Late yesterday Bitcoin shook off a rate-hike confirmation from US Fed chair Jerome Powell, but the US stock market isn’t reacting quite as well to pretty much the same news today.

Consequently, the crypto market is playing follow-the-leader yet again, at least at the time of writing.

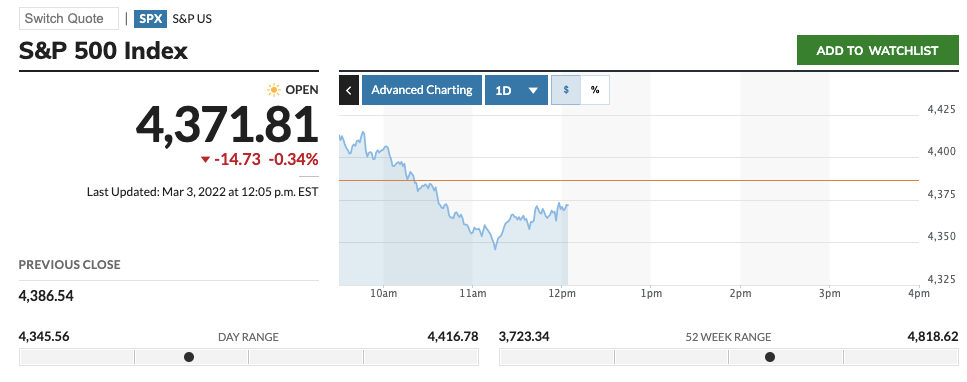

Russia’s invasion of Ukraine and the Fed’s inflation-combatting screw tightening is a two-pronged force suppressing the markets in waves for the moment. Here’s how the S&P 500 opened up today…

Still, it remains to be seen how two things pan out. Firstly, further negotiations between Russia and Ukraine, happening this afternoon, EET (although hope isn’t exactly high on that front).

The entire world is in turmoil because of this guy pic.twitter.com/z1lELNxNBT

— Sven Henrich (@NorthmanTrader) March 3, 2022

And then the other thing is the magnitude of the interest-rate hiking from the US Federal Reserve.

At this stage, many observers and analysts seem to be expecting no more than a 0.25% rate increase when the Federal Open Market Committee meets to decide mid March. Powell himself has hinted at that figure more than once. Anything more than that, though, and best strap in for a bumpy ride.

Top 10 overview

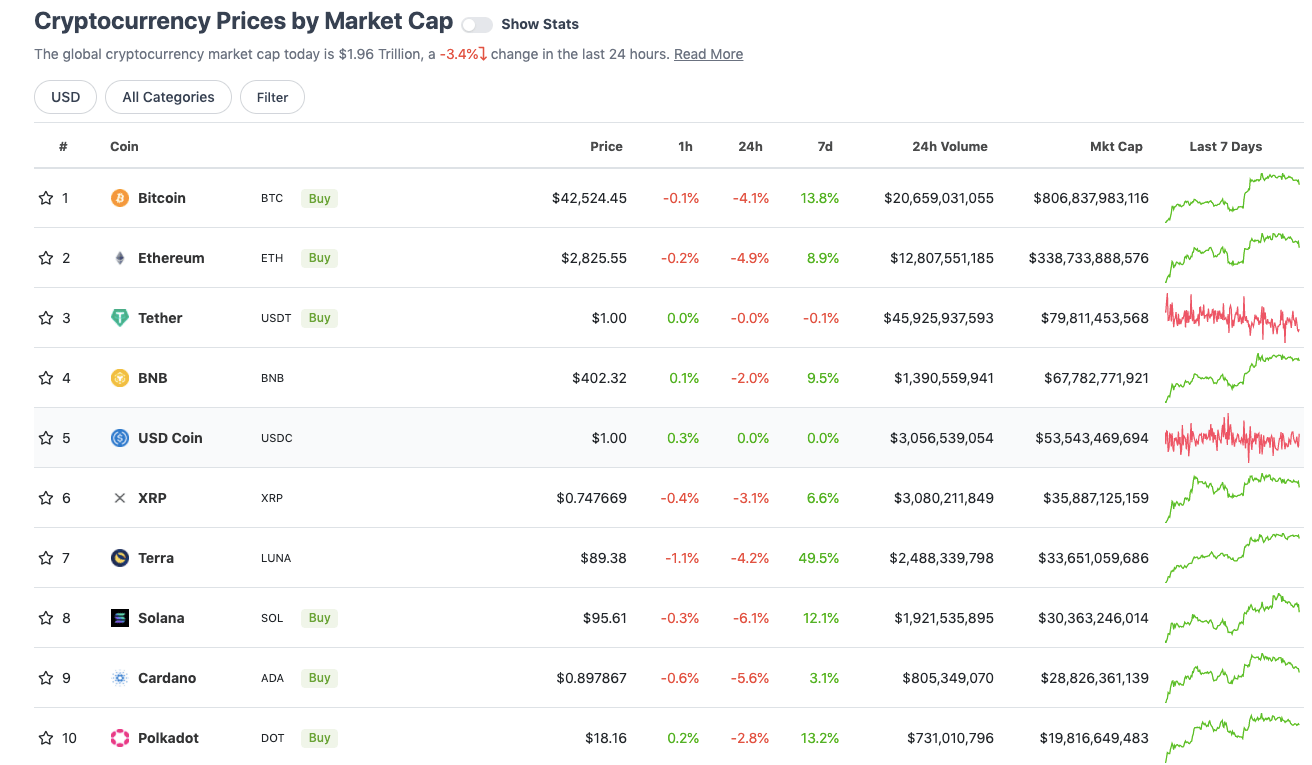

With the overall crypto market cap dipping below US$2 trillion again, down 3.4% compared with this time yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

Probably the main point of interest in this chart today is the absence of layer 1 protocol Avalanche (AVAX), which has dropped down to 11, usurped for now by the interoperability-focused Web3 blockchain champ Polkadot (DOT).

Ukraine has now received nearly $50 million of #Bitcoin #Ethereum #USDT and #Polkadot crypto donations

— Market Rebellion (@MarketRebels) March 3, 2022

Uppers and downers: 11–100

Sweeping a market-cap range of about US$19.2 billion to about US$912 million in the rest of the top 100, let’s find some of the biggest 24-hour gainers and losers at press time.

DAILY PUMPERS

• Anchor Protocol (ANC), (market cap: US$1.15 billion) +12%

• Quant (QNT), (mc: US$1.7b) +8%

• Frax Share (FXS), (mc: US$1.4b) +5%

• OKB (OKB), (mc: US$5.1b) +5%

• Juno (JUNO), (mc: US$1.9b) +4%

Anchor Protocol Fear and Greed Index is currently 99 – INSANITY

Current #ANC price is 4.656039616977981 usd

Current market cap is 1,203,564,964 usd

24h trading volume is 342,589,741 usd#Altcoin FGI live analysis for top 100 #cryptocurrencies pic.twitter.com/ZhQdxuRRgQ— Altcoin Fear and Greed Index (@AltcoinFGI) March 3, 2022

DAILY SLUMPERS

• Harmony (ONE), (market cap: US$1.8 billion) -9.5%

• Fantom (FTM), (mc: US$4.7m) -8.5%

• Aave (AAVE), (mc: US$1.75b) -8%

• Flow (FLOW), (mc: US$1.99b) -8%

• Avalanche (AVAX), (mc: US$19.2b) -7.5%

Uppers and downers: lower cap

Moving below the crypto unicorns (in some cases well below), here’s just a selection catching our eye…

DAILY PUMPERS

• Goldfinch (GFI), (market cap: US$223m) +80%

• Tornado Cash (TORN), (mc: US$133m) +50%

• Cola Token (COLA), (mc: US$11m) +30%

• Unifty (NIF), (mc: US$36m) +29%

• Liquity (LQTY), (mc: US$50m) +27%

DAILY SLUMPERS

• veDAO (WEVE), (market cap: US$25.5 million) -54%

• Scream (SCREAM), (mc: US$24m) -38%

• Geist Finance (GEIST), (mc: US$69m) -27%

• Beethoven X (BEETS), (mc: US$70m) -26%

• Thethys Finance (TETHYS), (mc: US$25m) -26%

Final words

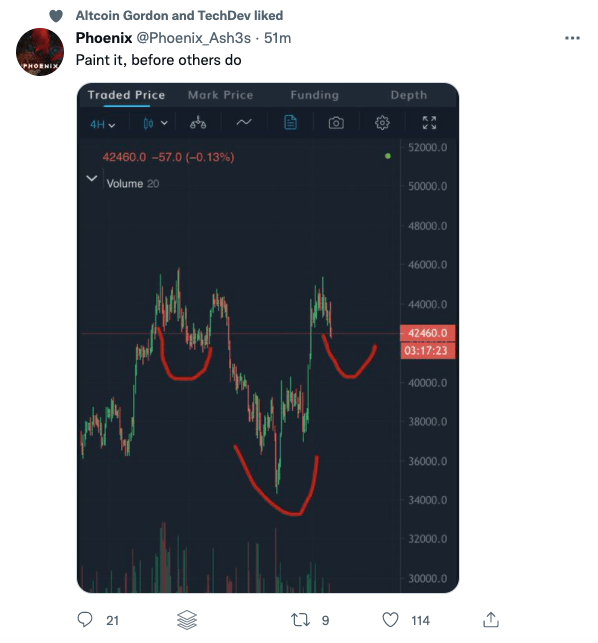

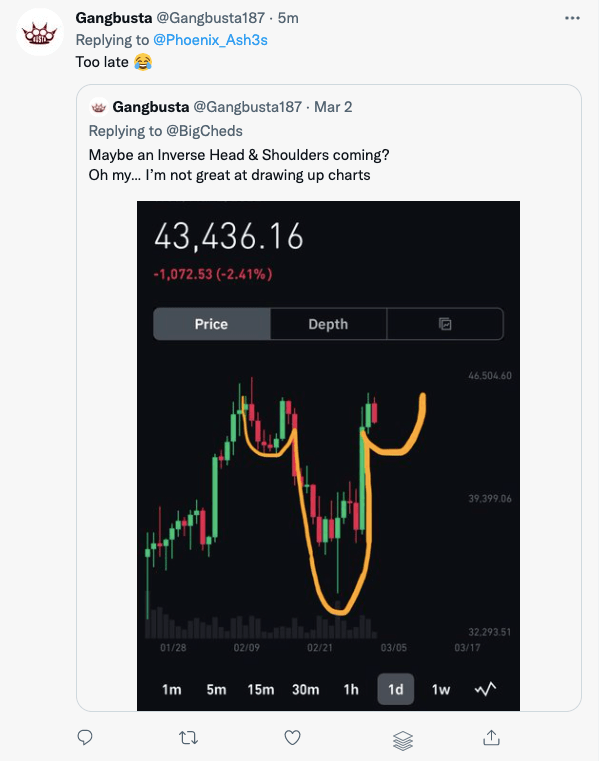

Some interesting technical analysis going on here on the four-hour timeframe Bitcoin chart just now. Looks like a possible bullish “inverse head and shoulders” pattern forming…

Or… is it just something else altogether?

Meanwhile, Meta’s Mark Zuckerberg has a sister by the name of Randi who’s into crypto. Not quite sure what else to say about the video below. We’ll let the tweet speak…

Zuckerberg’s sister just committed a crime.

This is honestly the worst thing i’ve seen ever 👇Its bad.pic.twitter.com/zCAz7CKabs

— Ƨ 👁 (@stellabelle) March 3, 2022

This news is republished from another source. You can check the original article here

Be the first to comment