While the crypto market sweats on the outcome of the looming Fed FOMC meeting this week, Nasdaq, MicroStrategy’s Bitcoin love and XRP are at least giving the odd positive vibe today.

There’s a bit to cover, so let’s belly flop in.

Nasdaq announces crypto division

Now this definitely seems like quite a big deal for further institutional adoption of crypto. Nasdaq, owner of three big US stock exchanges – yep, that Nasdaq – just announced the launch of a new crypto-focused division: “Nasdaq Digital Assets”.

Mike “Howlin’ Wolf” Novogratz did say somewhat repetitively in 2020 and ’21 that the “herd is coming”. He’s been proven right, and those years saw some fantastical gains – although not necessarily strictly on the adoption thesis.

Sure, Bitcoin and crypto has fallen back to Earth harder than an NRL spear tackle, with mitigating macro circumstances at play. Even if crypto remains somewhere not even close to the vicinity of a launchpad for the forseeable, though, news like this is surely a great long-term sign.

NEW: Nasdaq has been plotting a move into institutional crypto custody services, according to several people briefed by the company. The firm is waiting for a green light from regulators.

Firm is also launching a new crypto-focused division, Nasdaq Digital Assets.

— Frank Chaparro (@fintechfrank) September 20, 2022

To begin with, the new crypto division will offer custody solutions for Bitcoin (BTC) and Ethereum (ETH) to institutional (big player) investors. And Nasdaq is citing increased demand for crypto assets among said institutional investors as the reason for the move.

“Nasdaq’s custody solution will bring together the best attributes of hot and cold crypto wallets,” a Nasdaq announcement reads.

Speaking with Bloomberg, Tal Cohen, head of North American Markets at Nasdaq, said: “Demand among institutional investors for engaging in digital assets has increased in recent years, and Nasdaq is well-positioned to accelerate broader adoption and drive sustainable growth.”

Let’s take a look at some daily price action, including XRP…

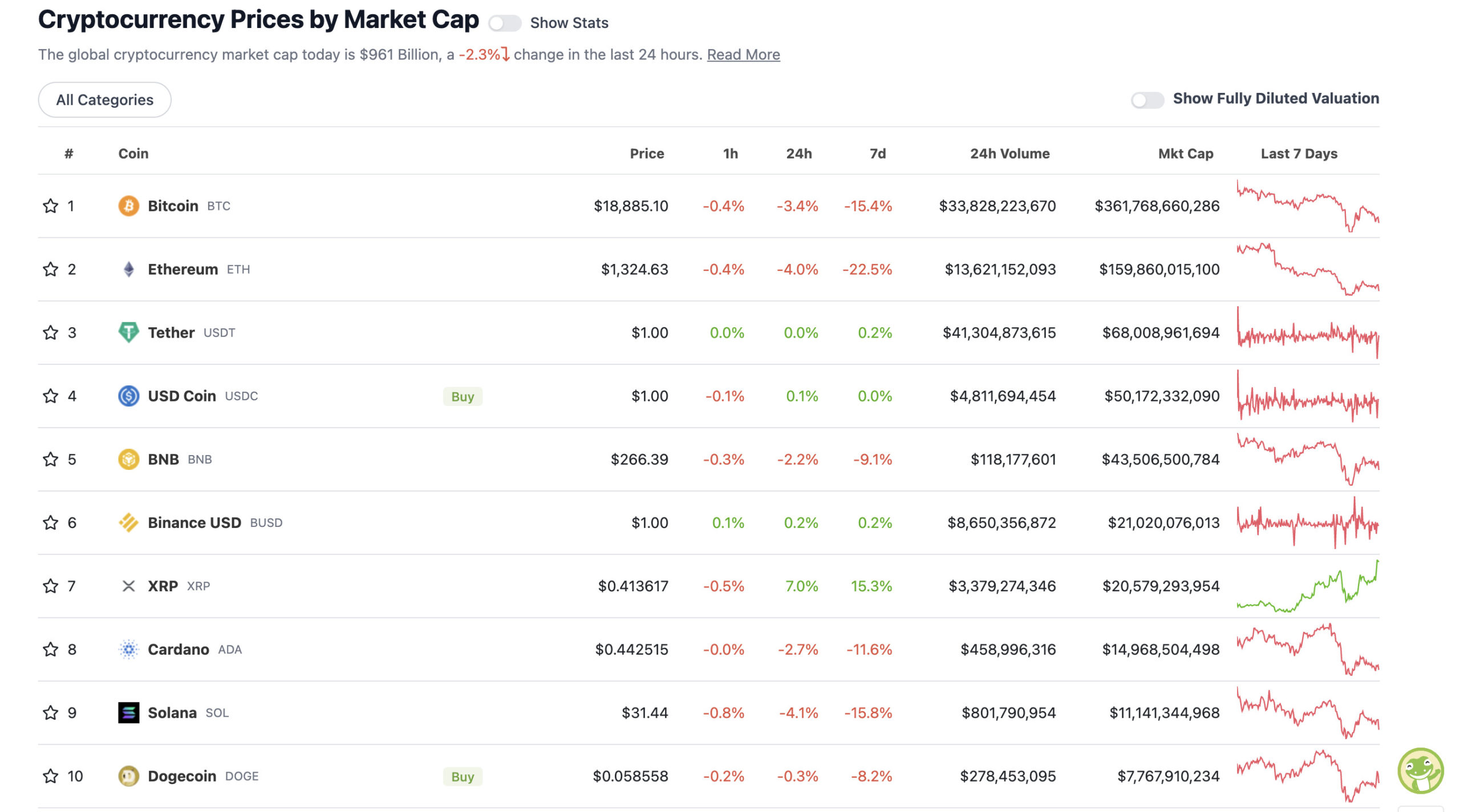

Top 10 overview

With the overall crypto market cap at US$961 billion and down about 2.3% since yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

While some positive news is floating about, the overall crypto market cap is still bleeding out as we head into the fateful Fed meeting in less than 24 hours now. No amount of good news can fight a Fed-led bear market, it seems.

when you buy the dip but it keeps dipping

— yzy.eth (@LilMoonLambo) September 21, 2022

XRP busts a move

Bitcoin, Ethereum and Solana are leading the daily plunge, but look at XRP! That’s some pretty decent upstream salmon-like action.

What’s going on? Building positivity from the “XRP Army” community regarding a potentially positive outcome in the SEC vs Ripple Labs court case, that’s what.

Here’s one of the main legal minds representing Ripple calling out the SEC boss Gary Gensler.

Great clip @ripple GC @s_alderoty lays out how @GaryGensler is actively hurting the investors he claims to protect through is ongoing regulation by enforcement. pic.twitter.com/AhPYpv5gaw

— Digital Asset Investor (@digitalassetbuy) September 20, 2022

Also, yesterday Commissioner Caroline Pham from the CFTC (Commodity Futures Trading Commission) wandered over to Ripple Labs HQ to check things out.

She met with Ripple CEO Brad Garlinghouse to discuss aspects of the project as as part of her “learning tour” in crypto and blockchain.

Seeing as the CFTC has been making a strong case for becoming the chief regulator of the crypto industry ahead of the SEC, which is generally seen as a more stifling agency for crypto innovation, the XRP community seemed to react positively to this little meeting. XRP rallied into the double digits not long after that news.

You can read a bit more about the SEC vs XRP and how it’s been going just lately, here.

Just a reminder, we should all be rooting for #XRP to win their fight against the SEC!

— Lark Davis (@TheCryptoLark) September 20, 2022

Uppers and downers: 11–100

Sweeping a market-cap range of about US$7.27 billion to about US$374 million in the rest of the top 100, let’s find some of the biggest 24-hour gainers and losers at press time. (Stats accurate at time of publishing, based on CoinGecko.com data.)

DAILY PUMPERS

• Helium (HNT), (market cap: US$629 million) +5%

• Compound (COMP), (mc: US$374 million) +5%

• Stellar (XLM), (mc: US$2.97 billion) +4%

• eCash (XEC), (mc: US$763 million) +2%

• EOS (EOS), (mc: US$1.34 billion) +2%

DAILY SLUMPERS

• Cosmos Hub (ATOM), (market cap: US$4.1 billion) -12%

• Osmosis (OSMO), (mc: US$563 million) -10%

• Evmos (EVMOS), (mc: US$762 million) -7%

• Synthetix Network (SNX), (mc: US$562 million) -6%

• Chiliz (CHZ), (mc: US$1.4 billion) -6%

Around the blocks: MicroStrategy buys more BTC

A selection of randomness and pertinence that stuck with us on our morning moves through the Crypto Twitterverse…

Michael Saylor’s Bitcoin-loving MicroStrategy company has bought another 301 of the OG orange crypto asset, worth roughly US$6 million. That increases the company’s BTC coffers to 130,000 of the physically intangible things – all bought at the average price of US$30,639 per coin.

Microstrategy shareholders must be absolutely sweating on this next Fed interest-rate hike decision, or at least a Fed pivot before the end of the year.

This actually represents the enterprise software company’s smallest BTC purchase in more than two years, according to Bloomberg. Guess $6m is its way of dollar-cost averaging in.

MicroStrategy has purchased an additional 301 bitcoins for ~$6.0 million at an average price of ~$19,851 per #bitcoin. As of 9/19/22 @MicroStrategy holds ~130,000 bitcoins acquired for ~$3.98 billion at an average price of ~$30,639 per bitcoin.https://t.co/5kYW98ij4I

— Michael Saylor⚡️ (@saylor) September 20, 2022

Seriously, the conviction is unreal, and I think long term the thesis is correct.

But the cost basis would be lower if the deployment strategy came with some more patience.

Then again, I’m a nobody who doesn’t have billions to deploy. Carry on! pic.twitter.com/lQD2G5mXJD

— Dylan LeClair 🟠 (@DylanLeClair_) September 20, 2022

One of #crypto‘s biggest market makers, Wintermute has been hacked for 160 million!

Yikes!

— Lark Davis (@TheCryptoLark) September 20, 2022

probably nothing pic.twitter.com/UcyKc6yhka

— Robbie Ferguson 🅧 – Hiring! (@0xferg) September 20, 2022

Was a super fun experience, to join @skynewsarabia live last night to discuss Web3 Education and how the UAE are implementing crypto assets in the economy.

It was translated into English through my headphones and then back to Arabic for the live national audience.

Unreal 🤯💪 pic.twitter.com/SEXhvPbNLC

— Ben Simpson @ Aus Crypto Con 📍 (@bensimpsonau) September 20, 2022

This news is republished from another source. You can check the original article here

Be the first to comment