Solana (SOL) remains under pressure as macroeconomic headwinds—particularly renewed tariff concerns — rattle investor confidence.

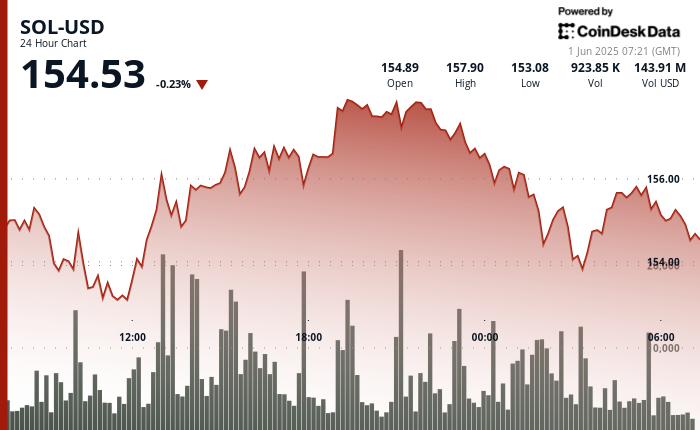

The token is now hovering around $154.50 after establishing a tight trading range between $152.33 and $158.06, reflecting a 3.76% swing in the past 24 hours, according to CoinDesk Research’s technical analysis data model.

Although higher lows had previously suggested resilience, SOL slipped from $156.74 to $154.86 in a single hour, breaking beneath its mid-April uptrend channel.

Derivatives data reflects bearish sentiment: open interest in SOL futures is down 2.47% to $7.19 billion, while long liquidations surged to $30.97 million, indicating pressure on leveraged positions. Short liquidations remain minimal, reinforcing the downside bias.

Still, institutional interest remains evident. Circle’s recent $250 million USDC mint on Solana has added liquidity and cemented the chain’s stablecoin leadership, with 34% of all stablecoin volume now routed through the network. Additionally, SOL Strategies’ $1 billion validator fund signals sustained long-term confidence in the protocol’s scalability, even as short-term price action falters.

Technical Analysis Highlights

- SOL established a 5.73-point range ($152.33–$158.06), indicating a 3.76% intraday swing.

- Earlier price action traced a clear ascending channel with solid support near $152.80, supported by heavy accumulation.SOL hit a session high of $158.06 during the 19:00 hour on strong volume, signaling earlier bullish momentum.

- A reversal unfolded in the early morning hours, with SOL falling from $156.74 to $154.86 on increased selling.Selling pressure peaked between 01:53–01:54, with over 74,000 units traded in a sharp burst.

- Short-term momentum turned bearish as lower highs and weaker volume defined the final trading stretch.As of writing, SOL is consolidating near $154.50, suggesting price stability but with downside risk if volume doesn’t improve.

External References

This news is republished from another source. You can check the original article here

Be the first to comment