The below is from a recent edition of the Deep Dive, Bitcoin Magazine’s premium markets newsletter. To be among the first to receive these insights and other on-chain bitcoin market analysis straight to your inbox, subscribe now.

In today’s Daily Dive we will take an in-depth look at Reserve Risk.

Source: Glassnode

Reserve risk is a metric founded by Hans Hauge, and it is a cyclical market indicator which aims to quantify the risk/reward of allocating to bitcoin based on the conviction of long-term holders. Simply, reserve risk is a ratio between the current price of bitcoin and the conviction of long-term holders. The current price can be thought of as the incentive to sell, and the conviction of long-term holders/investors can be quantified as the opportunity cost of not selling.

We will more thoroughly describe and quantify these metrics further along in the piece.

The following is an excerpt from Glassnode Insights:

“The general principles that underpin reserve risk are as follows:

- Every coin that is not spent accumulates coin-days which quantify how long it has been dormant. This is good tool for measuring the conviction of strong hand HODLers.

- As price increases, the incentive to sell and realise these profits also increases. As a result, we typically see HODLers spending their coins as bull markets progress.

- Stronger hands will resist the temptation to sell and this collective action builds up an ‘opportunity cost.’ Everyday HODLers actively decide NOT to sell increases the cumulative unspent ‘opportunity cost’ (called the HODL bank).

- Reserve Risk takes the ratio between the current price (incentive to sell) and this cumulative ‘opportunity cost’ (HODL bank). In other words, Reserve Risk compares the incentive to sell, to the strength of HODLers who have resisted the temptation.”

Reserve Risk is low when HODLer conviction is high (unspent opportunity cost is high and increasing), and price is low.

Reserve Risk is high when HODLer conviction is low (unspent opportunity cost is low) and price is high.

Reserve Risk Calculation

As shown in the graphic above, reserve risk is defined as “price” divided by “HODL bank.” While price obviously doesn’t need an explanation, what is HODL bank, and what signal does it provide?

As stated earlier, reserve risk is a ratio of the incentive to sell and the opportunity cost of not selling. HODL bank quantifies this “opportunity cost of not selling.”

Coin Days Destroyed

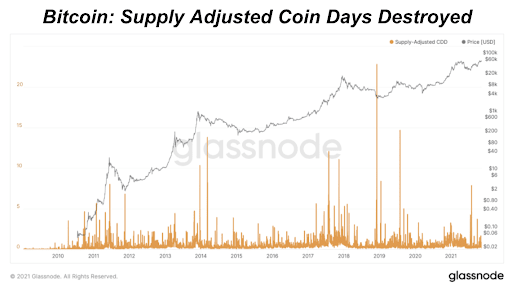

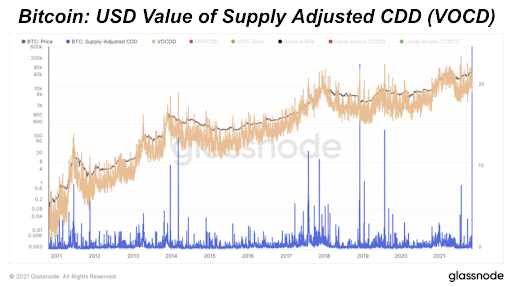

Essentially, with the complete transparency of the Bitcoin blockchain, one can see how many days each and every coin has been held and/or spent. When there is a large number of CDD on a particular day, it shows old coins are being spent/changing hands. Further, if we divide CDD by circulating supply, we can standardize the metric for an increasing circulating supply over time.

While the stand-alone metric of supply-adjusted CDD itself doesn’t provide much signal if any, it serves as a key input for reserve risk, and here’s how:

This news is republished from another source. You can check the original article here

Be the first to comment