In the crypto world, not all coins are the same. While some assets are used for store-of-value, others can be used to pay for services, and some even have power in something known as governance. So what are governance tokens, and which are the most popular in the market right now?

What Is a Governance Token?

Governance tokens can be used to make decisions within a certain ecosystem. While many online platforms leave the decision-making to executives, board members, or other important individuals, many DeFi services have adopted a governance model. This allows those who hold a certain amount of a given token to vote on decisions within the network.

Governance tokens originated in decentralized autonomous organizations (DAOs). DAOs focus on trustlessness and have no central authority. Instead, DAO members who hold the given DAO’s token can vote on decisions within the ecosystem, meaning that an organization’s progress relies on its members.

That’s a rough outline of how governance tokens work. Let’s now get into the most popular governance tokens in the market.

1. AAVE

Aave is a decentralized lending platform built on the Ethereum blockchain, wherein users can both lend and borrow funds without the need for a third party or middleman. The Aave ecosystem is totally decentralized and is run by a community of over 120,000 governance token holders. The native token of the Aave protocol, known as AAVE, can be used to vote in decision-making processes within the ecosystem.

AAVE token holders can vote on platform maintenance, implementing new features, adding new assets, and more. Essentially, Aave is in the hands of its thousands of token holders, making it a truly decentralized platform.

2. Maker

You may have heard of Maker, or MakerDAO before. MakerDAO is another decentralized lending platform built on the Ethereum blockchain, wherein users can lend and borrow various kinds of cryptos, including the Dai stablecoin and Ethereum.

Governance forms a huge part of the MakerDAO platform. While many associate Dai with MakerDAO, its governance token, Maker (MKR) is also very important. Those within the MakerDAO ecosystem who hold MKR funds can participate in the platform’s voting process, allowing them to play a role in its development. In addition, voters within the MakerDAO governance system can commit their MKR to delegates, streamlining the process and allowing selected members to represent individual MKR holders.

3. Decred

Decred (DCR) is a cryptocurrency designed using Bitcoin’s code. This crypto has its own blockchain and plays an important role in the network’s governance model.

Decred uses a ticket-based voting model, wherein DCR holders can lock their funds for a certain period to purchase voting tickets. Voting with Decred can take place both on- and off-chain. Decred’s on-chain voting involves the random selection of voting tickets through mining. When the ticket is selected, that member’s DCR funds are temporarily locked, and the ticket is issued.

In Decred’s off-chain voting process, proposals are made via Politeia, a platform concerned with Decred’s governance. The two governance types have different voting decisions, though one involves proposal submissions with a fee, and the other does not.

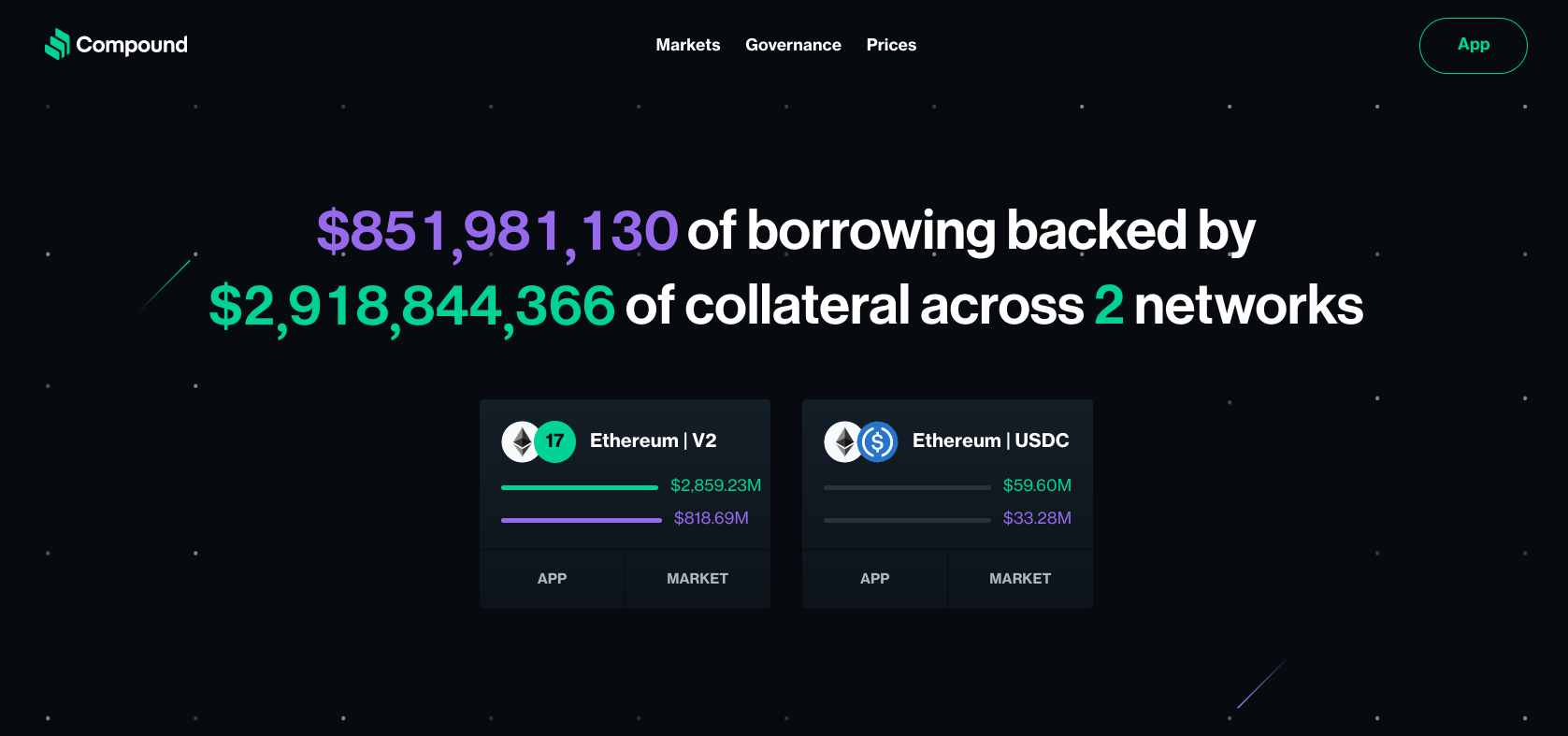

4. Compound

The Compound protocol is another lending and borrowing platform based on the Ethereum blockchain. It is also a DAO, with a prominent governance system that uses the COMP ERC-20 token.

In the Compound governance system, COMP token holders can delegate their funds to the address or delegate of their choice. These delegates can then represent token holders in the voting process. The more tokens a delegate has, the more voting power they have.

Any proposals made within the Compound governance system must go through a three-day voting period, during which a delegate can vote for or against them. However, if over 400,000 votes are cast on a specific proposal, the voting period can be decreased to just two days. In any case, the Compound governance system is a great representation of how decentralized organizations should work.

5. Uniswap

Uniswap is one of the most popular decentralized exchanges (DEXs) in the crypto market today, with millions of users and a range of useful features. Uniswap is built on the Ethereum blockchain and allows users to trade within a decentralized ecosystem. But things don’t stop there. Uniswap also has a governance process to maintain its platform’s decentralized nature.

Uniswap’s governance model uses the native Uniswap token, known as UNI. As with other governance systems, those holding UNI tokens can have their say in Uniswap’s voting process, which consists of three phases. The first phase, known as the Temperature Check, determines whether there is enough push behind an issue or topic to vote on it.

The second phase in the governance process is called the Consensus Check. This allows a discussion to be had on a potential proposal. This phase also involves an off-chain vote to see whether the proposal will be put forward.

The third phase, the Governance Proposal, occurs after a proposal has been put forward. This involves delegates who need at least two million UNI to represent token holders in the voting process. It’s in this phase that proposals are voted for or against.

6. PancakeSwap

PancakeSwap is another popular decentralized exchange, but unlike Uniswap, it is built on the Build and Build (BNB) Chain. This exchange employs a governance model to give holders of CAKE tokens voting power. CAKE is PancakeSwap’s native cryptocurrency and is used as a governance token within the ecosystem.

Within PancaeSwap’s governance model, individual users can make proposals for changes within the platform. For example, there may be a proposal for PancakeSwap to support a new cryptocurrency, or there could be a proposal to delist one. The PancakeSwap team also posts proposals when relevant.

Users can vote individually in the PancakeSwap governance process without selecting a voting delegate.

7. eCash

eCash is a cryptocurrency that uses the Avalanche proof of stake consensus mechanism. It is essentially a rebrand of Bitcoin Cash ABC (BCHA), created through a Bitcoin hard fork. This crypto is designed to be used as a currency for spending on goods and services.

eCash’s governance system uses the platform’s native token, XEC. Governance is made possible through XEC staking, which network members can use to vote. Those with XEC holdings can participate in governance via the platform’s Avalanche staking mechanism. When an XEC holder stakes their funds on eCash, they receive governance rights within the ecosystem.

Governance Tokens Are Central to DeFi

As more DeFi services pop up every year, more governance tokens are being developed and issued to users. This system allows regular individuals to have a say in the changes made to the platforms they use, so that such services can develop in a way that is beneficial to users, not just executives.

This news is republished from another source. You can check the original article here

Be the first to comment