Olga Ortega, the co-founder and CPO of the real-time DeFi explorer AnalytEx by HashEx.

_______

Currently, there are many decentralized protocols and their use cases, and not everyone is well-versed in the terminology of DeFi to start working with protocols right away. It requires a certain level of knowledge – that is why today we start with figuring out what a liquidity pool or a farm is.

What is a Liquidity Pool?

A trading pair of tokens with locked funds from liquidity providers is called a Liquidity pool. Liquidity pools are the foundation of DeFi. Placing two tokens into a liquidity pool, investors create an LP token and receive income from all swaps made between these two tokens on a protocol. For example, let’s consider SushiSwap.

In the liquidity menu item, by clicking on the pool option, we can add 2 tokens and create an LP token.

To create an LP token with a pair of ETH/SUSHI you should have both assets in your wallet.

Once created, you can simply keep your LP token in your wallet and earn some income that is dependent on your share of the liquidity pool of this trading pair.

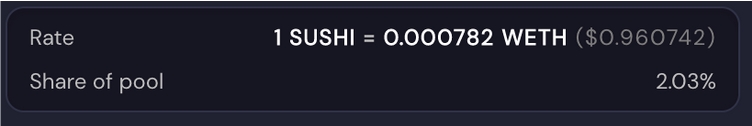

At the time of writing, the LP token consisting of 1 ETH and 1278.9 SUSHI is only 2.03% share of this liquidity pool.

Also, you can place your LP token into a Farm to start earning passive income.

What is a Farm?

A smart contract in which you can stake both LP tokens and solo tokens in order to receive income in tokens of the protocol you are using is called a Farm because all these pools are controlled with a MasterChef Farm smart contract. According to AnalytEx data, more than 1,000 smart contracts with the signature of MasterChef are created monthly, which are usually called Farms for short.

In other words, if you have an income in tokens of used protocol, regardless of whether you put an LP token (a pair of tokens) or a regular token into a smart contract, all of this belongs to the MasterChef contract and should be called a Farm.

Let’s look at the sushi swap interface:

We can see different pairs of tokens that form LP tokens, placing which in the MasterChef contract of Sushiswap, you will receive a token of this protocol – SUSHI.

For example, if you put your LP token, consisting of FRAX and WETH pairs, in SushiSwap, you will receive a token of this protocol called SUSHI. At the same time, the investor will receive a double reward, for staking the LP token in SushiSwap Farm (MasterChef), and for providing liquidity in the FRAX/WETH pair.

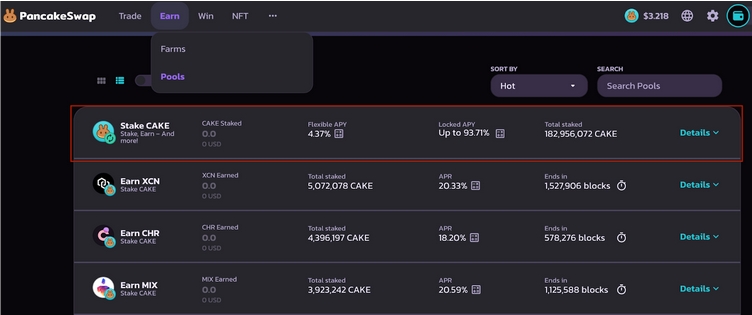

We observe the same situation on other protocols, for example, PancakeSwap – we can stake the LP token and get CAKE – the token of this protocol.

Where is the misunderstanding?

In the Pools tab (called Syrup pools), which almost all protocols separate from farms, we see a pool in which you can stake CAKE in order to receive CAKE, but above we discussed that if you are rewarded in tokens of the protocol you use, you use the MasterChef contract of that farm, regardless of whether the LP is tokens or solo. So it would be more correct to place this pool in the Farms tab.

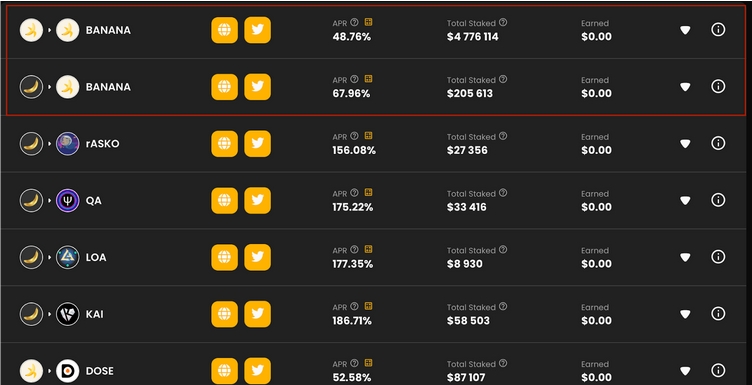

A similar situation we can see in ApeSwap protocol. Here are BANANA farms. BANANA is the main token of ApeSwap protocol.

However, in the Pools tab (called Staking pools) there are 2 pools related to the ApeSwap farm master chef contract.

According to AnalytEx, the master chief contains 123 pools in ApeSwap Protocol.

They are all called (Farm) pools because they are all related to the ApeSwap MasterChef contract.

What are Staking/Syrup Pools?

Staking or syrup pools are the kind where you can stake a regular token (usually a protocol token) into a smart contract to earn other tokens. Users pay interest to pledge their tokens to the network to provide security on proof-of-stake blockchains.

For example, on ApeSwap, you can stake BANANA tokens to earn various tokens. Staking and syrup pools are 2 names for the same thing on different protocols.

As a rule, most known protocols do not explain the difference between Farm pools and Staking/Syrup pools and divide farming opportunities according to the criterion of tokens placed in a smart contract. If we are talking about LP tokens, the commonly applied term is “farms”, but if it is about a solo token, it gets called “(staking / syrup) pool”.

To conclude

From everything we covered above, it can be concluded that, usually, if you receive income in tokens of the protocol that you use, you are accessing the MasterChef contract of this protocol. Regardless of whether you use LP tokens or solo tokens for staking. Such pools can be called “Farm Pools” for convenience.

If you use solo tokens and receive a reward in some other tokens, you use third-party smart contracts. They are called “Staking” or “Syrup” pools.

There are Liquidity Pools, Farm Pools, Staking/Syrup Pools, Lending Pools (relating to Lending protocols).

It is necessary to understand the basic terminology and its differences in order for DeFi space to be completely and clearly understood.

_____

Learn more:

– DeFi Suffers from Too Much Centralization, What Can Be Done?

– Hackers Stole USD 670M from DeFi Projects in Q2, Up by 50% from Q2 2021

– DeFi is ‘Designed to Avoid This Bullshit,’ Compound Founder Says About Crypto Bailouts

– How Tokenomics Might Change in the Wake of the Terra Collapse

This news is republished from another source. You can check the original article here

Be the first to comment