It’s been another interesting week of discussions on the popular SatoshiStreetBets Reddit forum. With the market currently in a downturn, many have been sharing opinions about some of the coins they’re watching.

Below, we have a quick roundup of some of the coins making the rounds all week on the Reddit forum.

1. Bitcoin (BTC)

Bitcoin continues to dominate cryptocurrency discussions on SatoshiStreetBets. It was no different this week.

Bitcoin has been amid some dismal performances. The coin has a 52-week trading range between $10,355 and $64,785. With a current price of $42,332, Bitcoin is trading 34.6 percent off its all-time high.

The primary reason for discourse on Bitcoin appears to be the regulatory action being taken by the Chinese authorities. Beijing has been anti-crypto for years, but it stepped its action against the industry up, even more, this year as it banned cryptocurrency mining. This week, the Peoples’ Bank of China (PBoC) also announced a set of new measures to coordinate with local agencies and fight crypto adoption in the country.

As expected, the news has sent Bitcoin on a tailspin. The asset is now trading below its moving average metrics, with its price only beating its 100-day MA of $40,896. The asset’s moving average convergence divergence (MACD) has flipped bearish, and its relative strength index (RSI) of 41.53 shows that investors are selling off fast.

67% of all retail investor accounts lose money when trading CFDs with this provider

2. Ethereum (ETH)

The second most valuable cryptocurrency, it’s no surprise that Ethereum also led discussions on the SatoshiStreetBets channel this week. The platform has been the focus of much ire, especially with some believing that it could eventually flip Bitcoin to become the crypto kingpin.

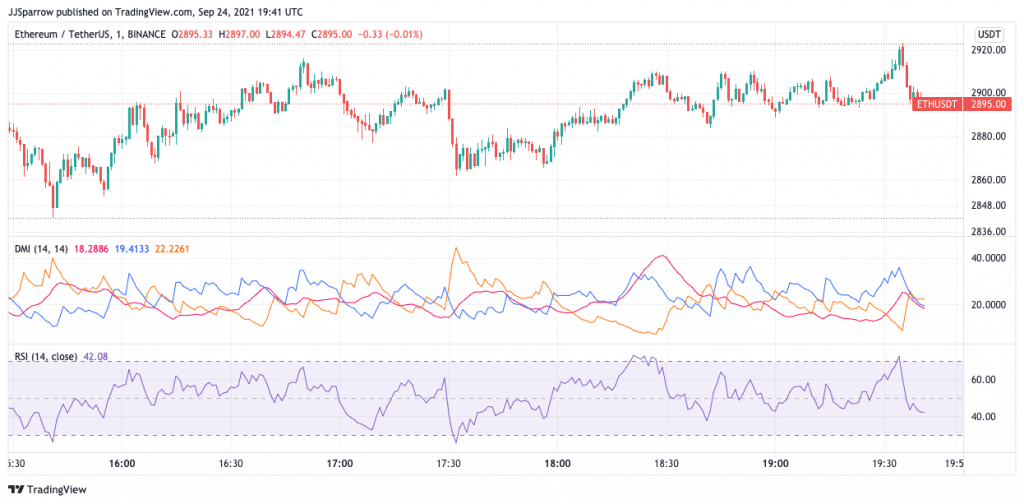

ETH has a 52-week trading range between $340.02 and $4,386.98. Its current price is $2,889.43 – down 34.1 percent from its all-time high.

Like Bitcoin, most of the discussion behind Ether has been about the Chinese ban. BTC is leading cryptocurrencies in dropping, but ETH has also seen significant price drops too. In the past day, ETH is trading down 7.31 percent – compared to BTC’s 4.06 percent loss.

On the technical front, there isn’t much to be happy about either. ETH is trading below its short-term MA indicators, but it’s above its 100 and 200-day MAs for now. The asset’s MACD has also flipped bearish as of today.

With an RSI of 40.53, ETH also appears to be seeing an outflow of investors.

67% of all retail investor accounts lose money when trading CFDs with this provider

3. Dogecoin (DOGE)

The leading meme coin Dogecoin has been on investors’ lips all week. The coin might not have seen a substantial price gain, but there is a lot to be excited about.

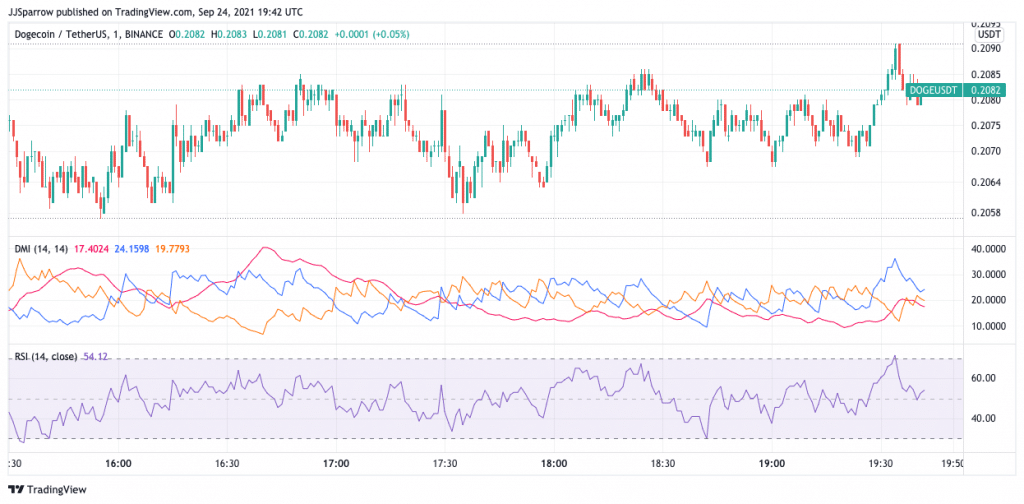

DOGE has a 52-week trading range between $0.0016 and $0.7416. With a current price of $0.2068, the coin is down 72.11 percent from its all-time high.

The primary discussion about DOGE has come from multiple sources. For one, Adam Aron, the chief executive of AMC Entertainment, shared a poll asking if the company should add DOGE as a payment option for movie tickets. 68.1 percent of respondents answered in the affirmative.

RedSwan, a commercial real estate tokenization platform, also announced that it would accept the leading meme coin for digital real estate deals on its marketplace. With all of this, it would be interesting to see how DOGE performs going forward.

DOGE isn’t performing so well technically. The coin is trading below all of its MA indicators, and its MACD is unsurprisingly bearish. Investors are also selling off fast, with DOGE’s RSI standing at 36.51.

67% of all retail investor accounts lose money when trading CFDs with this provider

4. XRP (XRP)

Launched by Ripple Labs, XRP is the leading cryptocurrency for cross-border transactions. The asset has been dogged all year following a legal battle between Ripple and the Securities and Exchange Commission (SEC), but XRP has remained quite impressive in 2021.

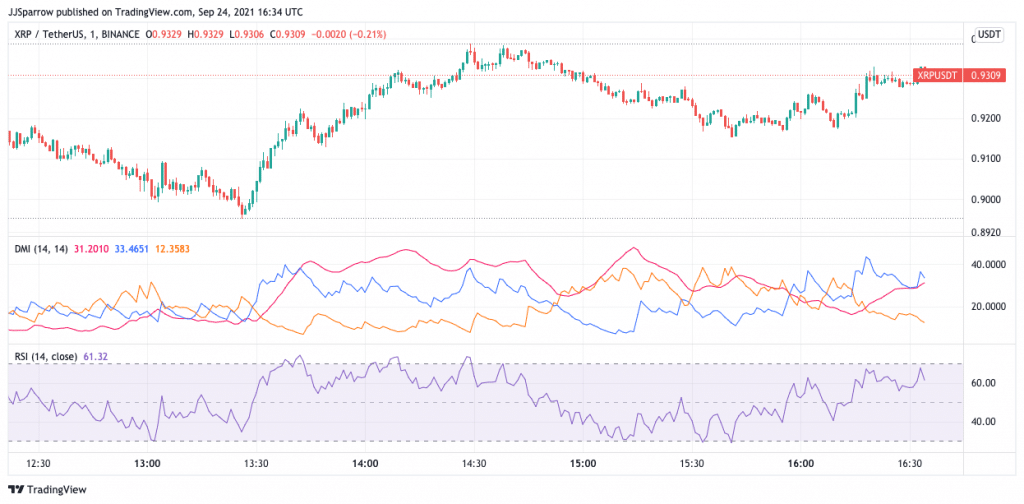

XRP holds a 52-week range between $0.17 and $1.96. With a current price of $0.91, XRP is trading down 53.8 percent from its yearly high.

XRP has been getting more attention recently, especially with many getting tired of Ripple’s case with the SEC. Ripple Labs also scored a big win earlier this week, announcing a partnership with the Royal Monetary Authority of Bhutan to launch a central bank digital currency (CBDC) for the kingdom.

The partnership will see both parties leverage Ripple’s private ledger to build the digital ngultrum. CBDC development remains a major movement for many countries, and Ripple is looking to get in on the action.

Sadly, the news wasn’t enough to save XRP from the current downturn. The coin’s technicals are not so great, with XRP trading below all of its MA metrics – except its 100-day MA of $0.87. The coin’s MACD is also negative, so it’s a sell signal for XRP. An RSI of 39.96 shows that the sell pressure for XRP is quite high.

67% of all retail investor accounts lose money when trading CFDs with this provider

5. MIOTA (IOTA)

IOTA is the native token for MIOTA an open-source decentralized blockchain platform that looks to power the Internet of Things (IoT). The platform has become more popular in 2021, as with other blockchains being discussed on SatoshiStreetBets.

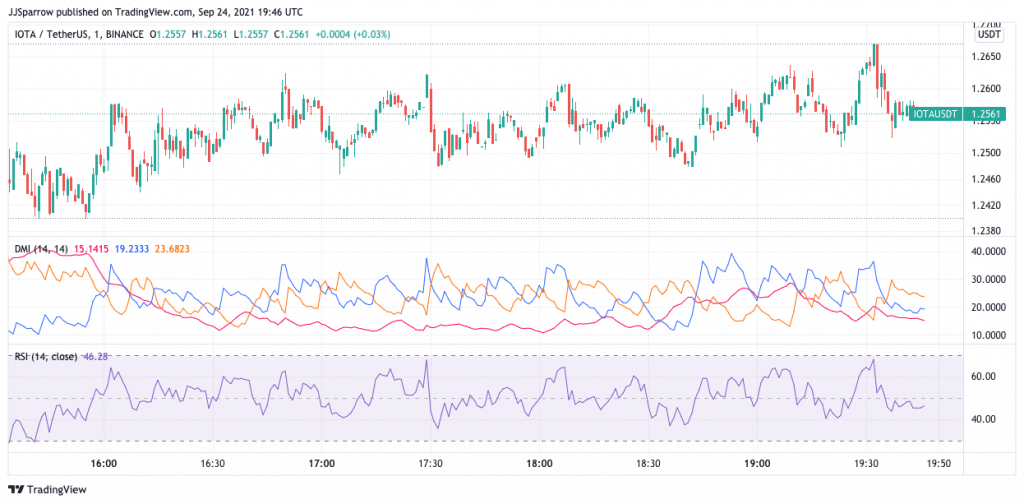

Currently, IOTA has a 52-week range between $0.21 and $2.68. With a current price of $1.24, the coin is down 53.7 percent from its all-time high.

Not much has been said about IOTA recently. The IOTA Foundation was recently included in an initiative from the European Union to invest heavily in blockchain technology. The Foundation will focus on building an EU-wide blockchain platform, with reports suggesting that the EU might spend as much as $177 billion on blockchain and other technologies.

The coin is trading below most of its MA indicators, besides its 100-day MA of $1.05. The asset’s MACD is positive, but continued bearish movements like this most likely yield a sell signal soon.

IOTA’s RSI44.49, sowing that it is very much underbought.

67% of all retail investor accounts lose money when trading CFDs with this provider

This news is republished from another source. You can check the original article here

Be the first to comment