Here is what you need to know on Thursday, May 5:

The Fed basically baulked at killing the equity market on Wednesday as it trod a by now well-worn conservative path in hiking rates: 50 bps as expected. By taking a 75 bps hike off the table, the bond market immediately repriced the front end of the curve, and equities went into a massive relief rally. This was what we had called for in our note on Wednesday.

Positioning was underweight equities and sentiment was terrible, so a relief rally was the high probability risk-reward trade. The US dollar we also mentioned in our morning note as needing a correction and so it proved. This morning sees things take a more bearish tone with the Bank of England being more direct than the Fed could ever be.

Equity markets though went on a rampage after the Fed, with the Nasdaq tacking on nearly 4% and the S&P 500 nearly 3%. All sectors finished in the green and market breadth was astounding. We are now likely to see risk assets continue to recover as we have some serious losses in the sector. Equity positioning will also get a boost now earnings season is over and buybacks can restart.

Expect this move to continue before the bond market eventually regains its footing and pushes yields back up and equities will again wobble. This remains a time for cash-rich companies and value, not growth. But a growth rally is expected in the short term.

Over in the currency markets, it’s all go in pound sterling this morning after the Bank of England was incredibly hawkish, bearish, or just plain negative. The BoE sees inflation hitting 10% this year and the UK economy suffering. No beating around the bush there then. Sterling cratered, losing 2% or nearly 3 big figures. 2% may not sound a lot to stock jockeys but it is a colossal move for a major currency pair.

Oil remains on the ascent after the EU proposal to ban Russian oil and is nearing $110. Gold price is up to $1900 and Bitcoin is at $39,460. Is BTC the forgotten asset, certainly cryptocurrency volatility is following meme stocks in collapsing.

See forex today

European markets are mixed: Eurostoxx -0.4%, FTSE +0.7% and Dax +1.7%.

US futures are lower: S&P -0.6%, Dow -0.4% and Nasdaq -0.7%.

Wall Street top news (WPY) (QQQ)

Bank of England sees significant slowdown as it raises rates and forecasts 10% inflation.

OPEC to increase supply by 432K barrels per day

Fed raises rates 50 bps, in case you missed it!

Twitter (TWTR) rises as Elon gets more financial backers.

NIO added to potential delisting from SEC.

XPEV, JD PDD see above!

Lucid (LCID) earnings after the close.

Crocs (CROX) smashes earnings, again!

ETSY wow income down 40%, stock down too!

EBAY down 7% on earnings.

Wayfair (W) down on revenue slipping.

Twilio (TWLO) up on earnings beat.

Seaworld (SEAS) up on earnings.

Spirit Airlines (SAVE) needs saving as earnings miss, stock 2% lower.

Shopify (SHOP) drops sharply on earnings.

Sunrun (RUN) making a run for it as shares surge 12% after earnings. Solar company so is that really a surprise!

Upgrades and downgrades

Source: Benzinga Pro

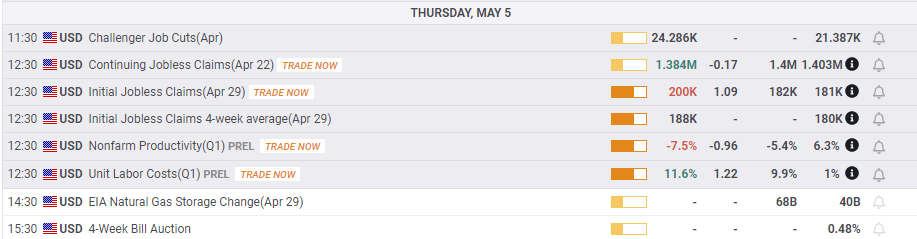

Economic releases

*The author is short TSLA.

This news is republished from another source. You can check the original article here

Be the first to comment