The adoption of Bitcoin (BTC) could occur more rapidly than the adoption of past disruptive technologies such as automobiles and electric power, with global take-up likely to hit 10% by 2030 according to a new report.

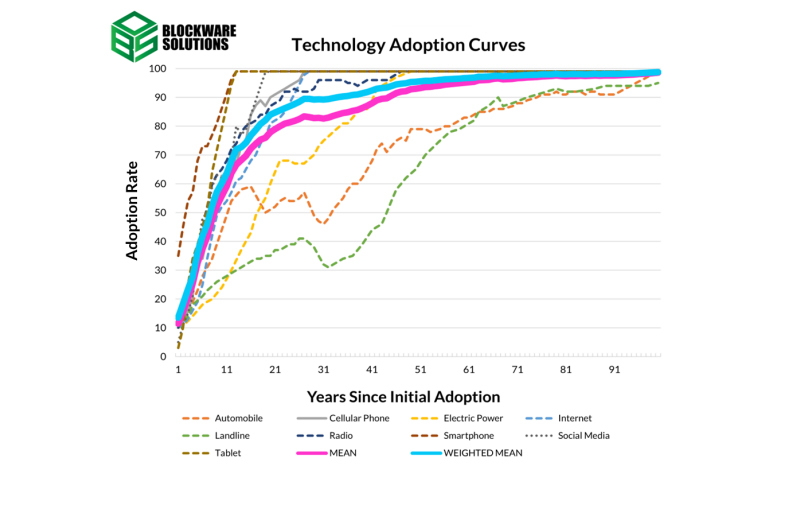

In its June 8 report, Blockware Intelligence said it arrived at this forecast by examining historical adoption curves for nine past disruptive technologies, including automobiles, electric power, smartphones, the internet, and social media, along with the growth rate of Bitcoin adoption since 2009.

All disruptive technologies follow a similar exponential S-curve pattern, but […] newer network-based technologies continue to be adopted much faster than the market expects.

Using the average and weighted average of historical technology adoption curves, as well as the growth rate of Bitcoin adoption, the report was then able to arrive at its prediction.

It said that based on a metric called Cumulative Sum of Net Entities Growth and Bitcoin’s predicted “CAGR of 60% we forecast that global Bitcoin adoption will break past 10% in the year 2030.”

Blockware Intelligence is the research arm of Blockware Solutions, a Bitcoin mining and blockchain infrastructure company, so you might expect it to be bullish on adoption.

The intelligence unit said it expects Bitcoin adoption to reach saturation quicker than many other disruptive technologies, given direct monetary incentives to adopt, the current macro-environment, and because adoption growth will be accelerated by the internet.

“From a consumer perspective, past technologies had convenience/efficiency-related incentives to adopt them: adopting automobiles allowed you to zoom past the horse and buggy, adopting the cell phone allowed you to make calls without being tied to a landline,” the report explains.

With Bitcoin direct financially incentivized adoption creates a game theory in which everyone’s best response is to adopt Bitcoin.

Bitcoin, like the internet, smartphones, and social media, also derives benefits the more people that adopt the technology, which is known as the “network effect”.

“Case in point if you were the only user on Twitter would it be of any value? It would not. More users make these technologies more valuable.”

However, the authors of the Blockware report stressed that the model used to predict the rate of adoption was only conceptual at this stage, adding it is neither meant to be used as investment advice nor a short-term trading tool and it would continue to be refined. However:

The general trend is clear; there is a high probability that Bitcoin’s global adoption will grow significantly into the future and thus so will price.

The report and model was reviewed by several crypto investors and analysts, including executives from Ark Invest, Arcane Assets, AMDAX Asset Management, and M31 Capital.

Cryptocurrency adoption has been growing rapidly over the last few years. In 2021, global crypto ownership rates reached an average of 3.9%, with over 300 million crypto users worldwide, according to data from TripleA, a global cryptocurrency payment gateway.

Blockchain data platform Chainanalysis last year revealed that global adoption of bitcoin and cryptocurrency surged 881% from July 2020 to June 2021. It found Vietnam to have the highest cryptocurrency adoption, leading 154 countries analyzed, followed by India and Pakistan.

In April, a survey conducted by cryptocurrency exchange Gemini found that crypto adoption skyrocketed in 2021 in countries like India, Brazil, and Hong Kong as more than half of respondents from its 20 countries polled stated that they started investing in crypto in 2021.

This news is republished from another source. You can check the original article here

Be the first to comment