David Trood/DigitalVision via Getty Images

Overview

Luna (LUNA-USD) is the primary utility coin of the Terra Luna ecosystem. Founded by Daniel Shin and Do Kwon, the project is aimed at increasing the adoption of stablecoins. Terra Luna’s best-known stablecoin is USTerra (UST-USD), pegged to the US dollar. However, the project also plans to release other stablecoins such as EUR, CNY, JPY, GBP, KRW, and the IMF SDR as per its white paper.

Terra Luna is a complete blockchain network meaning stablecoin adoption is just one part of the ecosystem. A total of 160 projects will be launched on Terra by the end of 2022.

Unlike other stablecoin projects, Terra’s UST is not backed by anything. It runs on an algorithm that burns Luna until UST supply matches demand. The reverse happens when demand for UST goes down and Luna’s supply is increased. As demand for UST has increased, Luna’s supply has decreased as more people exchange it, so this makes Luna a deflationary cryptocurrency. The price of Luna has increased as it is the main payment and governance currency mechanism inside the Terra Luna empire.

Terra Luna Ecosystem

The price stability of Terra’s stablecoins is ensured through a simple but ingenious solution. Users burn Luna to mint Terra stablecoins and burn Terra stablecoins to mint Luna. This dual token system includes twin pools that balance each other. It is purely based on market forces of demand and supply. The algorithm provides incentives to users in the form of arbitrage opportunities so there will always be willing participants to burn Terra for Luna or vice-versa.

However, Terra is much more than a sophisticated way of creating a stablecoin. The Terra ecosystem is filled with numerous protocols that allow users to exchange crypto quickly and earn a substantial yield on their holdings.

Projects on Terra Luna include Anchor Protocol, Mirror Protocol, Chai, Ozone, Pylon etc.

Anchor Protocol is a loan system designed to work with UST. It created history by offering a 20% yield for users who decided to make use of its platform. Simply deposit tokens on Anchor and get a yield of 20%. Users can take loans or deposit savings. It is like a bank working on the Terra ecosystem.

Chai is a payment app that comes with a debit card and allows merchants to accept payments for their products and services.

Mirror Protocol allows the trading of tokenized assets such as stocks of other companies.

Terra Luna is one of the few blockchain companies that has established major partnerships with other eCommerce giants. The Chai network is used by millions and generates sufficient income that can help sustain the Terra Luna ecosystem. Perhaps, this is one of the reasons why it can offer higher yields than other similar protocols.

Why Is Luna Outperforming?

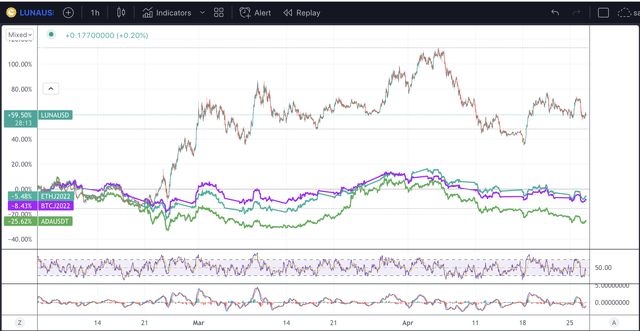

LUNA Price (TradingView)

As we can see above, the Luna token has performed much better than Bitcoin, Ethereum (ETH-USD) and Cardano (ADA-USD) in the last 3 months. Why is this?

Luna is the key to all projects inside the Terra Luna ecosystem. As the main currency, it is used to ensure the price stability of the UST token. The Terra Luna ecosystem runs on a blockchain based on the Proof of Stake mechanism. The network requires users to act as validators and this requires the staking of Luna.

As the entire Terra Luna ecosystem expands and more projects join, the value of Luna will certainly go higher. As the UST adoption increases, more LUNA will be burnt thereby decreasing its supply and pushing its price.

The recent decision of the Terra Luna network to include other assets such as Bitcoin for backing UST has generated a lot of publicity for the Terra Luna ecosystem, which has certainly helped drive the price up

Luna’s success can also be directly linked to the rise in popularity of UST and stablecoins in general. UST’s market cap currently sits at $18.8 billion, making it the 12th largest coin.

Ultimately, Terra is a vibrant ecosystem that includes many interesting projects. Anchor Protocol alone has attracted many users due to its higher yield.

Risks/Challenges

Terra Luna is one of the best-known algorithm-based stablecoin projects and directly challenges other asset-backed cryptocurrency stablecoins such as DAI (over-collateralized stablecoin) and USDT (faced lawsuits for not possessing enough assets as collateral).

Using an algorithm is best as it takes away human governance, but such programs remain untested in times of recession and a sudden collapse triggered by an unforeseen event cannot be ruled out. In times of challenges, humans have time and again expressed faith in hardcore assets such as Gold which is the reason why it is frequently used to back fiat currencies. Will the human race trust a computer program to ensure price stability for their dollar in times of war or recession?

Some experts have expressed fears and remain uncertain about backing a stablecoin with another cryptocurrency such as Bitcoin. If cryptocurrencies as a whole face a sudden downturn, then every coin will go down, so if UST is backed with other cryptocurrencies, it will face more difficulties in the future.

But Terra Luna also enjoys advantages over other less transparent stablecoins coins such as Tether (USDT-USD). Users can see for themselves and check assets in real-time. All currencies are produced out of thin air and are trusted as long as people continue to use them. UST’s long-term success will be determined by the number of users it can attract and this is perhaps Luna enjoys a greater edge since it already has partnerships with many companies across the globe.

Final Thoughts

In conclusion, Terra is one of the fastest-growing ecosystems in crypto, and I am confident that its token, LUNA, will continue to perform very well in the coming months.

This news is republished from another source. You can check the original article here

Be the first to comment