Cryptocurrency space was buzzing throughout 2021, with investors increasingly turning to crypto-based investments over traditional alternatives. The growing popularity of cryptos inadvertently invited some dubious scams and suspicious activities, urging authorities to take sooner action.

In fact, regulatory action has become necessary in 2022 after the previous year laid a solid foundation stone for cryptos. Regulators can no more neglect crypto investments worth millions of dollars made by individuals.

Countries eyeing cryptocurrency regulation

Interestingly, some authorities have already recognised the need for regulatory measures, including Australia. The Australian prudential regulator intends to devise a new rule that mandates banks to hold greater capital against exposure to volatile crypto assets to protect financial stability. At the same time, the regulator continues to support healthy innovation in the industry as it plans to keep the prudential framework simpler for smaller entities.

In addition to Australia, several countries are jumping on the bandwagon to regulate the crypto space, with a few nations even banning the asset class completely. In September last year, China banned all cryptocurrency transactions to prevent economic instability and curtail financial crime.

Following China’s ban, countries like Ecuador and Russia have decided to introduce domestic crypto regulations. Reports are doing rounds that Russia is planning to regulate cryptos as an analogue of currencies instead of a financial asset. In a way, cryptos will be treated as a foreign currency when the new regulations will come into effect.

Meanwhile, Ecuador may also regulate cryptos this year. The new regulation will not make any cryptocurrency legal tender in the country due to the volatility associated with the asset. Instead, the regulation will focus on bringing more clarity to the status of cryptocurrency in the country.

While similar rumours of a ban were widespread in India, the government finally introduced a hefty tax of 30 per cent on any income from the transfer of digital assets.

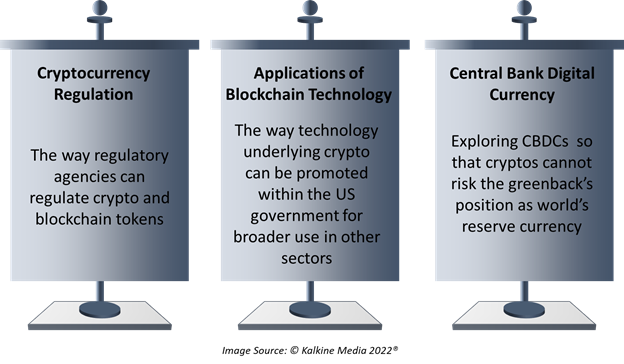

Meanwhile, regulatory action is also underway in the US, with Congress introducing crypto-based bills focused on three sections, which are highlighted in the figure below:

Will central bank digital currency solve the purpose?

Stringent regulatory action in the crypto space has emerged at a time when speculations around the launch of central banks’ digital currencies are rife in the market. To the uninitiated, a central bank digital currency or CBDC is a digital form of a nation’s fiat currency, which the central bank issues.

In several countries, central banks have shared their intention to roll out their version of cryptos backed by a highly secured technology. The aim is to provide consumers and businesses with privacy, accessibility, convenience, transferability, and financial security. However, this may invite further restrictions on trading in mainstream cryptocurrencies across countries.

Meanwhile, this brings forth an interesting observation of policymakers’ ability to exercise their power to control trading in crypto assets. The potential launch of central banks-backed cryptos effectively goes against the foundation of blockchain technology and the purpose with which cryptos were introduced.

However, from a macro perspective, a more protected ecosystem seems essential in securing the highly volatile cryptocurrency space, which is luring new investors each passing day.

This news is republished from another source. You can check the original article here

Be the first to comment