| Number of Cryptos | 80+ (US clients) |

| Trading Commission | Up to 0.10% |

| Debit Card Fee | 4.5% plus an instant buy fee of 0.5% |

| Minimum Deposit | Depends on the payment method |

What We Like:

- 80+cryptocurrencies to trade in the US

- Low trading commissions

- Advanced trading app for iOS and Android

- Suitable for technical traders

Cryptoassets are a highly volatile unregulated investment product. No UK or EU investor protection.

Cryptocurrency Trading Explained – Overview

The main premise of cryptocurrency trading is much the same as any other investment sector. For instance, just like stock trading, you will be buying and selling cryptocurrencies with the view of making a profit. You will be able to achieve this goal when you correctly predict the future direction of the market.

For example, if you stake $1,000 on Bitcoin at $40,000 per token and the digital currency increases to $44,000 – this would represent gains of 10% – or $100. And, just like stocks, cryptocurrency prices are determined by demand and supply. As such, the value of a cryptocurrency token will change on a second-by-second basis.

As we explained earlier, you will need an account with a cryptocurrency exchange or broker in order to access this marketplace. You also need to remember that cryptocurrencies are both speculative and volatile, so wild pricing swings should be expected. This makes the process of learning how to trade cryptocurrency even more important.

One of the best ways to approach the market is to understand risk-management tools. For example, by deploying stop-loss orders on every cryptocurrency trade that you place, you will never lose more than you are comfortable with. Bankroll management is also important. This will dictate how much of your account balance you can risk on a trade, in percentage terms.

How Does Crypto Trading Work?

In the sections below, we explain the fundamentals of how crypto trading works. Be sure to read through each section to ensure that you are able to enter this market with your eyes wide open.

Crypto Trading Pairs

The first thing to note is that when you trade cryptocurrency, you will be speculating on ‘pairs’. Each pair will contain two assets – which can be fiat or cryptocurrency, or a combination of both.

For example, when you use a regulated broker like eToro, you can trade dozens of cryptocurrencies against the US dollar. This makes it easier to assess the current and future value of your chosen digital currency.

However, when you use a cryptocurrency exchange that does not have the legal remit to deal with US dollars, you will likely be trading your chosen digital asset against a stablecoin like Tether.

Tip: If this is your first time learning how to trade cryptocurrency – then it’s best to start off with BTC/USD. This pair – which will see you trade the future value of Bitcoin against the US dollar, offers the most liquidity, least volatility, and tightest spreads.

Crypto Trading Orders

Once you have decided which cryptocurrency pair to trade, you then need to set up an order. As a beginner, you might want to start off with a market order – which allows you to place a trade instantly at the next best available price.

When you feel more comfortable with how the markets work, you might then enter a cryptocurrency trade with a limit order. This enables you to specify the exact price that your order is executed.

Moreover, you will need to specify your stake when placing a cryptocurrency trading order. This simply refers to the amount of money – in dollar terms, that you wish to risk on the position.

Crypto Trading vs Investing?

When you invest in cryptocurrency, you are typically doing so as part of a long-term strategy. This means that you can buy a cryptocurrency and leave the tokens in your wallet for several months or years.

As such, there is no requirement to actively analyze cryptocurrency prices and market trends. Cryptocurrency trading takes a different approach to investment, insofar that you will be looking to enter and exit positions on a shorter-term basis.

- For instance, you might decide to buy Ethereum on Monday morning because its price has dipped to $2,700 and then cash out on Wednesday afternoon when the token increases to $3,000.

- In another example, a cryptocurrency trader might even open a position and close it a few hours later.

- For example, at 9 am, you might buy BNB at $420.

- And then at 11.30 am, when BNB hits $441, you might cash out at gains of 5%.

Ultimately, while cryptocurrency investing is suitable for passive strategies, trading requires you to actively monitor and analyze the markets to stay ahead of the game at all times.

Why Trade Cryptocurrency?

There are many assets that you can trade as part of a short-term strategy. This includes stocks, forex, and even commodities like oil and gold.

With this in mind, in the sections below, we explain why you might decide to trade cryptocurrencies as opposed to conventional financial instruments.

Market Diversity

In a similar nature to stocks, there are thousands of cryptocurrencies that you can buy and sell in the open marketplace. This means that you will never be short of trading opportunities.

Moreover, there are cryptocurrencies to suit all financial objectives and appetite for risk. For example, if you are learning how to trade cryptocurrency as a complete beginner – then you might decide to stick with large-cap projects. This would include the likes of Bitcoin, Ethereum, and BNB – all of which carry huge market capitalization.

On the other hand, if you seek higher levels of volatility, then you might look to trade smaller-cap cryptocurrencies like Compound, Chiliz, Enjin, and Dash. These projects each carry a market capitalization of under $2 billion.

If you really have an appetite for high risk, you might even consider trading micro-cryptocurrencies that have a market capitalization of under $100 million.

Volatility

Another reason why short-term traders are now turning to cryptocurrency is that this marketplace is extremely volatile – especially in relation to traditional stocks.

For example, it is not unusual for smaller-cap cryptocurrencies to increase in value by several hundred percent in just a single day of trading. At the other end of the scale, the value of a cryptocurrency can decline by over 90% in the same timeframe.

Such huge pricing swings won’t be suitable if you are just learning how to trade cryptocurrency. Instead, it’s best to stick with the likes of Bitcoin and Ethereum, which, will rarely move in value by over 10% in a 24-hour period.

Huge Growth Potential

Even short-term traders can target significant gains in a short period of time.

- For example, let’s suppose that you staked $2,000 on STEPN.

- When you opened the trade on April 12th, 2022 – STEPN was priced at $2.20 per token.

- On April 19th, 2022, STEPN was trading at $3.34.

- As such, in just seven days of trading, the value of your position increased by over 50%.

- This means that on an original stake of $2,000 – you made a profit of $1,000.

This example is just one of many. The key point is that the cryptocurrency markets provide plenty of high-growth trading opportunities each and every day.

Cryptoassets are a highly volatile unregulated investment product.

How to Make Money from Crypto Trading?

There are a wide variety of ways to make money from the cryptocurrency trading markets – which we discuss in more detail in the sections below.

Cryptocurrency Trading Capital Gains

The main way that seasoned cryptocurrency traders make money is via capital gains. This refers to the amount of profit that a trader makes from a specific position.

You can work this out by subtracting the price that you paid for the cryptocurrency from the value at which you cashed the position out.

For example:

- Let’s say that you stake $1,000 on ETH/USD

- When you place the order, ETH/USD is priced at $2,900

- A couple of days later, ETH/USD has increased to $3,100

- This translates into gains of 6.8%

- On a stake of $1,000, the capital gains on this position amount to $68

Don’t forget, cryptocurrency exchanges are in the business of making money – so you will also need to factor in trading fees.

Liquidity Provision

Another way that you can make money trading cryptocurrency is to provide exchanges with some much-needed liquidity. This is more of a passive trading strategy, insofar that you won’t actually be buying and selling digital currencies yourself.

Instead, by depositing surplus tokens into an exchange, you will be paid interest. One of the best ways of achieving this is via crypto yield farming, which, in return for depositing cryptocurrency into a liquidity pool, will allow you to earn interest.

Other Ways to Make Money

In addition to the above, you can also make money from cryptocurrency trading via:

Cryptocurrency Trading Hours

The traditional stock markets operate during fixed hours from Monday to Friday. When trading cryptocurrency, however, you will be gaining exposure to a marketplace that never closes.

This means that you can enter buy and sell positions 24 hours per day, 7 days per week. With that said, trading volumes dip significantly over the weekend. This will result in wider pricing gaps and lower levels of liquidity.

As a beginner learning how to trade cryptocurrency for the first time, it’s, therefore, best to avoid placing orders on Saturday or Sunday.

Instead, it’s wise to engage with the markets between Monday and Friday – which is where the vast majority of trading activity is undertaken.

Crypto Price Movements

Cryptocurrencies are valued based on demand and supply. However, unlike the traditional stock markets, there is no single centralized exchange like the NYSE or NASDAQ. Instead, cryptocurrencies are traded across a wide variety of exchanges.

And as such, there will always be a slight variation in prices between each provider. With that said, the forces of market arbitrators ensure that these pricing differences are minute.

For example, as of writing, BTC/USD is priced at $40,719 on Coinbase. On FTX, the same pair is priced at $40,721. As such, this amounts to a difference of just 0.0049%.

The best way to assess crypto price movements is at CoinMarketCap – which is the gold standard for real-time valuations across more than 300 exchanges.

What are the Best Cryptocurrencies to Trade?

According to CoinMarketCap, there are nearly 19,000 cryptocurrencies in circulation that can be traded online.

If you’re wondering which best altcoins to target when trading, consider the five tokens discussed below.

1. Lucky Block (LBLOCK)

Lucky Block is perhaps the best cryptocurrency to trade if you’re looking to gain exposure to one of the hottest digital asset projects of 2022. Launched in January 2022, Lucky Block was initially available to buy at just $0.00015 during its presale campaign.

Lucky Block is perhaps the best cryptocurrency to trade if you’re looking to gain exposure to one of the hottest digital asset projects of 2022. Launched in January 2022, Lucky Block was initially available to buy at just $0.00015 during its presale campaign.

Just a month later, Lucky Block hit an all-time high of over $0.09. This translates into gains of nearly 6,000%. As such, this is a great example of how a shrewd cryptocurrency trader can make unprecedented gains in a short period of time.

Lucky Block – which is building the world’s first decentralized lottery ecosystem, has since gone through a market correction. Therefore, you can still trade this digital currency while it is changing hands at a discounted price.

Cryptoassets are a highly volatile unregulated investment product.

2. Bitcoin (BTC/USD)

If you’re somewhat unprepared for high levels of volatility, then perhaps the best cryptocurrency to trade as a beginner is Bitcoin. As noted earlier, when using a regulated broker like eToro, you can access BTC/USD – which will allow you to trade Bitcoin against the US dollar.

BTC/USD trades for tens of thousands of dollars, albeit, you only need to meet a minimum trade size of $10 at eToro. In terms of volatility, BTC/USD has seen 52-week highs and lows of $68,700 and $28,800 respectively.

Cryptoassets are a highly volatile unregulated investment product.

3. Ethereum (ETH/USD)

In terms of valuation, Ethereum is the second-largest cryptocurrency. Naturally, attracts large trading volumes across most cryptocurrency exchanges, so you’ll never struggle to find suitable levels of liquidity.

Ethereum as a project offers a blockchain and smart contract framework for thousands of cryptocurrency tokens.

As such, it’s often the go-to blockchain for new projects to build their ecosystem. This is especially the case with metaverse projects like Decentraland and The Sandbox. Over the prior 12 months, Ethereum has increased in value by over 40%.

Cryptoassets are a highly volatile unregulated investment product.

4. Shiba Inu (SHIB/USD)

Shiba Inu is essentially a meme coin – which means that its value is largely dictated by market speculation rather than anything tangible. With that said, the best meme coins are often sought-after by seasoned cryptocurrency traders that seek high levels of volatility.

Shiba Inu most certainly fits this bill – especially when you consider its pricing journey since launching in 2020. That is to say, in less than two years of trading, Shiba Inu has increased in value by millions of percent.

Cryptoassets are a highly volatile unregulated investment product.

5. Stellar (XLM/USD)

Stellar is an established cryptocurrency that was first launched in 2014. The platform allows users to benefit from fast and cheap transactions across any fiat currency.

This cryptocurrency is ideal for trading on a budget, not least because it has never surpassed a market price of $1. Moreover, Stellar attracts above-average market volatility, so you will never be short of trading opportunities.

Cryptoassets are a highly volatile unregulated investment product.

Cryptocurrency Trading Strategies

It is important to come up with a strategy when learning how to trade cryptocurrency. Otherwise, you may as well throw a dice when attempting to determine which way the markets are likely to move.

The best crypto trading strategies for beginners are discussed below.

Bankroll Management

Before you even place your first cryptocurrency trading position, it is crucial to understand bankroll management. In a nutshell, this refers to the maximum amount of money that you can risk on a single trade.

The amount is determined in percentage terms, against your current account balance.

For example:

- Let’s suppose that you have $2,000 in your crypto exchange account.

- You decide that you want to stick with a 2% bankroll strategy, which means that you can’t risk more than $40 per trade.

- With that said, as your account balance increases, so will the maximum size of your stake.

- For instance, let’s say that you have built your balance up to $3,000.

- In this scenario, you can now risk up to $60 per trade.

Crucially, if you go through an extended losing run, your bankroll will be protected – not least because your maximum stake will reduce. For example, if your balance went down to $1,000, at 2%, you would only be able to stake a maximum of $20.

Stop-Loss Orders

Another commonly used strategy that is implemented by seasoned cryptocurrency traders is to ensure that stop-loss orders are always deployed. As we briefly noted earlier, this will ensure that you never lose too much money on a single trading position.

- For example, let’s suppose that you want to limit your potential losses to 5%

- You decide to risk $1,000 on BTC/USD – which is priced at $50,000

- This would require you to set your stop-loss price to $47,500

As per the above example, if BTC/USD declines and it hits a price of $47,500, your trade will automatically be closed. This prevents you from experiencing further losses. As such, the most you can lose on a $1,000 stake is 5% – or $50.

Take-Profit Orders

In addition to stop-loss orders, you should also look to lock in your profit target when the respective price is met. After all, the cryptocurrency trading markets can move at an extremely fast pace.

- Meaning – that unless you are glued to your screen 24/7, you might miss a suitable opportunity to cash your position out.

- The easiest way to achieve this strategy is via a take-profit order.

- The fundamentals here work in exactly the same way as a stop-loss order.

- This is because you simply need to instruct your broker or exchange of the price that you wish the take-profit order to be executed.

For example, you wish to stake $1,000 on BTC/USD at an entry price of $ 50,000. You want to make a profit of 20% on this position. As such, you would need to set your take-profit order to $60,000.

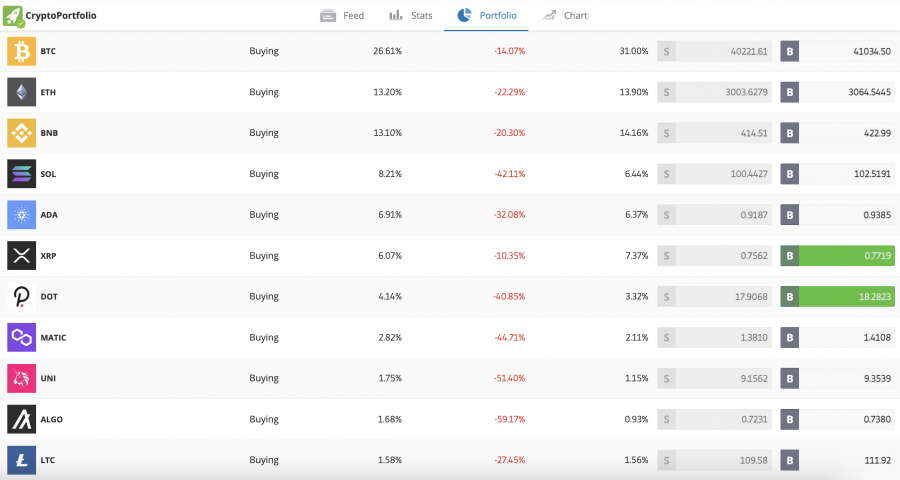

Take Advantage of Market Dips

In a similar nature to the US stock markets, cryptocurrencies often move in sync with each over. That is to say, when broader markets are bullish, many cryptocurrencies go through a prolonged upward trend.

And similarly, when the markets are bearish, most cryptocurrencies will enter a downward cycle.

- This means that you can look to capitalize on market dips by entering a buy position on high-grade cryptocurrencies.

- In doing so, you will be entering the market at a discounted price.

- For example, the previous all-time high of BTC/USD is over $68,000.

- Since hitting this high, BTC/USD has gone through a prolonged market correction – even dipping below $33,000.

In entering a position at this price point, you’ll be giving yourself an attractive upside target on a solid digital asset.

Trade Cryptocurrency Passively

If you don’t have the skillset to analyze cryptocurrency prices, then it might be worth looking into a passive investment tool. this will allow you to trade cryptocurrency without needing to actively research the markets.

One of the best ways of achieving this goal is via the eToro copy trading feature. This enables you automatically copy the same positions as a seasoned cryptocurrency trader of your choosing.

You’ll want to focus on traders that have an extended track record on eToro in terms of ROIs and risk management. The minimum copy trading investment required is just $200.

Crypto Day Trading

Ever wondered how to day trade cryptocurrency? Crypto day trading is a specific strategy that requires you to enter and exit positions within a 24-hour period. This means that you will be looking to buy a cryptocurrency and then sell it a few hours later.

In doing so, you will be looking to target smaller gains. However, as you will be placing orders much more frequently, these gains can quickly add up.

Due to the tight profit margins that you will be working towards, both stop-loss and take-profit orders are even more important when day trading crypto.

If you wish to day trade the cryptocurrency markets, the vast majority of your research will need to focus on technical analysis.

This means looking for historical pricing trends and how they might influence the future direction of the respective cryptocurrency.

Is Cryptocurrency Trading Safe?

Cryptocurrency trading is not risk-free from a variety of perspectives, it’s important that you understand the steps that you can take to remain safe.

First and foremost, the majority of cryptocurrency trading platforms are unlicensed. As such, in using an unlicensed platform, your funds are at risk.

This is why we like eToro – which is regulated by several tier-one licensing bodies and approved to offer cryptocurrency brokerage services to US residents.

Next, you need to think about the risks of losing money from your trading activities. We discussed these earlier in terms of bankroll management and ensuring that both stop-loss and take-profit orders are always deployed.

Another safety measure that you need to think about is the storage of your cryptocurrencies. After all, when using a trading platform, the provider will be responsible for keeping your digital currencies safe.

This is why it’s important to assess what security controls the platform offers. For example, eToro offers a custodial wallet service that utilizes institutional-grade security practices.

This means that you do not need to worry about keeping your own private keys safe. eToro also has an internal risk management department that is tasked with keeping its customers safe from financial crime.

Cryptoassets are a highly volatile unregulated investment product.

How to Trade Cryptocurrency – eToro Tutorial

This guide has covered how to trade cryptocurrency in a risk-averse manner. If you’re ready to put your newfound theoretical knowledge into practice, we are now going to show you how to get started with eToro.

To recap, the eToro platform is regulated and you only need to deposit $10 to open an account. Moreover, trading fees are super-low and US clients can deposit funds with a debit/credit card or e-wallet without being charged.

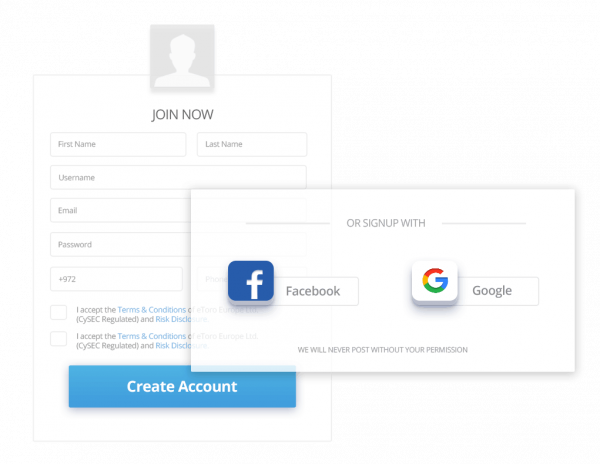

Step 1: Create an Account

You will need to create a verified account before you can deposit money into the eToro platform. Enter your full name, email address, and phone number, followed by your desired username and password.

Cryptoassets are a highly volatile unregulated investment product.

Click on the ‘Create Account’ button to proceed to the next step – which will require some additional personal information from you, alongside a quick overview of your prior trading experience.

You will also be asked to upload a copy of your passport, driver’s license, or state ID card. This ensures that your identity is verified as per KYC regulations.

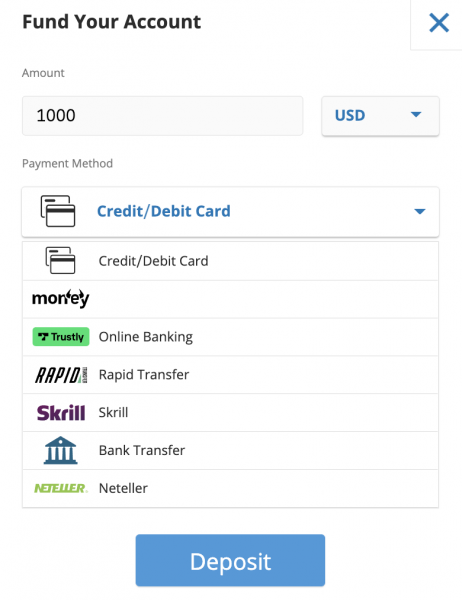

Step 2: Deposit Funds

The next step is to deposit some US dollars into your eToro account – which you can do without paying any fees.

If you want your deposit processed instantly, then select a debit or credit card, PayPal, Neteller, or any other supported e-wallet. Bank wires and ACH can take a couple of days to settle.

The minimum deposit across all supported payment methods is just $10.

Step 3: Trade Cryptocurrency via Demo Account

Although you now have trading funds in your eToro account, it might be a good idea to start off in demo mode. This will allow you to practice trading cryptocurrencies in a risk-free environment.

Your demo account will be preloaded with a balance of $100,000. All you need to do is switch over to ‘Virtual Portfolio’ mode.

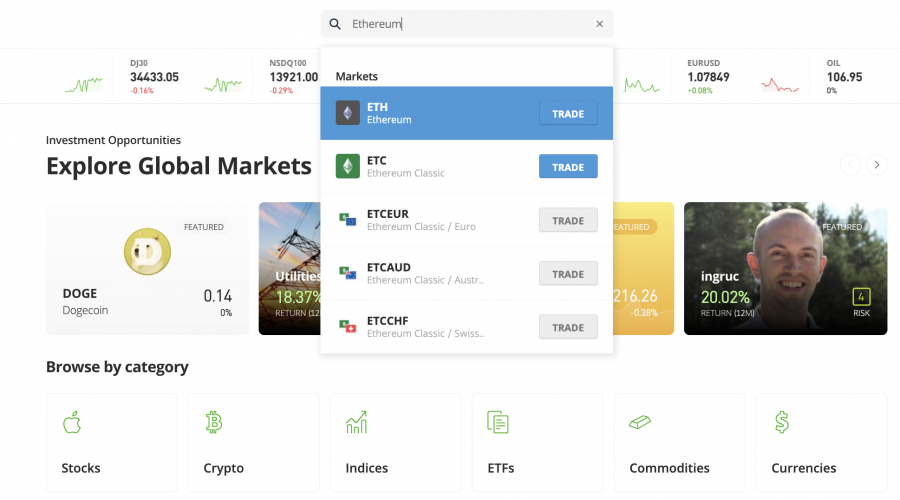

Step 4: Search for Cryptocurrency

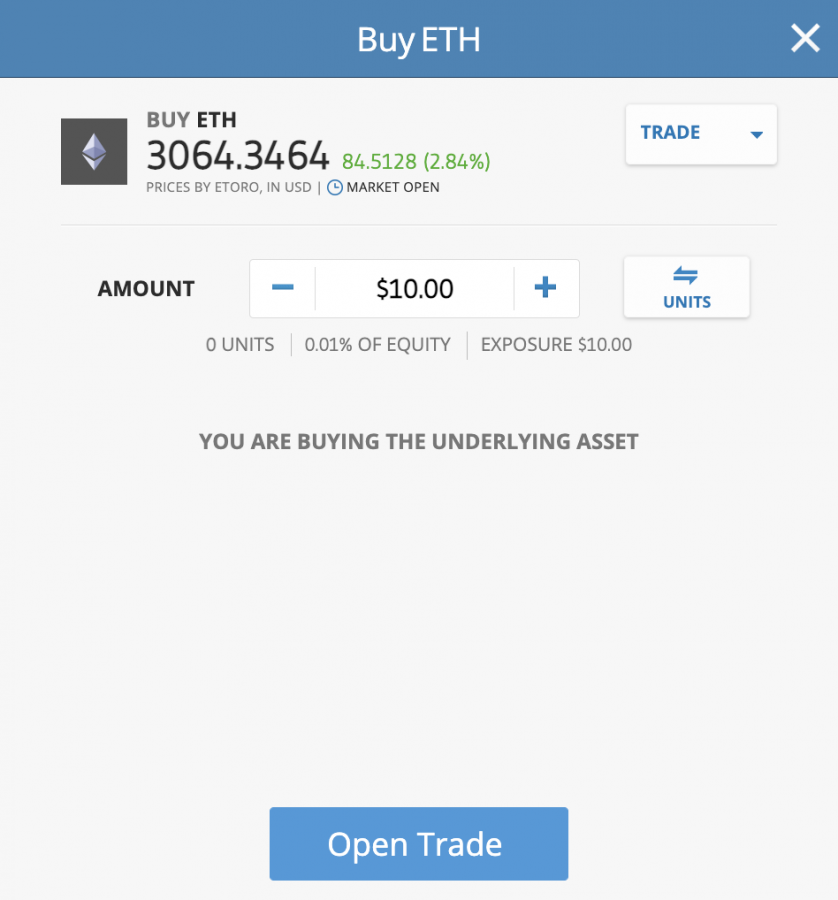

If you feel ready to start trading cryptocurrency with real money, switch back to ‘Real Portfolio’ mode. Then, use the search box to find the cryptocurrency that you want to trade. As you can see in the example image below, we are searching for Ethereum.

You can also view the full list of supported cryptocurrencies by clicking on ‘Discover’.

Step 5: Trade Cryptocurrency

Click on the ‘Trade’ button next to the cryptocurrency that you want to access. This will then populate an order – which we explained in great detail earlier in this guide.

To reiterate, in addition to entering your stake, you will need to decide between a market or limit order. You also have the option of deploying a stop-loss and/or take-profit order.

When you are ready to enter your position, click on the ‘Open Trade’ button.

Conclusion

The cryptocurrency markets are volatile and speculative, which makes this investment sector ideal for short-term traders. In reading this guide, you should now know how to approach the cryptocurrency trading scene in a risk-averse manner.

We’ve discussed many strategies that you can take to outperform the market – even as a beginner. If you want to trade cryptocurrency with real money right now – you only need $10 to get started on the eToro platform.

Crucially, this popular platform gives you access to dozens of cryptocurrencies in both a regulated and low-cost environment.

Cryptoassets are a highly volatile unregulated investment product. Your capital is at risk.

Frequently Asked Questions on Cryptocurrency Trading

How do I trade cryptocurrency and make a profit?

What is the best way to trade crypto?

What is the best place to trade cryptocurrency?

How does crypto trading work?

Is cryptocurrency trading profitable?

How do you day trade cryptocurrency?

This news is republished from another source. You can check the original article here

Be the first to comment