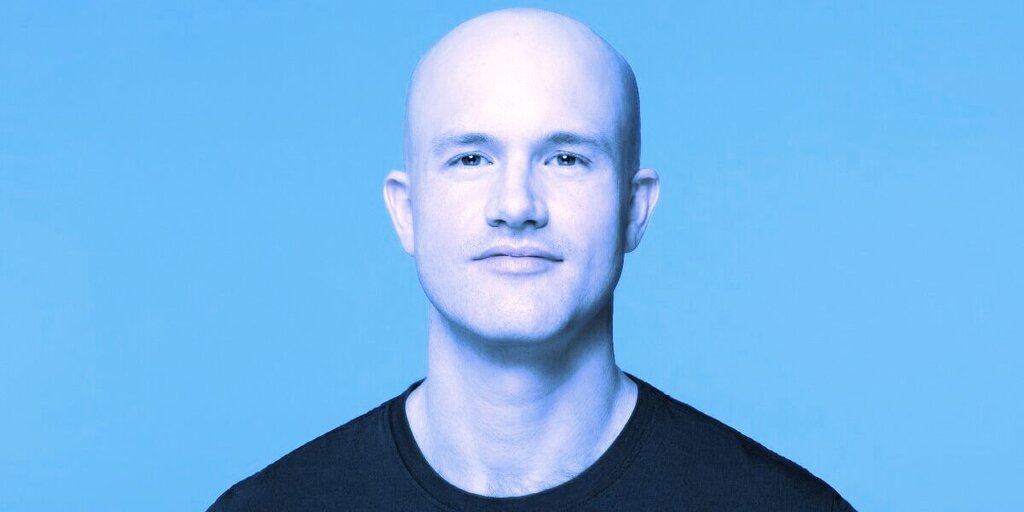

During Mainnet 2022 in New York City, Coinbase co-founder and CEO Brian Armstrong sat down for a chat with Messari co-founder and CEO Ryan Selkis to discuss Coinbase’s growing role in the industry.

“I’ve started to shift our point of view over time, and not just trying to build Coinbase, but how do we actually go out there and be a champion for the whole industry and defend the whole industry,” Armstrong said.

Being a trusted brand comes with compliance with regulations, he acknowledged. Still, Armstrong said his company is obligated to defend the industry and fund pushbacks when it sees policies unfair to crypto, prohibiting innovation, or exceeding regulatory authority.

The CEO of the largest U.S.-based cryptocurrency exchange pointed out that Coinbase supported the Tornado Cash users’ lawsuit against the U.S. Treasury earlier this month.

“Sanctioning open source software is like permanently shutting down a highway because robbers used it to flee a crime scene,” Armstrong wrote in a Coinbase blog post. “It’s not the best way to solve a problem. It ends up punishing people who did nothing wrong and results in people having less privacy and security.”

Before taking Coinbase public, Armstrong said he spoke with several CEOs who either had decided to go public or stay private on the pros and cons.

“[Going public] has put us on the main stage, where we’re able to get deals done with BlackRock and companies like Meta,” Armstrong said. “Now we’re the first Fortune 500 company doing crypto, and so we can go do deal with other Fortune 500 companies now, and they treat us more as a more legitimate force out there.”

He said another benefit of going public is the ability to raise funds quickly at attractive rates, saying Coinbase raised $3 million of debt last year in a week without needing to do a single meeting.

The downside, Armstrong said, is the scrutiny and media coverage.

“I think some of the scrutiny is not that helpful, to be honest,” he said. “It’s just people pushing their own narrative or trying to do anti-tech bias pieces, [that] should be labeled opinion pieces, but they’re not.”

But the negative press is just one of the issues facing Coinbase. After the U.S. Justice Department accused an ex-employee of insider trading in August, the SEC accused the exchange of listing unregistered securities.

Despite the scrutiny, investigations, and negative press, Armstrong says what matters most is building Coinbase’s list of products, customer protection with KYC (Know Your Customer) and AML (Anti-Money Laundering) policies, engaging with politicians and regulators, and supporting the industry.

“We’re just one of the companies building this movement,” Armstrong said. “It’s much more about the crypto space broadly than anything Coinbase is doing at this point.”

Stay on top of crypto news, get daily updates in your inbox.

This news is republished from another source. You can check the original article here

Be the first to comment