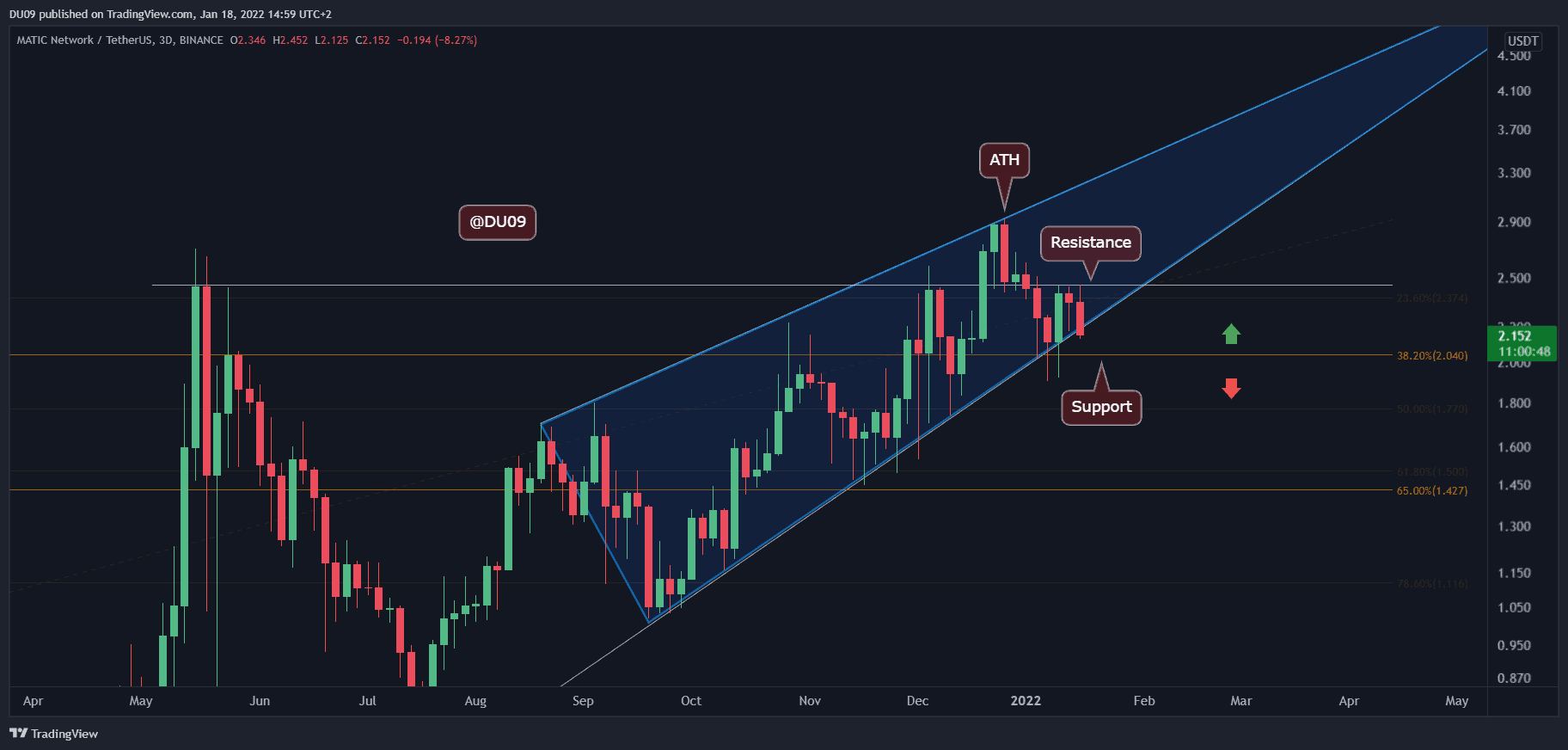

Key Support levels: $2, $1.8

Key Resistance levels: $2.4, $2.9 (ATH)

After a great performance where the price hit $2.9, MATIC lost momentum and is now correcting towards the key support at $2. The level at $2.4 was confirmed as resistance, and the price has formed lower highs since then.

On the way up, MATIC has formed a large bearish wedge (represented in blue on the first chart) and now the price appears to be on the decline. The cryptocurrency is likely to enter into a correction and longer consolidation.

Technical Indicators

Trading Volume: Somewhat expectedly, the volume decreased after the all-time high, and MATIC entered into a correction on low volume.

RSI: The daily RSI is making lower highs which are typical of a bearish trend. This is likely to continue as MATIC searches for new support.

MACD: The daily MACD turned bearish after the price hit $2.9, and since then, the trend has been bearish. So far, MATIC failed to turn around, and the correction continues. Until the MACD completes a bullish cross, it is unlikely for the price to make new highs.

Bias

The bias for MATIC is bearish.

Short-Term Price Prediction for MATIC

MATIC’s stellar performance in December 2021 was followed by a significant correction in January. The price decreased by over 30% before recovering. The trend remains bearish, and MATIC will likely test the $2 support level again. If that doesn’t hold bears in check, then MATIC is likely to fall lower.

Binance Free $100 (Exclusive): Use this link to register and receive $100 free and 10% off fees on Binance Futures first month (terms).

PrimeXBT Special Offer: Use this link to register & enter POTATO50 code to get 25% off trading fees.

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

Cryptocurrency charts by TradingView.

This news is republished from another source. You can check the original article here

Be the first to comment