Interlay has launched a wrapped Bitcoin asset called interBitcoin (iBTC) on the Polkadot chain. The product intends to widen BTC use “for DeFi, cross-chain transfers, NFTs, and more.”

iBTC is already Acala and Moonbeam compatible. But developers have put up $1 million of funding to extend the project to other chains. Plans are in place to launch on Ethereum, Cosmos, Solana, and Avalanche soon.

“iBTC is a Bitcoin-backed stablecoin, maintained by a decentralized network of collateralized Vaults and redeemable 1:1 for BTC.”

How does iBTC work?

Interlay’s mission is to realize “the true nature of BTC” by extending its use to any blockchain.

“interBTC realizes the true free nature of BTC and decentralized finance. A 1:1 Bitcoin-backed asset, fully collateralized, interoperable, and censorship-resistant.”

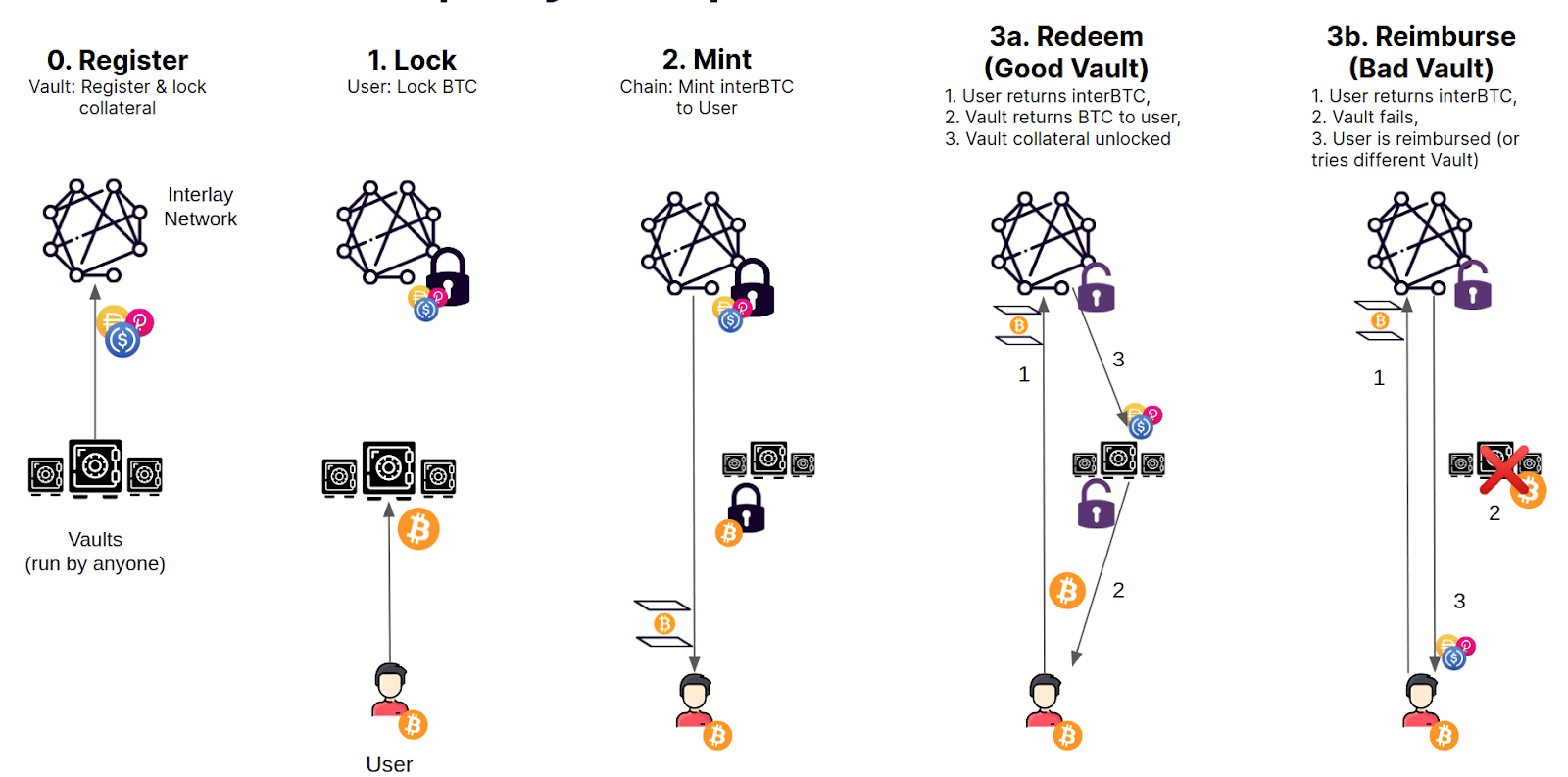

Underpinning this is a network of decentralized vaults, which the company has stated is open for anyone to run and operate their own vault. Users lock their Bitcoin collateral with a vault, which then mints and issues iBTC to the user.

Interplay said iBTC is 1:1-backed and redeemable with Bitcoin. Moreover, the locked BTC is insured and reimbursed in the event of vault failure.

Interlay co-founder and CEO Dr. Alexei Zamyatin said iBTC brings Bitcoin’s trust and security to more technologically innovative chains. In effect, combining the best of both worlds while protecting Bitcoin’s trustless nature.

“Bitcoin is the driving force behind global crypto adoption, while Polkadot, Ethereum & co. is where technological innovation is happening.”

The project said iBTC is different from other cross-chain bridges in that users need only trust Bitcoin and Polkadot. What’s more, “there is no single point of failure,” and there is an automatic reimbursement process for lost BTC from the collateral insurance.

Cross-chain bridges under fire

Several high-profile hacks, including the Nomad hack, which was drained for $190 million, and the Ronin hack, where attackers netted $615 million, have put cross-chain bridges firmly in the spotlight.

A recent report from data analytics platform Chainalysis estimated that $2 billion was lost to cross-chain bridge hacks so far this year. What’s more, this type of cybercrime now accounts for 69% of all stolen crypto funds.

Chainalysis researchers said the issue has become so prevalent it now poses “a significant threat” to public trust in blockchain technology.

To combat the problem, Chainalysis called for more rigorous code audits and the use of established smart contract code to serve as a template for new projects.

This news is republished from another source. You can check the original article here

Be the first to comment