Bankless premium members get full access to the September edition of Bankless Token Ratings. This month, we’re rating SYN, CVX, VELO, UNI, MKR, and SOL. 👀

Also access the Inner Circle Discord, claim your community badge, and enjoy exclusive Token reports and airdrop guides when you subscribe!

Dear Bankless Nation,

Here’s a recap of the biggest crypto news in the second week of September.

If you Google “the merge” right now, here’s what you’ll see.

The Merge is once-in-a-lifetime. Google knows it.

It’s scheduled to take place on 13-15th September next week. Activated this week was “Bellatrix”, the one last major network upgrade that sets the stage for the Merge.

The #stakefromhome Twitter hashtag this week shows hundreds of Ethereum validators setting up their mining rigs from home, with the help of Rocket Pool.

If you still have questions about the Merge, read David’s Everything You Need To Know About The Merge. 👈

Behind every successful protocol is a strong stablecoin.

Curve’s own stablecoin crvUSD is right around the corner as its interface code on Github was made public this week and confirmed by founder Michael Egorov two weeks ago. The specifics of the crvUSD’s design isn’t known yet, but it’s likely an overcollaterized, crypto-backed stablecoin.

Back in July, Aave announced its own GHO stablecoin, which was passed unanimously in an August governance vote. That’s kind of bad for Maker, obviously. Every one GHO in Aave is one less DAI in Aave. Immediate reactions from the Maker community was one marked with concerns of “anti-competitiveness” and urgency to expand its own product offering towards lending markets in order to preserve its market share.

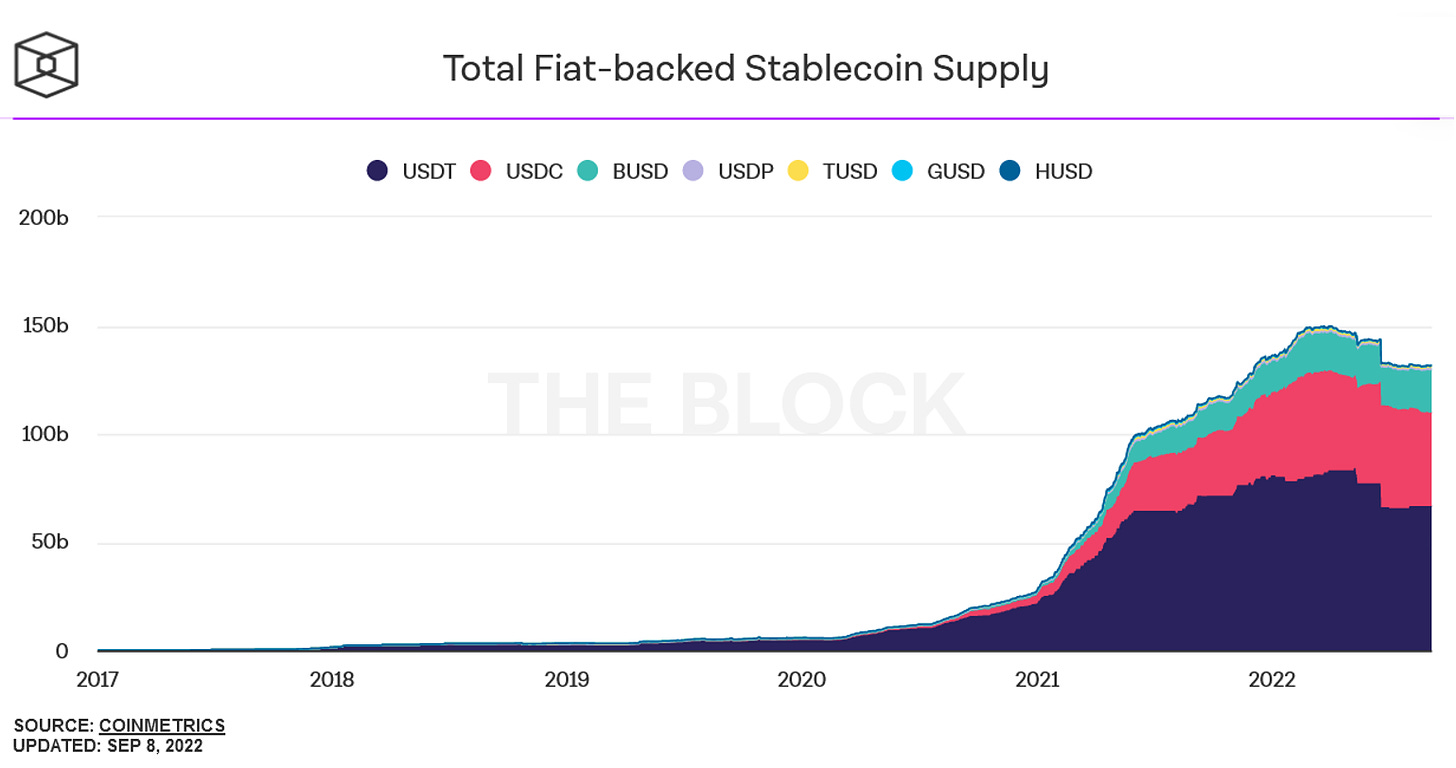

There are many moving pieces In the centralized stablecoins part of the crypto world too.

Binance announced Monday that by the end of September, it would automatically convert on its exchange three stablecoins USDC, USDP (Pax Dollar) and TUSD (TrueUSD) into its own native BUSD stablecoin, for reasons of “enhancing liquidity and capital-efficiency for users”.

A bunch of news headlines are reporting Binance’s move as “banishing” or “killing” or “no longer supporting” these competitor stablecoins, but that’s a lot of misleading clickbait.

You can still transfer and withdraw USDC/USDP/TUSD in and out of Binance – they’ll just be automatically converted into Binance’s native BUSD stablecoin on the backend for market-making reasons. This order book convergence is something that FTX and Coinbase already do on their own exchanges.

From a user perspective, this simply eliminates a step to convert their USDC/USDP/TUSD holdings into BUSD to trade on a BUSD pair, so you don’t have to worry about which flavor of USD has the most liquidity. I don’t know about you but having to pick between a dizzying array of similarly-named stablecoins to trade from in my early days of crypto was part of the horrendous process that makes crypto’s learning curve so steep for newbies.

Yet if users so wish, they’ll still be able to off-ramp those particular stablecoins into DeFi. Maybe it gives BUSD more of a marketing advantage, but that’s about it.

The real significance of this move lies in how Tether’s USDT is notably left out of the equation, thereby creating a wall of friction between USDT and every other consolidated stablecoin on the world’s largest crypto exchange. This was aptly pointed out by Wintermute CEO Evgeny Gaevoy, which Circle CEO Jeremy Allaire then tweeted out approvingly.

💡 Final thought: there’s an interesting comparison to be made between the competitive maneuvering in stablecoins between DeFi and CeFi:

Converging order books on centralized exchanges makes sense, but that still amounts to a strategically calculated business decision, as seen by Tether’s exclusion. What happens if and when Binance decides to cut USDC out from its consolidation? More importantly: how drastically does this move raise the entry barrier for emerging stablecoins that powerful exchanges like Binance don’t think is worthy?

In the world of CeFi, erecting such oligopolistic barriers and curating network effects is all fair game. In DeFi however, that ability is far more muted, for the simple reason that products are built on open-source code that is easily forkable. As such, walled gardens in DeFi are a lot harder to sustain.

That’s a good thing for market competition. The rate of experimentation in Web3 moves much faster because any latest trending project in DeFi is vulnerable to being duplicated, adapted and tinkered with as we’ve seen with countless examples: Sushiswap vs Uniswap, Olympus DAO and its forks, Curve’s vote-escrow model, and now with stablecoins.

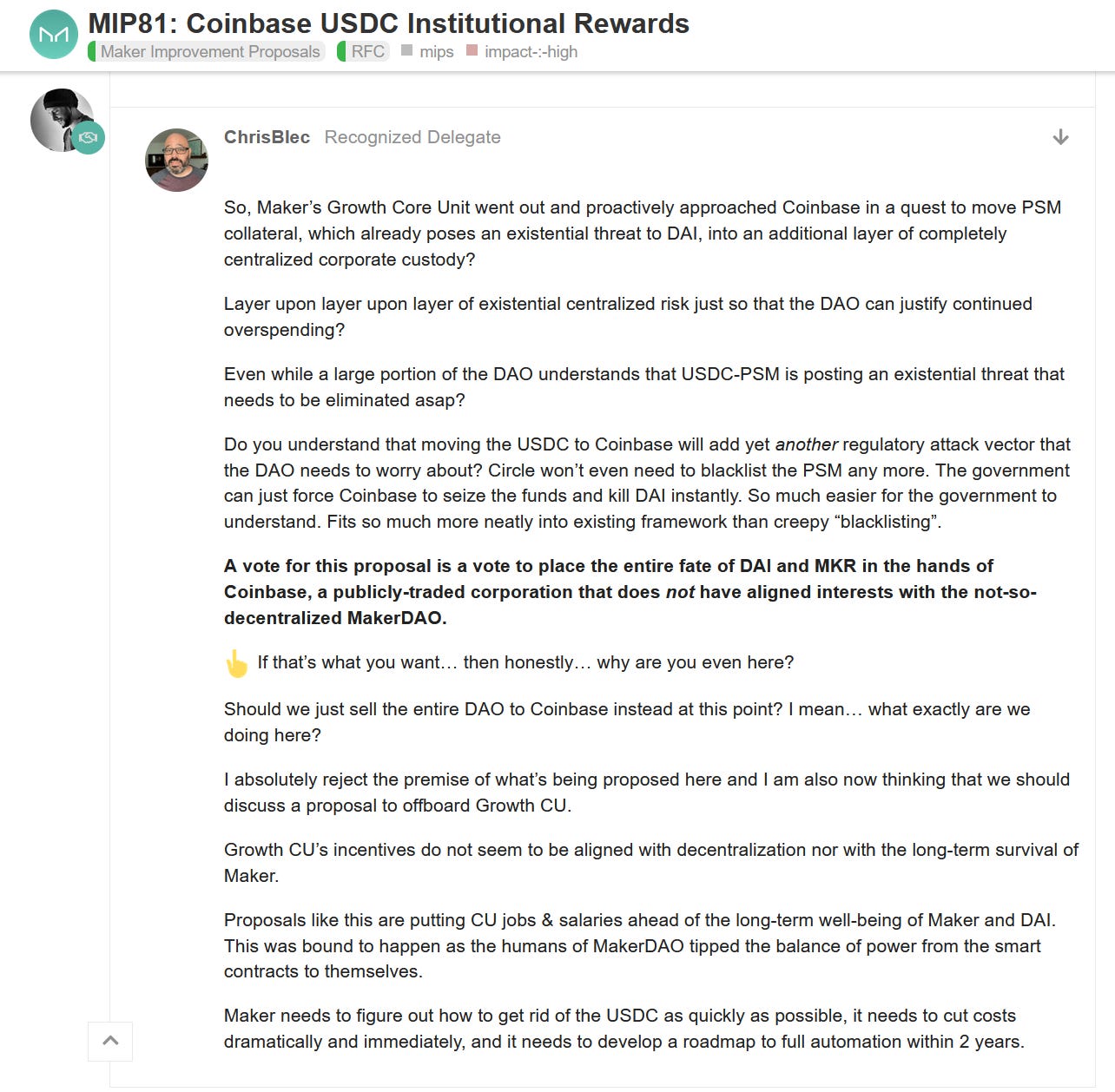

A Maker DAO governance proposal by Coinbase this week is proposing to transfer $1.6B of the DeFi giant’s USDC collateral under Coinbase’s custody of its “Institutional Rewards” program so it earns 1.5% APY on its USDC.

USDC makes up about ~35% of Maker’s collateral and this proposal, if passed, would net Maker ~24M in annual revenue.

Yay or nay? The proposal checks out for reasons of growth.

Maker’s peg-stability module (PSM) lets users mint DAI with dollar-stable assets like USDC, allowing it to scale easily as opposed to minting DAI with volatile collateral like ETH. One drawback though, is that USDC yield revenue goes to Circle, not Maker nor its users. The obvious solution here is for Maker to formulate a kind of profit-sharing agreement with any project whose collateral Maker uses to back DAI, and that’s exactly what this proposal does.

Rather than give it to Coinbase, an alternative is to farm the yield natively in DeFi lending markets like Aave or Compound, but such a colossal amount of USDC would compress the yields across DeFi and undermine DAI’s bottomline.

From a regulatory risk standpoint however, there’s not much to be excited about. Whether or not Maker’s USDC collateral is held within its own PSM vaults or under Coinbase’s custodianship, the possibility of those digital assets being frozen if regulatory hawks swoop in makes little difference.

Maker delegate Chris Blec makes this point more forcefully:

If Maker’s governance is confusing to follow, it’s because it is. To get up to speed, see my article last week on Maker’s existential crisis.

💡 Final thought: it’s worth pausing to marvel at the simple fact that a business decision involving $1.6B is up for open voting and debate. It’s fascinating because that’s unprecedented in the history of finance. Can you imagine Wells Fargo or Bank of America letting the public have a say in how they’re reinvesting retail user deposits? Or the US Treasury as to how it’s spending its managing its balance sheets? Coinbase isn’t a DAO, but the desire to transact one necessitates that it runs its proposals every step of the way through public scrutiny.

Coinbase is funding a lawsuit against the U.S. Treasury for its sanctions against Tornado Cash:

“Today we’re announcing that Coinbase is funding a lawsuit brought by six people challenging the United States Treasury Department’s sanctions of the Tornado Cash smart contracts and asking the Court to remove them from the U.S. sanctions list.

… while Treasury is allowed to sanction people (along with their property), Congress never gave it the power to sanction open source software. That’s why these plaintiffs are going to court to ask that this software be removed from the U.S. sanctions list.”

Here’s what’s lined up next week:

-

The Merge

See you on the other side.

– Donovan

🙏 Sponsor: Circle—Use code Bankless for $100 off Converge22 tickets 👀

Listen to podcast episode | Apple | Spotify | YouTube | RSS Feed

-

📺 Debating the Future of Crypto Security with Ian Rogers, Ledger

-

📺 Digidaigaku, DeGods/y00ts, The Stoics & More with Alexi Cortez

Bankless Premium Members get access to perks like these:

Launch your own raffle for Bankless Badge holders! Go ahead. We can’t stop you.

🗞️ Latest Weekly Rollup! Download the week in crypto to your brain in one show.

Listen to podcast episode | Apple | Spotify | YouTube | RSS Feed

✨See all listings on the Bankless Job Board✨

Go Bankless. $22 / mo. Includes archive access, Inner Circle & Badge—(pay w/ crypto)

Join us for Circle’s Converge22, a gathering for change makers looking to build what’s next in Web3. Converge22 is an unprecedented opportunity to dive deep, learn, collaborate and establish a shared vision of the crypto economy. Featuring wide-ranging demos and developer workshops, plus guest speakers including Aave’s Stani Kulechov, Compound’s Robert Leshner, Jill Gunter of Espresso Systems and more. And don’t miss an unforgettable after-hours at SFMOMA! Register with code Bankless for a discount!

Want to get featured on Bankless? Send your article to submissions@banklesshq.com

Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. This newsletter is not tax advice. Talk to your accountant. Do your own research.

Disclosure. From time-to-time I may add links in this newsletter to products I use. I may receive commission if you make a purchase through one of these links. Additionally, the Bankless writers hold crypto assets. See our investment disclosures here.

This news is republished from another source. You can check the original article here

Be the first to comment