the Chivo digital wallet and the Company has no direct knowledge of or responsibility for the alleged events.

None of the funds received under the agreements

are refundable upon contract termination.

The government of El Salvador owns the software

(which we refer to as the “IP Software”) and the Company has a perpetual, royalty-free license under its Master Services Agreement

to market the IP Software elsewhere.

Subsequent to executing the Master Services Agreement,

the Company implemented branding of its “Athena Ruru” suite of services, with such brand comprising of the three services

the Company offers: Bitcoin ATMs, POS terminals and merchant services, and the wallet solution, based on the App. To date, the Company

has not completed the sale of a license to its bitcoin platform, marketed under the Athena Ruru brand, to any other person, including

without limitation any government entity or bank.

The initial term of the Master Services Agreement

(the “MSA”) is three-years beginning on August 20, 2021. The Company’s El Salvador Contracts have the following ongoing

terms for their obligations:

| Specific Nature of Services | Term | Status | Revenue YE 2021 | Paid to YE 2021 | Accounts Receivable as YE 2021 | |||

| Contract 51/2021 (Installation and Maintenance of Chivo ATMs) |

July 30, 2021 – July 30, 2024 – | Ongoing | $ | 1,685,000 | $ | $800,000 | $ | 885,000 |

| Contract 56/2021 (Development of Chivo Wallet, alternative version of SA1) | August 9, 2021 – December 31, 2021 | Concluded | – | 3,500,000* | – | |||

| Service Addendum 1 (Phase 1: Service Fees for Chivo Ecosystem) | August 15, 2021 – December 31, 2021 | Concluded | 584,000 | 88,000 | 496,000 | |||

| Service Addendum 1 (Phase 2: Service Fees USA Based Activities) | September 7, 2021- December 31, 2022 | Ongoing | 37,900 | – | 37,900 | |||

| Service Addendum 2 (Importation, setup, and distribution of POS terminals) | August 20 – September 7, 2021 | Concluded | 360,000 | 360,000 | – | |||

*Recognized as Advances for revenue contracts

in the Consolidated Balance Sheets

See also Business – Operations in El Salvador- Material Contracts on page 61.

Our strategy is to become a global financial

services company that can connect the world’s cash to the world of digital assets including Bitcoin, Ethereum, Litecoin, and BCH.

We have spent years learning how to expand our business across borders. We have assembled the people, processes, and technologies

to enable us to continue to grow our global footprint we believe is unmatched by our competition.

Competitive Strengths

When comparing Bitcoin ATMs to other methods of

transacting, the primary advantage of an ATM is its ability to complete a transaction from payment to delivery of crypto assets quickly.

In the context of a purchase transaction, our ATM only accept physical currency, which is an immediate and permanent form of payment,

and which facilitates the immediate delivery of crypto assets, also an immediate and permanent form of transaction. Apps and services

that rely on ACH or other bank mechanisms for the delivery of fiat currency in a transaction often cannot deliver the crypto asset quickly

because the funding mechanism is neither immediate nor permanent.

Risk Factors Associated with Our Business

Investing in our shares of common stock involves

significant risks. You should carefully consider the risks described in “Risk Factors” before deciding to invest in our shares.

If we are unable to successfully address these risks and challenges, our business, financial condition, results of operations, or prospects

could be materially adversely affected. In any of such cases, the trading price of our common stock would likely decline, and you may

lose all or part of your investment. Below is a summary of some of the risks we face.

| · | Our shares are subject to liquidity risks. | |

| · | Our business is in a relatively new consumer product segment, which is difficult to forecast. | |

| · | Our operating results may fluctuate due to the highly volatile nature of crypto. | |

| · | A majority of our net revenue is derived from transactions in Bitcoin. If demand for crypto assets declines, our business, operating results, and financial condition could be adversely affected. |

|

| · | The future development and growth of crypto is subject to a variety of factors that are difficult to predict and evaluate. If crypto does not grow as we expect, our business, operating results, and financial condition could be adversely affected. |

|

| · | Cyberattacks and security breaches of our platform, or those impacting our customers or third parties, could adversely impact our brand and reputation and our business, operating results, and financial condition. |

| · | We are subject to an extensive and highly-evolving regulatory landscape and any adverse changes to, or our failure to comply with, any laws and regulations could adversely affect our brand, reputation, business, operating results, and financial condition. |

|

| · | As we continue to expand and localize our international activities, our obligations to comply with the laws, rules, regulations, and policies of a variety of jurisdictions will increase and we may be subject to investigations and enforcement actions by regulators and governmental authorities. |

|

| · | We currently rely on third-party service providers for certain aspects of our operations, and any interruptions in services provided by these third parties may impair our ability to support our customers. |

|

| · | Loss of a critical banking relationship could adversely impact our business, operating results, and financial condition. |

|

| · | Any significant disruption in our products and services, in our information technology systems, or in any of the blockchain networks we support, could result in a loss of customers or funds and adversely impact our brand and reputation and business, operating results, and financial condition. |

|

| · | The loss or destruction of private keys required to access any crypto assets held for our business transactions with our customers may be irreversible. If we are unable to access our private keys or if we experience a hack or other data loss relating to our ability to access any crypto assets, it could cause adversely impact our business operations, operating results, regulatory scrutiny, reputational harm, and other losses. |

|

| · | None of our stockholders are party to any contractual lock-up agreement or other contractual restrictions on transfer. Following the registration of our shares, the sales or distribution of substantial amounts of our common stock, or the perception that such sales or distributions might occur, could cause the market price of our common stock to decline. |

Impact from COVID-19

The significant global outbreak of COVID-19

has resulted in a widespread health crisis that has adversely affected the economies and financial markets worldwide and has affected

our business in several ways. First, we have been unable to ship our ATMs freely between countries. Second, it has restricted the movement

of our employees and their ability to both collaborate in-person, and to do some field-service and installation work.

We are responding to the global outbreak of

COVID-19 by taking steps to mitigate the potential risks to us posed by its spread and the impact of the restrictions put in place by

governments to protect the population. Our employees and service providers have transitioned to work-from-home. This subjects us to heightened

operational risks. For example, technologies in our employees’ and service providers’ homes may not be as robust as in our

offices and could cause the networks, information systems, applications, and other tools available to employees and service providers

to be more limited or less reliable than in our offices. Further, the security systems in place at our employees’ and service providers’

homes may be less secure than those used in our offices, and we may be subject to increased cybersecurity risk, which could expose us

to risks of data or financial loss, and could disrupt our business operations. There is no guarantee that the data security and privacy

safeguards we have put in place will be completely effective or that we will not encounter risks associated with employees and service

providers accessing company data and systems remotely.

In addition, the continued spread of COVID-19

and the imposition of related public health measures have resulted in, and is expected to continue to result in, increased volatility

and uncertainty in the crypto-economy. We also rely on third party service providers to perform certain functions. Any disruptions to

a service providers’ business operations resulting from business restrictions, quarantines, or restrictions on the ability of personnel

to perform their jobs could have an adverse impact on our service providers’ ability to provide services to us. The continued spread

of COVID-19 and efforts to contain the virus could adversely impact our strategic business plans and growth strategy, reduce demand for

our products and services, reduce the availability and productivity of our employees, service providers, and third-party resources, cause

us to experience an increase in costs due to emergency measures, and otherwise adversely impact our business.

Offering Summary

We are registering the resale of 459,783,937 shares

of our common stock that include: (i) 409,933,937 shares of common stock that were issued by us to the Selling Shareholders in the share

exchange transaction or were purchased by the Selling Shareholders in private transactions, and (ii) up to 49,850,000 shares of common

stock issued or issuable upon exercise of our outstanding 6% Convertible Debentures Due 2023 (the ”Convertible Debentures”)

which were issued in connection with a private placement financing in 2021.

Implications of Being an Emerging Growth

Company and Smaller Reporting Company

We are an emerging growth company, as defined

in the Jumpstart Our Business Startups Act of 2012 (“JOBS Act”). For as long as we continue to be an emerging growth company,

we may take advantage of exemptions from various reporting requirements that are applicable to other public companies that are not emerging

growth companies, including not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley

Act of 2002, or the Sarbanes-Oxley Act, reduced disclosure obligations regarding executive compensation in this prospectus and our periodic

reports and proxy statements and exemptions from the requirements of holding nonbinding advisory votes on executive compensation and stockholder

approval of any golden parachute payments not previously approved. We could remain an emerging growth company for up to five years after

the effective date of this Registration Statement, although circumstances could cause us to lose that status earlier, including if the

market value of our common stock held by non-affiliates exceeds $700 million as of any December 31 before that time or if we have total

annual gross revenue of $1.07 billion or more during any fiscal year before that time, in which cases we would no longer be an emerging

growth company as of the following December 31 or, if we issue more than $1.07 billion in non-convertible debt during any three-year period

before that time, we would cease to be an emerging growth company immediately. Even after we no longer qualify as an emerging growth company,

we may still qualify as a “smaller reporting company” which would allow us to take advantage of many of the same exemptions

from disclosure requirements, including reduced disclosure obligations regarding executive compensation in our periodic reports and proxy

statements. Additionally, even if we no longer qualify as an emerging growth company, as long as we are neither a “large accelerated

filer” nor an “accelerated filer,” we would not be required to comply with the auditor attestation requirements of Section

404 of the Sarbanes-Oxley Act. We cannot predict if investors will find our securities less attractive because we may rely on these exemptions,

which could result in a less active trading market for our securities and increased volatility in the price of our securities.

Finally, we are a “smaller reporting

company” (and may continue to qualify as such even after we no longer qualify as an emerging growth company) and accordingly may

provide less public disclosure than larger public companies, including the inclusion of only two years of audited financial statements

and only two years of management’s discussion and analysis of financial condition and results of operations disclosure. As a result,

the information that we provide to our stockholders may be different than you might receive from other public reporting companies in

which you hold equity interests.

Summary Consolidated Financial Data

The following tables set forth a summary of our

historical consolidated financial data as of and for the periods indicated. The summary consolidated statements of operations data

for the fiscal years ended December 31, 2021 and December 31, 2020, respectively, have been derived from our audited consolidated financial

statements and related notes thereto included elsewhere in this prospectus. Our historical results are not necessarily indicative

of the results to be expected in the future. When you read this summary consolidated financial data, it is important that you read it

together with the historical consolidated financial statements and the related notes thereto included elsewhere in this prospectus, which

qualify this summary consolidated financial data in their entirety, as well as the sections of this prospectus titled “Selected

Consolidated Financial Data” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

The summary financial data in this section are not intended to replace our audited consolidated financial statements and the related

notes, and are qualified in their entirety by such financial statements and related notes included elsewhere in this prospectus.

|

(in thousands) Balance |

For the twelve months ended December 31 |

|||||||

|

2021 Audited |

2020 Audited |

|||||||

| Current assets | $ | 7,948 | $ | 2,201 | ||||

| Other assets | 7,053 | 4,274 | ||||||

| Total assets | $ | 15,001 | $ | 6,475 | ||||

| Current liabilities | $ | 11,999 | $ | 4,312 | ||||

| Long-term liabilities | 10,576 | 5,435 | ||||||

| Total shareholders’ deficit | (7,574 | ) | (3,272 | ) | ||||

| Total liabilities and shareholders’ deficit | $ | 15,001 | $ | 6,475 |

|

(in thousands) Statement |

For the twelve months ended December 31 |

|||||||

|

2021 Audited |

2020 Audited |

|||||||

| Revenues | $ | 81,747 | $ | 68,937 | ||||

| Cost of revenues | 76,178 | 62,390 | ||||||

| Gross profit | 5,569 | 6,547 | ||||||

| Operating expenses | 6,774 | 3,497 | ||||||

| Income (loss) from operations | (1,205 | ) | 3,050 | |||||

| Fair value adjustment on crypto asset borrowing derivatives | 515 | 1,061 | ||||||

| Interest expense | 661 | 990 | ||||||

| Fees on crypto asset borrowing | 341 | 466 | ||||||

| Other (income) expense | 39 | (55 | ) | |||||

| Income (loss) before taxes | (2,761 | ) | 588 | |||||

| Income tax expense (benefit) | 883 | 428 | ||||||

| Net income (loss) | $ | (3,644 | ) | $ | 160 | |||

| Common Stock offered by Selling Shareholders | 459,783,937 shares of common stock which include: (i) 409,933,937 shares of common stock that were issued by us to the Selling Shareholders in the share exchange transaction or were purchased by the Selling Shareholders in private transactions, and (ii) up to 49,850,000 shares of common stock issued or issuable upon exercise of our outstanding 6% Convertible Debentures Due 2023 (the “Convertible Debentures”) which were issued in connection with a private placement financing in 2021. We are registering the resale of the shares of common stock underlying the principal amount of the Convertible Debentures, as required by the Securities Purchase Agreement that we entered into with the Selling Shareholders as of June 22, 2021, which provided said Selling Shareholders with certain registration rights with respect to the common stock issuable upon conversion of the principal amount of the Convertible Debentures (the “Purchase Agreement”). |

|

| Common Stock outstanding before the offering | 4,089,409,545 shares of common stock | |

| Exchange Symbol | ABIT | |

| CUSIP | 046839106 | |

| Terms of the Offering | The Selling Shareholders have not engaged any underwriter regarding the sale of their shares of common stock. The sale price to the public will vary according to prevailing market prices or privately negotiated prices by the Selling Shareholders. | |

| Termination of the Offering | The offering will conclude upon the earliest of (i) such time as all the common stock has been sold pursuant to the registration statement or (ii) such time as all the common stock becomes eligible for resale without volume limitations pursuant to Rule 144 under the Securities Act (iii) or we decide at any time to terminate the registration of the shares at our sole discretion. | |

| Trading Market | Our common stock is currently quoted on the OTC Pink Market operated by OTC Markets Group, Inc. There is an uneven and limited trading market for our securities. We intend to apply for quotation on the OTCQB once we become a fully reporting company with the SEC. | |

| Use of proceeds | We are not selling any shares of the common stock covered by this prospectus. As such, we will not receive any of the offering proceeds from the registration of the shares of common stock covered by this prospectus. | |

| Expenses | We will pay all expenses associated with this registration statement. | |

| Risk Factors | The shares offered hereby involve a high degree of risk and should not be purchased by investors who cannot afford the loss of their entire investment. See “Risk Factors” beginning on page 11. |

The number of shares of common stock to be outstanding

immediately after this offering is based on 4,089,409,545 shares of common stock outstanding as of March 31, 2022 and excludes:

| · | 250,000,000 shares of common stock issuable upon conversion of 8% Convertible Debenture Due 2025 issued to KGPLA Holdings, LLC; |

| · | 15,200,000 shares of common stock issuable upon conversion of the remaining outstanding principal amount of the 6% Convertible Debenture Due 2023 issued to certain accredited investors pursuant to the Company’s private placement of up to $5,000,000. See page 68. |

Investing in the Shares involves a high

degree of risk. You should carefully consider the risks and uncertainties described below, together with all of the other information

in this prospectus, before deciding to invest in the Shares. If any of the risks occur, our business, results of operations, financial

condition, and prospects could be harmed. In that event, the trading price of the Shares could decline, and you could lose part or all

your investment. Additional risks and uncertainties not presently known to us or that we currently deem immaterial also may impair our

business operations.

The Most Material Risks Related to Our

Business and Financial Position

Our business is in a new consumer product

segment, which is difficult to forecast.

Our industry segment is new and is constantly

evolving. As a result, there is a lack of available information with which to forecast industry trends or patterns. There is no assurance

that sustainable industry trends or preferences will develop that will lead to predictable growth or earnings forecasts for individual

companies or the industry segment. We are also unable to determine what impact future governmental regulation may have on trends and

preferences or patterns within our industry segment. See “Risk Factors Related to Current and Future Regulations and other Law Enforcement Actions” for a discussion

of the risks associated with governmental regulation.

The prices of Bitcoin and other crypto assets

are volatile.

We generate substantially all our revenue from

the sale of crypto assets to our customers, either using our Bitcoin ATMs or over the phone. Revenue is based on the prices that we charge

our customers based on prevailing market prices. The price at which we are able to purchase crypto assets prior to selling those same

crypto assets may not be lower than the sale price if the market conditions change between those two points in time. Purchasing Bitcoin

or other crypto assets for prices higher than they can be later sold could result in an impairment of the asset value and our operating

results could be adversely affected. The value of the entirety of our crypto assets held could be lost if the prices of those digital

assets were to significantly decrease, which would adversely affect our operating results. There are no assurances that the crypto assets

we hold will have value from one day to the next and we could suffer a loss if any of the prices of those crypto assets declines or is

permanently depressed.

As discussed in our financial statements included

in this prospectus, we account for our crypto assets as indefinite-lived intangible assets, which are subject to impairment losses if

the fair value of our crypto assets decreased below their carrying value. As of December 31, 2021, management’s estimate of the

effect on fair values due to a +/- 20% uniform change in the market prices of all crypto assets, with all other variables held constant,

was +/- $168.4 thousand (December 31, 2020: +/- $268.6 thousand).

Additionally, and as discussed in our financial

statements, we act as an agent (vs. principal) in the operation of the Chivo branded Bitcoin ATMs. As part of our contract with the government

of El Salvador, the Company manages the processes of purchasing and selling of Bitcoin that are involved with the operations of the Chivo

branded Bitcoin ATMs and assumes the price risk associated with those transactions. The value of the Bitcoin between the time of a transaction

at such an ATM and the time at which the Company exchanges them to/for USD can be between seconds and hours, during which time the price

of Bitcoin relative to the US dollar can change. As of December 31, 2021, management estimates that if Bitcoin were to change prices by

+/- 20%, with all other variables held constant, the risk of gain/loss on the value of the Bitcoin used by the Chivo branded Bitcoin ATMs

would be +/- $236.1 thousand (prior periods: Not Applicable).

Our total revenue is substantially dependent

on the volume of transactions conducted by our customers. If such volume declines, our business, operating results, and financial position

would be adversely affected.

We generate substantially all our revenue from

the sale of crypto assets to our customers, either using our Bitcoin ATMs or over the phone. Revenue is based on the prices that we charge

our customers based on prevailing market prices. This revenue may fluctuate based on the price of crypto assets. As such, any declines

in the volume of transactions, the price of crypto assets, or market liquidity for crypto assets generally may result in lower total

revenue to us.

The price of crypto assets and associated demand

for buying, selling, and trading crypto assets have historically been subject to significant volatility. The price and trading volume

of any crypto asset is subject to significant uncertainty and volatility, depending on several factors, including:

| · | market conditions across all elements of the crypto-economy; |

| · | changes in liquidity, market-making volume, and trading activities; |

| · | trading activities on other crypto platforms worldwide, many of which may be unregulated, and may include manipulative activities; |

| · | investment and trading activities of highly active retail and institutional users, speculators, miners, and investors; |

| · | the speed and rate at which crypto assets and specifically Bitcoin can gain adoption as a medium of exchange, utility, store of value, consumptive asset, security instrument, or other financial assets worldwide, if at all; |

| · | decreased user and investor confidence in crypto assets and associated exchanges and service providers; |

| · | negative publicity and events relating to Bitcoin, blockchain technology, or the digital currency economy as a whole; |

| · | unpredictable social media coverage or “trending” of Bitcoin or other crypto assets; |

| · | the ability for crypto assets to meet user and investor demands; |

| · | consumer preferences and perceived utility and value of crypto assets and associated markets; |

| · | increased competition from other payment services or other crypto assets that exhibit better speed, security, scalability, or other characteristics; |

| · | regulatory or legislative changes and updates affecting the use, storage, ownership, exchange, or any other aspect of the crypto-economy; |

| · | the characterization of crypto assets under the laws of various jurisdictions around the world; |

| · | the maintenance, troubleshooting, and development of the blockchain networks underlying crypto assets, including by miners, validators, and developers worldwide; |

| · | the ability for protocol networks to attract and retain miners or validators to secure and confirm transactions accurately and efficiently; |

| · | ongoing technological viability and security of protocols and their associated crypto assets, smart contracts, applications, and networks, including vulnerabilities against hacks and scalability; |

| · | fees and speed associated with processing blockchain transactions, including on the underlying protocol networks and on exchanges and other platforms for trading; |

| · | financial strength of wholesale market participants; |

| · | the availability and cost of funding and capital; |

| · | the liquidity of over-the-counter trading desks, market-makers, exchanges, and other wholesale dealers of crypto assets; |

| · | interruptions in service from or failures of major crypto asset exchanges and platforms; |

| · | availability of banking and payment services to support crypto-related projects; |

| · | level of interest rates and inflation in both G-10 economies and emerging markets; |

| · | monetary policies of governments, trade restrictions, and fiat currency valuation changes; and |

| · | national and international economic and political conditions. |

There is no assurance that any supported crypto

asset will maintain its value or that there will be meaningful levels of interest from customers. If the demand for purchasing or selling

crypto assets declines, our business, operating results, and financial condition would be adversely affected.

The future development and growth of

crypto assets and protocols is subject to a variety of factors that are difficult to predict and evaluate. If the future does not develop

and grow as we expect, our business, operating results, and financial condition could be adversely affected.

Blockchain technology was only introduced

in 2008 and remains in the early stages of development. In addition, different protocols are designed for different purposes. Bitcoin,

for instance, was designed to serve as a peer-to-peer electronic cash system, while Ethereum was designed to be a smart contract and

decentralized application platform. Many other protocol networks—ranging from cloud computing to tokenized securities networks—have

only recently been established. The further growth and development of any crypto assets and their underlying networks and other cryptographic

and algorithmic protocols governing the creation, transfer, and usage of crypto assets represent a new and evolving paradigm that is

subject to a variety of factors that are difficult to evaluate, including: