The cryptocurrency market reached a valuation of over $3trn during the latter half of 2021, highlighting the exponential growth that this asset class has experienced in recent years. Much of this growth has been fuelled by retail traders hoping to generate market-beating returns.

With that said, if you’re an Australian trader who falls into this category, it’s vital to understand the investment process before entering the market.

In this guide, we discuss how to buy cryptocurrency in Australia in detail, reviewing the top platforms for trading crypto and showing you how to make your cryptocurrency investment today – all in a matter of minutes!

How to Buy Cryptocurrency Australia – Quick Guide

Are you wondering how to buy cryptocurrency in Australia? If so, the four quick steps below outline how to do so in minutes with our recommended broker, eToro.

- ✅Step 1 – Open an account with eToro: Head to eToro’s website and click ‘Join Now’. Provide an email address and choose a username and a password for your account. Once your account is created, complete the verification process by uploading proof of ID and proof of address.

- 💳Step 2 – Deposit: Deposit at least $50 (36.92 AUD) into your account via credit/debit card, bank transfer, or e-wallet.

- 🔎Step 3 – Search for Cryptocurrency: Type the name or ticker symbol of the crypto you’d like to buy into the search bar and click ‘Trade’.

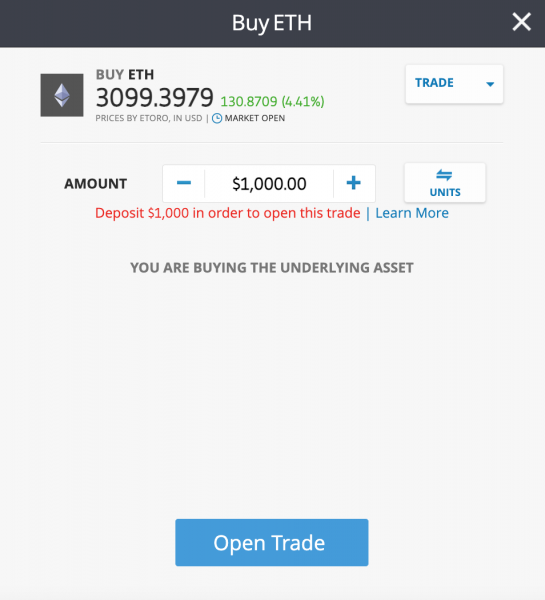

- 🛒Step 4 – Buy: In the order box that appears, enter your desired position size (minimum $10) and click ‘Open Trade’.

Where to Buy Cryptocurrency in Australia

Before you go ahead and buy cryptocurrency in Australia, your top priority should be to find a reputable trading platform to facilitate your crypto investments. There is an abundance of platforms and apps to buy cryptocurrency with, meaning the selection process can be quite daunting at first.

To aid with this process, we’ve completed the necessary research and testing, allowing us to narrow down the selection to our top five – all of which are reviewed below.

1. eToro – Overall Best Platform to Buy Cryptocurrency in Australia

Our number one pick when it comes to where to buy cryptocurrency in Australia is eToro. Launched in 2007, eToro has become one of the largest online brokers in the world and now boasts over 23 million registered users. The platform has a stellar reputation for safety, as it is regulated by multiple top-tier entities, including the ASIC, FCA, MiFID, FinCEN, and FINRA.

Users do not need to pay any transaction fees when placing a crypto trade, as all of eToro’s fees are built into the spread. The spread will vary from coin to coin, although it starts at 0.75% for BTC trading. There are no account fees, deposit fees, or withdrawal fees to worry about with eToro, although there is a small $10 charge per month after one full year of inactivity. Users can avoid this charge if they simply log in to their account, as this counts as activity.

At present, eToro offers 49 different cryptocurrencies to trade and regularly adds more as they become requested. New eToro users must deposit at least $50 (36.92 AUD) into their accounts before being able to trade, which can be completed via credit/debit card, bank transfer, or various e-wallets. Once the deposit is complete, eToro users can trade on the web app or mobile app, both of which synchronise seamlessly with one another.

Finally, eToro really stands out when it comes to features, as all users can download eToro’s free crypto wallet app (eToro Money) on iOS or Android. This allows the safe storage of crypto holdings through advanced DDoS protection and standardisation protocols. eToro users can even utilise the platform’s ‘CopyTrader’ feature, providing the ability to copy the trades placed by other experienced eToro traders – thereby automating the trading process!

Cryptoassets are a highly volatile unregulated investment product. No UK or EU investor protection.

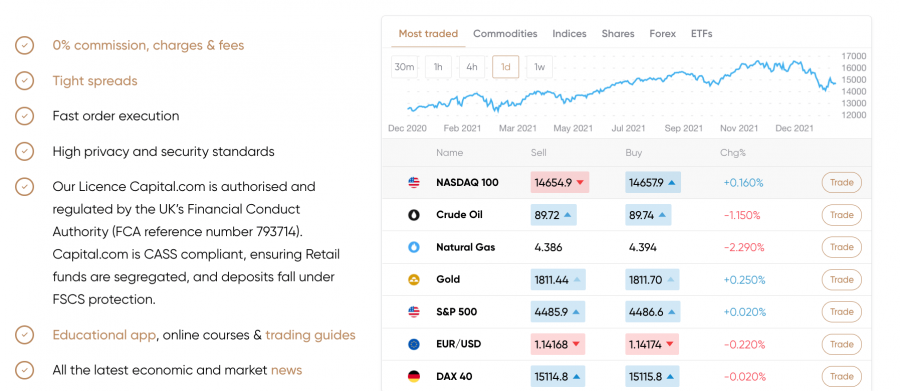

2. Capital.com – Popular CFD Broker with Leverage Facilities

If you’re looking for an alternative to eToro, we’d also recommend checking out Capital.com. Capital.com is a CFD broker launched in 2016 that has grown exponentially due to its low-cost trading options. The platform is regulated by the ASIC, FCA, CySEC, and NBRB, ensuring a high level of investor protection. What’s more, the account-opening process is seamless, fully digitised, and can be completed in minutes.

If you’re looking for an alternative to eToro, we’d also recommend checking out Capital.com. Capital.com is a CFD broker launched in 2016 that has grown exponentially due to its low-cost trading options. The platform is regulated by the ASIC, FCA, CySEC, and NBRB, ensuring a high level of investor protection. What’s more, the account-opening process is seamless, fully digitised, and can be completed in minutes.

As Capital.com is a CFD broker, all fees are incorporated into the spread, quoted on each asset’s listing page. Again, these vary depending on the asset, although they can start from around 34 pips for BTC/USD trading. Furthermore, Capital.com also offers up to 1:2 leverage when trading crypto CFDs. Notably, there will be a fee charged if you hold a leveraged position overnight, with the rate specified on the listing page.

One of the areas Capital.com stands out in is its trading platforms, as both the web-based app and the mobile app have sleek and clear interfaces. The mobile app also boasts two-step login and biometric authentication to boost security. Finally, both platforms come complete with price charts, technical indicators, and various order types to optimise the trading process.

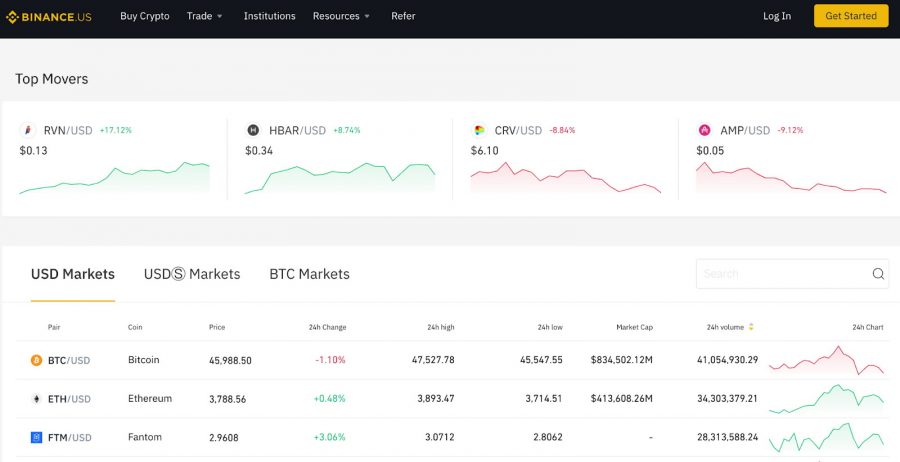

3. Binance – Best App to Buy Cryptocurrency with Low Fees

If you’re looking for the best app to buy cryptocurrency, Binance is worth considering. Binance is one of the largest cryptocurrency exchanges in the world, regularly handling over $14bn in daily trading volume. The platform offers over 500 crypto assets to trade, including altcoins, ERC-20 tokens, and crypto-to-crypto pairs. The great thing about Binance is that investing in the spot market will attract a fee of only 0.1% – one of the lowest in the industry.

If you’re looking for the best app to buy cryptocurrency, Binance is worth considering. Binance is one of the largest cryptocurrency exchanges in the world, regularly handling over $14bn in daily trading volume. The platform offers over 500 crypto assets to trade, including altcoins, ERC-20 tokens, and crypto-to-crypto pairs. The great thing about Binance is that investing in the spot market will attract a fee of only 0.1% – one of the lowest in the industry.

Users can reduce this fee by 25% by holding some Binance Coin (BNB) in their crypto wallets. In terms of account funding, Binance caters to all traders by offering FIAT deposits and crypto deposits. Crypto deposits are free for all supported coins, although a small withdrawal fee (and minimum withdrawal amount) applies. If you are based in Australia, you can also fund your account in FIAT via bank transfer – although this will require the completion of some KYC checks.

In terms of the trading process itself, Binance offers a web platform and a mobile app, both of which offer features for all experience levels. Both platforms allow users to buy crypto instantly with a credit card (for a fee) and earn interest on certain coins through Binance Earn. Finally, thanks to extensive price alert options and customisable charts, users can ensure they never miss a market opportunity.

Cryptoassets are a highly volatile unregulated investment product. No UK or EU investor protection.

4. Coinbase – Top Crypto Exchange Featuring Free Crypto Wallet

Although Binance offers the best app to buy cryptocurrency in our opinion, Coinbase is a close second. Coinbase was launched in 2012 and is also one of the top crypto exchanges in the world. The platform is registered and authorised by FinCEN and the FCA, and users can choose between a Coinbase and Coinbase Pro account depending on experience level – as each comes with its own features and fee structure.

Although Binance offers the best app to buy cryptocurrency in our opinion, Coinbase is a close second. Coinbase was launched in 2012 and is also one of the top crypto exchanges in the world. The platform is registered and authorised by FinCEN and the FCA, and users can choose between a Coinbase and Coinbase Pro account depending on experience level – as each comes with its own features and fee structure.

The former targets retail investors and charges a transaction fee and the spread when placing a crypto trade. The transaction fee varies depending on trade volume and payment method, although the spread typically sits at around 0.50% for most coins. Coinbase Pro accounts utilise a ‘maker/taker’ model, with fees based on the trader’s 30-day trading volume. Anything less than $10,000 per month will equate to 0.50% per trade fee.

In terms of asset selection, Coinbase offers over 90 coins to trade, along with 81 crypto-to-crypto trading pairs. The Coinbase mobile app has one of the best interfaces on the market, making it simple to buy and sell crypto in just a few taps. Finally, all Coinbase users get access to the platform’s free crypto wallet app, called Coinbase Wallet. This self-custody wallet allows the easy storage of crypto holdings and supports over 4000 different assets – including NFTs!

Cryptoassets are a highly volatile unregulated investment product. No UK or EU investor protection.

5. AvaTrade – Best Platform to Buy Cryptocurrency in Australia with ASIC Regulation

Rounding off our list of the best places to buy cryptocurrency in Australia is AvaTrade. AvaTrade is a respected CFD broker with extensive regulation from top-tier entities, including the ASIC and The Central Bank of Ireland. The platform offers 13 different coins to trade, along with a ‘Crypto10’ index that provides exposure to the top ten cryptocurrencies as measured by market cap.

Rounding off our list of the best places to buy cryptocurrency in Australia is AvaTrade. AvaTrade is a respected CFD broker with extensive regulation from top-tier entities, including the ASIC and The Central Bank of Ireland. The platform offers 13 different coins to trade, along with a ‘Crypto10’ index that provides exposure to the top ten cryptocurrencies as measured by market cap.

As a CFD broker, all of AvaTrade’s trading fees are built into the spread. These spreads are relatively competitive for the major coins, with BTC trading as low as 0.20% over-market. AvaTrade also offers up to 1:2 leverage when crypto trading, and there are no commissions to open or close a trade.

AvaTrade also optimises the trading process by offering MT4 and MT5 support. Users can download and log into both of these platforms with their AvaTrade credentials, providing the option to use powerful charting tools and the ability to conduct backtesting. Finally, AvaTrade even supports AUD as a base currency and accepts deposits from only 100 AUD – meaning there are no currency conversion fees to contend with for Australian traders.

Should I Buy Cryptocurrency?

So, should you buy cryptocurrency Australia? The answer to this question will vary from investor to investor, as each person will have a unique set of investment goals and their own risk appetite. Cryptocurrency can be highly volatile relative to other asset classes, so entering the crypto market should be a decision that is taken with significant consideration.

As noted by The Times, one key aspect of the crypto market is that it is open 24/7 – which isn’t the case with the equity market. As such, traders can often identify profitable opportunities over the weekend, even when trading volume is low. Furthermore, digital currencies can help diversify your portfolio and provide a hedge against inflation – although we will discuss this more in the section below.

Benefits of Buying Cryptocurrency

As touched on above, investing in cryptocurrency is accompanied by many benefits. Let’s explore some of the main ones:

High Returns Potential

If you buy cryptocurrency Australia, you’ll be purchasing an asset class that has exhibited incredible performance in recent years. Data gathered from UpMyInterest notes that Bitcoin (BTC) has returned over 60% in each of the past three years – and even produced a remarkable 302.8% return in 2020 alone! Although cryptocurrency can be more volatile than traditional asset classes such as equities and bonds, it’s ideal for speculative investors with high risk tolerance.

Portfolio Diversification

Building a portfolio of numerous cryptocurrencies can help spread the risk and optimise your risk-return ratio. Furthermore, certain equities have displayed negative correlations with specific coins in the past. For example, an article by Medium noted that BTC showed a negative correlation with PayPal and Block Inc (formerly Square), meaning it could help mitigate the risk from these equities.

Store of Value

Bitcoin has long been touted as a store of value, with many market commentators arguing that the crypto could offer a viable alternative to gold. Gold has been the traditional ‘go-to’ asset to hedge against inflation, which is an issue in certain countries right now. As more investors hold BTC, there is scope for it to become another ‘safe haven’ in times of macroeconomic turmoil.

Staking Rewards

Certain cryptocurrencies can be ‘locked up’ to help validate transactions on the associated blockchain network, allowing investors to earn interest on their holdings. Staking works similarly to depositing into a bank account, although yields tend to be far higher than with FIAT deposits. For example, Staked.us notes that yields in real terms for Terra staking can reach as high as 7.7% per annum!

Growing List of Use Cases

Finally, investing in cryptocurrency offers numerous benefits beyond just speculative ones. More merchants than ever accept crypto payments these days, which help customers maintain a higher level of anonymity than using FIAT to pay for goods and services. Furthermore, the growing area of decentralised finance (DeFi) looks likely to revolutionise the lending and borrowing process, meaning that owning crypto could make obtaining loans much simpler in the years ahead.

When to Buy Cryptocurrency

Investing in crypto optimally isn’t just a case of knowing which is the best cryptocurrency to buy now – it’s also essential to know when to make your investment. As numerous coins showed last year, the crypto market is a place where triple-digit (and even quadruple-digit) returns aren’t abnormal. So, how do you ensure that you make your crypto trade at the right time to optimise returns.

The ideal way to do this is to ‘buy the dip’. Ultimately, this is easier said than done, as there’s no way of knowing in advance what ‘the dip’ is. However, conducting extensive technical analysis is one way of identifying areas where price may reverse whilst in a downtrend – allowing investors to buy crypto at a price point that maximises future gains.

One key way of identifying these price points is to determine significant support areas on the price chart. As evidenced by the image above, identifying these areas can provide buying opportunities if there is a clear rejection on the 1H, 4H, or Daily timeframes. Not every support level will hold, although traders can mitigate this by setting their stop losses below support – so if the stop loss is triggered, the trade idea will be invalidated anyway.

Another strategy that investors can employ is to utilise moving average indicators. As explained by Yahoo Finance, these indicators take the ‘average’ of a specified number of price points to help show the general trend without the more extreme price movements along the way.

The image above presents the BTC price chart with the 200-day exponential moving average (EMA) highlighted in blue. As you can see, this moving average also acts as a support level, meaning that any rejections from the trendline can offer scope for price reversals. Again, much like with horizontal support levels, these indicators aren’t foolproof – although when combined with other types of analysis, they can generate high-probability trade ideas.

Which Are the Best Cryptocurrencies to Buy?

At this point, you may be wondering, ‘What cryptocurrency should I buy?’. There are thousands of coins to consider for investment within the cryptocurrency market, each offering its own unique use case and price potential.

To smooth the decision-making process, we’ve scoured the market and found five of the best cryptocurrencies to buy now – all of which are examined below.

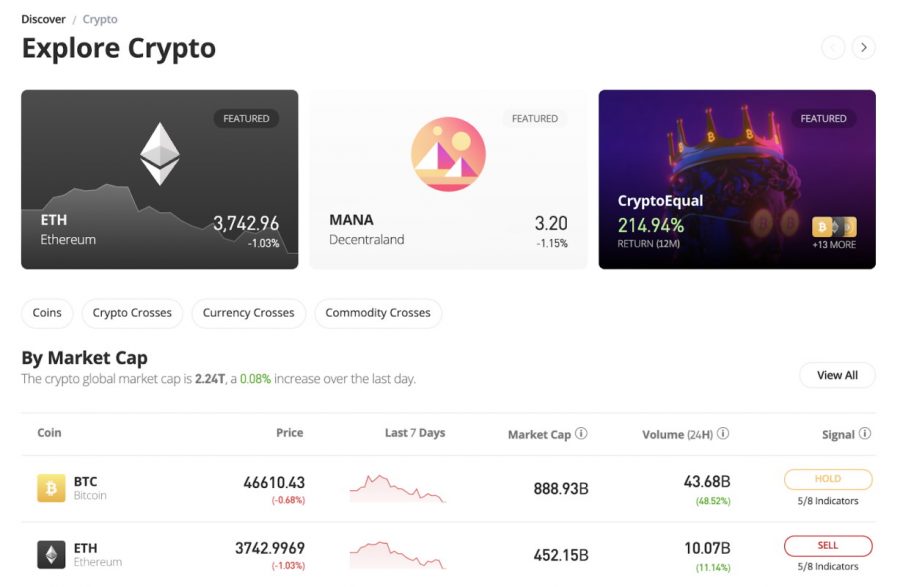

1. Ethereum (ETH)

Our pick for the best cryptocurrency to buy 2022 is Ethereum. Most people will have heard of Ethereum, as it is the world’s second-largest cryptocurrency, according to CoinMarketCap. Put simply, Ethereum is an open-source blockchain network that provides a medium for developers to build and host decentralised apps (dApps).

Our pick for the best cryptocurrency to buy 2022 is Ethereum. Most people will have heard of Ethereum, as it is the world’s second-largest cryptocurrency, according to CoinMarketCap. Put simply, Ethereum is an open-source blockchain network that provides a medium for developers to build and host decentralised apps (dApps).

These dApps can also utilise smart contracts, which eradicate the need for an intermediary in many transactions. At present, Ethereum has over 3700 dApps built on the platform – and this figure will continue to rise throughout 2022. Furthermore, with the upcoming release of Ethereum 2.0, the platform is set to become much more scalable, making ETH an excellent investment for exposure to the network’s growth.

Cryptoassets are a highly volatile unregulated investment product. No UK or EU investor protection.

2. Decentraland (MANA)

Decentraland is a virtual world hosted on the Ethereum blockchain that was one of the earliest to popularise the concept of the ‘metaverse’. In this world, users can create their own avatars and buy plots of land by using MANA – Decentraland’s native token. The exciting thing is that in-game items are structured as NFTs, meaning users can monetise them and build a working economy.

Decentraland is a virtual world hosted on the Ethereum blockchain that was one of the earliest to popularise the concept of the ‘metaverse’. In this world, users can create their own avatars and buy plots of land by using MANA – Decentraland’s native token. The exciting thing is that in-game items are structured as NFTs, meaning users can monetise them and build a working economy.

As recently as December 2021, Decentraland reached 500,000 monthly active users and is now generating mass appeal thanks to in-game concerts and events. Looking ahead, as advertisers begin to understand the potential the metaverse has, platforms such as Decentraland will continue to grow – which is why MANA is such an exciting investment prospect for the years ahead.

Cryptoassets are a highly volatile unregulated investment product. No UK or EU investor protection.

3. Aave (AAVE)

Aave is one of the most appealing DeFi projects in operation, as it is a digital ‘money market’ built on the Ethereum blockchain. Essentially, Aave allows users to borrow and lend cryptocurrency without the need for extensive credit checks or KYC information. Furthermore, Aave offers a unique ‘flash loans’ feature, which are immediate loans facilitated through smart contracts that provide scope for arbitrage.

Aave is one of the most appealing DeFi projects in operation, as it is a digital ‘money market’ built on the Ethereum blockchain. Essentially, Aave allows users to borrow and lend cryptocurrency without the need for extensive credit checks or KYC information. Furthermore, Aave offers a unique ‘flash loans’ feature, which are immediate loans facilitated through smart contracts that provide scope for arbitrage.

Aave facilitates the lending and borrowing process through smart contracts, making the entire network ‘trustless’. Instead of using FIAT as collateral, Aave users can deposit crypto into liquidity pools and earn a return in the process. AAVE, the native token of this network, is used for governance and speculative purposes, making it a great way to gain exposure to the DeFi space.

Cryptoassets are a highly volatile unregulated investment product. No UK or EU investor protection.

4. Solana (SOL)

Solana is a blockchain network that offers a viable alternative to Ethereum, thanks to increased scalability. Unlike Ethereum, Solana uses a ‘Proof-of-Stake’ algorithm to achieve consensus, allowing more transactions per second (TPS) and lower network fees.

Solana is a blockchain network that offers a viable alternative to Ethereum, thanks to increased scalability. Unlike Ethereum, Solana uses a ‘Proof-of-Stake’ algorithm to achieve consensus, allowing more transactions per second (TPS) and lower network fees.

As a blockchain network, Solana allows developers to build dApps and even mint NFTs. SOL, the network’s native token, works similarly to ETH and can be staked or used to pay fees. Finally, although Solana is still early in its development, it could become one of the go-to networks in the future for dApp developers.

Cryptoassets are a highly volatile unregulated investment product. No UK or EU investor protection.

5. Chainlink (LINK)

Chainlink is an exciting cryptocurrency, as it comprises a decentralised ‘oracle network’ that provides data to blockchains. As these blockchains are decentralised, they cannot obtain off-chain data easily. Chainlink looks to solve this issue through trusted oracles that must stake collateral to ensure the information they are providing is accurate.

Chainlink is an exciting cryptocurrency, as it comprises a decentralised ‘oracle network’ that provides data to blockchains. As these blockchains are decentralised, they cannot obtain off-chain data easily. Chainlink looks to solve this issue through trusted oracles that must stake collateral to ensure the information they are providing is accurate.

When an oracle provides off-chain data to a blockchain network, the oracle is rewarded in LINK – Chainlink’s native token. However, LINK is also used as a speculative asset by investors, as it provides exposure to the growth of the Chainlink network. Thanks to Chainlink’s valuable use case and the fact that it doesn’t have any real competitors at present, this crypto could be one of the most promising in the months ahead.

Cryptoassets are a highly volatile unregulated investment product. No UK or EU investor protection.

Ways of Buying Cryptocurrency

When considering how to buy cryptocurrency in Australia, another factor to be aware of is how to facilitate your investment. Ultimately, this boils down to which payment method you will use to deposit into your trading account and place your trade.

Thanks to the technological advances we have seen in the past decade, the process to buy cryptocurrency in Australia has never been more straightforward – with PayPal and card purchases forming two of the most popular approaches.

Buy Cryptocurrency with PayPal

According to data gathered from Statista, PayPal had over 416m active user accounts during Q3 2021. This highlights the wide usage of the platform and provides context as to why numerous brokers now accept PayPal as a payment method. Aside from its user-friendliness, many traders prefer to use PayPal during the investment process due to its high level of protection.

Currently, PayPal only allows US-based clients to buy cryptocurrency directly through the platform. However, traders can buy cryptocurrency with PayPal indirectly by funding their brokerage account using the platform. For example, eToro allows fee-free PayPal deposits that tend to arrive instantly – and users can even withdraw future profits back to their PayPal balance in just a few clicks.

Buy Cryptocurrency with Credit Card or Debit Card

Another popular option to buy cryptocurrency in Australia is to use a credit or debit card. Usually, this can be completed in one of two ways.

- Depositing into your trading balance using a credit or debit card

- Instantly buying crypto using a credit or debit card

The first approach is the most common and tends to be accompanied by lower fees than the second approach. However, the option to buy crypto instantly using a credit or debit card is ideal for traders looking to invest as quickly as possible. Numerous top crypto exchanges now offer this option, such as Binance and Coinbase.

How to Buy Cryptocurrency Safely

For those wondering how to buy and sell cryptocurrency, safety should be one element of the trading process that is given significant consideration. When deciding where to buy cryptocurrency in Australia, it’s vital to avoid unlicensed or unregulated platforms, as these offer no investor protection whatsoever. Unregulated platforms do not have a framework to protect traders from fraud or scams and do not have any compensation coverage if the platform were to go bankrupt.

Thus, to ensure you can trade safely, it’s wise to review a platform’s regulation before signing up. If you are an Australia-based trader, the regulatory body you should keep an eye out for is the Australian Securities and Investments Commission – commonly referred to as ASIC. ASIC has numerous responsibilities, although administering and enforcing financial laws within Australia is one of its main ones, which are designed to protect investors.

Aside from ASIC, other regulatory bodies worldwide offer a massive degree of credibility to a platform – even if they don’t operate within the same jurisdiction. An example of this would be with eToro, as the platform is regulated by ASIC and the FCA, CySEC, MiFID, FinCEN, and FINRA. Through this extensive regulation, traders can be confident that eToro’s structure is transparent and that the broker is held accountable for everything that occurs on the platform.

How to Buy Cryptocurrency in Australia – Tutorial

Now that you understand all of the crucial facets of crypto trading, let’s turn our attention to how to buy cryptocurrency in Australia. As noted earlier, we recommend partnering with eToro for this, as the platform is ASIC-regulated and features 49 different cryptocurrencies to trade.

With that in mind, here are the four quick steps to take to buy cryptocurrency in Australia with eToro:

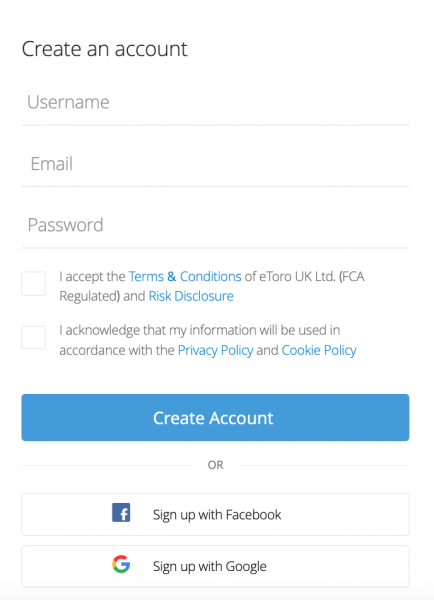

Step 1 – Create an eToro Account

Head to eToro’s website and click ‘Join Now’. Enter your email address on the following page and choose a username and a password for your account. Alternatively, you can also complete this process on the eToro mobile app, which you can download from the App Store or Google Play.

Step 2 – Verify your Account

Click ‘Complete Profile’ on your account dashboard and enter the personal details required for eToro’s KYC checks. You’ll also be asked to upload a photo ID (passport or driver’s license) and proof of address (bank statement or utility bill).

Step 3 – Make a Deposit

Click ‘Deposit’ on your account dashboard and enter the amount you’d like to fund your account with. eToro requires a minimum deposit of $50 (36.92 AUD), with the following payment methods accepted for Australian clients.

- Credit card

- Debit card

- Bank transfer

- POLi

- PayPal

- Neteller

- Skrill

Step 4 – Buy Cryptocurrency

Type the name or ticker symbol of the cryptocurrency you’d like to buy into the search bar and click the ‘Trade’ button next to the relevant entry in the drop-down menu. An order box will then appear, much like the one below. In this box, enter your desired position size (minimum $10), check everything is correct, and click ‘Open Trade’.

How to Sell Cryptocurrency

If you’ve made a successful cryptocurrency investment and wish to close out the position to receive your profits, you’ll be glad to know that the process is incredibly straightforward to complete. Noted below is how to sell cryptocurrency with eToro in seconds:

- Click on the ‘Portfolio’ tab on your eToro account dashboard

- Click on the name of the cryptocurrency you’d like to sell

- Click the red ‘X’ next to the specific position you’d like to close

- In the order box that appears, click ‘Close Trade’.

Once the trade has been closed, the position’s value will be added to your trading balance in your account’s base currency.

How to Buy Cryptocurrency in Australia – Conclusion

In summary, this guide has taken a comprehensive look at how to buy cryptocurrency in Australia, reviewing the best trading platforms on the market and showing you how to make your crypto investment today.

Although there are plenty of crypto trading platforms to choose from, we recommend that Australia-based traders use eToro. eToro is regulated within Australia by the ASIC, ensuring a high degree of investor protection. What’s more, as eToro charges no hefty transaction fees and offers tight spreads when crypto trading, the platform is ideal for investors looking to trade cost-effectively.

Cryptoassets are a highly volatile unregulated investment product. No UK or EU investor protection.

FAQs

Can I buy cryptocurrency in Australia?

What is the best platform to buy cryptocurrency in Australia?

Can I buy crypto on Coinbase in Australia?

Is cryptocurrency a good investment?

Which cryptocurrency should I buy?

How do you buy cryptocurrency in Australia?

What is the best time to buy cryptocurrency?

This news is republished from another source. You can check the original article here

Be the first to comment