In this issue

- Will crypto remain legal in India?

- Buying vending-machine soda using bitcoin

- Germany lauds VeChain as top of class

- In China: blockchain lotteries, and bitcoin mining as college entrance exam topic

- VC highlights: social media in India, and payment platforms in Singapore and UAE

From the Editor’s Desk

Dear Reader,

Time waits for no one, nor does innovation. In India, that is a lesson the country’s leadership may not have accepted quite yet when it comes to cryptocurrency. Despite a hard-fought Supreme Court ruling overturning the legality of the Reserve Bank of India’s banking ban on cryptocurrency, legislators are now reportedly moving to fill in the void that the central bank attempted to cover when it comes to cryptocurrency adoption and usage in India. Just as excitement and blockchain innovation started to bloom anew in India, there is a chill in the air again. India is the world’s second largest populated nation, with a market of 1.35 billion people. That’s an enormous number of potential customers that continues to be the holy grail of blockchain integration: mass adoption.

In this week’s Current Forkast, mass adoption is getting warmer. In Australia and New Zealand, soda-thirsty holders of cryptocurrency can head to the nearest vending machine that allows crypto payments for snacks and drinks. In Cambodia, China-based Hongbo’s blockchain-powered lottery technology is making its debut on paper scratchcards. Greater transparency equals greater trust equals greater sales. In the hands of dreamers of the big jackpot, suddenly mass adoption is picking up steam again.

For India and other nations like it, the avalanche of mass adoption may be coming whether one likes it or not. The question is, which side of the event do you want to be on?

Until the next time,

Angie Lau,

Founder and Editor-in-Chief

1. New clouds over cryptocurrency in India

By the numbers: India cryptocurrency — over 5,000% increase in Google search volume.

An Indian “senior government official” told The Economic Times that a cabinet note has been drafted to ban cryptocurrencies. The unnamed official says that the note has been “moved for inter-ministerial consultations.” The official also claims that the lifting of the Reserve Bank of India (RBI) banking ban on cryptocurrencies back in March triggered the drafting of the cabinet note.

- Since the Supreme Court’s reversal of the earlier RBI’s ban on crypto banking in March, some crypto companies in India have voiced continued issues with obtaining banking services due to lack of regulatory clarity from the RBI.

- Rumors of the cabinet note surfaced after the RBI was forced into responding to a Right to Information (RTI) Act last month to clarify that there are “no laws prohibiting banks from offering banking services” to crypto companies.

Forkast.Insights | What does it mean?

India was poised to be on the cutting edge of the latest crypto-boom with the reversal of the RBI’s anti-crypto ruling. But the latest rumors of a new ban has stopped that momentum.

While India’s Supreme Court lifted the RBI’s earlier ban against crypto banking, there wasn’t a follow-up ruling or bill that expressly allowed crypto either. The courts’ ruling was a constitutional interpretation that the RBI could not specifically prohibit any individual from owning a specific type of asset class.

So, in the interim, the industry existed in a legal vacuum. Cryptocurrency wasn’t illegal, but nor was it expressly legal either. The RBI said that there were no formal restrictions on banks allowing crypto traders but there was also no framework delineating best practices. Without this guidance, it was still difficult for crypto companies to get access to the banking sector, as banks felt nervous operating in an environment that was not specifically illegal but lacked clear legal guidance.

For the sector to move forward, lawmakers in India need to set up a legal framework to regulate the industry within the country. Right now, the momentum is moving toward an outright ban, but an enterprising lawmaker could stop this by citing examples like Singapore, where sandboxes were set up to let the industry operate while rules were being perfected. It would be unfortunate if the banking ban reversal is followed-up with an outright ban, but perhaps the industry could also be proactive and propose a framework to give the industry a legal structure to operate in.

2. This drink is on Centrapay

By the numbers: Centrapay — 5,000% increase in Google search volume.

Residents in Australia and New Zealand can now use crypto to pay for sodas and other items from Coca-Cola Amatil’s vending machines. Amatil is partnering up with New Zealand-based digital asset integrator Centrapay to allow Sylo Smart Wallet users to access its services.

- Sylo Smart Wallet announced that it officially integrated bitcoin support in March.

- “And it comes with the added benefit of reducing physical contact and addressing the hygiene concerns we’ve all become acutely aware of due to Covid-19,” said Jerome Faury, CEO of Centrapay.

Forkast.Insights | What does it mean?

Given crypto’s high transaction fees and long settlement times compared to credit card payment networks, vending machines might not be the best match-up of technology and use case.

As covered before on Current Forkast, retail volume for crypto as a payment medium still struggles to make even a modicum of progress against payments methods like Visa. Visa easily clears $2 trillion a quarter in transaction volume, while Coinbase Commerce only does $100 million a year.

Crypto has been around for over a decade, but progress for retail payments seems to be negligible. According to a Federal Reserve survey, by 1983, nearly a decade after credit cards became mainstream, 65% of American families had at least one. A survey from October 2019, which would be just over 10 years since the first bitcoin was mined, showed that 14.4% of Americans owned crypto but only 29% of this group used crypto for facilitating payments.

Moves such as this are good for generating buzz, but not necessarily something to drive a lot of transaction volume to a platform. While the press release noted that there was a partnership in place, it doesn’t specify a timeline to launch. When Forkast.News tried to scan a QR code on one of the Coke machines supposedly already in operation to accept crypto, the link was only to a “coming soon” page.

Contactless transactions may be a perk for adopting the technology, but such transactions have already been in use for some time with this company’s machines. A spokesperson for Coca-Cola Amatil, the bottling company responsible for the region, is quoted as saying that they’ve been using QR codes and contactless payments for sometime in tourist hotspots — not for crypto, but for AliPay and WeChat Pay.

3. Germany ranks VeChain as top of class

By the numbers: VeChain — 550% increase in Google search volume.

In a recent study, the German Federal Office for Information Security (BSI) praised VeChain, the blockchain supply chain platform. The study conducted by the BSI tested 300 blockchains to find the optimal platform for supply chain management.

- The study recognized eight blockchain platforms, including EOS and Corda, with VeChain highlighted as the most suitable one for supply chain management.

- The study also noted VeChain’s collaborations with major partners such as pharmaceutical giant Bayer and risk management firm DNV GL.

Forkast.Insights | What does it mean?

Faithful readers of Forkast.News have seen our spotlight on VeChain before. In our China Blockchain Report, we highlighted the company’s potential to use blockchain technology for enhancing food safety within China. As China has had a number of high-profile food scandals during the last decade, there is strong demand for technology that would mitigate risk and improve trust in the food supply chain. Shanghai-based food producer Bright Food understands the potential of this technology, and built out an IoT-based blockchain platform that tracks the product from farm to table, allowing users to view key data on animal health as well as information on the temperature of the product in transit and storage.

But for this to take off, VeChain would need a reference customer outside of China. Institutional mistrust of Chinese software is high, and VeChain would unlikely gain any sort of external traction without it. The report from BSI isn’t an endorsement, but the fact that it highlighted VeChain at all and spoke positively about the company’s technology collaborations (versus highlighting security concerns) is a step in that direction.

4. In China: blockchain-powered lotteries, and bitcoin mining as a college entrance exam topic

Shenzhen-listed firm Hongbo Co. Ltd., a well-known Chinese lottery service provider, recently launched a blockchain-based paper scratchcard product for use in lotteries in Cambodia, according to China’s local media.

- Hongbo signed a pact with Shanghai Haishi Technology to develop a blockchain-based lottery and digital invoice in September 2019. The same month, Hongbo signed a contract with Cambodia’s Jinxiang Co. Ltd., a subsidiary of Hong Kong’s Jin Cai Holdings, to cooperate in the field of blockchain lottery technology, lottery game design and printing services.

- The company operates a blockchain called Scratchblock, which allows regulators as well as players to inspect all aspects of the game, from ticket printing to payout ratios.

Forkast.Insights | What does it mean?

Lotteries are all about algorithms that generate random numbers. On a scratchcard product, these numbers dictate the placement of the symbols that need to be matched to receive a prize.

In most jurisdictions, the algorithms that dictate the distribution — or randomness — of these numbers are closely monitored by authorities that oversee gambling. Cambodia is a developing economy, and its regulators are known to be prone to corruption or sometimes just in over their heads. Gambling only recently became legalized for Cambodian citizens, and the industry “gold rush” to get launched and national lotteries established has led to complaints that they operated in a black box. There were numerous complaints about the integrity of the lottery games, as the number of winning tickets didn’t seem to match up with the published ratios.

With Scratchblock, all of this can be monitored on the blockchain, especially key metrics such as comparing award return rates to ticket batch numbers that would show that the odds are evenly distributed.

Cambodia will be another interesting reference customer for the potential of this technology. While the country was once defined by corruption, its stakeholders now understand the power of transparency and good governance. Blockchain will be a tool to push the country in this direction.

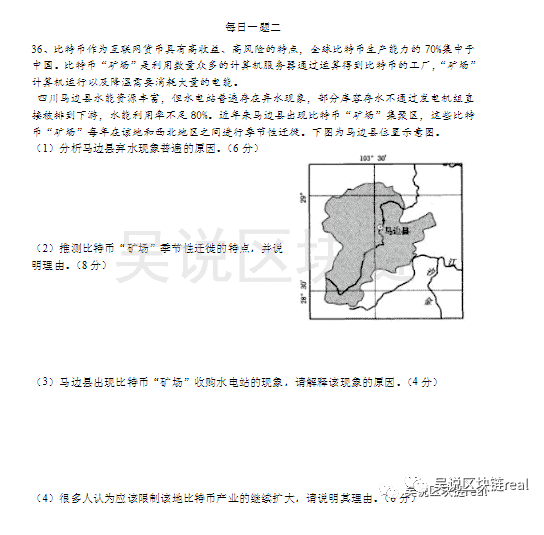

Bitcoin mining has been appearing on mock tests for China’s highly competitive National College Entrance Examination, also known as Gaokao, which will take place on July 7 and 8 this year.

- Gaokao is widely regarded as one of the most difficult standardized tests in the world. This year, it will be taken by about 10 million high schoolers, and the results determine which university they can go to.

- The bitcoin mining questions are showing up in the geography section of practice exams.

- According to screenshots published in Chinese media, the questions require knowledge of how bitcoin is mined and the geography of China’s hinterlands as well as analytical writing skills.

Forkast.Insights | What does it mean?

As the Gaokao is taken by an enormous cross-section of Chinese society, like the SAT in the United States or the A-Levels in the United Kingdom, the questions asked in the exam become part of the broader cultural zeitgeist of China’s young people. On the 2014 edition of the exam, the Belt and Road Initiative — introduced earlier that year as a mechanism to stimulate growth by opening up new trade routes — took center stage as a theme in the exam. Likewise, in 2007, the test focused heavily on the 11th 5-year plan, a set of economic and development initiatives presented to China’s congress to develop strategies to guide it through a specific period.

But highlighting bitcoin of all things, though an instrument of such educational importance, may seem like a paradox. Recall that in China, bitcoin exchanges and initial coin offerings are still officially banned. At the same time, China is home to the world’s largest crypto mining community as well as major crypto mining equipment companies Canaan and Bitmain. “Chinese” bitcoin exchanges incorporated in offshore jurisdictions also continue doing business on the mainland while skirting the requirements of Chinese securities laws. As mixed as China’s messages toward cryptocurrency may be, the takeaway may be, the government tolerates and sees value in the industry. Through its actions, Beijing is demonstrating it appreciates the strategic value in having control over this commodity. And they also think the technology is something the youths of China should know about.

China National Radio (CNR) news, an official mouthpiece for the central government, published a story about initial coin offerings and crypto trading last week.

- The article singled out Binance, one of the biggest crypto exchanges in the world — which had previously announced that it would no longer serve mainland users — is still providing illegal services to people in China via a localized .cn domain.

- The article warned users about the potential risks of losing their capital in an unregulated market, and highlighted the dangers of the ICO market, noting how many ICO projects have failed to materialize or provide returns for their investors.

- Chinese “bitcoin billionaire” Li Xiaolai joined the chorus of critics and accused Binance CEO “CZ” Zhao Changpeng of defrauding his users.

- On the same day, Binance competitor Huobi — which, like Binance, also conducts its cryptocurrency trades outside the mainland — received glowing coverage in Chinese media as being an important part of the tech cluster in Hainan, the new free-trade port of China.

Forkast.Insights | What does it mean?

In China, state media is often used as a proxy to signal the government’s annoyance with, or approval of companies.

Apple was on this list back in 2013. As the iPhone was taking off in China, its user data was stored on servers outside the country, where it was out of reach of local law enforcement. At the same time, Washington began putting Huawei through the wringer (which eventually culminated in the arrest of Huawei’s CFO as she was in transit at Vancouver’s airport). So, when Apple’s warranty practices came under close scrutiny by Chinese media, a seemingly well-coordinated army of Chinese celebrities started piling on too, posting criticisms of the company on Weibo. In the end, Apple capitulated to China’s demands and opened up a data center within China to store user data locally, which now makes iPhone user data easily accessible to Chinese law enforcement.

There certainly are parallels to this current flare up with state media apparatus targeting Binance — which left China years ago — while Huobi receives the opposite treatment (to be sure: Huobi’s exchange business is not incorporated in China). The difference may come down to this: Huobi doubled down, opening a Chinese Communist Party government relations department within its corporate office, showing a commitment to regulatory compliance as well as party loyalty.

5. Investments in social media and installment payment platforms

Hapramp Studio — India, seed, US$1 million

Indian blockchain startup Hapramp Studio announced it has closed on a $1 million round in seed funding. The company promotes itself as an “idea lab,” promoting its own startup social media platforms and a blockchain-focused security protocol. GoSocial, a social media platform that invites users to contribute to artist-designed creative projects, is their mainstay. Capital for the round was provided solely by Anand Mahindra, the billionaire founder and CEO of Fortune India 500’s Mahindra Group. The international conglomerate ranks 15th in market capitalization in India.

Split — Singapore, seed, undisclosed

Singaporean fintech startup Split secured an undisclosed amount of funding from VC firm 500 Durians, a 500 Startups subsidiary focused upon emerging technologies in Southeast Asia. The firm maintains a mobile app that allows users to transform big purchases into payment installments — without a credit card. Split operates in Malaysia and Singapore through partnerships with local businesses and online boutique stores, enabling users to enter a payment plan for a purchase through “chat app or social media platforms.”

Tabby — UAE, seed, US$7 million

Dubai’s fintech startup Tabby announced it had closed a funding round of $7 million, bringing their total cumulative funding to US$9 million. The funding round was led by Saudi VC firm Raed Ventures, a Middle Eastern and North African tech investor group. Similar to Split in Singapore, Tabby is also a payment planning platform that allows users to plan out payments in terms for as little as 14 days, with monthly installment options as well. Like Split, the firm mainly focuses on small business partnerships. The app is also functionally similar to a credit card by setting a spending limit for users.

Forkast.Insights | What does it mean?

This week, we see a clear trend toward building platforms that allow for payments to be split up into installments. Splitting up payments gives those with lower income — such as consumers in fast-developing Southeast Asia — the ability to buy items with a big price tag without tapping into expensive credit, thus expanding their reach for higher-tiered consumer goods around the region. It also gives retailers and brands access to a much wider market. Past initiatives, including American Express’s Plan It function (which was geared toward middle-income Western consumers), have found widespread appeal — but more innovation was needed in the mobile payments area. Any competition, especially when it comes to financing, benefits all consumers.

This news is republished from another source. You can check the original article here

Be the first to comment