The week started with modestly higher prices, despite warnings that the market could fall further, Ethereum transaction fees dropped to their lowest level since December 2020, CEL rallied even though Celsius fired 150 employees, Cardano’s Vasil upgrade launched on testnet “successfully” and is expected to deploy on the mainnet next month, and Circle denied it’s facing any difficulty in maintaining USDC’s peg, while the USDT supply on Curve remained elevated. As this was happening, Solana faced a class-action lawsuit.

Voyager filed voluntary petitions for relief under Chapter 11 of the US Bankruptcy Code, while Vauld was the latest exchange to suspend withdrawals, deposits, and trading, and it may be acquired by Nexo. Crypto.com was calming down their users amid “plenty of FUD,” Three Arrows Capital reportedly has USD 7.5M worth of blue-chip NFTs, and the crypto chaos continued as CoinLoan cut withdrawal limit, 3AC moved funds, and Celsius apparently paid Maker – and yet, there was more turmoil. But when it comes to crypto bailouts, Compound founder said that DeFi is ‘designed to avoid this bullshit’.

In ‘various news’ news: Bitstamp dropped their previously announced inactivity fee following a community backlash, Bitmain will launch its AntMiner E9 despite the approaching Ethereum Merge, an Ethereum Name Service domain sold for USD 345,000 amid market crash, Chevrolet’s first NFT drew zero bids even though it’s accompanied by a Corvette, Indian crypto trading dropped following the new tax implementation, and Peter Schiff experienced problems with the traditional international banking system, getting a lesson in the benefits of BTC. Meanwhile, Crema Finance lost over USD 8.7m worth of crypto in a flash loan attack, and Immunefi found that hackers stole USD 670m from DeFi projects in Q2.

The Central African Republic unveiled its Sango Coin amid transparency and credibility worries, Argentinians rushed to tether after the economy minister resigned, the Chinese central bank may apply smart contract technology to the digital yuan, and a Beijing court ruled in favor of a man who refused to be paid in USDT instead of fiat. Meanwhile, the EU lawmakers want the anti-money laundering rules to cover NFTs, and CUBE found that the regulatory scrutiny is increasing in Europe and North America. In Spain, the government plans to make citizens who hold coins on overseas platforms declare their holdings, while the police spent USD 115,000 on crypto monitoring technology to fight drug smuggling.

Meanwhile, Gary Gensler is now under stronger pressure over Bitcoin ETFs, and Mt. Gox trustee moved closer to a pay-out.

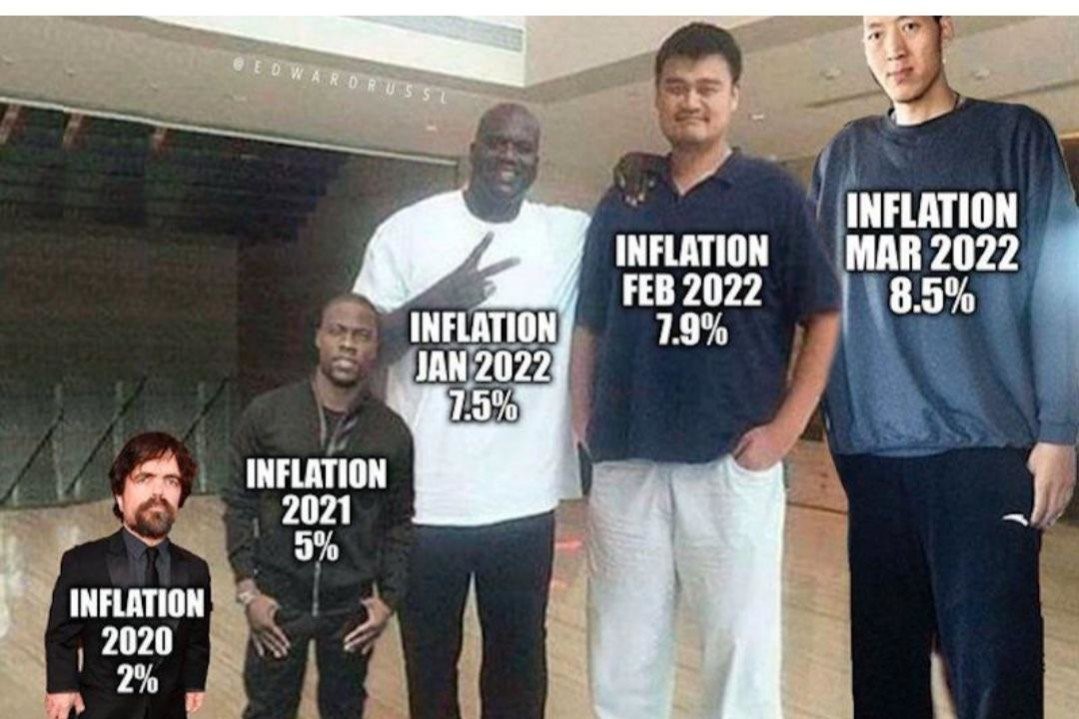

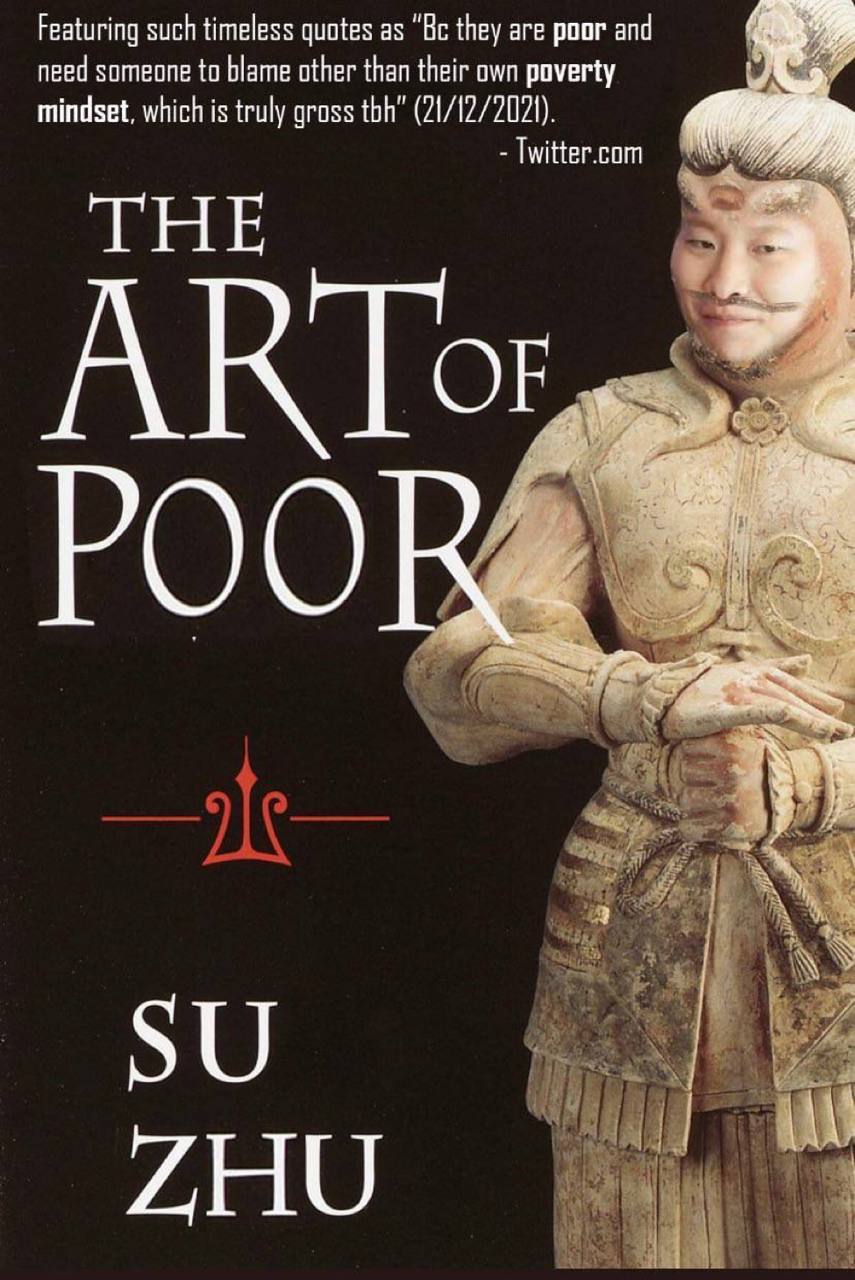

Joke time!

__________

For starters this time, let’s welcome the newcomers. How are you all?

__

TBH. Poor. Gross.

__

……I don’t even…like… You had one job, crypto market!

__

Time’s a bi– …. Bitcoin!

__

How to put a person back into a coma. Go ahead, tell him.

__

See you in crypto spring.

__

For future reference, until a bull returns, that is.

__

No worries, FTX’s got it!

__

“Maaan, I’m telling you, like, totally, we’re just suuuper early, maan.”

__

What do you mean ‘drawer’ and ‘cutlery’? What do you mean ‘house’?

__

A bit shaky, maybe some fainting involved, but otherwise relatively unstable.

__

Conferences are back, y’all!

__

I totally want to be an agent of wonders. Can those wonders be in the crypto market?

__

A volcanic – though not yet bond – burn.

__

“Fine, maybe there is no heaven, but at least when you’re dead you’re no longer starving.”

__

Show me September!

__

Don’t forget to send your urine samples for weekly testing.

__

An example sentence: “Do you think this project is a Carlo Pietro Giovanni Guglielmo Tebaldo Ponzi?”

__

It’s magic!

__

And here’s a documentary for you about mythical creatures who sold the top.

This news is republished from another source. You can check the original article here.

Be the first to comment