smshoot/iStock via Getty Images

After 13 years, Genworth Financial Inc. (NYSE:GNW), an unloved small-cap mortgage, life, and long-term care insurer, has started returning capital to shareholders. The return comes in the form of share buybacks to the tune of $350m and is just one manifestation of the solid progress Genworth has made over the last several years to secure the future for its shareholders. Going forward, Genworth owners are now positioned to become the primary beneficiary of the company’s cash flows, a delightful outcome given the tumultuous road of yesteryear.

As time marches on, favorable progress across the business is expected to continue for Genworth. The company’s equity position in Enact Holdings Inc. (ACT) will provide enough cash to fund Genworth’s liquidity needs as well as its growth initiatives. Then there are the company’s deferred tax assets which will provide additional, and substantial, cash flows in the form of intercompany cash tax payments. These payments are in excess of Genworth’s maintenance and growth needs and will likely be used to further the company’s priority of returning capital to shareholders. Last but not least is Genworth’s LTC business and the headway being made to rerate policies. The company now expects to achieve breakeven within the next 5 years, well ahead of peak claim years.

Genworth will, however, continue to face its share of uncertainty. For instance, the looming recession could put pressure on Enact, resulting in smaller returns of capital to Genworth. Another possible risk is Genworth not generating enough taxable income in the coming years, making its DTAs unusable. Genworth also might have trouble receiving future rerating approvals from regulators, thereby stifling the company’s progress in bringing its LTC business to breakeven.

Despite the risks, Genworth is currently on very solid footing, and should remain that way for the foreseeable future. Therefore, Genworth is a Buy with an increased Price Target of $5.10/sh.

Optimal Capital Structure

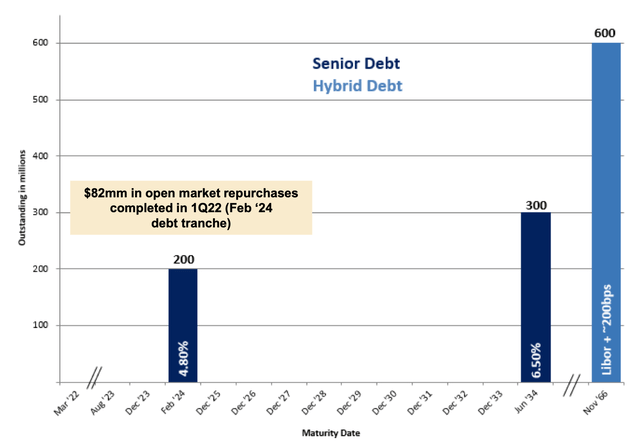

Genworth is closing in on its targeted $1,000m or less debt level. In Q1, the company redeemed $82m of notes due ’24, reducing Genworth Holding Company’s (“HoldCo”) debt to $1,100m. The plan is to redeem the remaining $200m of ’24 notes by the end of Q3’22. Upon redemption, HoldCo will have $900m of debt outstanding with the closest tranche not due until ’34:

GNW Q1’22 Investor Presentation

Going forward, debt servicing is expected to cost Genworth ~$40m/year. That is, however, assuming LIBOR remains flat. The ’66 notes have a floating rate which means as rates move higher, the cost of the notes rise as well. Put another way, the ~$40m/year debt servicing cost could be $50m this time next year.

With that said, Genworth is comfortably positioned to service the debt despite raising rates as the regular dividend established by Enact will more than cover annual interest payments.

Enact Dividends

Genworth’s ~81.6% controlling ownership of Enact is a cash cow. Last year, the mortgage insurer generated net income of $549m to Genworth on $1,118m of revenue, a 49% margin. This year, Wall Street analysts estimate Enact will net $567m, or $3.48/sh. Based on Enact’s target 40-50% payout ratio, Genworth’s equity position is poised to rake in between $185m and $231m in ’22 from Enact’s regular and special dividends.

In April Enact started dishing out dividends when its board of directors initiated a 14¢ regular quarterly dividend. This regular dividend nets Genworth $18.6m quarterly, or $74.4m per annum, and is more than enough to cover Genworth’s annual debt servicing costs (~$40m/year). Enact management has guided that the remaining payout will come towards year-end and likely in the form of a special dividend.

There is the chance that recession reduces Enact’s ability to pay a special dividend in the back half of this year. Like Genworth, Enact is highly regulated and under certain circumstances the company must receive regulatory approval before paying extraordinary dividends. In April new home sales slid 17% y/y, coming in much weaker than expected. A cooling housing market is bad news for Enact, considering the company relies, in part, on underwriting new mortgage insurance policies. With that said, a cooling market will also lead to higher persistency, which is good for Enact. To boot, the U.S. job market remains strong with a 3.6% unemployment rate in April. Needless to say, there are opposing forces at work. In any event, the regular ordinary dividend will remain and should all but eliminate any near term liquidity concerns.

Deferred Tax Assets

Then there is Genworth’s DTAs. The company has a regulator-approved tax sharing arrangement where HoldCo receives cash from its operating subsidiaries in order to pay Genworth’s tax liabilities. But because of Genworth’s past book operating losses, HoldCo can retain the cash and repurpose it for other uses. Through this tax sharing arrangement, HoldCo received $127m, $283m, and $370m cash tax payments in ’19, ’20, and ’21, respectively. Management has guided between $200-$250m in cash taxes to flow up to HoldCo in ’22, but has not provided guidance beyond year-end.

With that said, it is reasonable to believe Genworth will receive cash tax payments in ’23 and possibly into ’24. At the end of Q4’21, Genworth had a ~$500m in DTAs. Because the company expects to utilize at most $250m DTAs this year, that would leave ~$250m in ’23. Beyond that, an additional ~$200m in DTAs could become available depending on the outcome of the AXA v. Santander litigation. Keep in mind, however, Genworth must have taxable income to utilize its DTAs.

Proceeds from cash taxes will likely be used to fund Genworth’s plan to return capital to shareholders. Aside from authorizing a $350m share repurchase, the board of directors is contemplating a dividend starting in ’23. The repurchase plan is already well underway with $15m utilized in early May, and the remaining authorization is expected to be tapped throughout the remainder of ’22, and possibly into ’23.

Multi-Year Rate Action Plan (“MYRAP”)

It is also noteworthy to mention the progress being made under MYRAP. Genworth continues to make tremendous strides in effort to achieve breakeven in the company’s LTC business. The goal of MYRAP is to increase the amount of premiums from existing policies and/or reduce benefits in order to ensure that the business has enough assets to cover future LTC liabilities. The breakeven point is $28.7b on a net present value basis, of which Genworth has achieved $20.4b.

Genworth projects that claims for its legacy LTC policies will peak in ~’31. Right now management expects to achieve breakeven within the next 5 years, or ’27. The 5-year projection seems conservative, however, considering Genworth achieved ~$800m on a NPV basis in Q1’22 alone ($20.4b in Q1 – $19.6b in Q4). If management can maintain a similar cadence, then the shortfall will be achieved in less than 3 years! Moreover, Genworth will benefit from rising rates in its investment portfolio which will also help the company reach its goal in the long-term. Nevertheless, until Genworth achieves breakeven, the LTC business will continue to be held at zero value.

It is possible regulators slow down or stop approving Genworth’s rerating requests. There are already several hold-out states that continue to deny Genworth’s requests. If this continues, or more states stop approving the rerating, Genworth will likely be unsuccessful in achieving breakeven. This is unlikely, however, as regulators understand that they will be on the hook if the LTC business fails. Therefore, it is anticipated the majority of regulators will continue to approve Genworth’s actuarially justified rate increases.

Valuation

Applying a sum-of-the-parts valuation, Genworth is presently worth $5.20/sh, up from $4.35/sh previously estimated. The change in valuation is primarily attributable to the increased market value of Enact and the expectation that Genworth will receive additional cash taxes in ’23. The SOTP includes:

- Enact equity position = $3,189.1m (132.9m shares @$24/sh)

- Life business = $0

- Runoff = $0

- DTAs = $376m (NPV = rate (.15), $186m remaining in ’22, $250m in ’23)

- Net debt = $885m ($1,100m – $215m)

- SOTP = ~$5.20/sh (517.4m Q1 average diluted S/O)

The SOTP implies that Genworth is currently undervalued by ~28%. Going forward, it is anticipated that the SOTP will increase in the back half of the year as Genworth completes the redemption of its ’24 notes and reduces share count through its repurchase plan. This, of course, assumes Enact continues to trade in-line with its current valuation. Therefore, the upside is expected to increase from here if Genworth stays @$4/sh.

Overall, Genworth is creating real, tangible value for its shareholders. Inevitably this will translate into a higher stock price. Therefore, Genworth is a Buy.

This news is republished from another source. You can check the original article here

Be the first to comment