The crypto market at large appears relatively calm on the surface right now, but a deeper dive into specific projects shows typical swirling volatility. Waves and its flagship stablecoin, for instance, are having a dumpy old ride.

We’ll get to that in a minute…

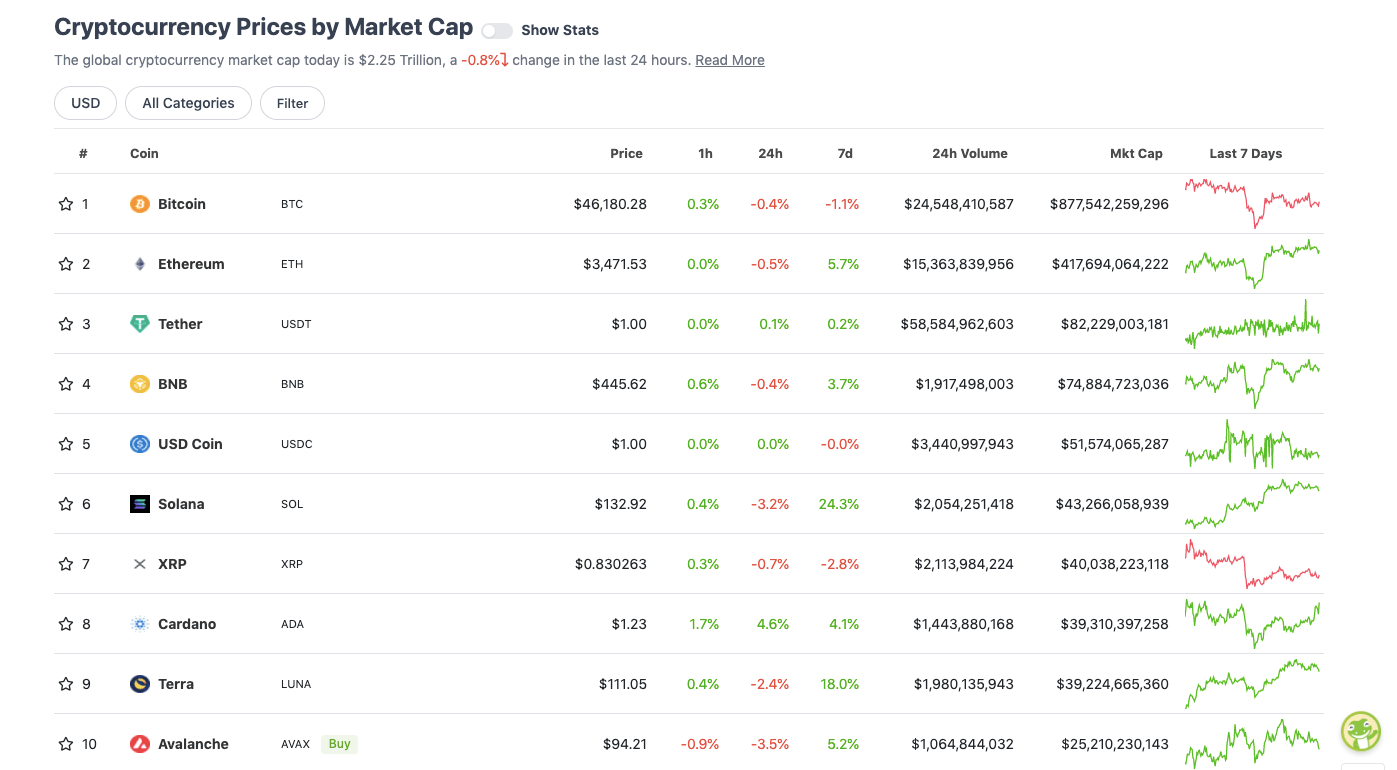

Top 10 overview

With the overall crypto market cap at about US$2.25 trillion, down roughly 0.8% from this time yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

Bitcoin (BTC) hasn’t moved a great deal over the past week, but at least it’s been holding relatively steady since April Fool’s Day, where it made a bounce at around the US$44,800 mark. That said, it does seem to be having a little trouble hanging on to US$46k at the time of writing.

There seems to be a sense of calm before the storm with the OG asset, especially as the biggest Bitcoin conference yet is set to take place in Miami in a couple of days on April 6. That event may or may not be a price mover – last year’s edition actually didn’t do much for the price of Bitcoin in the short term, despite the El Salvador Bitcoin-adoption news.

But there appears to be at least one solid piece of technical analysis in its favour right now. As Bitcoin Archive points out below, the BTC “moving average convergence divergence” (MACD) indicator has now confirmed a bullish crossover…

#Bitcoin Weekly MACD just confirmed a bullish cross-over! 🚀 pic.twitter.com/hoMRykJGdR

— Bitcoin Archive 🗄🚀🌔 (@BTC_Archive) April 4, 2022

Also, the on-chain data analytics firm Glassnode has made note of an extremely high level of exchange outflows for Bitcoin just lately. Outflows = good? Well, yeah, possibly. It potentially means BTC is being sent to cold storage, and locked away, not for sale. At least today, anyway…

#Bitcoin exchange outflow volume recently hit a rate of 96.2k $BTC per month.

Aggregate exchange outflows of this magnitude have only been seen on a handful of occasions through history, with most being after the March 2020 liquidity crisis.

Live Chart: https://t.co/k9wM940HCQ pic.twitter.com/836zjf39Nh

— glassnode (@glassnode) April 4, 2022

Elon Musk buys in to Twitter, DOGE briefly pumps

It’s been confirmed today that Tesla and SpaceX CEO Elon Musk has bought a 9.3% stake in Twitter worth US$3 billion, which makes him the largest shareholder in the company.

On March 25 Musk held a Twitter poll asking whether Twitter adheres to the principle of free speech being essential to a functioning democracy.

The vast majority of the more than two million people who voted told him no. Some speculated at the time that it was a precursor for the billionaire looking to buy in to the social-media platform.

The consequences of this poll will be important. Please vote carefully.

— Elon Musk (@elonmusk) March 25, 2022

Anyway, what does this have to do with Dogecoin (DOGE)? Pretty much anything Elon Musk does that’s deemed positive or catalytic, the price of DOGE reacts. And that’s simply because it’s Musk’s favourite cryptocurrency.

I’ve got a funny feeling that Twitter is about to get a lot more fun with Elon Musk on board 👀#dogecoin #doge @elonmusk pic.twitter.com/xJjJi8uxJt

— Sir Doge of the Coin 🇺🇦 🦊 (@dogeofficialceo) April 4, 2022

Perhaps DOGE fans and investors believe he’s now going to take to Twitter to shill the living hell out of the thing even more regularly.

In any case, DOGE pumped more than 10% in an hour on the news, but has been falling back to earth ever since.

Uppers and downers: 11–100

Sweeping a market-cap range of about US$24.2 billion to about US$1.2 billion in the rest of the top 100, let’s find some of the biggest 24-hour gainers and losers at press time.

DAILY PUMPERS

• Celo (CELO), (market cap: US$1.8 billion) +14%

• Mina Protocol (MINA), (mc: US$1.28 billion) +6%

• Lido DAO (LDO), (mc: US$1.3 billion) +4%

• PancakeSwap (CAKE), (mc: US$2.7 billion) +4%

• NEXO (NEXO), (mc: US$1.42 billion) +2%

• Waves (WAVES), (market cap: US$4.1 billion) -21%

• Frax Share (FXS), (mc: US$1.98 billion) -17%

• Humans.ai (HEART), (mc: US$1.43 billion) -11%

• eCash (XEC), (mc: US$2 billion) -9%

• JUNO (JUNO), (mc: US$1.2 billion) -7%

After a strong recent run, the Waves (WAVES) token has now lost over 30 per cent – about US$1.8 billion – in value over the last four days. The layer 1 decentralised crypto platform supports and mints the Neutrino (USDN) stablecoin (see below), which is also crashing today.

There had been recent surging demand for the USDN token, attributed to the large staking yields offered for the stablecoin on DeFi platforms in the Waves ecosystem.

However, the fact USDN is down almost 10% is a particularly bad sign as its peg to the US dollar has broken. It’s currently trading at US$0.86.

Rumours have surfaced that the Waves project has been using leverage to prop up the value of the stablecoin, which seems to have contributed to the dump and possible loss of faith from investors.

A Twitter account belonging to a pseudonymous crypto investor called 0xHamZ (who professes to be a “former Goldman” identity) breaks down the leverage-propping thesis in a detailed thread…

WAVES is the biggest ponzi in crypto

It has recklessly engineered price spikes by borrowing USDC at 35% to buy its own token

Continuous WAVES market cap growth is needed to keep the system stable

WAVES will eventually crash and USDN will break with it

You’re on notice🧵

— 0xHamZ (@0xHamz) March 31, 2022

0xHamZ writes that he calls the Waves platform a ponzi “because it is being propped up by borrowed money. There is no organic activity”.

Waves founder Sasha Ivanov, however has blamed the crypto-trading juggernaut Alameda Research, which was founded by Sam Bankman-Fried (also the founder of the FTX exchange), for apparently organising an anti-Waves “FUD” campaign.

“Get your popcorn ready: @AlamedaResearch manipulates $waves price and organizes FUD campaigns to trigger panic selling. I hope I caught your attention,” Ivanov wrote.

Get your popcorn ready: @AlamedaResearch manipulates $waves price and organizes FUD campaigns to trigger panic selling.

I hope I caught your attention. Follow me.

— Sasha Ivanov 🌊 (1 ➝ 2) (@sasha35625) April 3, 2022

Popcorn indeed. It’s a developing story and developing Twitter spat, probably. Whatever the case… it’s rough seas for the Waves ecosystem right now. (Yeah, sorry – went there.)

Uppers and downers: lower caps

Moving below the crypto unicorns (in some cases well below), here’s just a selection catching our eye…

DAILY PUMPERS

• district0x (DNT), (market cap: US$85 million) +131%

• GXChain (GXC), (mc: US$189m) +39%

• RAMP (RAMP), (mc: US$57.5m) +33%

• Opulous (OPUL), (mc: US$36m) +25%

• QASH (QASH), (mc: US$57m) +25%

DAILY SLUMPERS

• Shyft Network (SHFT), (mc: US$30m) -22%

• Genopets (GENE), (mc: US$56m) -21%

• Spool DAO Token (SPOOL), (mc: US$42m) -20%

• Ooki (OOKI), (mc: US$56m) -19%

• IDEX (IDEX), (mc: US$119m) -17%

• Neutrino USD (USDN), (mc: US$914m) -9%

Around the blocks

The OTR petrol station/convenience store adoption of crypto is big news, and not just in South Australia and Victoria. It’s also making its way round the globe on crypto Twitter today…

💥BREAKING: Australian convenience store chain with +170 locations now accepts #Bitcoin pic.twitter.com/ZVcgHoxDfi

— Bitcoin Archive 🗄🚀🌔 (@BTC_Archive) April 4, 2022

Meanwhile, that Apple Bitcoin/crypto-adoption rumour we looked at last week… it’s still building…

Strong rumors are circulating that Apple are set to announce a $1.5B Bitcoin purchase #BTC

— Altcoin Gordon (@AltcoinGordon) April 4, 2022

Apple will send #Bitcoin to $100k

— Ash WSB (@ashwsbreal) April 4, 2022

This news is republished from another source. You can check the original article here

Be the first to comment