This crypto bull run has shown many similarities to what happened in the 2017 run-up. In that cycle, cryptocurrencies seemed to be sprouting out of the ground at an alarming rate.

Fast Facts:

- SafeMoon is a BEP-20 token launched on the Binance Smart Chain (BSC) ecosystem on March 8, 2021.

- SafeMoon is built to have three core components:

- The first is the “reflection” where SafeMoon transactions are charged a fee that gets distributed among holders of the token.

- The second is a fee charged on transactions that will be given to various liquidity pools on Pancake Swap and other platforms.

- The third is a token burn that occurs on each trade.

- SafeMoon is built on the Binance Smart Chain which uses proof-of-authority as its consensus mechanism.

- In proof of authority, the block creators are known as validators. These validators are pre-approved and chosen by Binance, making the blockchain centralized.

- Due to the centralization of the Binance Smart Chain, users of its platform need to trust Binance and rely on it for security.

There was a mania of initial coin offerings and it was hard to discern what projects were real and which ones were outright scams. Today, there are over 10,000 different cryptocurrencies, all promising new use cases.

Learn how smart money is playing the crypto game. Subscribe to our premium newsletter – Crypto Investor.

With the recent Dogecoin craze, several cryptos popped up that seemed entirely fake. Ones like Siba Inu, Akita Inu, Dogelon and more. They all seemed to be capitalizing on Dogecoin’s success with meme culture investments, but what about SafeMoon? Is it trying to do the same or is it a serious project?

What is SafeMoon?

SafeMoon is a BEP-20 token launched on the Binance Smart Chain (BSC) ecosystem on March 8, 2021. BSC is a centralized finance (CeFi) ecosystem and a competitor to Ethereum’s decentralized finance (DeFi) ecosystem.

SafeMoon has quickly risen to be Binance’s third-largest token by market capitalization.

Its website says that the cryptocurrency has three core components. The first is reflection. This is where SafeMoon transactions are charged a fee which gets distributed among holders of the token.

The second is a fee charged on transactions that will be given to various liquidity pools on Pancake Swap and other platforms.

The third component is a token burn that occurs on each trade. Nowhere in the whitepaper, or the rest of the site, does it clarify the percentage of each transaction that gets burned. It only says that transactions are taxed a 10% fee that is split two ways.

5% goes to reflection rewards and 5% to liquidity pools. 2.5% of the 5% that is sent to liquidity pools is converted into Binance Coin (BNB) to ensure the liquidity of the SafeMoon and Binance Coin pair.

“Having burns controlled by the team and promoted based on achievements helps to keep the community rewarded and informed. SafeMoon aims to implement a burn strategy that is beneficial and rewarding for those engaged for the long term. Furthermore, the total number of SAFEMOON burned is featured on our readout located on the website”

It’s unclear what criteria the team uses to make these decisions, nor is it clear what level of autonomy the team has in changing SafeMoon’s max supply. The team’s ability to burn tokens at their discretion could allow for potential manipulation of supply and price.

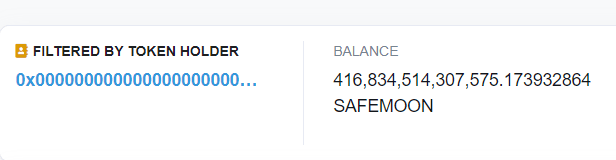

As seen above, 416 trillion SafeMoon have been burned so far. This quantity is accurately represented by the following wallet which looks to be SafeMoon’s burn address.

https://bscscan.com/token/0x8076c74c5e3f5852037f31ff0093eeb8c8add8d3?a=0x0000000000000000000000000000000000000001

SafeMoon currently ranks 202 on coinmarketcap with a market capitalization of $2.9 billion and a circulating supply of 585 trillion tokens. The total supply of SafeMoon is one quadrillion tokens.

Who Created SafeMoon?

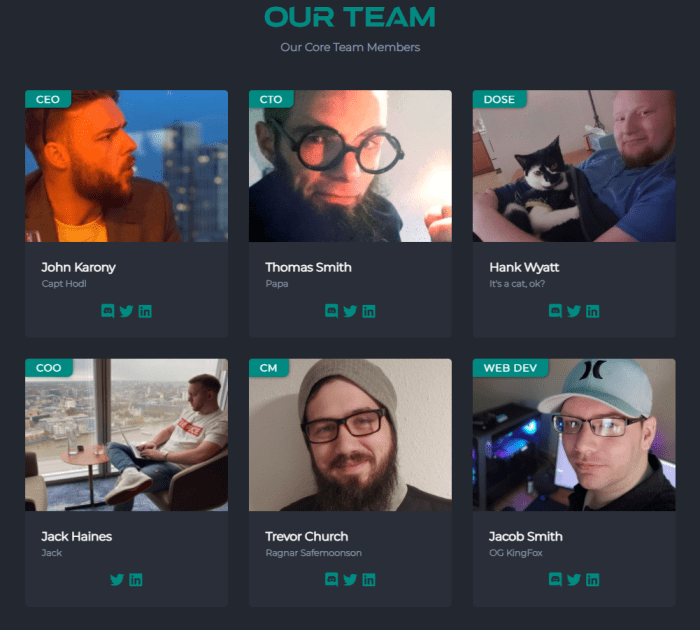

The token is run by a group of six that all look to have some degree of previous work history together.

According to LinkedIn profiles The CEO, John Karony, CTO, Thomas Smith and Community Manager, Trevor Church, founded and worked together at an indie game studio called TANO, an acronym for Technically A New Operation.

TANO’s site only has the words “Alpha Launch Coming.” So it’s unclear if this is a functioning business or something yet to come.

The CTO, Thomas Smith, has the most established work history of the group with various software engineering roles held at a number of companies.

The rest of the team seems to have varying degrees of experience in web development, game development or general management. Henry “Hank” Wyatt, SafeMoon’s VP of research and development, also founded a game development company, according to his LinkedIn. Unforetunealty, the website leads to a 521 error from the host’s end. SafeMoon’s web developer, Jacob Smith, apparently worked for this game development company as well.

On Jacob Smith’s LinkedIn he states that he “Worked as the lead website developer working on several of their projects. Work is on hold atm due to the lack thereof.”

Henry Wyatt is the only team member to have earned a four-year degree. The rest look to have spent brief periods at universities or colleges.

While education or experience at larger companies is not prerequisites for creating a cryptocurrency, their previous work history and credentials seem a bit unclear. They promote SafeMoon on their Twitter accounts, which isn’t that out of the ordinary from crypto project leaders, but it’s hard to say how genuine the project is or how qualified they are.

The site also has SafeMoon related merchandise for sale, including hoodies, hats, sweatpants and more. This isn’t very typical for a cryptocurrency project, though proceeds could be used for development money.

How is SafeMoon Different Than Bitcoin?

As mentioned, SafeMoon is a BEP-20 token issued on the Binance Smart Chain. The creator of Binance, Changpeng Zhao, has admitted that BSC is not decentralized. In a since-deleted tweet, Zhao called BSC “CeDeFi,” which is short for centralized DeFi and a bit of an oxymoron.

Proof of Authority

The Binance Smart Chain uses a consensus mechanism called proof of authority. In proof of authority, the block creators are known as validators. These validators are pre-approved and chosen by Binance. To be approved, they must confirm their real identities, invest money to prove long-term commitment and be equal to all other candidates. This makes proof of authority reputation-based by design.

In this model, Binance has absolute control over the blockchain. They decide who becomes a validator and they remove validators at their discretion. All of the chain’s users must trust that Binance will behave in everyone’s best interest. Should Binance decide to alter any aspects of the chain or ecosystem it has the power to do so.

Proof of Work

Bitcoin uses a totally different consensus mechanism called proof of work. Proof of work was the original consensus mechanism used by blockchains and has proved to be very effective at securing a decentralized system from bad actors.

In proof of work, computers compete with each other to process and validate transactions. To win this competition, the computer must solve complex mathematical puzzles. Once they’ve won, the computer adds a new block of transactions to the blockchain. These computers are also known as miners and they are given Bitcoin for completing a new block of transactions.

This process is very energy-intensive and helps to secure the network. Enough miners geographically distributed makes for a decentralized network without a central authority, which is drastically different than how the BSC operates. Today, Bitcoin is a massively distributed and decentralized network with many thousands of nodes and miners across the globe.

So, Should You Invest In SafeMoon?

Choosing to invest in SafeMoon is a personal decision that should be made based on how much risk you would like to take. The success of SafeMoon depends on Binance, the SafeMoon team and whatever community is built around it.

A calculated investment in SafeMoon would require the investor to take into account the centralization of the Binance Smart Chain and how much control Binance has over it. It would also require a level of faith in the legitimacy of the SafeMoon team, which has little proof of previous success. While people need to get their start somewhere, a healthy dose of skepticism can go a long way.

SafeMoon, along with all other tokens on the Binance Smart Chain, is effectively at the whim of Binance with the centralized nature of proof of authority. If Satoshi Nakamoto returned and could make direct edits to Bitcoin’s code and have it implemented to every miner and node in the network it would no longer be decentralized and would therefore reduce faith in the system.

An investment in SafeMoon in its current stage would be pure speculation as it is not yet a proven team or project. That said, all ships tend to rise with the tide. Should Bitcoin continue on its trajectory in this bull market there could be a chance SafeMoon will increase as well, and other speculative investors could push it higher, but these are risky bets to make.

This news is republished from another source. You can check the original article here

Be the first to comment