Eoneren/E+ via Getty Images

Bit Digital (NASDAQ:BTBT) is a well-known Bitcoin mining company with operations in the US and Canada.

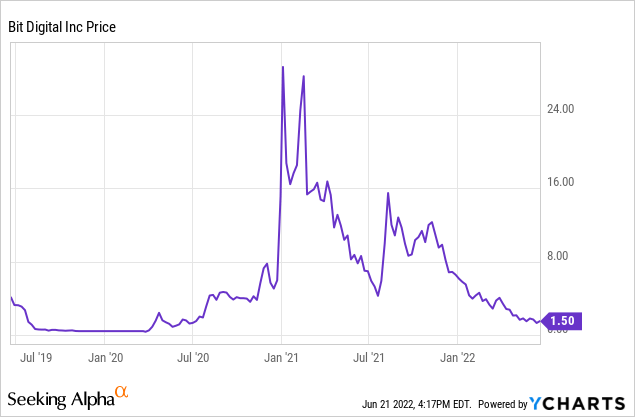

In February 2020, they began their first bitcoin mining operation, and shareholders will be the first to tell you it has been a wild ride ever since. Bitcoin miners like Bit Digital use special hardware to produce bitcoins, a cryptocurrency. Like regular mining companies, they stockpile resources and attempt to sell them at advantageous prices. For this reason, they often trade like cryptocurrencies on steroids. But recently, the crypto market has been seeing somewhat of a crisis. Today we will discuss that crisis and what it means for Bit Digital shareholders.

Before we get started, if you’d like definitions of a few critical terms concerning cryptocurrency, please see the Crypto cheat sheet in my Riot Blockchain (RIOT) article. But of course, crypto veterans feel free to skip this section.

Stellar Year Checked By Bad Crypto Prices

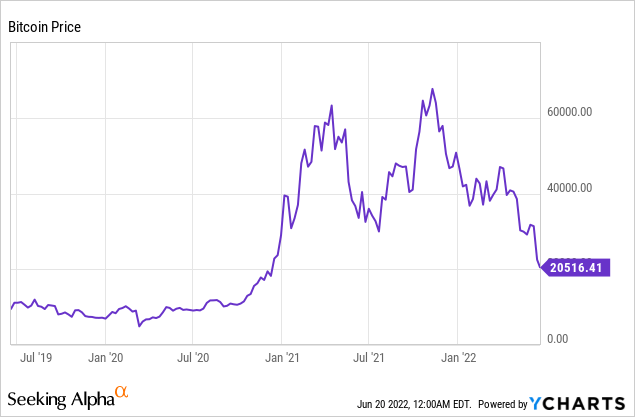

The company has reported its annual financials; full-year 2021 revenue stood at $96.1 million, up 355% which saw it mine 2,065 bitcoins vs. 1,510 in 2020. Net income was $4.9M, and EPS was $0.08 compared to a loss of $0.06 in the year prior. The massive selloff in crypto should significantly threaten profitability this year should Bitcoin prices remain around the $19,750 mark.

Bit Digital has roughly $42 million in cash along with no debt. In its May 2022 update, the company’s holdings of BTC (BTC-USD) and ETH (ETH-USD) were 793.6 and 316.1, representing an approximate fair market value of $25.2M and $0.6M for the two tokens at the time. At today’s prices – less than a month later – the holdings would total roughly $16 million, which speaks to the catastrophic decline we see in the crypto market. The combined value of the treasury holdings accounts for approximately 14% of the company’s $114.16 million market cap. At last year’s highs, the tokens would be worth roughly 48% of the current market cap. It is also important to note that the company mined almost 200 Bitcoins in Q1 and the treasury holdings stood at 802 in December 2021, which implies that they have been selling – hopefully at advantageous prices.

Outlook

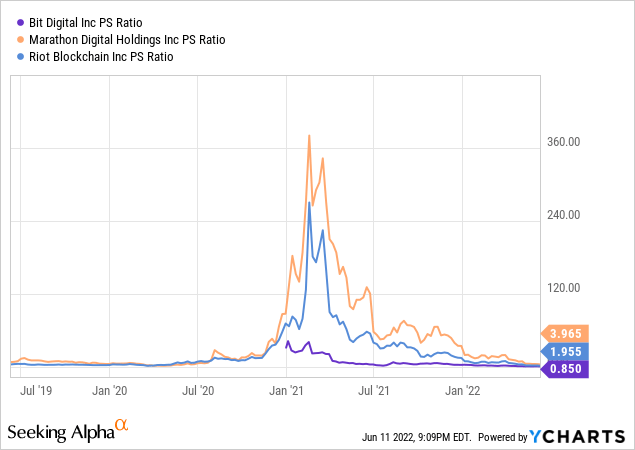

As you can imagine, this stellar drop has implications for PS figures going forward. We have noticed the compression of PS figures across the industry.

Investors are now paying less than a dollar for each dollar of the company’s revenue which is quite reasonable when you consider the selloff erodes the value of the treasury holdings.

Bit Digital has been unlucky. They did the right thing by procuring a large mining fleet, but due to factors outside their control (discussed here), they faced notable disruptions in their operation that set them back for months, only to now be facing a crypto bear market. Had the company been at its optimal level, it would have benefited from significantly more attractive crypto valuations and would have probably had a much stronger 2021.

Things may yet get worse for the firm. The company has production costs for BTC in the $7771 area, and further downwards pressure on BTC could put a lot of pressure on the firm.

The company also faces challenges with Ethereum.

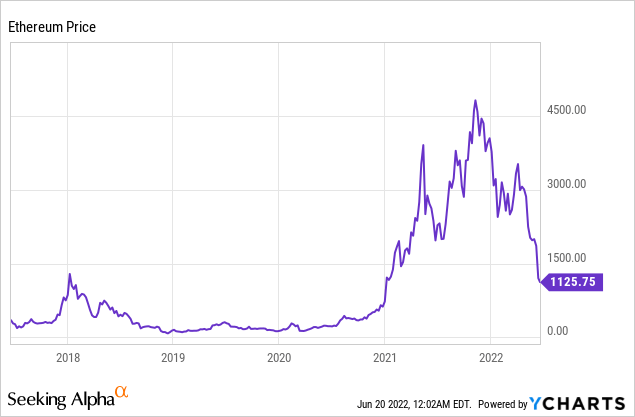

Ethereum 2.0 Merger

The decision to merge the Ethereum Mainnet with the Beacon Chain will involve shifting from proof of work to proof of stake. This would almost eliminate the reliance on miners. This may negatively affect the Ethereum mining industry. This is discussed in greater detail here. The good thing is the Ethereum business is a small part of Bit Digital’s business, so the impact should be minimal. It is also important to note that the crypto merger is unlikely to hurt Ethereum prices alone, but the token is in the midst of a massive selloff and was down more than 75% at the time of the writing of this article.

This is part of broader selling pressure across the crypto market due to macroeconomic headwinds.

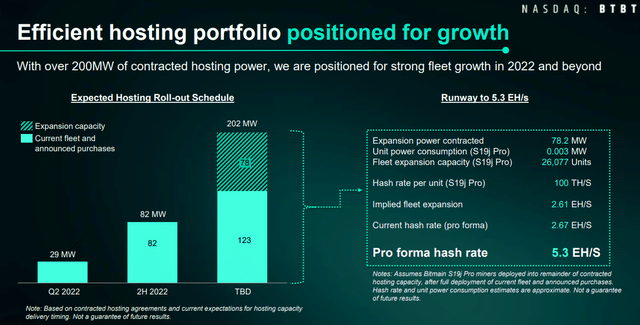

On a positive note, the company is operating with a fraction of its fleet deployed, so we could see better production figures during the back half of the calendar year 2022. The company thinks it can get to 5.3 EH/s which would be a massive increase that is pretty consistent with the aggressive hashrate growth approach taken on by the major players in the industry.

Upcoming Earnings Report

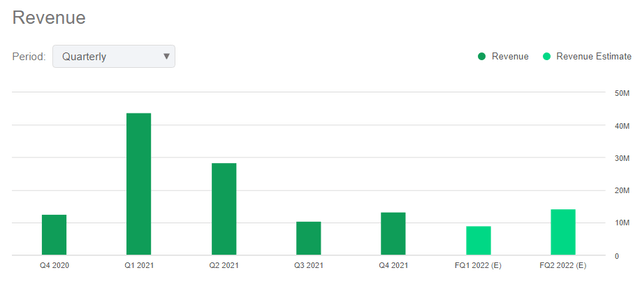

This report should be a painful one for shareholders. Bitcoin and Ethereum are both in freefall and the company was already facing challenges with fleet deployment. We can see that there is a general expectation that revenue will decline during the upcoming quarter versus Q4 2021.

Revenue is expected to be around $10m for the quarter. I think that is quite generous unless there is heavy crypto liquidation. With the recent selloff in crypto markets, I wouldn’t be surprised to find that Bit Digital is holding on to its tokens and using its strong cash balance to fund operations as it attempts to weather the storm. Other crypto companies have been exploring financing options with the option of stock offerings being off the table due to low valuations. This is not ideal but is acceptable. The main thing investors should focus on is fleet redeployment. This would be extremely unlikely. With less than half of the fleet deployed in the last update, the biggest priority has to be fleet count. I wouldn’t expect any suggestion of forced crypto liquidation just yet, as the company did an excellent job managing cash balances in the past. I am also expecting an increase in direct bitcoin production costs, with the cost of energy rising across the industry. Many mining companies have agreements that help stabilize these costs, so I would not expect a sensational increase. I would expect that the company will need 2 to 3 quarters to resolve the fleet issue entirely, but a lot of the pain may already be priced into the stock.

I expect full-year Bitcoin production for 2022 to come in between 600 and 800 tokens, with production increasing throughout H2 2022. I expect Ethereum to continue to be a bit-part revenue contributor, with production ranging from 300 to 550 for the year.

Analysis and Forward-Looking Commentary

Bitcoin is Bit Digital’s main product, which simplifies the analysis. The company produced roughly 194 BTC in Q1 2022, with less than 50% of its fleet deployed. In the May update, production dropped to 53.4 Bitcoins – A 30% decrease. The company is currently redeploying its fleet, and it is unclear how much improvement investors can reasonably expect with increasing difficulty rates. As our guide for the worst case, we will take 1200 BTC for 2021. For the best case (most unlikely), we will take 1800 BTC. I expect the actual number to come in between the base and the worst case. For BTC’s prices, we will take $12K as the worst case, the current price, and $45K as the best case. Below are the rough revenue estimates for the different cases.

| Cases | Bitcoin Price | ||

| Bitcoin Production | Low | Base (current) | Best |

| $12,000.00 | $19,750.00 | $45,000.00 | |

| 1200 | $14,400,000.00 | $23,700,000.00 | $54,000,000.00 |

| 1800 | $21,600,000.00 | $35,550,000.00 | $81,000,000.00 |

| 2200 | $26,400,000.00 | $43,450,000.00 | $99,000,000.00 |

Source: Author’s Estimates

For Ethereum, we will use $1000, $1500, and $3000 with the production levels shown below. The estimates include treasury holdings.

| Cases | Ethereum Price | ||

| Ethereum Production | Low | Base (current) | Best |

| $1,000.00 | $1,500.00 | $3,000.00 | |

| 300 | $300,000.00 | $450,000.00 | $900,000.00 |

| 420 | $420,000.00 | $630,000.00 | $1,260,000.00 |

| 550 | $550,000.00 | $825,000.00 | $1,650,000.00 |

Source: Author’s Estimates

We will use a P/S ratio due to the variable revenue. If we apply the current 0.85 ratio, we get the following prices as targets:

| P/S | 0.85 | Forecasted Price | |

| Cases | Bitcoin Price | ||

| Bitcoin Production | Low | Base (current) | Best |

| 1200 | $0.16 | $0.26 | $0.58 |

| 1800 | $0.23 | $0.38 | $0.87 |

| 2200 | $0.28 | $0.47 | $1.06 |

Source: Author’s Estimates

This is consistent with the expected decline in revenue. I did not account for an increase in Bitcoin production as the fleet is fully deployed due to the time the fleet has been impacted. It is important to note that this assumes the P/S ratio remains compressed. As price action improves, the multiple should begin to expand again. If the P/S multiples can get back to 5 and double its production during H2 2022, this is how the story looks:

| P/S | 5 | Forecasted Price | |

| Cases | Bitcoin Price | ||

| Bitcoin Production | Low | Base (current) | Best |

| 1600 | $1.21 | $1.99 | $4.53 |

| 2200 | $1.67 | $2.74 | $6.24 |

| 2600 | $1.97 | $3.25 | $7.38 |

Source: Author’s Estimates

The Takeaway

It is probably better for crypto bulls to turn their attention to the actual tokens at this point. The Bit Digital leadership team is doing everything right, but they can’t control crypto prices. The company has an awful lot of cash on the balance sheet, and it should be able to make it through a year-long recession comfortably, but in the medium term, there isn’t much to be excited about. It is likely best for investors to be patient with purchases until the situation with cryptos becomes clearer.

This news is republished from another source. You can check the original article here

Be the first to comment