A number of decentralized finance (DeFi) applications and their communities are vying for protection from a wave of liquidations as a result of the record-breaking collapse in cryptocurrencies, sometimes by taking unheard-of actions.

DeFi Staggers In The Winter

Even if the crypto market’s lending problem caused a gloomy period this past week, the DeFi ecosystem experienced a number of fresh advancements. Celsius, a different cryptocurrency lender with significant interests in DeFi technologies, filed for bankruptcy. In the second quarter, the market as a whole reached new lows.

A new alarm-equipped decentralized application (DApp) platform was introduced by the BNB Chain. Insolvent cryptocurrency lender Celsius was the subject of an investigation by the Vermont state regulator.

A huge user’s account that faced the possibility of a significant liquidation was temporarily taken over by token holders of Solend, a lending app on the Solana blockchain, earlier in June. This drastic action for DeFi looks to be a first. Later last month, a second vote resulted in the ruling being overturned.

All of that happened after MakerDAO, a cryptocurrency community-run software that supports the stablecoin DAI and operates Aave, one of the first decentralized autonomous organizations, halted the token’s ability to be deposited and created on the DeFi crypto lending platform.

The collapse of Terra and its stablecoin TerraUSD Classic (USTC) in May was a major factor in the entire DeFi market cap falling from $142 million to $36 million over the second quarter, says a report released by the cryptocurrency data aggregator CoinGecko on Wednesday.

BTC/USD trades above $20k. Source: TradingView

Despite a 74.6% market cap fall in Q2, user activity has remained largely stable, according to CoinGecko. It highlighted that the number of daily active users reduced just 34.5% from 50,000 to 30,000 in Q2 2022.

Additionally, the report noted that the spike in protocol exploits during the quarter, which affected companies like Inverse Finance and Rari, which saw hacks totaling $1.2 million and $11 million, respectively, contributed to the decline. The report said:

“These attacks have negatively impacted token prices as investors lose faith in these hacked protocols.”

Due to their tendency to be networked, DeFi apps—which allow users to trade, borrow from, and lend to each other without the use of intermediaries like banks—are struggling. Users frequently use tokens as collateral when borrowing coins from one app to deposit into another for higher rewards.

Related reading | DeFi Protocols At Higher Risk Of Exploit During The Bear Market, Here’s Why

NFT Marketplaces Thrive But DeFi With Revenue Floats

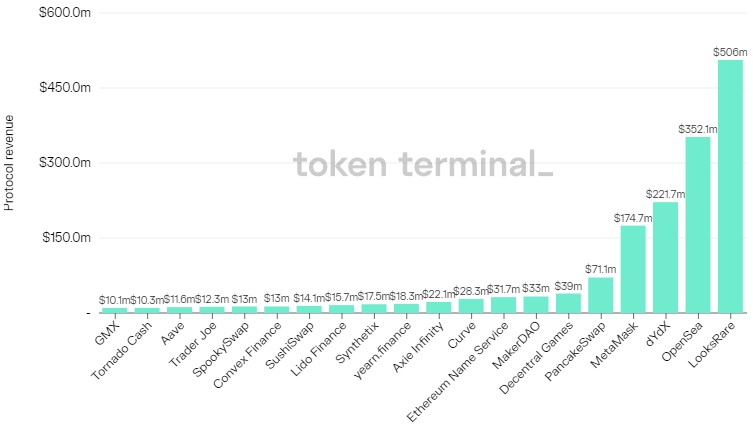

According to Token Terminal data, nonfungible token (NFT) marketplaces like LooksRare and OpenSea are the main platforms that still generate revenue.

Top dapps based on cumulative protocol revenue in the past 180 days. Source: Token Terminal

The majority of the surviving protocols with the biggest revenue are decentralized financial platforms, demonstrating that while DeFi is down, it’s still in the game. These select protocols include MetaMask, Decentral Games, Axie Infinity, and Ethereum Name Service.

Decentralized applications (DApps) and protocols that share fees with token holders and liquidity providers are also profit-positive.

Historical view of crypto/web3 projects that generate fee revenue to their token holders.

Protocol revenue market share leaders in ’21:

Q1: MakerDAO

Q2: PancakeSwap

Q3: Axie Infinity

Q4: Ethereum pic.twitter.com/zNRFnss7c4— Token Terminal (@tokenterminal) January 29, 2022

Protocols that provide token holders with passive revenue streams have a stronger chance of surviving till the start of the next bull market as the bear market continues to hammer prices and eliminate unproductive and poorly managed platforms.

Related reading | DeFi Loses $678 Million To Hackers In Q2 2022, New Report Reveals

Featured image from Getty Images, charts from TradingView.com and Token Terminal

This news is republished from another source. You can check the original article here

Be the first to comment