Ahead of another potential market-moving US Federal Reserve (Fed) disclosure today, Bitcoin (BTC) has been largely trading in the same sideways range it’s been in for several days.

And that’s a range of about US$45.5k to about US$48.6k over the past week.

At 2.30pm EST (6.30am AEDT), the Fed is releasing its minutes from its latest FOMC meeting, which was held in December, and both traditional and crypto markets are anticipating clarity on the pace of the potential Fed interest-rate hikes and scaling back of its bond-buying program.

Whether this moves the price of Bitcoin (and consequently the entire crypto market), and in which direction, is a bit of a guessing game at the moment, but faster rate hikes from the Fed than first supposed could be a bit of a short-term bummer for riskier asset classes such as crypto. A steady-as-she-goes rate-hiking pace from the Fed is probably what the market wants to see.

Speaking of things related to inflation levels and crypto, though… it’s time for a meme…

#Bitcoin pic.twitter.com/4MVUWSFZul

— naiive (@naiiveclub) January 5, 2022

Top 10 overview

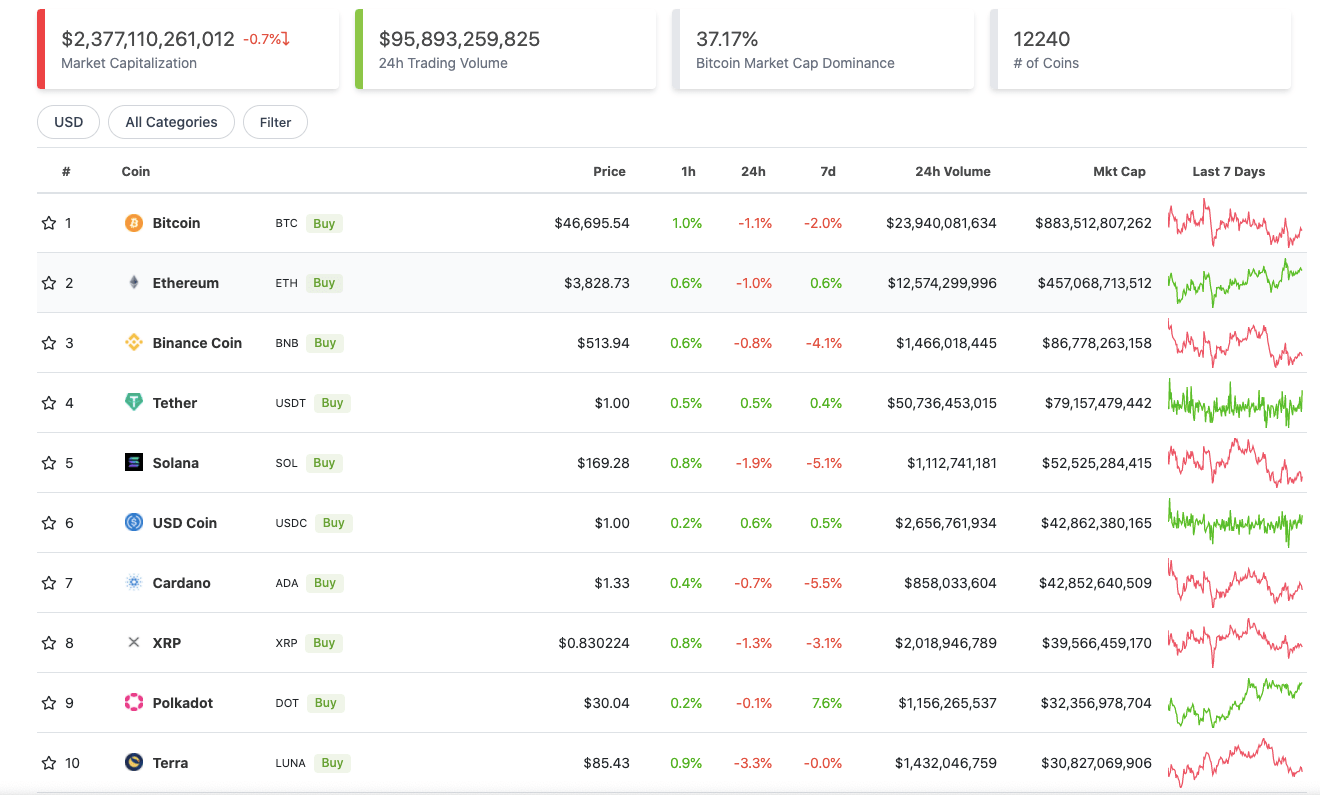

With the overall crypto market cap down 0.7% from this time yesterday and sitting around US$2.38 trillion, here’s the state of play in the top 10 by market cap at press time, according to CoinGecko data.

There’s not much movement at the station there. Not in crypto terms, anyway.

Unless you’re looking at the Bitcoin dominance figure, that is – which has dropped significantly, below 40%, to its lowest level since May 2018. And with that, there’s building excitement around Crypto Twitter about a potential “altcoin season” brewing, although a fair bit of understandable fence sitting, too…

#Bitcoin dominance did not behave as we expected in Q4 2021. It’s now forming a triple bottom, with bullish divergence

We’re either looking at a new Alt Season, Bitcoin Pump or Nuke very soon

Which one is going to be? pic.twitter.com/7pximPLrWQ

— Game of Trades (@GameofTrades_) January 2, 2022

Annnnd… then there’s gold fan no. 1 Peter Schiff’s predictable take… which is pretty much: “Bitcoin and crypto are screwed whatever happens”…

https://t.co/apKdvXpTxu

— Willy Woo (@woonomic) January 5, 2022

Winners and losers: 11–100

Sweeping a market-cap range of about US$25.5 billion to about US$1.4 billion in the rest of the top 100, let’s find some of the biggest 24-hour gainers and losers at press time.

DAILY PUMPERS

• SafeMoon [OLD] (SAFEMOON), (market cap: US$1.45b) +28%

• Chainlink (LINK), (mc: US$12.6b) +14%

• Helium (HNT), (mc: US$4.5b) +8%

• Synthetix (SNX), (mc: US$1.47b) +7.5%

• The Graph (GRT), (mc: US$3.8b) +7.3%

Widely regarded as one of the top projects in the space and the leading “oracle” (a project that connects real-world and smart-contract blockchain data), Chainlink has finally been seeing some notable movement in the past week or so after a long period of stagnation.

Some strong fundamentals could be driving the move, not least of all the prospect of staking on its network.

This 2022 kickoff presentation highlights how #Chainlink has come to secure over $75 billion, plans for cross-chain interoperability using CCIP, the upcoming release of staking, and the use of Chainlink as an abstraction layer by Web 2.0 and enterprises. https://t.co/Ii0eG0vznJ

— Chainlink – Official Channel (@chainlink) January 1, 2022

As for SafeMoon, meanwhile, it’s a little harder to see why the memecoin is having a pump today, other than perhaps the fact it’s leading this Twitter poll being conducted by former MMA star Chuck Liddell…

Im curious who will win this. Which #cryptocommunity is the strongest! between these 3. @dogecoin @safemoon @Shibtoken #dogecoin #shiba #SAFEMOON

— Chuck Liddell (@ChuckLiddell) January 4, 2022

DAILY SLUMPERS

• Spell Token (SPELL), (mc: US$1.63b) -8.5%

• Radix (RDX), (market cap: US$2.3b) -8%

• Convex Finance (CVX), (mc: US$2.16b) -7%

• Arweave (AR), (mc: US$3.15b) -6%

• Cosmos (ATOM), (mc: US$11.5b) -5%

Lower-cap winners and losers

Moving below the crypto unicorns (in some cases well below), here’s just a selection catching our eye…

DAILY PUMPERS

• Fuse (FUSE), (market cap: US$207m) +125%

• Pendle (PENDLE), (mc: US$53m) +72%

• Premia (PREMIA), (mc: US$49.4m) +49%

• Vader Protocol (VADER), (mc: US$559m) +38%

• Universe.XYZ (XYZ), (mc: US$33m) +30%

Buying $FUSE based on 2 minutes of research on it. What I found is it’s a small L1 focused around gaming and micropayments and sometimes narratives are enough.

— Looq (@CryptoLooq) January 5, 2022

DAILY SLUMPERS

• Tomb Shares (TSHARE), (market cap: US$666m) -29%

• Saito (SAITO), (mc: US$104m) -17%

• Opulous (OPUL), (mc: US$53m) -10%

This news is republished from another source. You can check the original article here

Be the first to comment