Here is what you need to know on Wednesday, April 20:

A lot is going on, so let’s get straight to it. First, this article comes to you live from the FXStreet offices in Barcelona, where the weather is less than stellar, perhaps in tune with the less than stellar earnings from Netflix after the close on Tuesday. While your author was unwinding after a long day with a bit of Netflix, it appears I am in the minority as the streaming service is losing subscribers at an alarming rate. Price hikes certainly are to blame, so too is the end of the pandemic, but it certainly makes for worrying times ahead as investors saw fit to dump the stock to the tune of 27% and counting in the premarket. See more here. It is not like we have never seen this movie before as Netflix aired the same show back on January 21 when it collapsed about 22% after earnings. This is not a great start to earnings season for the FANGT names. Tesla (TSLA) gets its chance afterhours on Wednesday, and we have our earnings primer for Tesla here. It may be tough to overcome Giga Shanghai lockdowns, but let us wait and see.

Back to the macro environment now, stocks held up pretty well in the face of a continued advance in yields globally. The US 10-year is nearing 3%. This is a level flagged in a recent investor survey that would begin to tempt investors to move from equities to bonds. Bonds offer certainty in an uncertain environment, and there are not too many leading stocks offering a dividend over 3% currently.

The currency market remains yen-centric with the Bank of Japan holding down JGB yields and seeing the yen lose value at an accelerating rate. Now the yen is up to 128 versus the dollar, having just failed to break 130 this morning. This has helped the dollar index to trade at 100.33. Meanwhile, the Russia-Ukraine war appears to enter a new phase in the east, but so far energy prices are taking it in stride with oil lower at $102.73. Gold is at $1,954, and Bitcoin is at $41,700.

European markets are higher: Eurostoxx +1.3%, FTSE +0.1% and Dax +1.1%.

US futures are mostly higher: Nasdaq flat, S&P +0.1% and Dow +0.1%.

Wall Street Top News

IMF says beware of sell-offs as central banks tighten.

Libya lost oil production due to shutdowns.

Russian President Putin says he will continue operations in Ukraine.

Tesla (TSLA) earnings due after the close.

IBM beats on top and bottom lines.

Netflix (NFLX) loses 200k subscribers, stock down 27% premarket.

Palantir (PLTR) upgraded by RBC.

Proctor & Gamble (PG) beats on EPS and revenue, up 1.6% premarket.

Lululemon (LULU) says it aims to double revenue in the next five years.

Robinhood (HOOD) could be back on with plans to enter the UK as it buys Ziglu, a London-based app for crypto.

ROKU down 7% on read-across from Netflix.

Disney (DIS) also down 5% on read-across from Netflix.

ASML up 4% on revenue growth.

Upgrades and Downgrades

Source: Benzinga Pro

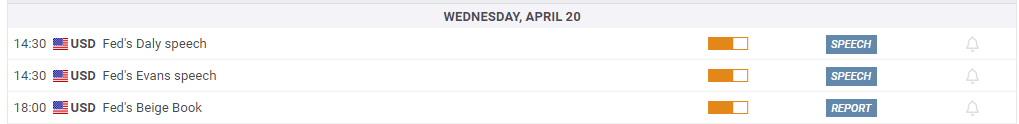

Economic releases

The author is short Tesla

This news is republished from another source. You can check the original article here

Be the first to comment