Mooners and Shakers is sponsored by Dacxi, the world’s first purpose-built Crypto Wealth platform.

Right, where were we? Ah yeah – analysts think Bitcoin and crypto could go up, down or sideways. Sounds about right. Just overnight here in Oz, things are sideways with the tiniest hint of uppishness. Golf clap.

But… let’s see where Bitcoin lands on its North American weekly close, still a handful of hours away at the time of writing.

As pseudonymous, European-sounding chart watcher Rekt Capital points out, Bitcoin is “very close to performing yet another weekly close above the 200-week MA [moving average]”. And that’s generally a good sign for a market that’s moving in a positive direction… we’re led to believe.

Then again, another account this column occasionally references, “Roman Trading”, has been banging on about low volume and a “bearish divergence on the MACD – a moving average-based momentum indicator – and on the RSI (relative strength index, which measures the speed and change of price movements).

$BTC 1D

Looks like we retested/rejected supply once again on yesterday’s close.

MACD/RSI showing bearish divergence with a potential bearish cross.

Many alts like $ETH & $LINK are forming potential double tops. Stocks at resistance.#bitcoin #cryptocurrency #cryptotrading pic.twitter.com/HjZe5Fgjdk

— Roman (@Roman_Trading) August 6, 2022

Ah yes, the relatively weak pump going into the weekly #Bitcoin close

— Benjamin Cowen (@intocryptoverse) August 7, 2022

Metrics schmetrics? In this ongoing uncertain macro environment, kinda. With constantly conflicting info, crypto technical analysis can seem as volatile as a Ricky Stuart press conference, and about as easy to interpret as prog rock jazz fusion… or this Nancy Pelosi speech…

What ever loving F**k is this. Kamala and Nancy have the same speech writer! @SpeakerPelosi #pelosi https://t.co/GAeb62WaFy

— Mamajo (@NACYJO0927) July 29, 2022

Anyways… onto some price action…

Top 10 overview

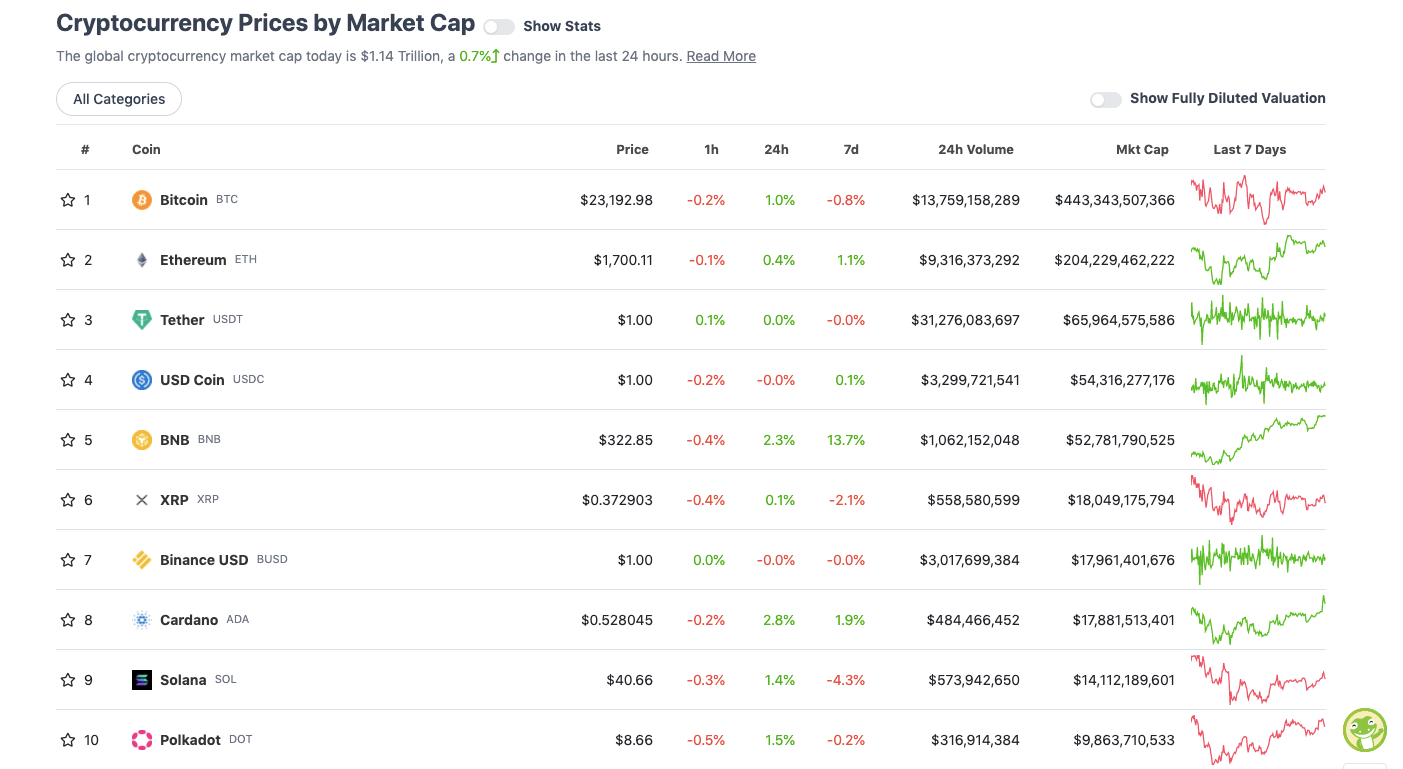

With the overall crypto market cap at US$1.14 trillion and up 0.7% since this time yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

Actually, if you do prefer bullish metrics, here’s one for you. For the past 55 days or so, according to the clever folks at Cointelegraph, the entire crypto market cap has managed to hold above the US$1.1 trillion mark, with Bitcoin (BTC) largely in a holding pattern, Ethereum gaining some ground in that time, and a selection of top altcoins, such as Polkadot (DOT), Polygon (MATIC), AAVE and BNB all performing strongly.

In fact, DOT has located a wristband just recently and is back in the Top 10 club at the expense of Musk’s doggy meme fave DOGE.

When Polkadot first hit the crypto airwaves in 2020, there was a hecka lot of excitement for its DeFi ecosystem. While layer 1 rivalries have taken a bit of a backseat this year, overshadowed by UST/LUNA crapping the bed, crypto-contagion after effects and inflation bantz, Polkadot is still definitely one to watch for when the market eventually turns around.

Here’s why the Acala protocol digs it… and it’s partly down to its strong developer community – something, the top gun Ethereum’s always laid its foundations on.

Acala co-founder Bette Chen (@bettechentt)’s response to @scottmelker‘s question of “Why did you choose to build Acala on @Polkadot?”

1. Plug-and-play security from Polkadot

2. @substrate_io‘s flexibility for building Acala’s DeFi app-chain

3. The Polkadot developer community pic.twitter.com/y0fVCT4XJc— Acala (@AcalaNetwork) August 3, 2022

Uppers and downers: 11–100

Sweeping a market-cap range of about US$7.4 billion to about US$393 million in the rest of the top 100, let’s find some of the biggest 24-hour gainers and losers at press time. (Stats accurate at time of publishing, based on CoinGecko.com data.)

DAILY PUMPERS

• Oasis Network (ROSE), (market cap: US$542 million) +25.6%

• Loopring (LRC), (mc: US$599 million) +11%

• Theta Network (THETA), (mc: US$1.66 billion) +18%

• Cosmos Hub (ATOM), (mc: US$3.3 billion) +7%

• Chainlink (LINK), (mc: US$3.8 billion) +6%

DAILY SLUMPERS

• Lido DAO (LDO), (market cap: US$1.32 billion) -6%

• Tenset (10SET), (mc: US$566 million) -6%

• Filecoin (FIL), (mc: US$2.23 billion) -5%

• Synthetix Network (SNX), (mc: US$948 million) -5%

• Decred (DCR), (mc: US$563 million) -3%

Around the blocks: Coinbase and BlackRock spoon together

A selection of randomness and pertinence that stuck with us on our daily journey through the Crypto Twitterverse… starting with an unholy union that made headlines a handful of days ago.

On Thursday last week crypto exchange giant Coinbase and Blackrock, the world’s biggest winner of real-life Monopoly, announced a partnership that caught much of the cryptoverse by surprise. A deal that will allow BlackRock’s wealthy institutional clients to directly buy Bitcoin.

And it’s been a much-needed boost for Coinbase’s recently languishing COIN share price, which has surged more than 52% over the past five days.

The partnership is a “watch this space” setup, because it could have very positive implications for BTC down the not-so-distant track, considering BlackRock manages more than US$10 trillion in assets globally. And somehow… it feels a bit dirty saying that.

Here’s the CEO of crypto index fund Bitwise’s take on it…

Working in crypto is an incredible, never-ending education in how far the pendulum can swing pic.twitter.com/ecTQKZAGD6

— Hunter Horsley (@HHorsley) August 5, 2022

Meanwhile… staying on pendulum swings, here’s a little reminder about taking profits in crypto… regularly, while they’re still there.

When you’re just about to take profit in a choppy market pic.twitter.com/O85UJHk0ay

— smilinglllama (@smilinglllama) August 6, 2022

Not that HODLers are in it for short-term profits, mind…

Bear market don’t scare HODLers

😎 #Bitcoin pic.twitter.com/K9r6exQQTL— Bitcoin Archive 🗄🚀🌔 (@BTC_Archive) August 6, 2022

This news is republished from another source. You can check the original article here

Be the first to comment