solarseven/iStock via Getty Images

Investment Thesis

Over the next two years, MercadoLibre, Inc. (MELI) is expected to report breakthroughs in revenue growth at a CAGR of 33.08%, with a slight moderation from the pull forward growth during the COVID-19 pandemic. At the same time, the company is poised to report massive net income profitability, reaping the gains after aggressive investments in its logistical assets, SG&A, and Research and Development.

Moving forward, we expect MELI to report sustained market share gains in its e-commerce and fintech services, as one of the market leaders in the region.

MELI’s Sales Hit Record Highs In FY2021

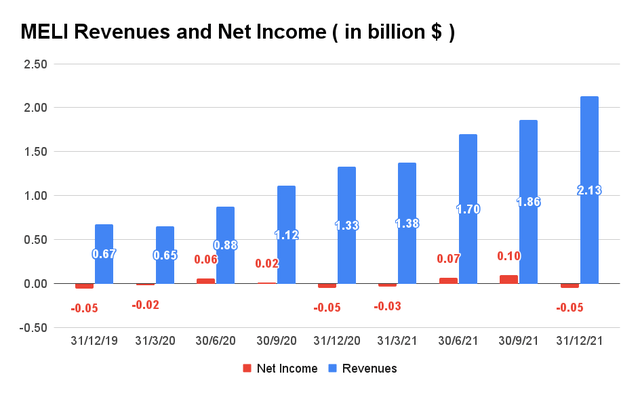

MELI Revenue and Net Income

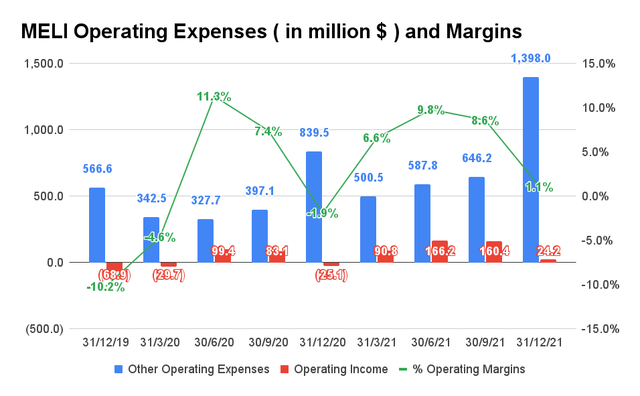

In the past five years, MELI reported excellent revenue growth at a CAGR of 52.96%. The company had a stellar year in FY2021 despite the global supply chain issues, by reporting revenues of $7.06B with YoY growth of 77.9%. MELI also improved its gross profit margins to 40% in FQ4’21, compared to 36.8% in FQ4’20. Given MELI’s aggressive expansion in multiple segments, it has yet to report sustained profitability in the past few years. However, the company turned that around in FY2021 with $83.3M of net income and 6.4% of operating margins. It is an impressive improvement from 3.2% in FY2020 and -6.7% from FY2019.

MELI Operating Expenses, Income, and Margins

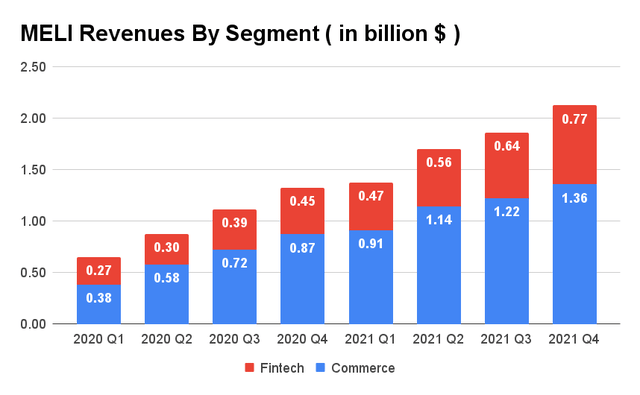

MELI Revenue By Segments

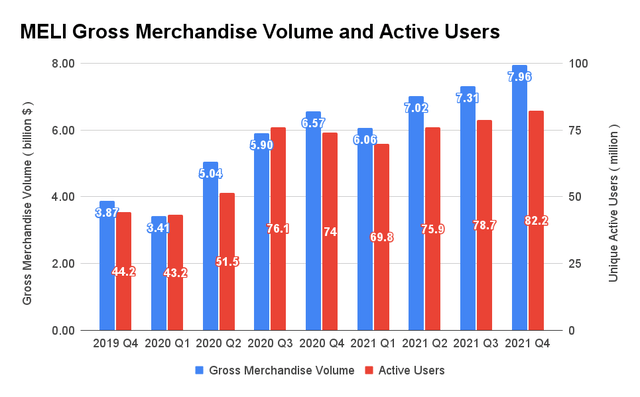

In the past two years, MELI has been expanding its revenue through its fintech and commerce segments, at a remarkable CAGR of 68.87% and 89.18%, respectively. Though the growth could be partly attributed to the COVID-19 pandemic in FY2020, the company managed to sustain its expansion, despite the reopening cadence and global supply chain issues in FY2021. Its growth is also evident in its Gross Merchandise Volume (GMV), which more than doubled from $3.87B in FQ4’19 to $7.96B in FQ4’21. Its unique active members also grew at a CAGR of 36.37% in that time frame.

MELI Gross Merchandise Volume and Active Users

In addition, we observed increased spending per user from $87.55 in FQ4’19 to $96.83 in FQ4’21, representing a 10.5% increase in the past two years. In its recent earnings call, MELI also reported that buyers are buying more with an increase of 17% YoY. It represented over 50% increases compared to the pre-pandemic period, despite the reopening of physical stores in the region. MELI’s improved metrics demonstrate Latin America’s sustained adoption of digital commerce, setting the stage for its long-term growth.

By offering free shipping for over 80% of its GMV, MELI had definitely seen an improvement in its user engagement on its platform. Additionally, the company has improved its delivery speed, buyer protection, customer service, loyalty program, and expanded the products it offers on its marketplace. Due to these factors, over 60% of its GMV is based on organic sales on its online platform, setting itself apart as a global leader in e-commerce.

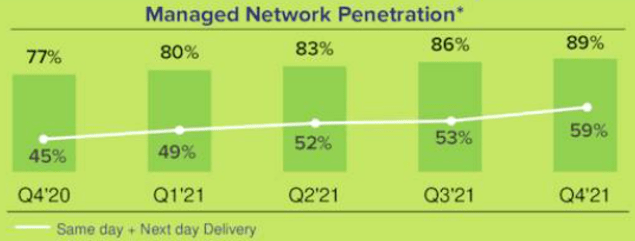

Mercado Envios’ Impressive Managed Network Penetration

Mercado Envios’ Managed Network Penetration

Seeking Alpha

Mercado Envios also reported improved managed network penetration at 89% in FQ4’21, compared to 77% in FQ4’20. It represented a 16.2% improvement YoY. In addition, the logistic segment managed to ship over 275.9M items at a 29% YoY volume increase in FQ4’21, with over 59% completed within the same day or next day delivery and nearly 80% completed within 48 hours of purchase. Despite the usually busy holiday season, MELI also improved its logistics networks through lower average shipping costs and enhanced delivery speed.

MELI also reported improved capabilities and service levels in its fulfillment centers with a reduced delivery period of lesser than 24 hours in FQ4’21. The scaling in its warehousing operations has by far improved its productivity and cost efficiencies in its logistics, compared to FQ3’21. As a result, we expect to see improved margins for its operations moving forward, directly contributing to its gross profit margins and net income profitability.

Stellar Performance For Fintech Mercado Pago

Growth In Mercado Pago’s TPV and User Acquisition

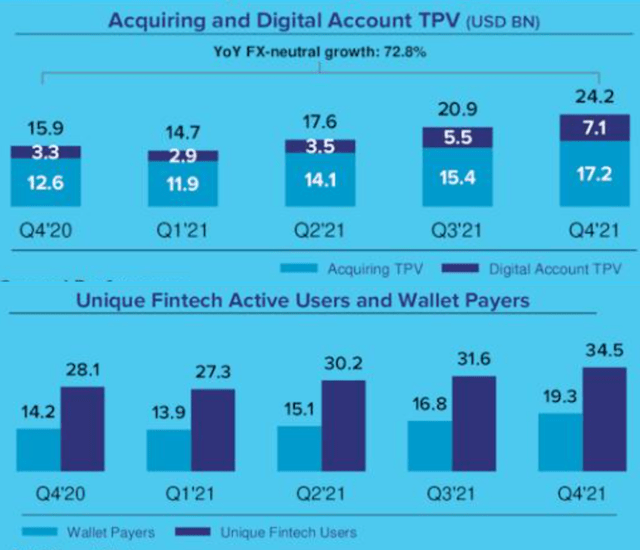

For FY2021, MELI reported exemplary growth for its payment business at 78% YoY with $77.4B of Total Payment Volume (TPV) on an FX-neutral basis. In FQ4’21, MELI reported an increase of 56.1% YoY to 1.02B online transactions on its platform, with a total of $24.2B of sales at 72.8% YoY growth on an FX-neutral basis. The off-platform TPV also outperformed by accounting for most of its revenue at 62%, with $48B of sales in FY2021, representing an impressive increase of 97% YoY on an FX-neutral basis. In FQ4’21, its off-platform TPV grew 96.5% YoY to $16.1B, with YoY increase of 69.4% to 849.9M off-platform transactions.

These impressive numbers emphasized the fact that commerce and online payments are gaining strength in the region, lending credibility to MELI’s aggressive expansions and acquisition of Redelcom so far. On an FX-neutral basis, digital accounts TPV, including wallet payments, P2P transfers, and Card transactions, grew by 138.3% YoY to $7.1B. Its unique fintech active users also reached 34.5M, representing impressive increases of 9.1% QoQ and 22.7% YoY.

In addition, MELI finally entered the cryptocurrency market in November 2021, by allowing its customers to invest through their digital accounts. Though cryptocurrency adoption is still at nascency in the region, we expect exponential growth, once the decentralized system gains widespread popularity post-Ukraine war. It is a matter of time before MELI facilitates e-commerce transactions through cryptocurrency, which has proved crucial upon the “collapse” of the Russian currency through multiple global sanctions on its economy.

So, Is MELI Stock A Buy, Sell, Or Hold?

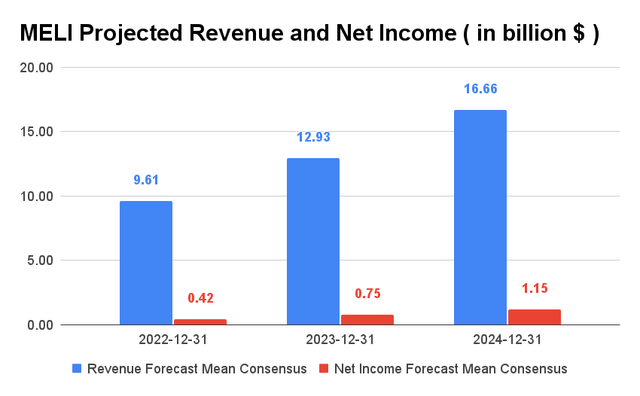

MELI Projected Revenue and Net Income

MELI is expected to report a slight deceleration of revenue growth at a CAGR of 33.08% over the next two years. However, we simply view it as a moderation from the pull forward growth experienced during the COVID-19 pandemic in FY2020 and FY2021. For FY2022, consensus estimates that MELI will report revenues of $9.61B, representing an impressive increase of 35.9% YoY.

In addition, the company is expected to report impressive net income growth at a CAGR of 65.9% over the next two years. For FY2022, consensus estimates that MELI may report a net income of $418.2M, representing a blockbuster 502% increase YoY. Furthermore, the company is expected to hit net income profitability of $1.151B by FY2024, which is extremely impressive given Shopify’s (SHOP) pessimistic outlook post-pandemic.

MELI is currently trading at an EV/NTM Revenue of 5.15x, lower than its 3Y mean of 11.65x. As a result of its impressive performance and undervaluation, consensus estimates also rank MELI’s stock as attractive now. Given the recent market correction, MELI is also trading at $957.87, nearer to its 52 weeks low of $858.99. Its valuation is also “almost” back at a more neutral pre-pandemic level, providing an excellent entry for those who have yet to buy. Therefore, we encourage interested investors to take advantage of this opportunity to gain more exposure.

Therefore, we rate MELI stock as a Buy.

This news is republished from another source. You can check the original article here

Be the first to comment