Disclaimer: The Industry Talk section features insights by crypto industry players and is not a part of the editorial content of Cryptonews.com.

With so many developments within the blockchain ecosystem, more so in DeFi, it is becoming challenging to keep track of the most promising projects. However, one project has risen above the lot, racing past some legacy networks to secure itself in the top ten cryptocurrencies by market capitalization.

With its token price cresting new heights, the Solana ecosystem has emerged as a low-cost, high speed, and scalable alternative to Ethereum and other networks. These inherent features, paired with composability, have helped Solana cement itself as a choice platform for veteran and beginner developers to experiment with smart contracts, NFTs, and DeFi products and protocols.

Solana is the world’s first web-scale open-source blockchain protocol capable of processing 50,000 transactions per second (TPS) and 400ms block time, which also makes it the world’s fastest blockchain network. The Solana ecosystem currently boasts over 500 dApps, spread across DeFi, lending protocols, NFT marketplaces, Web3 dApps, and much more.

Earlier this year, Solana made headlines after a USD 314 million private token sale round led by Polychain and Andreessen Horowitz. Due to Ethereum’s scalability and gas costs, Solana has quickly become the go-to platform for projects. Many new projects have chosen to develop on Solana to take advantage of the platform’s high throughput and extremely low transaction fees.

That said, here are some new and upcoming projects that are shaping the future of the Solana DeFi ecosystem.

Smart Lending Protocol With On-Chain Credit System

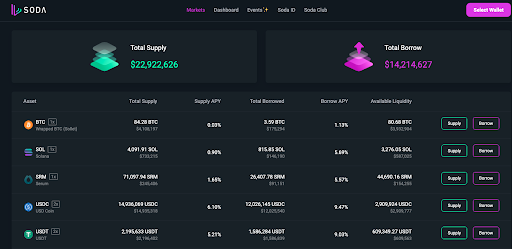

Built to merge DeFi lending with the innovative Sol ID credit ranking system, Soda Protocol, a smart lending protocol, uses Solana blockchain to offer its services. The platform delivers basic lending features, which are quite similar to that of Aave and Compound. Soda Protocol also provides Flash Loan, Flash Liquidation, Easy Repay, and more through its lending service.

Unlike existing platforms, Soda Protocol ensures less restriction on position slots, allowing users to lend and borrow multiple assets simultaneously. Furthermore, the platform continuously optimizes its interest rate model to offer more reasonable interest rates for both borrowers and lenders, even under varied market conditions.

Soda Protocol recently launched its credit rating system, Sol ID, which aims to add a world of new possibilities to the growing DeFi ecosystem. Scheduled for a release alongside the launch of Soda’s mainnet, Sol ID, will serve as the on-chain data-based financial identity system for the Solana DeFi ecosystem. The Sol ID will generate credit models and profiles using an artificial intelligence algorithm to collect and analyze various types of on-chain behavioral data. In various settings, the Sol ID can be used by other DeFi platforms that have partnered with Soda Protocol. Other uses of the Sol ID include governance, discounted rates on products, IDO allocations, and more.

Solana’s DeFi And Stablecoin Project Aims Big

Hubble Protocol, the DeFi and stablecoin project on Solana, is one of the new projects that aim to amplify liquidity on the Solana DeFi ecosystem and allow users to earn passive returns while HODLing their tokens.

Dubbed as the “sustainable DeFi service on Solana,” Hubble Protocol offers a multi-asset zero-interest borrowing service that mints the USDH stablecoin for a one-time fee of 0.5% while ensuring a guaranteed yield of up to 7.0% on SOL and several other cryptocurrencies.

As part of its roadmap, the Hubble team plans to launch DeFi structured products and uncollateralized lending in 2022. Built for facilitating interest rate products on the Solana ecosystem, Hubble Protocol will play a critical role in helping Solana expand into DeFi 2.0.

One of the standout features of Hubble Protocol is cross-margining, which automatically utilizes the Profit & Loss (PnL) from one position to offset losses and increase leverage in other positions. Scheduled to go live next month, the Hubble Protocol team has raised USD 3.6 million in its latest seed funding round from some of the most prominent names within the cryptoverse, including DeFi Alliance, Three Arrows Capital, Delphi Digital, among others.

Leveraging DeFi To Power Micro Finance Globally

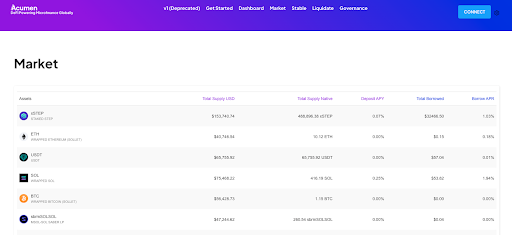

Solana-based DeFi protocol, Acumen, aims to make the global financial ecosystem more equitable by leveraging DeFi initiatives. This decentralized interest rate protocol built natively on the Solana blockchain is designed to set interest rates algorithmically, allowing users to earn reasonable returns.

By building decentralized money markets and asset pools with interest rates based on the demand and supply of the token in concern, the platform brings lenders and borrowers together to facilitate a more rewarding ecosystem. Users can supply their assets to non-custodial liquidity pools for individual asset classes without directly dealing with borrowers.

Furthermore, Acumen, built on Solana, assures the lowest transaction costs. Compared to Ethereum-based DeFi protocols, Acumen’s average transaction fee is as low as USD 0.0001, enabling users to partake in microlending, giving them more flexibility and better opportunities to generate profits on even the most minor transactions.

Yield Farming Aggregator For The Solana Ecosystem

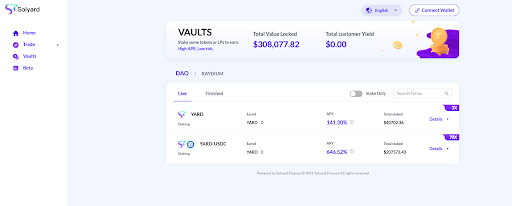

Solyard Finance, the leveraged yield farming platform on Solana, is designed to help users earn safe and stable yields. It also provides users with access to undercollateralized loans for leveraged yield farming positions, allowing them to significantly increase the value of their farming principals and the profits they generate.

While Solyard operates atop Solana, it aims to work for the entire DeFi ecosystem. Because it connects long-term borrowers and lenders, it enhances the liquidity layer of integrated exchanges, allowing them to operate more efficiently and effectively.

Solyard has established itself as a fundamental building block within DeFi due to this empowering function, bringing the power of finance to the hands of every individual. The platform also provides yield enhancement strategies for all Solana-based assets while auto-compounding interest investment. This enables Solyard to allow every user to participate in the growing DeFi market irrespective of their available capital.

The decentralized finance (DeFi) sector has been the most significant growth area for Solana, as it has been for Ethereum. Solana’s fast block times and low transaction fees have made it a popular choice for on-chain trading protocols because of its low transaction fees. With more and more projects lining up to harness the power of the Solana ecosystem, the platform has positioned itself to be the new home for DeFi 2.0, posing serious competition to Ethereum’s dominance.

This news is republished from another source. You can check the original article here

Be the first to comment