- Bitcoin price drops 7% on geopolitical news but is close to offering a nice entry-level.

- Ethereum price deteriorates 10% for the day and still has 7% to go before some solid support is present.

- XRP price sees early price bounce-off but might be too soon as better entry levels are present further down the line.

Cryptocurrencies are waking up to a shocker this morning as the whole Eastern border of Ukraine is under siege of missile attacks by Russia and Belarus. This afternoon, NATO and the EU are scrambling for emergency meetings to further retaliate with sanctions cutting off Russia entirely from the financial system. In the meantime, investors are hoarding cash and pulling out their money into safe havens, but in the process, offering some lovely entry levels for the longer term.

Bitcoin price breaks below $36,709 and looks to test support at $32,650, below $33,000

The Bitcoin (BTC) price got slaughtered this morning as the Russian offensive started in early trading hours, shedding 7% of its market value. As it is looking for support, it will be vital for market participants to await the right time to execute any trades. It is too late now for both bears and bulls to get in as markets will or could go either way, and both parties are better off waiting for the right entry-level.

BTC price will favour bulls with an entry below the $34,000 key-level as above, for now, no actual entry points are offered. At $32,650, a solid entry-level is offered, going back to June 25. With this, BTC price would need to shed another 5% on top of the 7% it has already lost in early morning trading. Expect this to unfold once the US sessions kicks in and further deterioration of asset prices happens across the board.

BTC/USD daily chart

Should Putin step up military action, expect to see further deterioration of price action in several asset classes, certainly when civilian casualties are reported. Expect $32,650 to be breached and see BTC further deepen its losses towards $31,322. Following that, the famous distribution zone will have been entered, and short-term bulls and long-term investors will be buying up bits and pieces of the price action for a rebound once the situation stabilises.

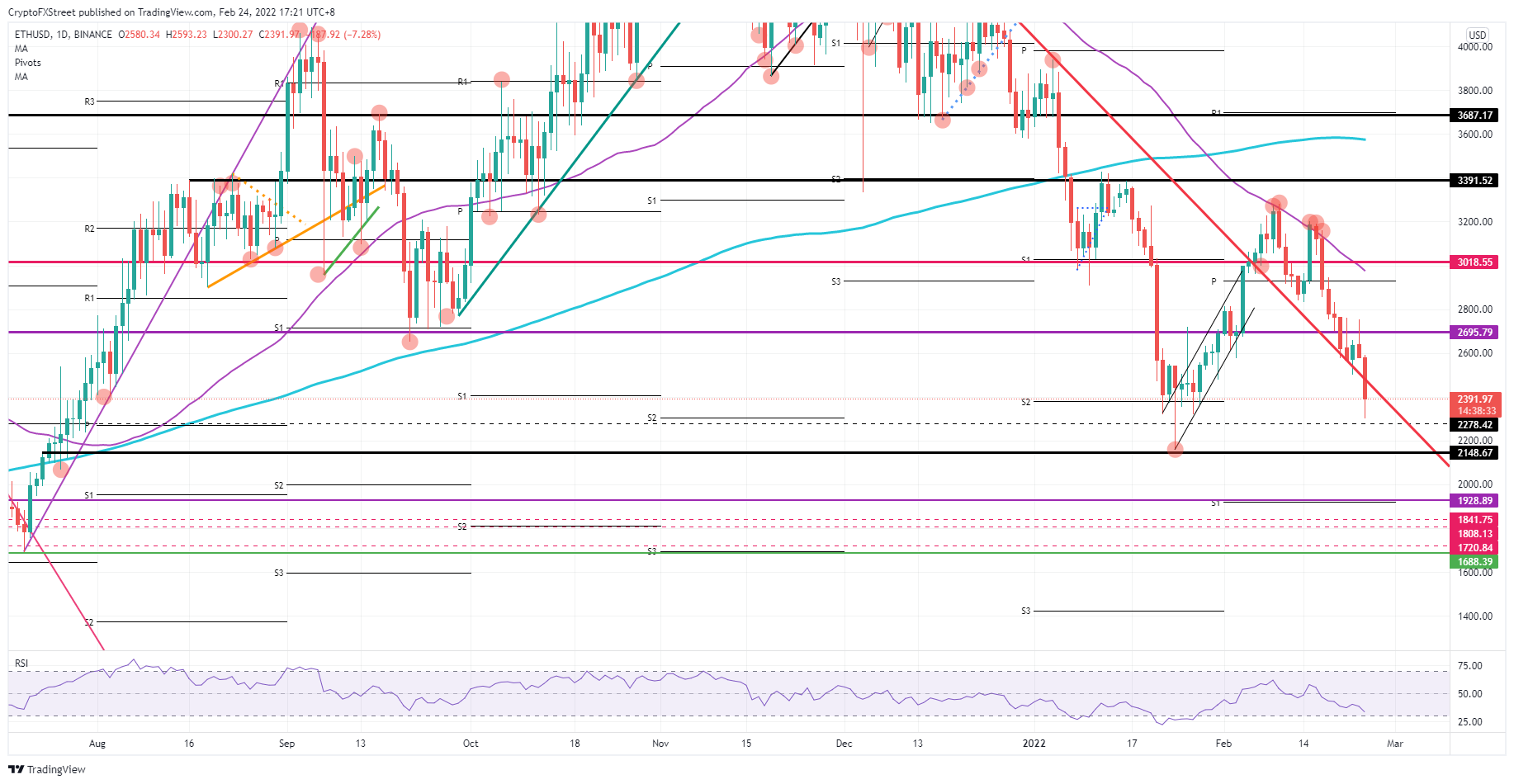

Ethereum bulls should open up their wallets as price action is set to offer some great entry points

Ethereum (ETH) price is nearing some interesting levels as price action dips to the downside in an accelerated move as Russian troops are attacking several important cities in Ukraine. Whilst Europe tries to deal with the situation, more reports have come in of several critical Ukrainian military installations being fired upon by missiles and mortars. Putin proclaimed conducting a military surgical operation to demilitarise the country and succeed.

ETH price gets under pressure as investors hoard cash and kick out any risky asset in the process, as Ethereum already lost 10% in early morning trading. Expect more downside to come towards $2,148, losing 18% of its value in the process. At the same time, this is an excellent window of opportunity for investors to buy ETH coins at a very lucrative discount once the situation stabilises.

ETH/USD daily chart

As this story develops further into the trading day, expect to see a deterioration of ETH price action towards $1,928 or even $1,688 – breaching $2,000, should more reports come in from Russian troops entering mainland Ukraine and taking over control of key cities. That would mean that ETH is set to lose another 17% to 25% in the process as the US session will be expected to deepen the loss intraday. In the meantime, Ethereum price action has entered a distribution zone, offering an excellent opportunity for investors to start building a stake in for any upside potential to come.

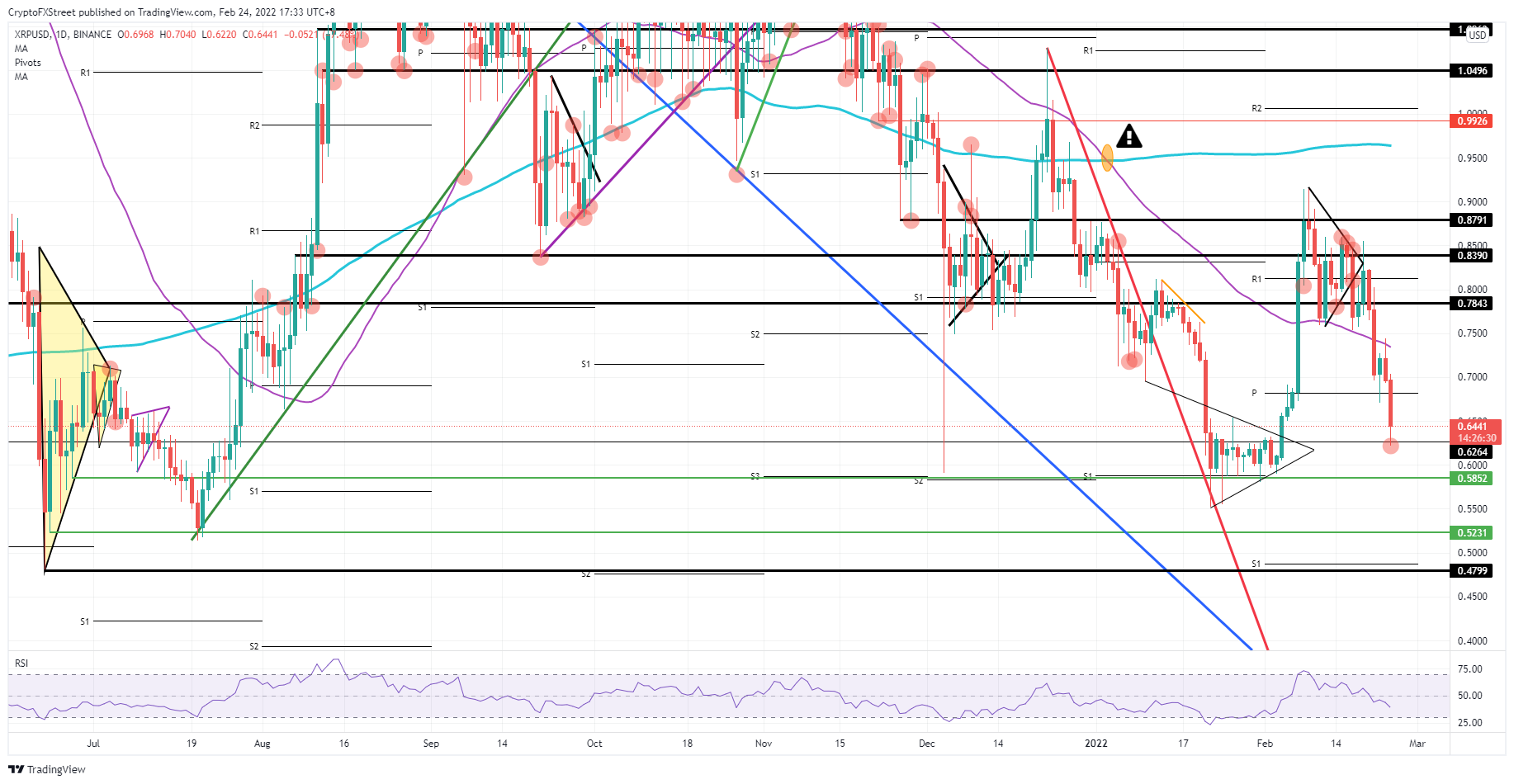

XRP price is at risk of losing another 25% as first support is being tested

Ripple’s (XRP) price sees an initial bounce off the $0.6264 level this morning as Europe awakes to some severe military threats spilling over into global markets with risk assets being slashed across the board. XRP price action already shredded 10% at the time of writing and is seen bouncing off technically and recovering back to more moderate levels – but still holding heavy losses. As the situation further develops, expect cryptocurrencies to react instantly in both directions as more headlines and news hit the wires today.

Expect $0.6264 not to withstand further selling pressure since the situation remains fragile. As possible combat headlines start to accelerate, expect to see another dip lower in XRP to $0.5852 or even $0.5231, adding another 6% to 16% of losses to the price action. With this, the Relative Strength Index will be diving deeply into oversold territory, making this area an excellent entry level for investors going long once the situation dies down and the market falls back to a more normal level.

XRP/USD daily chart

In the worst case, XRP could dip below $0.50 and tick $0.48 in the process, the lowest level since June 2021. Depending on the situation expect to see bulls either waiting and holding, or taking the bounce off the historic $0.48 level and the monthly S1 support level, which they may use as a point of entry for going long if the situation calms down in the near future.

This news is republished from another source. You can check the original article here

Be the first to comment